(All amounts expressed in Canadian dollars)

LEXAM EXPLORATIONS INC. (TSX VENTURE: LEX) today reported

financial results for the First Quarter, 2010. The Company recorded

a net loss of $108,521 ($0.00 per share) versus a net loss of

$130,225 ($0.00 per share) for the respective period, 2009. The

market value of securities, cash and other monetary assets minus

liabilities was approximately $29.6 million at the end of the First

Quarter, 2010 versus $12.6 million in the respective period, 2009

and $35.5 million at the end of the Fourth Quarter, 2009.

FINANCIAL RESULTS

For the three months ended March 31, 2010, Lexam reported a net

loss of $108,521 ($0.00 per share). This compares with a net loss

of $130,225 ($0.00 per share) in the respective period, 2009. Net

profit (or loss), due to accounting standards, will fluctuate from

quarter-to-quarter. Lexam anticipates this to continue in the

future.

The market value of securities, cash and other monetary assets

minus liabilities was approximately $29.6 million during the First

Quarter 2010 versus $12.6 million in the respective period 2009 and

$35.5 million at the end of the Fourth Quarter 2009. As of May 27,

2010 this figure was approximately $26.3 million. Lexam believes

this figure provides the best overview of the Company's financial

health. For a quarter-over-quarter comparison, please see Table

1.

Table 1.

----------------------------------------------------------------------------

Q1 Q2 Q3 Q4 Q1 May 27

2009 2009 2009 2009 2010 2010

----------------------------------------------------------------------------

Total Assets minus Total

Liabilities (in millions) $ 12.6 $ 16.5 $ 36.0 $ 35.5 $ 29.6 $ 26.3

----------------------------------------------------------------------------

Per Share Basis $ 0.26 $ 0.26 $ 0.74 $ 0.73 $ 0.61 $ 0.54

----------------------------------------------------------------------------

The loss during the First Quarter was related to holding and

exploration ($99,791), administrative ($97,374) and operating

losses at VG Gold ($113,049). Losses were partially offset by

selling certain securities above cost ($197,190).

Lexam's working capital at March 31, 2010 was approximately $9.9

million compared to $11.8 million at March 31, 2009 and $10.7

million at December 31, 2009. The Company's cash balance at March

31, 2010 was approximately $7.3 million from $1.2 million at March

31, 2009 and $7.9 million at December 31, 2010. The Company has no

significant contractual obligations. At March 31, 2010 Lexam's

outstanding common shares remained unchanged at 48,499,287.

The complete First Quarter, including management's discussion

and analysis, financial statements, and notes can be found on the

Company's website at www.lexamexplorations.com and on SEDAR at

www.sedar.com.

VG GOLD CORP INVESTMENT

Timmins, Ontario, Canada

During the First Quarter Lexam's ownership in VG Gold remained

unchanged from the December 31, 2009. At March 31, 2010 Lexam's

investment in VG Gold had a market value of $21.8 million. As of

May 27, 2010 Lexam's investment in VG Gold has a current market

value of $18.0 million.

Table 2 - Change in VG Gold Investment

----------------------------------------------------------------------------

VG Gold Investment VG Gold Investment VG Gold Investment

(Q4-Dec 31, 2009) (Q1-Mar 31, 2010) (May 27, 2010)

----------------------------------------------------------------------------

Number of Shares 75.0 million 75.0 million 75.0 million

----------------------------------------------------------------------------

Market Value $27.8 million $21.8 million $18.0 million

----------------------------------------------------------------------------

RUBICON MINERALS INVESTMENT

Red Lake, Ontario, Canada

During the First Quarter Lexam's ownership in Rubicon Minerals

remained unchanged from the December 31, 2009. At March 31, 2010

and May 27, 2010 Lexam's investment in Rubicon had a market value

of $2.6 million.

It is important to note that Lexam has net taxes receivable in

relation to these shares based on Rubicon's share price at the time

they were received (US$2.00 per share). Therefore, Lexam is only

required to pay capital gains on sales that exceed US$2.00 per

share (For example, if a share is sold for $4.50 capital gains

would only be applied to amount that exceeded $2.00. In this

example the taxable amount would be $2.50).

Table 3 - Change in Rubicon Investment

----------------------------------------------------------------------------

Rubicon Investment Rubicon Investment Rubicon Investment

(Q4-Dec 31, 2009) (Q1-Mar 31, 2010) (May 27, 2010)

----------------------------------------------------------------------------

Number of Shares 0.7 million 0.7 million 0.7 million

----------------------------------------------------------------------------

Market Value $3.2 million $2.6 million $2.6 million

----------------------------------------------------------------------------

BACA OIL & GAS PROJECT

Colorado, USA

The Baca Oil and Gas Project is located in south-central

Colorado, USA. The Company owns 75% of the oil and gas rights. The

remaining 25% is owned by ConocoPhillips.

During the Fourth Quarter of 2008, the Company announced that

the United States Fish and Wildlife Service (USFWS) had issued a

Finding of No Significant Impact (FONSI). The USFWS' decision was

reached based on the results of an Environmental Assessment (EA)

conducted by the Service under the National Environmental Policy

Act (NEPA). The USFWS environmental review process lasted 15 months

and involved extensive public meetings, participation, and comment

by all interested parties.

This decision by the USFWS was the final approval required

before the Company could move forward with its planned exploration

for oil and gas.

The Baca Project has been consistently challenged by opposition

groups and on November 3, 2008 the San Luis Valley Ecosystem

Council (SLVEC) made a motion to reopen litigation against the

USFWS.

The SLVEC maintains that USFWS decision to issue a FONSI based

on the EA does not comply with NEPA.

During the First Quarter of 2009, the District Court of Colorado

ordered that the motion to reopen litigation against the USFWS be

allowed to proceed. A Preliminary Injunction Hearing was held on

May 20, 2009.

On September 4, 2009 the Company announced that the Federal

District Court granted the SLVEC Motion for a Preliminary

Injunction against the USFWS. This decision prohibits any

exploration drilling by the Company until a final ruling is reached

in the litigation.

On November 17, 2009 the parties to the litigation attended a

court mandated Settlement Conference. On January 15, 2010 a second

Settlement Conference was held to discuss a potential settlement

terms and to set a briefing schedule should the settlement be

unsuccessful.

The Company has extended an offer to sell its mineral interests

underlying the Baca Wildlife Refuge and surrounding areas for cash

consideration of approximately US$8,400,000. The purchase price

offered by the Company represents a settlement proposal to resolve

pending litigation and does not represent management's valuation of

the Company's mineral interest on the Baca property. If a signed

agreement of purchase and sale has not been executed by June 11,

2010, the Company has agreed to participate in a process to prepare

a new document in compliance with the U.S. National Environmental

Policy Act (NEPA). The new NEPA document will be prepared by the

U.S. Fish and Wildlife Service and is scheduled to be completed by

April 2011. The Company plans to proceed with the exploration

program later that year.

OTISH URANIUM PROJECT

Quebec, Canada

The Otish Uranium Project is located in north-central Quebec,

Canada. The Company owns 50% of the project with the remaining 50%

owned by Golden Valley Mines Ltd. No exploration is currently

planned for this project.

As at March 31, 2010, the Company has an outstanding receivable

of $22,730 from the Quebec government regarding the 2009 rebate for

exploration expenditures.

About Lexam

Lexam is a North American exploration company. The Company holds

significant equity stakes in VG Gold Corp and Rubicon Minerals

Corp. Lexam also owns 75% of the Baca Oil & Gas Project in

south-central Colorado, USA and it has a 50% joint venture interest

in the Otish Basin uranium project located in Quebec, Canada with

Golden Valley Mines.

CAUTIONARY STATEMENT

Some of the statements contained in this release are

"forward-looking statements". Such forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to

differ materially from the anticipated results, performance or

achievements expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially from anticipated results include risks and uncertainties

such as: ability to raise financing for further exploration and

development activities; risks relating to estimates of reserves,

deposits and production costs; extraction and development risks;

the risk of commodity price fluctuations; political, regulatory and

environmental risks; and other risks and uncertainties in the

reports and disclosure documents filed by Lexam from time-to-time

with Canadian securities regulatory authorities. The Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. The complete First Quarter and Annual

report including management's discussion and analysis, financial

statements and notes can be found on our Company's website at

www.lexamexplorations.com and on SEDAR at www.sedar.com.

Contacts: Lexam Explorations Inc. Daniela Ozersky Manager,

Investor Relations (647) 258-0395 or Toll Free: (866) 441-0690

(647) 258-0408 (FAX) info@lexamexplorations.com

www.lexamexplorations.com Lexam Explorations Inc. Corporate Head

Office 99 George Street, 3rd Floor Toronto, ON M5A 2N4

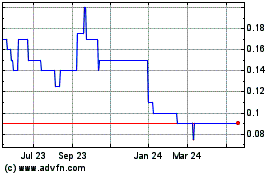

Longhorn Exploration (TSXV:LEX)

Historical Stock Chart

From Dec 2024 to Jan 2025

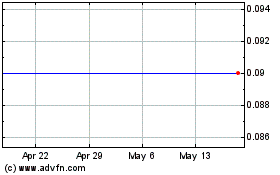

Longhorn Exploration (TSXV:LEX)

Historical Stock Chart

From Jan 2024 to Jan 2025