NevGold Corp. (“

NevGold” or the

“

Company”)

(TSXV:NAU) (OTCQX:NAUFF)

(Frankfurt:5E50) announces the issuance (the

“

Share Issuance Payment”) of

10,000,000 NevGold common shares to GoldMining Inc. (TSX:GOLD,

NYSE:GLDG) (“

GoldMining”) pursuant to the Nutmeg

Mountain Option Agreement dated June 13, 2022 (see June 14, 2022

News Release). The total Share Issuance Payment of 10,000,000

shares equates to $3.0 million issued at $0.30 per share

representing the 30-day VWAP share price as of market close on

December 18, 2023.

NevGold has now exercised the option

under the Nutmeg Mountain Option Agreement to acquire 100% of the

Nutmeg Mountain Gold Project in Washington County, Idaho

(the “Project”, “Nutmeg

Mountain”, see Figure 1). NevGold announced a Mineral

Resource Estimate (“MRE”) at the Project on August

17, 2023 (News Release Link) of 1,007,000 Indicated ounces of gold

(51.7 Mt @ 0.61 g/t Au), and 275,000 Inferred ounces of gold (17.9

Mt @ 0.48 g/t Au) (see Note 1).

NevGold CEO, Brandon Bonifacio,

comments: “Completing the acquisition of 100% of Nutmeg

Mountain from GoldMining is a monumental milestone for the Company.

We have diligently advanced our efforts since closing the

transaction on Nutmeg Mountain in August-2022. After less than 12

months of working on the project we released our initial Mineral

Resource Estimate in August-2023, where we delivered an open-pit,

oxide, heap-leachable gold Indicated Mineral Resource of 1.01Mozs

and Inferred Mineral Resource of 275kozs. We will continue to focus

our future efforts on drilling the many high priority drill targets

both on the private ground and fully permitted Bureau of Land

Management (“BLM”) unpatented claims to unlock further value at the

Project. We are fortunate to now own 100% of one of the very few

open-pit, oxide, heap-leach gold projects of scale and grade with

mineralization starting at surface in the Western USA. Nutmeg

Mountain’s location in Western Idaho (Washington County) also

offers many benefits as it is a premier mining jurisdiction with

excellent infrastructure in place, which will allow for rapid

project advancement.”

The Share Issuance Payment is subject to the

final approval of the TSX Venture Exchange (the

“Exchange”). The securities issued to GoldMining

are subject to a four-month hold period ending on May 19, 2024 in

accordance with applicable securities laws and the policies of the

Exchange.

GoldMining, a shareholder owning over 20% of the

outstanding common shares, was issued 10,000,000 shares through the

Share Issuance Payment. Prior to the closing of the Share Issuance

Payment, GoldMining held, and had control and direction over,

16,670,250 common shares and 1,488,100 warrants of the Company

exercisable into 1,488,100 common shares, representing

approximately 20.6% of the Company’s outstanding common shares on

an undiluted basis and approximately 22.1% on a partially-diluted

basis assuming the exercise of the warrants held by GoldMining. On

completion of the Share Issuance Payment, GoldMining holds, and has

control and direction over, 26,670,250 common shares and 1,488,100

warrants, representing approximately 29.4% of the Company’s

outstanding common shares on an undiluted basis and approximately

30.5% on a partially-diluted basis assuming the exercise of the

warrants held by GoldMining.

Figure 1 – Nutmeg Mountain District Map To view

image please click here

Note 1: Nutmeg Mountain – 2023 Mineral

Resource EstimateDetails of the MRE are provided in a

technical report entitled “Technical Report on the Nutmeg Gold

Property” with an effective date of June 22, 2023, prepared in

accordance with National Instrument 43-101 (“NI

43-101”) standards, which is filed under the Company’s

SEDAR+ profile.

|

Classification |

Cutoff Grade (g/t) |

Tonnes |

Gold Grade (g/t) |

Ounces Gold |

|

Indicated |

0.30 |

51,660,000 |

0.61 |

1,006,000 |

|

Inferred |

0.30 |

17,860,000 |

0.48 |

275,000 |

Notes:

- Effective date of this mineral

resource estimate is June 22, 2023.

- All mineral resources have been

estimated in accordance with Canadian Institute of Mining,

Metallurgy and Petroleum definitions, as required under NI 43-101.

The Mineral Resource Statement was prepared by Greg Mosher, P. Geo

(Global Mineral Resource Services, “GMRS”) in

accordance with NI 43-101.

- Mineral Resources reported

demonstrate a reasonable prospect of eventual economic extraction,

as required under NI 43-101. Mineral Resources are not Mineral

Reserves and do not have demonstrated economic viability. There is

no certainty that all or any part of the estimated Mineral

Resources will be converted into Mineral Reserves. The potential

development of the Mineral Resources may be materially affected by

environmental, permitting, legal, marketing, and other relevant

issues.

- Mineral Resources are reported at a

cut-off grade of 0.30 g/t Au for an open-pit mining scenario.

Cut-off grades are based on a price of US$1750/oz gold, and a

number of operating cost and recovery assumptions, including a

reasonable contingency factor. Metallurgical recoveries of 80% were

used. Densities based on lithology were assigned.

- Ounce (troy) = metric tonnes x

grade / 31.10348. All numbers have been rounded to reflect the

relative accuracy of the estimate.

- The quantity and grade of reported

Inferred Mineral Resources are uncertain in nature and there has

not been sufficient work to define these Inferred Mineral Resources

as Indicated or Measured Mineral Resources. It is reasonably

expected that many of the Inferred Mineral Resources could be

upgraded to Indicated Mineral Resources with continued exploration,

however, there is no assurance that further exploration will result

in all or any part of the Inferred Mineral Resources being

converted into Indicated Mineral Resources.

- Tonnages and ounces in the tables

are rounded to the nearest thousand and hundred, respectively.

Numbers may not total due to rounding.

ON BEHALF OF THE BOARD

“Signed”

Brandon Bonifacio, President &

CEO

For further information, please contact Brandon

Bonifacio at bbonifacio@nev-gold.com, call 604-337-4997, or visit

our website at www.nev-gold.com.

About the CompanyNevGold is an

exploration and development company targeting large-scale mineral

systems in the proven districts of Nevada and Idaho. NevGold owns a

100% interest in the Limousine Butte and Cedar Wash gold projects

in Nevada and the Nutmeg Mountain gold project in Idaho.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking

Statements

This news release contains forward-looking

statements that are based on the Company’s current expectations and

estimates. Forward-looking statements are frequently characterized

by words such as “plan”, “expect”, “project”, “intend”, “believe”,

“anticipate”, “estimate”, “suggest”, “indicate” and other similar

words or statements that certain events or conditions “may” or

“will” occur. Forward-looking statements include, but are not

limited to, the final approval of the Exchange to the Share

Issuance Payment and further exploration and development work on

the Nutmeg Mountain project, estimates of mineral resources, and

the potential upgrade of inferred mineral resources to indicated

mineral resources. Such forward-looking statements involve known

and unknown risks, uncertainties and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such risks include, but are not limited

to, general economic, market and business conditions, and the

ability to obtain all necessary regulatory approvals. There is some

risk that the forward-looking statements will not prove to be

accurate, that the management’s assumptions may not be correct or

that actual results may differ materially from such forward-looking

statements. Accordingly, readers should not place undue reliance on

the forward-looking statements. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Company disclaims

any intent or obligation to update any forward-looking statement,

whether as a result of new information, future events or results or

otherwise. Forward-looking statements are not guarantees of future

performance and accordingly undue reliance should not be put on

such statements due to the inherent uncertainty therein.

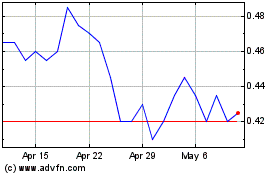

Nevgold (TSXV:NAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nevgold (TSXV:NAU)

Historical Stock Chart

From Jan 2024 to Jan 2025