(All amounts expressed in Canadian dollars unless otherwise stated)

LEXAM EXPLORATIONS INC. (TSX VENTURE: LEX)(PINK SHEETS:

LEXEF)(FRANKFURT: D2Q) is pleased to announce financial results for

the fourth quarter and year ending 2008, an update on the Baca Oil

and Gas Project in Colorado, USA and Otish Uranium Project in

Quebec, Canada.

FOURTH QUARTER HIGHLIGHTS & SUBSEQUENT EVENTS

- Baca Oil & Gas: Preliminary Injunction Hearing date set

for May 20, 2009. Lexam intends to vigorously defend its mineral

rights in order to proceed with the oil and gas exploration.

- Otish Uranium: Results from final core drill holes have been

received. Highlights include: 0.072% U3O8 over 6.33 m, incl. 0.196%

U3O8 over 1.46 m.

- Treasury: Lexam's financial position remains strong. As of

December 31, cash and securities totaled $8,262,701 and no

long-term liabilities.

FINANCIAL RESULTS

Fourth Quarter - 2008

For the three and twelve months ending December 31, 2008, Lexam

reported a loss of $817,223 ($0.02 per share) and $2,705,730 ($0.06

per share) compared with a gain of $3,351,205 ($0.07 per share) and

a gain of $12,094,138 ($0.25 per share) in the respective periods,

2007. The net income recorded during both periods for the prior

year was primarily attributable to the gain recorded on the sale of

the Company's Nevada and Yukon properties.

The loss during the fourth quarter of this year was due to

permitting and legal expenses associated with the Baca Oil and Gas

Project ($0.3 million), exploration at the Otish Uranium Project

($0.7 million) and administrative expenses ($0.2 million).

At the end of the fourth quarter Lexam had a working capital of

$9.6 million, compared with working capital of $10.5 million in

2007.

The complete fourth quarter and year-end report, including

management's discussion and analysis, financial statements, and

notes can be found on the Company's website at

www.lexamexplorations.com and on SEDAR at www.sedar.com.

BACA OIL & GAS PROJECT - COLORADO, USA

The Baca Oil and Gas Project is located in south-central

Colorado, USA. Lexam owns 75% of the oil and gas rights. The

remaining 25% is owned by ConocoPhillips. Lexam is advancing the

project and is planning to drill two natural gas wells that will

reach depths of 4,265 m.

During the Fourth Quarter, Lexam announced that the United

States Fish and Wildlife Service (USFWS) had issued a Finding of No

Significant Impact (FONSI). The USFWS' decision was reached based

on the results of an Environmental Assessment (EA) conducted by the

Service under the National Environmental Policy Act (NEPA). The

USFWS environmental review process lasted 15 months and involved

extensive public meetings, participation, and comment by all

interested parties. This decision by the USFWS was the final

approval required before Lexam could move forward with its planned

exploration for oil and gas.

The purpose of the EA is to ensure that exploration is conducted

in a reasonable manner that protects the project's surface and

other resources. The EA includes specific terms and conditions

applicable to Lexam's proposed exploration that are designed to

accomplish this objective.

The Baca Project has been consistently challenged by opposition

groups and on November 3, 2008, the San Luis Valley Ecosystem

Council (SLVEC) made a motion to reopen litigation against the

USFWS. The SLEC maintains that the USFWS decision to issue a FONSI

based on the EA does not comply with NEPA.

During the First Quarter of 2009, the District Court of Colorado

ordered that the motion to reopen litigation against the USFWS be

allowed to proceed. Since reopening the case Lexam has successfully

made a motion to intervene in the courts proceedings in order to

vigorously defend its right to mineral exploration. A Preliminary

Injunction Hearing date has been set for May 20, 2009.

On April 3, 2008, Lexam announced that the Colorado Oil and Gas

Conservation Commission (COGCC) had renewed the Company's state

permits to drill. Since Lexam was not able to complete the wells

within the stated one year time frame the permits expired in April

2009. As the Company expects to successful prevail against the

SLVEC in its attempt to seek a preliminary injunction, Lexam will

be filing applications with the COGCC in order to renew the

previously approved permits.

OTISH URANIUM PROJECT - QUEBEC, CANADA

The Otish Uranium Project is located in north-central Quebec,

Canada. In January 2007, Lexam entered into an option to earn 50%

of the project from Golden Valley Mines by spending $3 million over

three years. To date, approximately $3.2 million has been spent by

Lexam and as a result is now executing its option to earn 50% of

the project from Golden Valley Mines.

In 2008, Lexam and Golden Valley Mines completed 69 holes

totalling 2,800 m of diamond drill core in the Mistassini portion

of the project. Drill highlights that were released during 2008,

include: 0.14% U3O8, over 5.6 m (meters) and 0.42% U3O8 over 2.4 m,

including 1.63% U3O8 over 0.6 m and including, 2.02% U3O8 over 0.4

m.

Additional drilling announced during February 2009 included

0.072% U3O8 over 6.33 m, incl. 0.196% U3O8 over 1.46 m.

The objective of the drill program was to confirm and then

expand the historically documented uranium mineralization. Drilling

successfully accomplished these goals and has outlined new

high-grade mineralization as highlighted by the drill results

above. The U3O8 mineralization is shallow, located approximately 20

m below surface and the estimated thickness of the zone is 5 m. The

mineralization is located in two separate zones that are separated

by 2.4 km. The exploration potential between these two areas

remains untested.

Lexam and Golden Valley Mines are currently in the process of

evaluating the data from the 2008 exploration program. The

objective of this work is to help quantify the uranium discovered

thus far, identify targets that possess high-grade potential for

follow up drilling in 2009 and, if warranted, prepare a NI 43-101

resource estimate.

During 2008, Lexam received a provincial rebate totalling

$347,867 from the Quebec government in connection with 2007

exploration expenditures. The amount relates to the provincial

government's rebate program that is designed to promote mineral

exploration, particularly in Quebec's northern areas. The Company

expects an approximate rebate of $899,154 based upon the completed

exploration expenditures last year.

RUBICON MINERALS - 4.4 MILLION SHARES ($8.4 MILLION)

In early 2007 Lexam announced that it had traded its Nevada

properties for Rubicon common shares. Since then, Rubicon has

announced a series of encouraging drill results from its Phoenix

Gold Project, located in the heart of the prolific Red Lake gold

district of Ontario that have increased the value of these shares

versus Lexam's base value.

Highlights from Rubicon's 2009 exploration drilling include:

173.7 g/t gold over 2.5 m and 260.5 g/t gold over 0.5 m.

Lexam owns approximately 4.4 million shares of Rubicon that have

a current market value of $8.4 million (as of April 27, 2009). It

is important to note that Lexam has prepaid taxes in relation to

these shares based on Rubicon's price at the time the shares were

received (US$2.00 per share). Therefore, Lexam is not required to

pay any additional tax until Rubicon's shares exceed US$2.00 per

share.

The Company has no current intention to sell any additional

shares of Rubicon, since it is providing Lexam shareholders a

unique way to benefit from the rising gold price and Rubicon's

growing discovery.

Michael P. Rosatelli, P. Geo. is a "Qualified Person" as defined

in National Instrument 43-101 and is responsible for the technical

information presented in this news release regarding the Otish

Uranium Project.

About Lexam

Lexam Explorations is a North American based energy exploration

company. The company is advancing the Baca Oil & Gas Project

located in south-central Colorado, USA, which is 75% owned by Lexam

and 25% by ConocoPhillips and has an option to earn 50% interest in

Golden Valley Mines' Otish Basin uranium project located in Quebec,

Canada.

CAUTIONARY STATEMENT

Some of the statements contained in this release are

"forward-looking statements". Such forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, performance or achievements to

differ materially from the anticipated results, performance or

achievements expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially from anticipated results include risks and uncertainties

such as: ability to raise financing for further exploration and

development activities; risks relating to estimates of reserves,

deposits and production costs; extraction and development risks;

the risk of commodity price fluctuations; political, regulatory and

environmental risks; and other risks and uncertainties in the

reports and disclosure documents filed by Lexam from time-to-time

with Canadian securities regulatory authorities. The Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. The complete fourth quarter report

including management's discussion and analysis, financial

statements and notes can be found on our Company's website at

www.lexamexplorations.com and on SEDAR at www.sedar.com.

Contacts: Lexam Explorations Inc. Ian J. Ball VP, Corporate

Development (647) 258-0395 or Toll Free: (866) 441-0690 (647)

258-0408 (FAX) Lexam Explorations Inc. Stefan M. Spears VP,

Strategic Development (647) 258-0395 or Toll Free: (866) 441-0690

(647) 258-0408 (FAX) info@lexamexplorations.com

www.lexamexplorations.com Lexam Explorations Inc. Corporate Head

Office 99 George Street, 3rd Floor Toronto, ON M5A 2N4

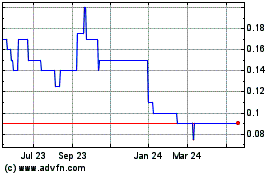

Longhorn Exploration (TSXV:LEX)

Historical Stock Chart

From Dec 2024 to Jan 2025

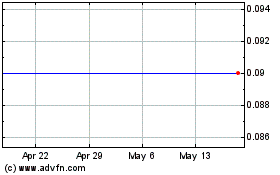

Longhorn Exploration (TSXV:LEX)

Historical Stock Chart

From Jan 2024 to Jan 2025