Additional Information (definitive) (defa14c)

May 23 2023 - 6:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C

INFORMATION

STATEMENT PURSUANT TO SECTION 14(c)

OF

THE SECURITIES EXCHANGE ACT OF 1934

☐

Preliminary Information Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14c–5(d)(2))

☐

Definitive Information Statement

☒

Definitive Additional Materials

American

International Holdings Corp.

(Name

of Registrant as Specified in Charter)

Payment

of Filing Fee (Check all boxes that apply):

☒

No fee required

☐

Fee paid previously with preliminary materials

☐

Fee computed on table in exhibit required by Item 25(b) of Schedule 14A (17 CFR 240.14a–101) per Item 1 of this Schedule and Exchange

Act Rules 14c–5(g) and 0–11

SUPPLEMENT

TO

DEFINITIVE

INFORMATION STATEMENT

PURSUANT

TO SECTION 14(C) OF THE SECURITIES EXCHANGE ACT OF 1934 AND REGULATION 14C PROMULGATED THEREUNDER

OF

AMERICAN

INTERNATIONAL HOLDINGS CORP.

The

following information relates to the definitive Information Statement on Schedule 14C (the “Information Statement”)

of American International Holding Corp. (the “Company”) dated May 12, 2023, and filed with the Securities and Exchange

Commission on May 15, 2023 in connection with certain shareholder actions approved effective on May 10, 2023, by Marble Trital Inc.,

which entity is beneficially owned by Mr. Michael McLaren, the Company’s Chief Executive Officer and Chairman, due to his ownership

of 100% of Marble Trital Inc. and his position as Chief Executive Officer thereof, the holder of 1,000,000 shares of the Company’s

Series A Convertible Preferred Stock, representing 292,500,000 voting shares as of such date or 60.0% of the 487,500,000 total voting

shares as of such date (the “Majority Shareholder”), via a written consent in lieu of a special meeting of shareholders

(the “Majority Shareholder Consent”).

Capitalized

terms used in this supplement to the Information Statement dated May 22, 2023 (this “Supplement”) and not otherwise

defined have the meaning given to them in the Information Statement.

THIS

SUPPLEMENT SHOULD BE READ IN CONJUNCTION WITH THE INFORMATION STATEMENT. Information presented in this Supplement, to the extent it contradicts

any language in the previously filed Information Statement, shall replace and supersede such contradictory language included in the previously

filed Information Statement.

EXPLANATORY

NOTE

This

Supplement is being filed solely to correct the disclosure in the Information Statement regarding the conversion rights of the Series

A Convertible Preferred Stock of the Company as set forth in footnote (5) of the table showing the effects of the reverse stock split

based on various exchange ratios on page 11 and footnote (1) of the Security Ownership of Certain Beneficial Owners and Management table

on page 14. Other than to correct those footnotes (as corrected below) this Supplement does not alter or affect any other part or other

information set forth in the Information Statement nor does this Supplement modify or update in any way disclosures made in the Information

Statement. The Information statement contains important additional information. This Supplement should be read in conjunction with the

Information statement.

CORRECTION

TO INFORMATION STATEMENT

Footnote

(5) on page 11 of the Information Statement is corrected to read:

(5)

Each holder of Series A Preferred Stock may, at its option, convert its shares of Series A Preferred Stock (each a “Series

A Conversion”) into that number of shares of common stock equal to the holder’s pro rata share of all Series A Preferred

Stock then issued and outstanding, multiplied by (i) 60%, minus the aggregate percentage of the Company’s outstanding common stock

previously converted by holders of the Series A Preferred Stock, through such applicable date (the “Remaining Percentage”)(for

example, if prior to the applicable date of determination, shares of Series A Preferred Stock have been converted into 3% of the outstanding

shares of common stock as of such date of determination, the Remaining Percentage would be 57%), multiplied by (ii) the outstanding shares

of our common stock as of the applicable date of determination, divided by 0.40, divided by (iii) the total number of shares of Series

A Preferred Stock then outstanding. No individual conversion by any individual holder shall be in an amount greater than 9.99% of the

outstanding common stock of the Company on the date on which the holder delivers notice of such conversion to the Company (the “Individual

Conversion Limitation”). The result of the above, is that such Series A Preferred Stock is convertible into 60% of the Company’s

outstanding common stock (on a post-conversion basis, i.e., 150% of the Company’s outstanding common stock on a pre-conversion

basis) currently.

Footnote

(1) on page 14 of the Information Statement is corrected to read:

(1)

The Series A Preferred Stock currently has the right, voting in aggregate, to vote on all shareholder matters equal to sixty percent

(60%) of the total vote. The Series A Preferred Stock is also currently convertible into 60% of the Company’s total outstanding

common stock following such conversion (i.e., 150% of the Company’s outstanding common stock on a pre-conversion basis), subject

to the Individual Conversion Limitation, discussed above.

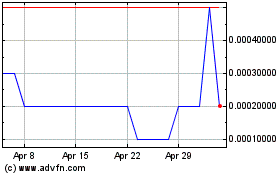

American (CE) (USOTC:AMIH)

Historical Stock Chart

From Nov 2024 to Dec 2024

American (CE) (USOTC:AMIH)

Historical Stock Chart

From Dec 2023 to Dec 2024