VANCOUVER, British Columbia -- March 12, 2018 -- InvestorsHub

NewsWire -- Anfield Energy Inc. (TSX-V:AEC) (OTCQB:ANLDF)

(FRANKFURT:0AD) (“Anfield” or the

“Company”) is pleased to announce that it has

entered into a term sheet with Cotter Corporation (N.S.L.)

(“Cotter”) to acquire the Charlie ISR Uranium

Project (the “Charlie Project”) located in the

Pumpkin Buttes Uranium District in Johnson County, Wyoming. The

Charlie Project consists of a 720-acre Wyoming State uranium lease

which has been in development since 1969 and sits immediately

adjacent to two of Uranium One’s producing mines. The transaction

will be settled with the issuance of common shares of Anfield to

Cotter equal to a 10% ownership interest in Anfield, with Cotter

retaining a 20% interest in all yellowcake production from the

project. Anfield currently has 22,508,358 shares issued and

outstanding. Anfield will have access to the data from the

previous exploration activities at the Charlie Project, allowing

for rapid preparation of technical reports on the Project.

Anfield’s CEO, Corey Dias, commented: “We are excited to add

the Charlie Project to our portfolio of uranium properties. It is a

critical component of our strategy to create a robust mine-and-mill

production complex in Wyoming. We are now well-positioned for

production when market conditions are right. The Charlie

Project is one of the most-advanced uranium properties in the

United States and Anfield has a resin processing agreement in place

with nearby Uranium One to produce up to 500,000 pounds of uranium

per year at its existing processing facility. Moreover, in

building a significant resource pipeline we are continuing to

update and delineate uranium resources at the 24 Wyoming uranium

projects acquired from Uranium One in 2016. These projects

complement our conventional assets, including the Shootaring Canyon

Mill, allowing us to bring projects on stream optimally according

to market conditions and potential contracts."

The Charlie Project

Inexco Oil began exploration drilling on the Charlie Project in

1969 and over a two year period completed 215 holes, comprising

91,000 ft. of drilling. A joint venture was formed with Uranerz USA

in 1974 and an additional 715 holes were completed, including 57

core holes, totaling 283,906 ft. Cotter acquired the project

from Uranerz and proceeded to evaluate it for both conventional

open pit and in situ mining methods. Cotter excavated a 200 ft.

test pit in 1981 on a small mineralized zone east of the main

trend. Falling uranium prices in the 1980s halted further

development on the project. In January, 1995 Power Resources Inc.

(PRI) completed what it defined as a “feasibility study” for the

project under an agreement with Cotter Corporation for development

as an ISR mine. PRI estimated what it defined as “total

geologic (indicated and inferred) ore reserves” for the project.

The estimate was based on a data from some 1,252 exploration drill

holes using an initial cutoff of 2 feet of 0.02

%eU3O8. PRI utilized both manual GT

contouring and computer-aided geostatistical mineral resource

estimation methods to estimate the contained pounds by blocks (42’

by 42’). PRI then applied economic criteria based on estimated

uranium content, by ISR wellfield pattern, which resulted in range

of 3.1 to 4.6 million pounds of uranium oxide “total geologic ore

reserve” and a corresponding range of average GT of 1.64 to 2.72.

PRI did not state the average thickness or grade. Anfield

considers these estimates to be historical in nature and cautions

that a qualified person has not done sufficient work to classify

the historical estimate as current mineral resources or mineral

reserves and Anfield is not treating the historical estimate as

current mineral resource or mineral reserves. The term “ore

reserve” disclosed as an historical estimate is not consistent with

the requirement of the definition of a mineral reserve per CIM

definitions as the economic viability and technical feasibility of

the project have not been established by preparation and filing of

a preliminary feasibility study or feasibility study.

As part of this study PRI completed, in 1994:

- A coring program to assess disequilibrium, porosity, and to

provide a composite sample for metallurgical testing;

- Mineralogical studies on the core;

- Bench scale leach studies;

- An assessment of the local hydrology and water rights;

- An outline which defined permitting and licensing requirements;

and

- Estimates of both CAPEX and OPEX for the development of the

project as a satellite to PRI’s Highland ISR Uranium Mine.

About Anfield

Anfield is a uranium and vanadium development and near-term

production company that is committed to becoming a top-tier

energy-related fuels supplier by creating value through

sustainable, efficient growth in its assets. Anfield is a

publicly-traded corporation listed on the TSX-Venture Exchange

(AEC-V), the OTCQB Marketplace (ANLDF) and the Frankfurt Stock

Exchange (0AD). Anfield is focused on two production centres, as

summarized below:

Wyoming – Irigaray ISR Processing Plant (Resin

Processing Agreement)

Anfield has also signed a Resin Processing Agreement with

Uranium One whereby Anfield would process up to 500,000 pounds per

annum of its mined material at Uranium One’s Irigaray processing

plant in Wyoming. In addition, the Company can both buy and borrow

uranium from Uranium One in order to fulfill some or all of its

sales contracts.

Anfield’s 24 ISR mining projects are located in the Black Hills,

Powder River Basin, Great Divide Basin, Laramie Basin, Shirley

Basin and Wind River Basin areas in Wyoming. Anfield’s two projects

in Wyoming for which NI 43-101 resource reports have been completed

are Red Rim and Clarkson Hill.

Arizona/Utah – Shootaring Canyon Mill

A key asset in Anfield’s portfolio is the Shootaring Canyon Mill

in Garfield County, Utah. The Shootaring Canyon Mill is

strategically located within one of the historically most prolific

uranium production areas in the United States, and is one of only

three licensed uranium mills in the United States.

Anfield’s conventional uranium assets consist of mining claims

and state leases in southeastern Utah and Arizona, targeting areas

where past uranium mining or prospecting occurred. Anfield’s

conventional uranium assets include the Velvet-Wood Project, the

Frank M Uranium Project, as well as the Findlay Tank breccia pipe.

A NI 43-101 Preliminary Economic Assessment has been completed for

the Velvet-Wood Project. All conventional uranium assets are

situated within a 125-mile radius of the Shootaring Mill.

About Cotter Corporation

Cotter Corporation is a General Atomics (GA) affiliate

headquartered in Denver, Colorado. Originally incorporated in 1956

in New Mexico as a uranium production company, Cotter was purchased

by and became a wholly owned subsidiary of Commonwealth Edison in

1975. GA acquired Cotter in early 2000. Through its various mining

and milling operations, Cotter has produced uranium, vanadium,

molybdenum, silver, lead, zinc, copper, selenium, nickel, cobalt,

tungsten and limestone.

Douglas L. Beahm, P.E., P.G. has approved the scientific and

technical disclosure in the news release. He is a Qualified Person

as defined in NI 43-101.

On behalf of the Board of Directors

ANFIELD ENERGY, INC.

Corey Dias, Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contact:

Anfield Energy, Inc.

Clive Mostert

Corporate Communications

780-920-5044

contact@anfieldenergy.com

www.anfieldenergy.com

Safe Harbor Statement

THIS NEWS RELEASE CONTAINS “FORWARD-LOOKING STATEMENTS”. STATEMENTS

IN THIS NEWS RELEASE THAT ARE NOT PURELY HISTORICAL ARE

FORWARD-LOOKING STATEMENTS AND INCLUDE ANY STATEMENTS REGARDING

BELIEFS, PLANS, EXPECTATIONS OR INTENTIONS REGARDING THE

FUTURE.

EXCEPT FOR THE HISTORICAL INFORMATION PRESENTED HEREIN, MATTERS

DISCUSSED IN THIS NEWS RELEASE CONTAIN FORWARD-LOOKING STATEMENTS

THAT ARE SUBJECT TO CERTAIN RISKS AND UNCERTAINTIES THAT COULD

CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM ANY FUTURE RESULTS,

PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SUCH

STATEMENTS. STATEMENTS THAT ARE NOT HISTORICAL FACTS, INCLUDING

STATEMENTS THAT ARE PRECEDED BY, FOLLOWED BY, OR THAT INCLUDE SUCH

WORDS AS “ESTIMATE,” “ANTICIPATE,” “BELIEVE,” “PLAN” OR “EXPECT” OR

SIMILAR STATEMENTS ARE FORWARD-LOOKING STATEMENTS. RISKS AND

UNCERTAINTIES FOR THE COMPANY INCLUDE, BUT ARE NOT LIMITED TO, THE

RISKS ASSOCIATED WITH MINERAL EXPLORATION AND FUNDING AS WELL AS

THE RISKS SHOWN IN THE COMPANY’S MOST RECENT ANNUAL AND QUARTERLY

REPORTS AND FROM TIME-TO-TIME IN OTHER PUBLICLY AVAILABLE

INFORMATION REGARDING THE COMPANY. OTHER RISKS INCLUDE RISKS

ASSOCIATED WITH SEEKING THE CAPITAL NECESSARY TO COMPLETE THE

PROPOSED TRANSACTION, THE REGULATORY APPROVAL PROCESS,

COMPETITIVE COMPANIES, FUTURE CAPITAL REQUIREMENTS AND THE

COMPANY’S ABILITY AND LEVEL OF SUPPORT FOR ITS EXPLORATION AND

DEVELOPMENT ACTIVITIES. THERE CAN BE NO ASSURANCE THAT THE COMPANY

WILL BE ABLE TO COMPLETE THE PROPOSED TRANSACTION, THAT THE

COMPANY’S EXPLORATION EFFORTS WILL SUCCEED OR THE COMPANY WILL

ULTIMATELY ACHIEVE COMMERCIAL SUCCESS. THESE FORWARD-LOOKING

STATEMENTS ARE MADE AS OF THE DATE OF THIS NEWS RELEASE, AND THE

COMPANY ASSUMES NO OBLIGATION TO UPDATE THE FORWARD-LOOKING

STATEMENTS, OR TO UPDATE THE REASONS WHY ACTUAL RESULTS COULD

DIFFER FROM THOSE PROJECTED IN THE FORWARD-LOOKING STATEMENTS.

ALTHOUGH THE COMPANY BELIEVES THAT THE BELIEFS, PLANS, EXPECTATIONS

AND INTENTIONS CONTAINED IN THIS NEWS RELEASE ARE REASONABLE, THERE

CAN BE NO ASSURANCE THOSE BELIEFS, PLANS, EXPECTATIONS OR

INTENTIONS WILL PROVE TO BE ACCURATE. INVESTORS SHOULD CONSIDER ALL

OF THE INFORMATION SET FORTH HEREIN AND SHOULD ALSO REFER TO THE

RISK FACTORS DISCLOSED IN THE COMPANY’S PERIODIC REPORTS FILED FROM

TIME-TO-TIME.

THIS NEWS RELEASE HAS BEEN PREPARED BY MANAGEMENT OF THE COMPANY

WHO TAKES FULL RESPONSIBILITY FOR ITS CONTENTS.

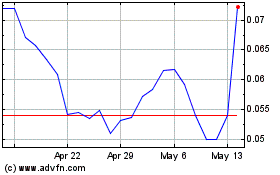

Anfield Energy (QB) (USOTC:ANLDF)

Historical Stock Chart

From Oct 2024 to Nov 2024

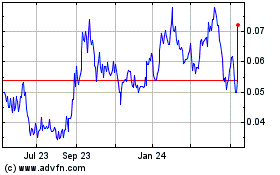

Anfield Energy (QB) (USOTC:ANLDF)

Historical Stock Chart

From Nov 2023 to Nov 2024