American Bus. Bank Announces Its Results for the Year Ended December 31st 2011, Including 17% Deposit Growth & 14% Earnings G...

January 20 2012 - 3:42PM

Business Wire

AMERICAN BUSINESS BANK (Bank) (OTCBB: AMBZ) today reported net

income of $9,886,000 for the year ended December 2011, a 14%

increase over the $8,701,000 earned in 2010. Earnings per share

(EPS) for 2011 increased to $2.24 versus $1.99 in 2010. Shares

outstanding at the end of the year totaled 4,427,862.

“The Bank once again exceeded its targets for asset and income

growth in 2011, a year that presented challenges due to the very

low investment yields available in the marketplace and the general

lack of demand for loans by customers affecting the banking

industry as a whole,” said Wes Schaefer, Vice Chairman of the

Bank.

“Our results reflect the Bank’s ability to stay on the course

set out since its founding. We have not changed our business model

and it has proven to be effective despite the swings in the economy

that we have seen over the past fourteen years,” said Don Johnson,

CEO of the Bank.

Robert Schack, Chairman, added, “When you combine some of the

best bankers in the business with one of the best business banking

markets in the country, the results are excellent.”

Assets and Liabilities

Total assets increased over 17% or $168 million to $1.178

billion at December 31, 2011 as compared to $1.010 billion at

December 31, 2010. Loans increased 2% or $8 million from $401

million to $409 million, while investments increased 25% or $141

million. Funding the asset growth was a 17% or $150 million

increase in core deposits.

Interest Income

During 2011, Net Interest Income increased $3,594,000 or 11%

over the previous year.

Non-interest Income

Non-interest Income for the year rose 24% to $4,309,000 in 2011

from $3,461,000 in 2010.

Credit Quality

Asset quality at year-end remains excellent, with no past dues

and no OREO loans. At 2011 year-end, the allowance for loan losses

stood at $8.9 million or 2.14% of loans.

AMERICAN BUSINESS BANK headquartered in downtown Los Angeles

offers a wide range of financial services to the business

marketplace. Clients include wholesalers, manufacturers, service

businesses, professionals and non-profits. The Bank has opened four

Loan Production Offices in strategic areas including our Orange

County Office in Irvine, our South Bay Office in Torrance, our San

Fernando Valley Office in the Warner Center and our Inland Empire

Office in Ontario.

AMERICAN BUSINESS BANK BALANCE SHEET

(Unaudited - 000's omitted)

December

2011 2010

Assets Investment Securities $ 702,949 $ 562,053

Loans and Leases (net) 409,354 401,554 Cash, Checks in process of

collection, Due From Banks 28,093 9,750 Premises, Equipment and

Other Assets 37,330 36,152

Total Assets

$ 1,177,726 $ 1,009,509

Liabilities and Shareholders' Equity Demand Deposits

$ 459,317 $ 346,992 Money Market and NOW Deposits 483,480 447,261

Savings and Time Deposits 85,760 84,656 Total

Deposits 1,028,557 878,909 FHLB Advances/ Borrowings 48,000

56,400 Other Liabilities 14,197 8,225 Shareholders' Equity

86,972 65,975

Total Liabilities and

Shareholders' Equity $ 1,177,726 $

1,009,509 AMERICAN BUSINESS BANK INCOME

STATEMENT

(Unaudited - 000's omitted)

Twelve months ended December

2011 2010 Interest

Income Loans and Leases $ 22,122 $ 21,319 Investment Securities

16,339 14,580 Total Interest Income

38,461 35,899

Interest Expense Money Market and NOW

Accounts 2,453 3,085 Savings and Time Deposits 778 1,003 Repurchase

Agreements/ Other Borrowings 315 490

Total Interest Expense 3,546 4,578

Net Interest Income 34,915 31,321 Provision for Loan

Losses (2,043 ) (1,783 ) Net Interest Income

After Provision for Loan Losses 32,872 29,538

Other

Income 4,309 3,461

Operating Expenses

23,210 22,020

Operating Income

13,971 10,979

Income Taxes (4,085 )

(2,278 )

Net Earnings

$ 9,886 $ 8,701 Selected

Ratios: Earnings per Share $ 2.24 $ 1.99 Tier 1 Capital Ratio

6.72 % 6.68 % Net Interest Margin (Prior to tax effects) 3.39 %

3.49 % Return on Beginning Equity 15.04 % 13.79 % Return on Average

Assets 0.91 % 0.91 % Efficiency Ratio 56.3 % 61.6 %

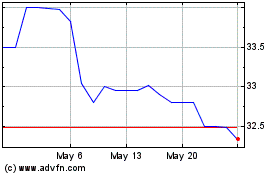

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

American Business Bank (QX) (USOTC:AMBZ)

Historical Stock Chart

From Jan 2024 to Jan 2025