Questor Technology Inc. (“Questor” or the “Company”) (TSX-V: QST)

announced today its financial and operating results for the second

quarter ended June 30, 2024.

Questor’s unaudited Condensed Consolidated

Financial Statements and Management’s Discussion and Analysis for

the quarter ended June 30, 2024, are available on the Company’s

website at www.questortech.com/investors and at

www.sedarplus.ca.

Unless otherwise noted, all financial figures

are presented in Canadian dollars, prepared in accordance with

International Financial Reporting Standards and are unaudited for

the three and six months ended June 30, 2024, and June 30,

2023.

SECOND QUARTER 2024 FINANCIAL

RESULTS

|

|

Three months ended June 30, |

Six months ended June 30, |

|

For the |

2024 |

2023 |

2024 |

2023 |

|

(Stated in CDN $) |

|

|

|

|

|

Revenue |

870,360 |

2,216,578 |

1,601,978 |

4,055,353 |

|

Gross profit |

42,156 |

807,705 |

254,431 |

1,550,221 |

|

Adjusted EBITDA(1) |

(721,640) |

205,289 |

(1,199,225) |

433,911 |

|

Loss for the period |

(966,246) |

(501,777) |

(1,603,005) |

(676,645) |

|

Loss per share - basic and diluted |

(0.03) |

(0.02) |

(0.06) |

(0.02) |

|

As at |

June 30, 2024 |

December 31, 2023 |

| (Stated in CDN $) |

|

|

| Working capital (2) |

7,837,556 |

11,844,178 |

| Total assets |

26,925,851 |

27,125,820 |

| Total

equity |

22,716,291 |

24,357,652 |

(1) Adjusted EBITDA is defined as net income or

loss for the period less interest, taxes, depreciation and

amortization, foreign exchange losses (gains), non-cash stock-based

compensation, and gains and losses that are extraordinary or

non-recurring.(2) Working capital is defined as total current

assets less total current liabilities.

Revenue for the three and six months ended June

30, 2024 was $0.9 million and $1.6 million, compared to $2.2

million and $4.1 million for the same periods ended June 30, 2023.

The reduction of revenue is primarily attributed to timing

differences resulting from shifting projects and rental start dates

within the timelines of customer proposals. As of today, the

Company has $1.5 million of committed equipment sales revenue to be

completed in 2024. Requests for both equipment sales and rental

proposals remain strong in 2024. The company remains focused on

strategic initiatives to drive future growth.

Gross profit as a percent of revenue for the

three and six months ended June 30, 2024 was 5 and 16 percent

compared to 36 and 38 percent in the same period of 2023. The

reduction is mainly due to the shifting of projects and rental

start dates, where the Company continues to incur fixed costs,

partially offset with strong margins on revenue and sales mix,

paired with continued focus on controlling costs.

Adjusted EBITDA for the three and six months

ended June 30, 2024 was negative $0.7 million and negative $1.2

million compared to positive $0.2 million and positive $0.4 million

for the same periods in 2023. The reduction in Adjusted EBITDA is

mainly due to the shifting of equipment sales projects and rental

start dates, where the Company continues to incur operational and

administrative fixed costs.

The Company continues to have a strong financial

position at June 30, 2024 including cash and cash equivalents of

$3.8 million, $5.1 million of highly liquid short-term investments,

and working capital of $7.8 million.

SECOND QUARTER 2024 HIGHLIGHTS AND

SUBSEQUENT EVENTS

In the quarter, Questor announced a purchase

order for $0.5 million to a large midstream company in Canada, and

another for $1 million to an energy company in Nigeria.

The Company continues construction of its

prototype 1,500kw waste heat to power unit. Shop testing of the

unit will commence in September of 2024. Negotiations are under way

for a partner location for site installation and field testing.

In June, the Company recognized the final

payment of the SDTC milestone one totaling $1,393,246 with

reasonable assurance the conditions of receiving the grant have

been met, and grant disbursal is expected to be received by the end

of 2024.

On February 9, 2024, Questor commenced a

Normal-course issuer bid (“NCIB”), allowing Questor to purchase a

maximum of 1,400,000 common shares over the 12-month period for

cancellation. NCIB is effective until the earliest of (i) February

7, 2025, (ii) the Company purchasing the maximum of 1,400,000

Shares, and (iii) the Company terminating the NCIB. In connection

with the current NCIB, Questor entered into an automatic share

purchase plan (“ASPP”) with its designated broker to enable the

purchase of shares during blackout periods during which the Company

would not ordinarily be permitted to purchase shares. Purchases

under the ASPP during those periods are determined by the

designated broker in its sole discretion based on the purchasing

parameters set by Questor in accordance with the rules of the TSX

Venture Exchange, applicable securities laws and the terms of the

ASPP. Outside of the periods noted above, purchases under the

current NCIB are completed at Questor's discretion. As of August

14, 2024, under the current NCIB and the instructions in place with

the broker, Questor purchased for cancellation of 391,500 shares at

a weighted average share price of $0.55.

During the second quarter of 2024, the Board of

Directors approved the issuance of 25,000 stock options, 100,000

performance share units and 105,167 restricted share units, to

officers and employees. The share-based awards will be granted in

the third quarter.

PRESIDENT’S MESSAGE

The global emission regulatory environment is

rapidly evolving and continues to develop favorably for the

Company’s products, as regulators, the courts, investors, and the

public are putting pressure on the industry to reduce methane

emissions, flaring and venting from their operations. Questor is

seeing significant global interest in its technology solutions.

Methane has become the emission of focus in the battle to stop the

global temperature rise. Methane is a climate "super

pollutant" and is considered the low-hanging fruit in climate

change mitigation because it’s a potent greenhouse gas

with 86 times the warming potential of

carbon dioxide over a 20-year period and responsible for 30% of

observed global warming to date. It also degrades much more

quickly than CO2, meaning that cuts in methane emissions now, can

have a quick and significant effect on reducing global

warming. Reducing methane emissions from sources like the

fossil fuel industry is seen as one of the cheapest and most

effective ways to combat climate change. The combustion efficiency

of our thermal oxidizer is ISO 14034 certified to 99.99% combustion

efficiency performance, allows our clients to credibly demonstrate

their facilities are not emitting methane, and reducing or

eliminating volatile organic compounds (VOCs). Utilizing the heat

generated from combusting the methane by our organic rankine cycle

(ORC), creates a revenue stream that offsets the costs of getting

to (net) zero carbon dioxide equivalent emissions. Most major oil

and gas producers have made net zero goals. The combination of our

clean combustion and waste heat to power technology allows our

clients to achieve their net zero goals at potentially zero net

cost.

The purchase orders received by Questor in the

second quarter, totalling approximately $1.5 million, are the

result of a multi-year strategy of positioning Questor to be an

indispensable solution for our clients in honouring their

commitment to zero routine flaring by 2030 and cutting global

methane emissions by at least 30% from 2020 levels by 2030. To

accelerate the adoption of Questor solutions, we have partnered

with global representatives for our products and services. In

India, Questor has partnered with Hi-Tech, who have been in

business since 1989 with 11 locations and a track record

introducing technology solutions to the Indian market. Questor is

represented by OilSERV, a leading integrated oilfield services

company in the Middle East and North Africa region.

In Nigeria, Questor is represented by Ar-Rahman

Technical Services Nig. Limited. In the Latin America region,

Questor has partnered with Hoerbiger, which has over 120 locations

in around 50 countries worldwide and has been in business since

1925. Questor has spent the last two years developing relationships

with these partners, educating them on our technology, and

supporting them in client meetings and proposals. Over this period,

we have submitted proposals worth over $60 million all of which

have the potential to grow our international revenue

significantly.

We anticipate new and existing global clients

will view Questor as an ideal solution to accelerate the attainment

of their net zero pledges, given our suite of products and services

eliminate flaring and utilize waste heat to reduce costs.

FORWARD LOOKING STATEMENTS

Certain information in this news release

constitutes forward-looking statements. When used in this news

release, the words "may", "would", "could", "will", "intend",

"plan", "anticipate", "believe", "seek", "propose", "estimate",

"expect", and similar expressions, as they relate to the Company,

are intended to identify forward-looking statements. This news

release contains forward-looking statements with respect to, among

other things, business objectives, expected growth, results of

operations, performance, business projects and opportunities and

financial results. These statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking statements. Such statements reflect the

Company’s current views with respect to future events based on

certain material factors and assumptions and are subject to certain

risks and uncertainties, including without limitation, changes in

market, competition, governmental or regulatory developments,

general economic conditions and other factors set out in the

Company’s public disclosure documents. Many factors could cause the

Company’s actual results, performance or achievements to vary from

those described in this news release, including without limitation

those listed above. These factors should not be construed as

exhaustive. Should one or more of these risks or uncertainties

materialize, or should assumptions underlying forward-looking

statements prove incorrect, actual results may vary materially from

those described in this news release and such forward-looking

statements included in, or incorporated by reference in this news

release, should not be unduly relied upon. Such statements speak

only as of the date of this news release. The Company does not

intend, and does not assume any obligation, to update these

forward-looking statements. The forward-looking statements

contained in this news release are expressly qualified by this

cautionary statement.

ABOUT QUESTOR TECHNOLOGY

INC.

Questor Technology Inc., incorporated in Canada

under the Business Companies Act (Alberta) is an environmental

emissions reduction technology company founded in 1994, with global

operations. The Company is focused on clean air technologies that

safely and cost effectively improve air quality, support energy

efficiency and greenhouse gas emission reductions. The Company

designs, manufactures and services high efficiency clean combustion

systems that destroy harmful pollutants, including Methane,

Hydrogen Sulfide gas, Volatile Organic Hydrocarbons, Hazardous Air

Pollutants and BTEX (Benzene, Toluene, Ethylbenzene and Xylene)

gases within waste gas streams at 99.99 percent efficiency per its

ISO 14034 Certification. This enables its clients to meet emission

regulations, reduce greenhouse gas emissions, address community

concerns and improve safety at industrial sites.

The Company also has proprietary heat to power

generation technology and is currently targeting new markets

including landfill biogas, syngas, waste engine exhaust, geothermal

and solar, cement plant waste heat in addition to a wide variety of

oil and gas projects. The combination of Questor’s clean combustion

and power generation technologies can help clients achieve net zero

emission targets for minimal cost. The Company is also doing

research and development on data solutions to deliver an integrated

system that amalgamates all of the emission detection data

available to demonstrate a clear picture of the site’s emission

profile.

The Company’s common shares are traded on the

TSX Venture Exchange under the symbol “QST”. The address of the

Company’s corporate and registered office is 2240, 140 – 4 Avenue

S.W. Calgary, Alberta, Canada, T2P 3N3.

QUESTOR TRADES ON THE TSX VENTURE

EXCHANGE UNDER THE SYMBOL ‘QST’

Investor Relations Contact

Aly Sumar - Chief Financial

Officer

investor@questortech.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This document is not intended for dissemination

or distribution in the United States.

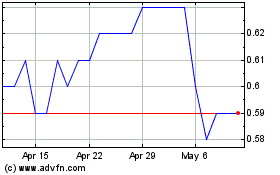

Questor Technology (TSXV:QST)

Historical Stock Chart

From Nov 2024 to Dec 2024

Questor Technology (TSXV:QST)

Historical Stock Chart

From Dec 2023 to Dec 2024