BioSyent Releases 2009 Financial Results

April 26 2010 - 4:05PM

Marketwired Canada

BioSyent Inc. ("BioSyent")(TSX VENTURE:RX) today released a summary of its 2009

financial results.

Total Sales were 6.5% lower at $1,029,903 in 2009 compared to $1,101,991 in 2008.

Gross Margins increased from 58.8% in 2008, to 64.4% in 2009 primarily because

of sales mix in favour of higher margin products.

The Company incurred a loss of ($260,556) in 2009 compared to a loss of

($287,892) in 2008. This loss is predominantly due to a decrease in sales of

Canadian Protect-It(R) and investments in pharmaceutical operations.

Full details of 2009 results including December 31, 2009 Financial Statements

and Management's Discussion & Analysis will be published in the company's 2009

Annual Report and will be posted on sedar.com on April 26, 2009.

BioSyent Inc. continues to concentrate on its pharmaceutical strategy to source

products that have been successfully developed and proven to be safe and

effective; manage these products through the regulatory process and product

registration (approval); and once approved, market these products in Canada.

These pharmaceuticals will compete in both the branded and generic market

segments and will not require further product development investment other than

regulatory costs.

BioSyent Inc. is a publicly traded specialty pharmaceutical company whose wholly

owned subsidiary, BioSyent Pharma Inc., sources, acquires or in-licences

pharmaceutical products and markets these products in Canada. Wholly owned

BioSyent subsidiary Hedley Technologies Ltd. operates the company's legacy

business marketing bio and health friendly non-chemical insecticides. BioSyent

common shares are listed for trading on the TSX Venture Exchange (TSXV) under

the symbol RX.

This press release may contain information or statements that are

forward-looking. The contents herein represent our judgment, as at the release

date, and are subject to risks and uncertainties that may cause actual results

or outcomes to be materially different from the forward-looking information or

statements. Potential risks may include, but are not limited to, those

associated with clinical trials, product development, future revenue,

operations, profitability and obtaining regulatory approvals.

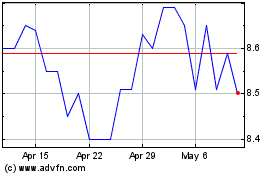

Biosyent (TSXV:RX)

Historical Stock Chart

From Jun 2024 to Jul 2024

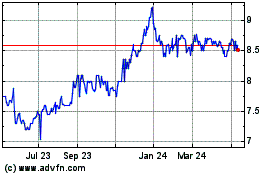

Biosyent (TSXV:RX)

Historical Stock Chart

From Jul 2023 to Jul 2024