UPDATE: Actelion Dismisses Investor Criticism Ahead Of AGM

May 02 2011 - 6:22AM

Dow Jones News

Actelion Ltd (ATLN.VX) Monday dismissed criticism from investor

Elliott Advisors, who bashed the Swiss firm's management for having

lost a legal battle that could cost Europe's largest biotech more

than $500 million and renewed its call for a board overhaul, urging

investors to back its proposals at this week's annual shareholder

meeting.

Investors, meanwhile, voted with their feet in the wake of the

costly legal verdict and dumped Actelion's stock, which fell more

than 5% in early Monday trade. The fall erased some CHF400 million

of Actelion's market capitalization, which currently hovers around

CHF6.2 billion. At 0940 GMT, the shares were down 5.4%, or CHF2.75,

at CHF48.2.

Actelion said Sunday that a U.S. jury last Friday had awarded

Japan-based drug maker Asahi Kasei Pharma Corp. (AHKSY) up to $547

million. It also warned of potential punitive damages stemming from

the legal fight with the Japanese firm, which revolves around a

drug compound Actelion decided to discontinue when, in 2007, it

took over CoTherix, which had a development agreement with Asahi

Kasei.

Analysts said the verdict came at a very bad time for Actelion,

warning that the punitive damages could be several times higher

than the initial award. Brokerage Helvea analyst Olav Zilian,

however, said Actelion is likely to appeal the jury's verdict.

The legal battle has already cost Actelion some CHF90 million

and may further undermine the credibility of its contested

management and board ahead of the crucial investor meeting May 5 in

Basel. Elliott Advisors, which is owned by $17 billion U.S. hedge

fund Elliott Management, said the court room loss was a reflection

of Actelion's "poor management as well poor corporate governance by

the Actelion board." It urged shareholders who have planned to back

the Swiss firm at the investor meeting to amend already submitted

proxies, saying "it's not too late to save Actelion." Actelion

dismissed the criticism.

Elliott, which owns more than 6% in the Swiss company, wants to

renew Actelion's board and has nominated six new board members,

including former Novartis AG (NVS) executive James Shannon, whom it

wants to run as chairman, replacing longstanding Rob Cawthorn.

Elliott is also backing Actelion board nominees Jean-Pierre

Garnier, a former GlaxoSmithKline PLC (GSK) chief executive, and

former Schering-Plough chief financial officer Robert Bertolini.

The new board should redefine Actelion's strategy, including a

potential sale of the company.

Firms such as Amgen Inc (AMGN) and GlaxoSmithKline were believed

to have considered a bid for the Swiss firm, but no official offer

has been made and the companies have repeatedly declined to

comment. Given the added legal trouble and Elliott's renewed

pressure, Bank Vontobel analyst Andrew Weiss said "we see a

possibility that Elliott may get its way and put Actelion up for

sale, or Actelion seeks protection in the form of a strong

partner."

Elliott's harsh criticism, which it made public earlier this

year, follows a series of drug development setbacks at the biotech

firm, which relies heavily on sales of its single blockbuster

hypertension drug Tracleer, which generates the bulk of Actelion's

roughly CHF2 billion in annual sales. Elliott has argued that once

Tracleer loses its patent protection in 2015 and should the Swiss

company fail to bring a follow-up drug on the market, the company

would massively destroy shareholder value as such an outcome could

force Actelion to cut costs and reduce its staff base.

Elliott is claiming that it has the backing of most hedge fund

investors and that many institutional shareholders are likely to

back it as well after U.S. proxy advisor ISS supported part of

Elliott's proposals. According to an analysis by U.S. shareholder

service firm Georgeson Inc, which was hired by Elliott, the hedge

fund investor may prevail at the upcoming annual shareholder

meeting. Analysts say that Actelion's court room loss could also

help sway the result in favor of Elliott.

Actelion, meanwhile, is confident it can prevail at this week's

meeting, shrugging off Elliott's critique. "Respectfully, the

company believes that these criticisms have no factual basis,"

Actelion said in a statement Monday.

Actelion said that it will wait until the U.S. jury has

concluded its deliberations before deciding to appeal the verdict

and specifically address Elliott's criticism, which besides being

directed against the company's board also centered on CEO Jean-Paul

Clozel. Elliott has said it is exploring various legal options,

"including whether Actelion has complied with ad-hoc publication

requirements, whether the board and management have breached their

fiduciary duties [and] whether there is criminal liability of

management involved."

Actelion, which recently launched a CHF800 million share buyback

and plans to pay out its first ever dividend in an attempt to win

over investors, has received official backing for its strategy and

board from Swiss investor Rudolf Maag, who owns about 4% in the

company's capital, and Swiss investment company BB Biotech AG.

Actelion wants to stay independent as the board and management

believe that its drug pipeline carries more shareholder value than

investors could receive in a potential sale. Actelion is confident

it can bring Tracleer follow-up drug macitentan to market in 2013,

helping it shield itself from the expected sales drop after

Tracleer loses its patent. Other drugs, such as a

multiple-sclerosis compound, should help the concern going

forward.

-By Goran Mijuk, Dow Jones Newswires, +41 43 443 80 47;

goran.mijuk@dowjones.com

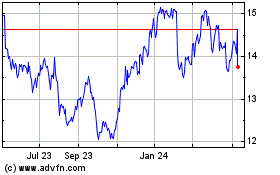

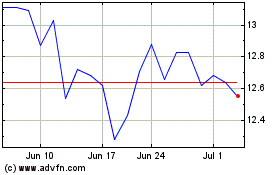

Asahi Kaisai (PK) (USOTC:AHKSY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Asahi Kaisai (PK) (USOTC:AHKSY)

Historical Stock Chart

From Jan 2024 to Jan 2025