Allianz Sets out Midterm Targets

December 03 2021 - 2:38AM

Dow Jones News

By Joshua Kirby

Allianz SE on Friday set out higher financial targets for the

next three years, as the German insurer looks to focus on its most

profitable business lines.

Marking its capital-markets day, Allianz said it is aiming to

book 5%-7% compounded average annual growth in earnings per share

between 2022 and 2024. This will be driven by higher revenue,

better profitability and efficient capital management, the company

said.

The company is targeting a return on equity of at least 13% by

2024, and a Solvency II ratio of at least 180%.

In order to attain these goals, Allianz will focus on preferred

businesses in life & health such as protection & health,

unit-linked and capital-light products, it said. In the property

& casualty division, Allianz is targeting revenue growth of

3%-4% annually, and aims to reduce expenses to a ratio of around

26% by 2024.

Separately Friday, Allianz set out its amended dividend policy,

targeting a yearly increase of at least 5% in its payout. This

policy is dependent on a Solvency II ratio of at least 150%,

Allianz said.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

December 03, 2021 02:23 ET (07:23 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

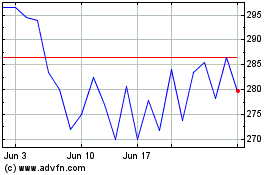

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Nov 2024 to Dec 2024

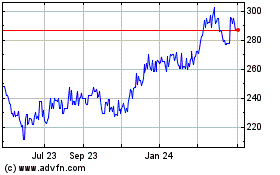

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Dec 2023 to Dec 2024