AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $3,091,000 for the third quarter of 2013. Earnings per

share (basic) in the third quarter of 2013 were $0.63 versus $0.68

in the third quarter of 2012.

“In the third quarter of last year, the Bank took advantage of

some of the gains in the bond portfolio, adding to its earnings and

thus increasing the Bank’s capital. These strategic gains were

limited in the third quarter of this year due to the movement in

interest rates. As a result, the Bank’s securities gains were

smaller for the three months ended September 2013 compared to the

three months ended September 2012. Comparing the two quarters

operating results without the securities gains, the Bank’s earnings

grew 2% from 2012 to 2013 and the earnings per share rose from

$0.55 to $0.56,” said Wes Schaefer, Vice Chairman and CFO.

“We were very happy with our third quarter loan production,”

said Leon Blankstein, President and CEO. “The increase in deposits

is also outstanding, reflecting the Bank’s continued ability to

gain market share in Southern California.”

“The Bank has been true to its commitment to maintain a fortress

balance sheet,” said Robert Schack, Chairman. “We continue to build

our retained earnings and increase reserves at a time when many

banks are releasing reserves to enhance their profitability.”

Total assets increased 5% or $69 million to $1.349 billion at

September 30, 2013 as compared to $1.280 billion at September 30,

2012. The loan portfolio (net) increased 28% or $121 million to

$558 million at September 30, 2013 as compared to $437 million at

September 30, 2012. Deposits increased 13% or $143 million to

$1.203 billion at September 30, 2013 as compared to $1.060 billion

at September 30, 2012.

During the third quarter of 2013, Net Interest Income increased

$359,000 or 3% to $10,064,000 from $9,705,000 during the third

quarter of 2012.

Non-Interest income during the third quarter of 2013 decreased

$626,000 to $833,000 from $1,459,000 during the third quarter of

2012. This was centered in fewer investment gains as mentioned

above.

Non-Interest expense during the third quarter of 2013 increased

$422,000 or 7% to $6,211,000 from $5,789,000 during the third

quarter of 2012.

Asset quality at quarter-end remains excellent, with $979,000 of

non-performing loans, or 0.2% of total loans; and, no OREO.

Included in the non-performing loans was a $280,000 U.S. government

guaranteed SBA loan. At the end of September of 2013, the allowance

for loan losses stood at $10,924,000 or 1.92% of loans.

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

with $1.349 billion in total assets offers a wide range of

financial services to the business marketplace. Clients include

wholesalers, manufacturers, service businesses, professionals and

non-profits. The Bank has opened four Loan Production Offices in

strategic areas including our Orange County Office in Irvine, our

South Bay Office in Torrance, our San Fernando Valley Office in the

Warner Center and our Inland Empire Office in Ontario.

American Business

Bank Figures in $000, except per share amounts

CONSOLIDATED BALANCE SHEET (unaudited) For

the period ended: September September

Change 2013 2012 %

Assets: Cash & Equivalents $ 70,668 $

49,261 43.5 % Fed Funds Sold 1,000 1,000 0.0 % Interest Bearing

Balances 28 28 0.0 %

Investment

Securities:

US Agencies 359,695 432,016 -16.7 % Mortgage Backed Securities

155,317 184,639 -15.9 % State & Municipals 161,988 136,513 18.7

% Other 3,139

134 2242.5 % Total Investment

Securities 680,139 753,302 -9.7 %

Gross

Loans:

Commercial Real Estate 334,810 253,398 32.1 % Commercial &

Industrial 193,217 156,992 23.1 % Other Real Estate 36,713 31,682

15.9 % Other 4,745

5,410 -12.3 % Total Gross Loans

569,485 447,482 27.3 % Allowance for

Loan & Lease Losses (10,924 )

(9,846 ) 10.9 % Net Loans 558,561 437,636 27.6 % Premises

& Equipment 726 793 -8.4 % Other Assets

37,689 37,723

-0.1 %

Total Assets

$ 1,348,811

$ 1,279,743 5.4 %

Liabilities:

Demand Deposits $ 573,039 $ 532,999 7.5 % Money Market 549,875

446,893 23.0 % Time Deposits and Savings

80,469 80,244 0.3 % Total

Deposits 1,203,383 1,060,136 13.5 % FHLB Advances / Other

Borrowings 44,000 100,000 -56.0 % Other Liabilities

6,031

19,210 -68.6 %

Total Liabilities

$ 1,253,414

$ 1,179,346 6.3 %

Shareholders'

Equity:

Common Stock & Retained Earnings $ 103,878 $ 87,799 18.3 %

Accumulated Other Comprehensive Income (8,481

) 12,598 -167.3 %

Total Shareholders' Equity $

95,397 $ 100,397

-5.0 %

Total Liabilities & Shareholders'

Equity $ 1,348,811

$ 1,279,743 5.4 %

Capital

Adequacy:

Tangible Common Equity / Tangible Assets 7.07 % 7.85 % -- Tier 1

Leverage Ratio 7.79 % 7.25 % -- Tier 1 Capital Ratio / Risk

Weighted Assets 15.61 % 17.50 % -- Total Risk-Based Ratio 16.87 %

18.76 % --

Per Share

Information:

Common Shares Outstanding 4,898,911 4,875,564 -- Book Value Per

Share $ 19.47 $ 20.59 -5.4 % Tangible Book Value Per Share $ 19.47

$ 20.59 -5.4 %

American Business Bank Figures in $000, except per share

amounts

CONSOLIDATED INCOME STATEMENT (unaudited)

For the 3-month period:

September September Change 2013

2012 %

Interest

Income:

Loans & Leases $ 6,499 $ 5,856 11.0 % Investment

Securities 3,984

4,473 -10.9 % Total Interest Income 10,483 10,329 1.5

%

Interest

Expense:

Money Market, NOW Accounts & Savings 311 426 -27.0 % Time

Deposits 85 123 -30.9 % Repurchase Agreements / Other

Borrowings 23 75

-69.3 % Total Interest Expense 419 624 -32.9 % Net

Interest Income 10,064 9,705 3.7 % Provision for Loan Losses

(300 ) (300 ) 0.0 % Net

Interest Income After Provision 9,764 9,405 3.8 %

Non-Interest

Income:

Deposit Fees 312 259 20.5 % Realized Securities Gains / (Losses)

451 937 -51.9 % Other

70 263 -73.4 % Total

Non-Interest Income 833 1,459 -42.9 %

Non-Interest

Expense:

Compensation & Benefits 3,860 3,583 7.7 % Occupancy &

Equipment 491 532 -7.7 % Other

1,860 1,674

11.1 % Total Non-Interest Expense 6,211 5,789 7.3 %

Pre-Tax Income 4,386 5,075 -13.6 % Provision for Income Tax

(1,295 ) (1,742 )

-25.7 %

Net Income

$ 3,091 $ 3,333 -7.3 %

Per Share

Information:

Average Shares Outstanding (for the quarter) 4,895,700 4,875,564 --

Earnings Per Share - Basic $ 0.63 $ 0.68 -7.6 %

American Business Bank

Figures in $000, except per share amounts

September September Change 2013

2012 %

Performance

Ratios

Return on Average Assets (ROAA) 1.09 % 0.92 % -- Return on Average

Equity (ROAE) 13.93 % 12.00 % --

Asset Quality

Overview

Non-Performing Loans $ - $ - NA Loans 90+Days Past Due

979 220

345.0 % Total Non-Performing Loans $ 979 $ 220 345.0 %

Restructured Loans (TDR's) $ 1,911 $ 4,928 -61.2 %

Other Real Estate Owned 0 0 -- ALLL / Gross Loans 1.92 %

2.20 % -- ALLL / Non-Performing Loans * 1115.83 % 4475.45 % --

Non-Performing Loans / Total Loans * 0.17 % 0.05 % --

Non-Performing Assets / Total Assets * 0.07 % 0.02 % -- Net

Charge-Offs $

1,063

$ -

--

Net Charge-Offs / Average Gross Loans

0.19

% 0.00 %

--

* Excludes Restructured Loans

AMERICAN BUSINESS BANKWes E. SchaeferVice Chairman and Chief

Financial Officer(213) 430-4000

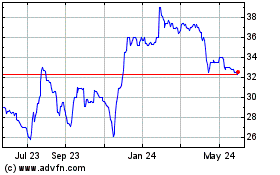

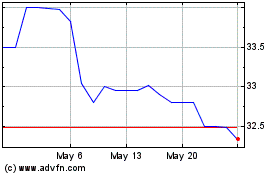

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025