Trigon Metals Closes on C$5.5 million funding from The Lind Partners

May 04 2022 - 7:28PM

Trigon Metals Inc. (TSX.V:TM)

(“

Trigon” or the “

Company”) is

pleased to announce that it has closed on the funding of

C$5,500,000 pursuant to its previously announced convertible

security funding agreement (the “

Agreement”) with

Lind Global Fund II, LP, an entity managed by The Lind Partners,

LLC, a New York-based institutional fund manager (together,

“

Lind”) (see the Company’s press release dated

April 28, 2022 for further details).

Pursuant to the Agreement, Lind has made an

investment of C$5,500,000, less a commitment fee of C$165,000, in

exchange for a convertible security (the “Convertible

Security”) with a face value of C$6,600,000 (the

“Face Value”), representing a principal amount of

C$5,500,000 (the “Principal Amount”) and a

pre-paid interest amount of C$1,100,000 (the “Pre-Paid

Interest”). Commencing four months from today’s date,

Trigon will begin repaying the Convertible Security in C$275,000

monthly installments. Lind will have the right to convert any

portion of the Principal Amount (less the commitment fee) into

common shares of Trigon ("Common Shares") at a

price per share of C$0.335. Pre-Paid Interest will accrue over a

period of 24 months from closing and be calculated at the end of

each calendar month. Once accrued, Lind will have the option, once

every 90 days, to convert accrued Pre-Paid Interest into Common

Shares at a price equal to 90% of the market closing price of the

Common Shares on the TSX Venture Exchange (the “Exchange”) on the

day immediately prior to conversion. The Agreement also contains

strict no shorting provisions.

The Convertible Security ranks senior, secured

by all of Trigon's assets (except the shares in Trigon’s Moroccan

subsidiary), including a general security agreement, a guarantee

from Trigon's Barbados subsidiary and a share pledge of its

Barbados subsidiary shares.

In connection with the issuance of the

Convertible Security, Trigon has issued to Lind 15,925,373 Common

Share purchase warrants exercisable for a term of 24 months at an

exercise price of C$0.35 per Common Share.

The Agreement and the issuance of securities

thereunder were conditionally approved by the Exchange on April 28,

2022. The transactions described herein are subject to final

approval of the Exchange.

About Trigon

Trigon is a publicly traded Canadian exploration

and development company with its core business focused on copper

and silver holdings in mine-friendly African jurisdictions.

Currently the company has operations in Namibia and Morocco. In

Namibia, the Company holds an 80% interest in five mining licences

in the Otavi Mountainlands, an area of Namibia widely recognized

for its high-grade copper deposits, where the Company is focused on

exploration and re-development of the previously producing Kombat

Mine. In Morocco, the Company is the holder of the Silver Hill

project, a highly prospective copper and silver exploration

project.

About The Lind Partners,

LLC

The Lind Partners manages institutional funds

that are leaders in providing growth capital to small- and mid-cap

companies publicly traded in the US, Canada, Australia and the UK.

Lind’s funds make direct investments ranging from US$1 to US$30

million, invest in syndicated equity offerings and selectively buy

on market. Having completed more than 100 direct investments

totaling over US$1 Billion in transaction value, Lind’s funds have

been flexible and supportive capital partners to investee companies

since 2011.For more information, please visit

http://www.thelindpartners.com.

On behalf of the Board of Directors of Trigon

Metals Inc.:

Jed Richardson, Director and Chief Executive

Officer

Follow on:

Facebook Instagram LinkedIn Twitter

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

This news release may contain forward-looking

statements. These statements include statements regarding the

Convertible Security and Trigon's future business plans and

objectives. These statements are based on current expectations and

assumptions that are subject to risks and uncertainties. Actual

results could differ materially because of factors discussed in the

management discussion and analysis section of our interim and most

recent annual financial statements or other reports and filings

with the TSX Venture Exchange and applicable Canadian securities

regulations. We do not assume any obligation to update any

forward-looking statements, except as required by applicable

laws.

For further information,

contact:

Jed Richardson+1 647 276

6002jed.richardson@trigonmetals.comWebsite: www.trigonmetals.com

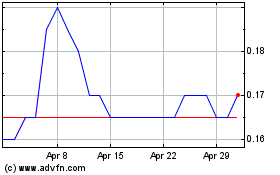

Trigon Metals (TSXV:TM)

Historical Stock Chart

From Feb 2025 to Mar 2025

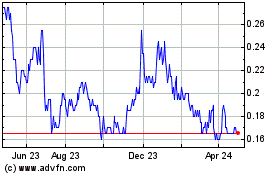

Trigon Metals (TSXV:TM)

Historical Stock Chart

From Mar 2024 to Mar 2025