/NOT FOR DISTRIBUTION TO U.S. NEWS WIRE

SERVICES OR FOR DISSEMINATION IN THE U.S./

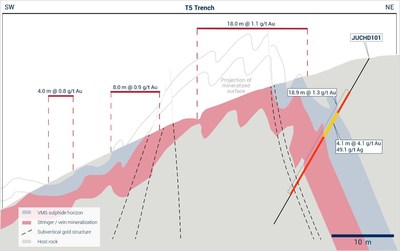

Historical trenching and drilling results

combine to extend Santa Helena gold trend to 1.3 km

LONDON,

March 29, 2022 /CNW/ -

Meridian Mining UK S (TSXV: MNO), (Frankfurt/Tradegate: 2MM) & (OTCQB:

MRRDF), ("Meridian" or the "Company") is pleased to announce that

its ongoing review of historical data of the Santa Helena

copper-gold-silver-zinc VMS deposit ("Santa Helena")1,

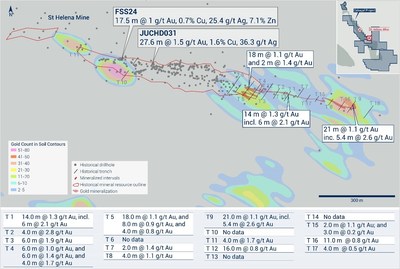

has identified that the gold overprint extends over 1.3km in strike

and remains open. The historical Santa Helena mine is an advanced

prospect within the Company's camp scale copper-gold VMS Project

("Cabaçal") located in Mato Grosso,

Brazil. Near-surface historical diamond drill results,

located to the east of Santa Helena's pre-mining VMS resource,

returned 18.9m @1.3g/t Au from

6.3m and are coincident with surface

trench results of 18.0m @ 1.1 g/t Au

(Figure 1). The Company is continuing its evaluation of Santa

Helena as it sees this open gold trend and the under-lying Santa

Helena VMS mineralization (Figure 2), as having strong attributes

for open pit potential that would be incorporated into a larger

Cabaçal development scenario. Santa Helena field programs are

ongoing.

Highlights of today's announcement:

- Meridian identifies open, 1.3km gold trend at Cabaçal's Santa

Helena deposit;

- Meridian maps extensive gold over print of Santa Helena's

copper-gold-silver-zinc VMS deposit;

- Robust gold mineralization above VMS massive sulphides

confirmed by 1980's drill results;

-

- JUCHD-101 assays 18.9m @ 1.3g/t

Au from 6.3m;

Including

-

- 4.1m@ 4.1g/t Au & 49.1g/t Ag from 10.2m;

- Surface vertical structures align with down dip gold

mineralization;

- Historical trenching results map a continuous gold

structure;

-

- T5 assays 18.0m @ 1.1g/t

Au;

- T9 assays 21.1m @ 1.1g/t Au;

and

- Santa Helena fits Meridian's strategy of focusing on Cabaçal

copper-gold mine while developing high-grade satellite prospects

along the 11km Mine Corridor.

Dr Adrian McArthur, CEO and

President of Meridian, comments, "Meridian's ongoing field programs

and historical data reviews are continuing to strengthen our view

that Santa Helena represents a robust opportunity for a satellite

open pit project. The cross-section below indicates Santa Helena's

geology is very similar to that of the Cabaçal Mine's, with a

defined VMS envelope being overprinted by steeper gold-bearing

structures; something we also expect to see repeated along the

intermediate 9km of the Cabaçal Mine Corridor and potentially over

the entire Cabaçal camp. Significantly, Santa Helena's open surface

gold trend extends 350m beyond the

limits of its pre-mining resource envelope, which was focussed on

the underlying, but shallow, high-grade massive-sulphide

mineralization. These and other geochemical anomalies are open

100m past the last reported trench

results, while the lateral but parallel soil anomalies may

represent repeats of the gold overprint, all requiring following

up. With only part of the pre-mining resource extracted and

near-surface gold mineralization open and undeveloped, Santa Helena

has significant potential for an open-pit development program. The

Company will continue with its validation programs, applying the

same methodology as at the Cabaçal Mine to bring Santa Helena

towards an updated resource estimation in early 2023."

Figure 1. Santa Helena surface gold and JUCHD101 gold

intersections: structural style and mineralization.

Santa Helena Review

Santa Helena is the most advanced of several prospects along

Cabaçal's Mine Corridor. Santa Helena was partially mined between

2006 to 2008, with resource development and small-scale underground

mining focused at the time on the high-grade zinc-dominant massive

sulphide. The life of mine production was planned to run to 2011,

but the 2008 commodities price slump led to early termination of

the operation. Similar to the Cabaçal Mine's history, the gold

overprint and the full extent of the copper-gold-silver-zinc VMS

mineralized halo has remained largely untested since its discovery.

Despite Santa Helena's prospective grades and geometry, it was

never considered for open pit development. Meridian's immediate

focus is on developing the Cabaçal copper-gold mine, while

sustaining a medium-term program to develop the potential open pit

upside of multiple shallow copper-gold mineralized prospects

defined within the Mine Corridor; Santa Helena is the most advanced

deposit and is within a granted mining licence.

The Santa Helena deposit (historically also referred to as C2C,

and Monte Cristo), is located 9km to

the southeast of the Cabaçal Mine area, within the 11km Mine

Corridor trend. The deposit was first discovered by BP Minerals

(BPM) in 1984, following evaluation of surface soil

copper-lead-zinc-gold anomaly, which was found to be associated

with gossans enriched in gold and silver. BPM executed three local

campaigns of drilling between 1984 and 1989, totaling 100 holes for

10,975m of drilling. At least 17

trenches (735m) were also concluded

by BPM, supplementing the drilling results. Meridian's senior

geologist, Mr Antonio José de

Almeida, was heavily involved in the exploration campaign during

this phase. The deposit is associated with the same correlative

stratigraphic package as the Cabaçal Mine's; metamorphosed felsic

to intermediate volcanics, cherts, tuffaceous volcaniclastic rocks,

and gabbroic intrusives. The rocks exhibit a chloritic alteration

overprint associated with the VMS event. The mineralization is

localized in an east-south-easterly trending fold, with an overall

synformal geometry, cut by subvertical shears.

Figure 1. Santa Helena historical drilling, trenching, and

soil geochemistry. Santa Helena's underground resource outline is

shown, highlighting the broad footprint of gold mineralization to

the east and to the south.

The former operator at Santa Helena, Prometálica, completed 39

holes for 2479m between 1999 and 2001

and conducted development studies ahead of commissioning the

underground mine, with mine production commencing in October 2006. This drilling campaign was focused

on the main massive sulphide mineralization, with no sampling of

the drill cores for assays until an average down-hole depth of

33.0m. Gold assays are not available

for 12 of the holes, and for an additional nine of the holes, the

first recorded sample starts within the mineralized halo (grades of

0.1 – 1.0g/t Au). Assay sampling in the original BPM holes (for

which data is available in the JUCHD series), is similarly, with an

average starting depth of 22.4m.

Whilst some angled holes were drilled by BPM, historical drilling

was overwhelmingly vertical unsuited to vertical structures.

The advanced nature of Santa Helena, with a defined mineralized

envelope and known metallurgical flow sheet and mineral products,

means that it can be developed much faster and at a lower risk when

compared to more "early stage" but larger prospects located within

and outside of the Mine Corridor. This would allow it to be

incorporated into a conceptual Cabaçal development program

providing supplementary high-grade feed to a centralized mill

located at the Cabaçal Mine, while the greater Mine Corridor

provides the potential for Cabaçal's long-term scalability.

Notes

Historical BP Minerals samples from Santa Helena were

analysed with a three-acid digest for base metals with atomic

adsorption finish, aqua regia digest for silver with an atomic

absorption finish, and fire assay of a 50g charge for gold at the

Nomos laboratory in Rio de

Janeiro. Quality control measures included the use of

laboratory standards, blanks, duplicates, and umpire laboratory

checks. Samples from Prometálica underground drilling program were

analysed in their on-site mine laboratory (archival searches for

analytical protocols and QAQC are progressing).

The Company also announces that further to the Company's news

releases dated March 31, 2020,

April 27, 2020, and June 3, 2020, with respect to the Consolidated

Facility Agreement (the "Convertible Loan") between the Company and

Sentient Global Resources Fund IV, L.P. ("Sentient IV") which was

entered into at the time of the Company's financial restructuring

in April 2020, the Company intends to

issue 5,869,671 common shares to Sentient IV (the "Settlement

Shares") at a deemed price of C$2.50

per Settlement Share, in settlement of the debt owing to Sentient

IV, pursuant to the Convertible Loan. The Company is proposing to

issue the Settlement Shares to preserve cash to fund future

operations. The Settlement Shares will be issued on receipt

of TSX Venture Exchange approval and will be subject to a four

month and one day hold period.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO, President and Director

Executive Chairman

Meridian Mining UK S

Stay up to date by subscribing for news alerts here:

https://meridianmining.co/subscribe/

Follow Meridian on Twitter:

https://twitter.com/MeridianMining

Further information can be found at www.meridianmining.co

ABOUT MERIDIAN

Meridian Mining UK S is focused on the acquisition, exploration,

and development activities in Brazil. The Company is currently focused on

resource development of the Cabaçal VMS Copper-Gold project,

exploration in the Jaurú & Araputanga Greenstone belts located

in the state of Mato Grosso;

exploring the Espigão polymetallic project and the Mirante da Serra

manganese project in the State of Rondônia Brazil.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking

information or forward-looking statements for the purposes of

applicable securities laws. These statements include, among others,

statements with respect to the Company's plans for exploration,

development and exploitation of its properties and potential

mineralization. These statements address future events and

conditions and, as such, involve known and unknown risks,

uncertainties, and other factors, which may cause the actual

results, performance, or achievements to be materially different

from any future results, performance or achievements expressed or

implied by the statements. Such risk factors include, among others,

failure to obtain regulatory approvals, failure to complete

anticipated transactions, the timing and success of future

exploration and development activities, exploration and development

risks, title matters, inability to obtain any required third party

consents, operating risks and hazards, metal prices, political and

economic factors, competitive factors, general economic conditions,

relationships with strategic partners, governmental regulation and

supervision, seasonality, technological change, industry practices

and one-time events. In making the forward-looking statements, the

Company has applied several material assumptions including, but not

limited to, the assumptions that: (1) the proposed exploration,

development and exploitation of mineral projects will proceed as

planned; (2) market fundamentals will result in sustained metals

and minerals prices and (3) any additional financing needed will be

available on reasonable terms. The Company expressly disclaims any

intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events or

otherwise except as otherwise required by applicable securities

legislation.

The Company cautions that it has not completed any feasibility

studies on any of its mineral properties, and no mineral reserve

estimate or mineral resource estimate has been established.

Geophysical exploration targets are preliminary in nature and not

conclusive evidence of the likelihood of a mineral deposit.

The TSX Venture Exchange has neither approved nor disapproved

the contents of this news release. Neither TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

|

1 See

Meridian news releases December 6, 2021 and February 7,

2022

|

SOURCE Meridian Mining UK Societas