Form 8-K - Current report

December 05 2023 - 9:31AM

Edgar (US Regulatory)

false

0001566243

0001566243

2023-12-05

2023-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): Dec 5, 2023

Arax

Holdings Corp.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

333-185928 |

|

99-0376721 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1600

B SW Dash Point Rd, #1068 Federal

Way, WA

98023

Registrant’s

telephone number, including area code: (850) 254-1161

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which

registered |

| N/A |

N/A |

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry

into a Material Definitive Agreement.

On

Nov 30, 2023 (the “Effective Date”), the Company and Undo Studios SA, (Nemesis) entered into a Sales Purchase agreement,

to acquire 31% of the share capital of Nemesis in a share swap and cash transaction representing a minority interest in the assets,

licenses, and intellectual property of Nemesis.

Pursuant

to the provisions in the Sale Purchase Agreement, the Company will issue (six million six hundred and fifty thousand) 6,650,000 shares

of its common stock at fair market value as of the date of the Sale Purchase Agreement for the initial 20% and the option for the

remaining 11% of Nemesis. The common shares issued for the conversion if exercised, shall be issued with a restriction under Rule

144 of the U.S. Securities and Exchange Commission Act of 1934. That portion of the Company’s issued shares representing the

11% of the Nemesis acquisition will be held in escrow until such time as the option has been exercised.

In

addition, the Company agrees to invest a total amount of (one million two hundred thousand) $1,200,000 in cash installments of (one

hundred thousand) $ 100,000 per month starting December 1, 2023. Any amounts previously paid to Nemesis under a previously reported

Letter of Intent will be deducted from this amount due.

The

Company has the option to acquire an additional 11% of Nemesis upon fulfillment of certain milestones to be agreed upon in a future

agreement. Nemesis will provide one seat to Arax as a Director of Undo Studios and will allow Arax to have operational oversight

on an ongoing basis.

|

The

foregoing description of the Sale Purchase Agreement does not purport to be complete and are qualified in their entirety by reference

to the full text of the Letter of Intent, which is filed as Exhibits 99.1, to this Current Report on Form 8-K and are incorporated herein

by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

Exhibits:

*

Filed herewith

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

Arax Holdings Corp. |

| |

|

|

| |

By: |

/s/ Christopher

D. Strachan |

| |

|

Christopher

D. Strachan

Chief

Financial Officer |

Dated:

Dec 5, 2023

Letter

of Intent

Dated

November 29, 2023

by

and among

on

the one hand

Undo

Studios SA, c/o SiPaFid SA Via Ferruccio Pelli 13 6900 Lugano, Switzerland, registered with the Register of Commerce under No. CHE-434.124.671

(the

"Company")

and

on

the other hand

ARAX

HOLDINGS CORP., a company registered under the laws of United States of America with registered office at 30 N Gould Street Sheridan,

Wyoming 82801 (850) 254-1161,

(the

“Investor”)

(Company

and Investor each a “Party” and collectively the “Parties”)

Whereas

| (A) | Undo

Studio SA is a company registered under the laws of Switzerland, with registered office

at c/o SiPaFid SA Via Ferruccio Pelli 13 6900 Lugano, Switzerland, registered with the Register

of Commerce under No. CHE-434.124.671, with a share nominal value of CHF 100 per share, engaged

in the business of developing of software and new technologies, in particular the metaverse; |

| (B) | Arax

Holding Corp. is a company registered under the laws of United States of America with registered

office at 30 N Gould Street Sheridan, Wyoming 82801 (850) 254-1161,with a share nominal value

of USD 0.0001, per share is a company holding participations in different entity building

software solutions on the Core Blockchain and implementing the Codetech Ecosystem and the

Luna Mesh in use cases for peer to peer solutions and communication; |

| (C) | The

Parties have subscribed on the 29th August 2023 a Letter of Intent foreseeing

the covering of USD 31’386 in exchange of a future investment into the Company. With

Addendum to the Letter of Intent dated 11th September 2023 the Parties agreed

to a further financing of USD 39’150. |

| (D) | The

Parties agree to regulate certain provisions contained in this Agreement into all details

with the drafting and signature of specific agreements, as provided below and where needed,

within 30 days from the signature of this Agreement. |

| (E) | For

the purpose of this agreement, the following forex rates (average last 3 months) are used: |

EUR/CHF=

0,96

USD/CHF=

0,88

NOW

THEREFORE

| 1.1 | The

Investor agrees to invest a total amount of USD 1’200’000 (one million two hundredth

thousand USD) in the Company in exchange for 6% (six percent) of the Company’s corporate

capital shares, on a fully diluted basis. |

| 1.2 | The

total amount shall be paid in subsequent instalments, at least paid every 30 days, and in

maximum 12 instalments. |

| 1.3 | The

amounts already paid by the Investor as per (C) above will be deducted from the total amount

to be paid under 1.1. whereas Arax will deduct USD 40’000 for the first two months

in 1.2 above |

| 1.4 | The

investment will be regulated by an “Investment Agreement” to be drafted

by the Parties as per (D) above. |

| 2.1 | The

Company further agrees and undertakes towards the Investor to swap an amount of the Company's

existing shares towards existing shares of the Investor (the “Quota Conversion”).

|

| 2.2 | The

agreed swap for the Quota Conversion will consist of the following: |

| (i) | 6’650’000

(Six million six hundredth and fifty thousand) shares of ARAX HOLDINGS CORP. in exchange

for |

| (ii) | 14%

(fourteen percent) of Undo Studios’ corporate capital shares, on a fully diluted basis. |

| 2.3 | The

Quota Conversion will be regulated by a specific agreement (the “QC Agreement”)

to be drafted by the Parties as per (D) above. |

| 3.1 | Moreover,

the Company grants the Investor with an option to subscribe to an additional 11% (eleven

percent, the “Option”), on a fully diluted basis, of the Company’s

corporate capital. |

| 3.2 | The

Option will be exercisable upon fulfilment of a set of business milestones which will be

agreed by the Parties and will be included in a separate agreement to be drafted as per (D)

above. |

The

Investor is aware that the Company needs further new investments for the development of its activities and expressly agrees and authorizes

the Company to search for new investors and funding. The Company will inform the Investor about the discussions with any new investors

but will not need the Investor’s approval to conclude any fundraising agreements provided that they are concluded at a pre-money

evaluation which is equal or higher than the one which will be defined in the Investment Agreement.

This

Letter of Intent currently constitutes the whole agreement and understanding of the Parties and supersedes any previous arrangements,

understandings or agreements relating to the subject matter of this Letter of Intent.

| 6.1 | Any

variation of this Letter of Intent must be in writing and signed by or on behalf of the parties. |

| 6.2 | Any

waiver of any right under this Letter of Intent is only effective if it is in writing and

it applies only to the party to whom the waiver is addressed and to the circumstances for

which it is given. |

| 6.3 | No

failure to exercise or delay in exercising any right or remedy provided under this Letter

of Intent or by law constitutes a waiver of such right or remedy nor shall it prevent any

future exercise or enforcement thereof. |

| 6.4 | No

single or partial exercise of any right or remedy under this Letter of Intent shall preclude

or restrict the further exercise of any such right or remedy or other rights or remedies. |

| 7. | Governing

law and jurisdiction |

| 7.1 | This

Letter of Intent and any disputes or claims arising out of or in connection with its subject

matter or formation (including non-contractual disputes or claims) are governed by and construed

in accordance with the substantive laws of Switzerland. |

| 7.2 | The

parties irrevocably agree that the competent courts of Lugano, Switzerland have exclusive

jurisdiction to settle any dispute or claim that arises out of or in connection with this

Letter of Intent or its subject matter or formation (including non-contractual disputes or

claims). |

Signed

on November 29, 2023 by:

/S/Alessandro

De Grandi

________________________

Undo

Studios SA

Name:

Alessandro De Grandi

Title:

CEO |

/S/Michael

P. Loubser

________________________

ARAX

HOLDINGS CORP.

Name:

Michael Loubster

Title:

CEO |

|

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

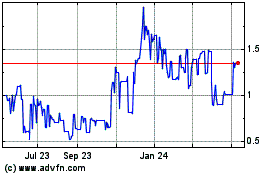

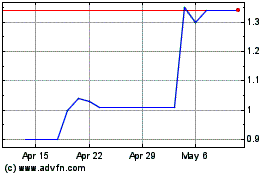

Arax (PK) (USOTC:ARAT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Arax (PK) (USOTC:ARAT)

Historical Stock Chart

From Nov 2023 to Nov 2024