Current Report Filing (8-k)

January 20 2023 - 4:10PM

Edgar (US Regulatory)

0001448597

false

0001448597

2023-01-20

2023-01-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): January 20, 2023

AUGUSTA GOLD CORP.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | |

000-54653 | |

41-2252162 |

(State or other jurisdiction

of Incorporation) | |

(Commission

File Number) | |

(I.R.S. Employer

Identification No.) |

Suite 555 - 999 Canada Place, Vancouver, BC

Canada | |

V6C 3E1 |

| (Address of principal executive offices) | |

(Zip Code) |

Registrant’s telephone number including area

code: (866) 441-0690

_____________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act: None

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry into

a Material Definitive Agreement.

On January 20, 2023, Augusta

Gold Corp. (the “Company”) closed its previously announced “bought deal” underwritten offering (the “Offering”)

of 6,725,147 units (“Units”) of the Company at a price of Cdn.$1.71 per Unit, including the units issued pursuant to

the full exercise of the over-allotment option by the underwriters in the Offering (the “Underwriters”), for aggregate

gross proceeds of approximately Cdn.$11.5 million before deducting Offering expenses.

In connection with the closing

of the Offering, the Company entered into a Warrant Indenture dated January 20, 2023 (the “Warrant Indenture”) with

Endeavor Trust Corporation, as the warrant agent, pursuant to which the Company issued Warrants to purchase up to a maximum of 3,362,573

Warrant Shares. Each Warrant is exercisable at any time after January 20, 2023, and prior to January 20, 2026.

The Warrant Indenture provides

for the creation of the Warrants underlying the Units.

The Warrant Indenture sets

forth the exercise terms of the Warrants, the mechanics for the exercise of the Warrants, and the mechanics for issuance of the Warrant

Shares. The Warrant Indenture further sets forth the rights of each Warrant holder in respect to the Warrants.

The Warrant Indenture contains

customary representations, warranties, and indemnification provisions.

As compensation in

connection to the Offering, the Company paid the Underwriters cash compensation equal to 5.0% of the aggregate gross proceeds of the

Offering and issued to the Underwriters 336,257 common stock purchase warrants (the “Compensation Warrants”).

Each Compensation Warrant is exercisable for one share of common stock (each, a “Compensation Warrant Share”) for

a period of 12 months following the closing of the Offering at a price of Cdn.$1.71 per Compensation Warrant Share.

Copies of the Warrant Indenture,

and Compensation Warrant are filed hereto as Exhibits 4.1, and 4.2, respectively. The foregoing descriptions of the terms of the Warrant

Indenture and Compensation Warrants do not purport to be complete and are subject to and qualified in their entirety by reference to such

exhibits. Copies of the opinion of Dorsey & Whitney LLP and Cassels Brock & Blackwell LLP relating to the legality of the issuance

and sale of the Units and Compensation Warrants in the Offering are attached hereto as Exhibit 5.1 and 5.2, respectively. The Warrant

Indenture and form of Compensation Warrant have been filed with this Current Report on Form 8-K to provide investors and security holders

with information regarding their terms. They are not intended to provide any other factual information about the Company. The representations,

warranties and covenants contained in the Warrant Indenture and Compensation Warrants, where applicable, were made only for purposes of

such agreements and as of specific dates, were solely for the benefit of the parties to such agreements, and may be subject to limitations

agreed upon by the contracting parties.

| Item 7.01 |

Regulation FD Disclosure. |

On January 20, 2023, the Company

issued a press release announcing closing of the Offering. A copy of the press release is furnished herewith as Exhibit 99.1.

The information furnished

under this Item 7.01, including the press release, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall

be expressly set forth by reference to such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: January 20, 2023 |

AUGUSTA GOLD CORP. |

| |

|

| |

By: |

/s/ Tom Ladner |

| |

Name: |

Tom Ladner |

| |

Title: |

VP Legal |

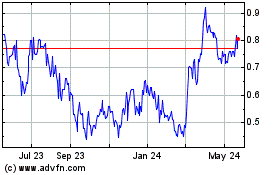

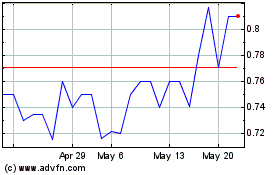

Augusta Gold (QB) (USOTC:AUGG)

Historical Stock Chart

From May 2024 to Jun 2024

Augusta Gold (QB) (USOTC:AUGG)

Historical Stock Chart

From Jun 2023 to Jun 2024