LithiumBank Files Preliminary Economic Assessment Technical Report for the Boardwalk Lithium Brine Project, West-Central Alberta

June 21 2023 - 9:00AM

LithiumBank Resources Corp. (

TSX-V:

LBNK) (

OTCQX:

LBNKF) (“

LithiumBank” or the

“

Company”) is pleased to announce the filing of

the Boardwalk Lithium Brine Project Preliminary Economic Assessment

(“PEA”) Technical report entitled “Preliminary Economic Assessment

(PEA) for LithiumBank Resources Boardwalk Lithium-Brine Project in

West- Central Alberta, Canada” effectively dated June 16, 2023,

originally announced May 25th, 2023.

PEA Highlights

- 31,350 metric tonnes per year of

battery grade lithium hydroxide monohydrate (“LHM”)1 production

over a 20-year period, the largest proposed LHM production in North

America;

- USD $2.7 Billion NPV8 and 21.6% IRR

on a pre-tax basis;

- USD $1.7 Billion NPV8 and 17.8% IRR

on an after-tax basis;

- OPEX of USD $6,807/ton LHM;

- Direct Lithium Extraction (“DLE”)

used to process Boardwalk brine will require less fresh water and

have a surface footprint that is a fraction of hard rock or

evaporation lithium production;

- Ramp up to commercial production

within 3 years is possible under newly established permitting

directives;

- Located in Tier 1 jurisdiction,

west-central Alberta, which has a long history of resource

extraction, well established infrastructure, and an actively

supportive government;

- Power to be generated on site using

high-efficiency gas turbines with steam cogeneration that will

lower the project’s overall carbon footprint. The proposed gas

turbine units may be run on 80% hydrogen when a reliable supply is

available;

- Multiple opportunities to enhance

project economics through optimization, further engineering, and

pending incentive tax credit;

- Project economics used USD

$26,000/t LHM and provides strong leverage to higher lithium

prices.

A PEA is preliminary in nature as it includes a

portion of inferred mineral resources that are considered too

speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral

reserves, and there is no certainty that the preliminary economic

assessment will be realized.

In addition to the Boardwalk project,

LithiumBank also holds two other development ready, district scale

assets in Western Canada, Park Place (AB) & Saskatchewan. The

Company sees multiple avenues to create value in the coming months

through enhancing the economics of the Boardwalk PEA, delivering an

initial PEA for Park Place (AB), and by estimating a resource at

its Saskatchewan assets.

“The Boardwalk PEA sets the stage for our team

to pursue advanced lithium resource development in Western Canada”

commented Rob Shewchuk CEO & Director of LithiumBank. "By the

end of 2023, we expect to commence pilot plant studies in parallel

on both Boardwalk and Park Place and capture near-term enhancement

opportunities that have already been identified. We believe this

has the potential to position both the Boardwalk and Park Place

districts among the most attractive direct brine projects in North

America.”

Near Term PEA Enhancements

- The Government of Canada announced

an Investment Tax Credit (ITC) for Clean Technology Manufacturing

in its Budget 2023. Refundable tax credit will be applied on

capital expenditures for the extraction and processing of critical

minerals (ITC link);

- Use of smaller electrical

submersible pumps (ESPs) that could fit in reduced diameter well

casing throughout the network that is expected to reduce capital

expenditures;

- Leveraging of existing wells and

surface infrastructure including roads, well pads, pipelines, and

utilities;

- Reduction of well and power

requirements through enhanced 3-D reservoir modelling and new

drilling information;

- Next generation sorbent being

developed by Conductive, the provider of the lithium brine DLE

technology chosen for the PEA, is expected to reduce costs,

increase efficiency and reduce reagent consumption;

- Alternative DLE technology

trade-off studies;

- Utilise ZS2 Technologies Inc. to

capture and sequester CO2 emissions to produce carbon credits,

extract magnesium from barren brine to produce low carbon cement

products that will lower brine reinjection amounts by at least 10%;

and

- Additional trade-off studies aimed

at streamlining pipeline infrastructure.

The PEA Technical Report was prepared by the

following Qualified Persons; Roy Eccles, P. Geol. of APEX

Geoscience Ltd., Kim Mohler, P. Eng., of GLJ Ltd., Gordon

MacMillan, P. Geol. of Fluid Domains, Jim Touw, P. Geol. of HCL

Ltd., Frederick Scott, P. Eng., of Scott Energy, Egon Linton, P.

Eng., of Hatch Ltd., Evan Jones, P. Eng., of Hatch Ltd., Stefan

Hlouschko, P. Eng., of Hatch Ltd.

About LithiumBank Resources

Corp.

LithiumBank Resources Corp. is a development

company focused on lithium-enriched brine projects in Western

Canada where low-carbon-impact, rapid DLE technology can be

deployed. LithiumBank currently holds over 3.6 million acres of

mineral titles, 3.33M acres in Alberta and 336k acres in

Saskatchewan. LithiumBank’s mineral titles are strategically

positioned over known reservoirs that provide a unique combination

of scale, grade and exceptional flow rates that are necessary for a

large-scale direct brine lithium production. LithiumBank is

advancing and de-risking several projects in parallel of the

Boardwalk Lithium Brine Project.

Contact:

Rob ShewchukChairman & CEOrob@lithiumbank.ca(778)

987-9767

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward

Looking Statements

This release includes certain statements and

information that may constitute forward-looking information within

the meaning of applicable Canadian securities laws. All statements

in this news release, other than statements of historical facts,

including statements regarding future estimates, plans, objectives,

timing, assumptions or expectations of future performance,

including without limitation, the results of the Preliminary

Economic Assessment, including the expected NPV of the Boardwalk

project; expectations that commercial production will be achievable

within 3 years under new permitting directives; expectations that

governmental regulators will be supportive of the Boardwalk

project; expectations that the carbon footprint of the Boardwalk

project will be reduced through DLE extraction technology and

through the use of high-efficiency gas turbines with steam

cogeneration; expectations that that the 30% Investment Tax Credit

(ITC) for Clean Technology Manufacturing will be passed by the

Government of Canada; expectations that reduced capital

expenditures can be achieved on the Boardwalk projects;

expectations that the Boardwalk project will see reduced costs,

increased efficiency and reduced reagent consumption through the

use of new sorbent; expectations that the Company will pursue and

obtain a mineral resource estimate at its Saskatchewan asset and/or

a Preliminary Economic Analysis on the Park Place project on the

timing anticipated or at all; and expectations that the Company

will commence pilot plant studies on both the Boardwalk and Park

Place projects by the end of 2023 are forward-looking statements

and contain forward-looking information. Generally, forward-looking

statements and information can be identified by the use of

forward-looking terminology such as “intends” or “anticipates”, or

variations of such words and phrases or statements that certain

actions, events or results “may”, “could”, “should” or “would” or

occur.

Forward-looking statements are based on certain

material assumptions and analysis made by the Company and the

opinions and estimates of management as of the date of this press

release, including that the results of the Preliminary Economic

Assessment, including the expected NPV of the Boardwalk project,

will prove to be accurate; that commercial production will be

achievable within 3 years under new permitting directives; that

governmental regulators will be supportive of the Boardwalk

project; that the carbon footprint of the Boardwalk project can and

will be reduced through DLE extraction technology and through the

use of high-efficiency gas turbines with steam cogeneration; that

that the 30% Investment Tax Credit (ITC) for Clean Technology

Manufacturing will be passed by the Government of Canada; that

reduced capital expenditures can be achieved on the Boardwalk

projects through the use of smaller electrical submersible pumps

that could fit in reduced diameter well casing; that the use of new

sorbent will result in reduced costs, increased efficiency and

reduced reagent consumption; that the Company will be able to

obtain a mineral resource estimate on its Saskatchewan asset and/or

a Preliminary Economic Analysis on the Park Place project on the

timing anticipated or at all; and that the Company will commence

pilot plant studies on both the Boardwalk and Park Place projects

by the end of 2023.

These forward-looking statements are subject to

known and unknown risks, uncertainties and other factors that may

cause the actual results, level of activity, performance or

achievements of the Company to be materially different from those

expressed or implied by such forward-looking statements or

forward-looking information. Important risks that may cause actual

results to vary, include, without limitation, the risks that

circumstances may arise which require that the Preliminary Economic

Assessment be revised; the risk that permitting directives will not

accommodate commercial production within 3 years; the risk that

governmental regulators will not be supportive of the Boardwalk

project; the risk that DLE extraction technology and the use of

high-efficiency gas turbines will not reduce the carbon footprint

of the Boardwalk project as anticipated; the risk that the 30%

Investment Tax Credit (ITC) for Clean Technology Manufacturing will

not be passed by the Government of Canada; the risk that smaller

electrical submersible pumps will not result in reduced capital

expenditures on the Boardwalk project; the risk that the use of new

sorbent will not result in reduced costs, increased efficiency and

reduced reagent consumption; the risk that the Company is not able

to obtain a mineral resource estimate on its Saskatchewan asset

and/or a Preliminary Economic Analysis on the Park Place project on

the timing anticipated or at all; and the risk that the Company

will be unable to commence pilot plant studies on both the

Boardwalk and Park Place projects by the end of 2023 or at all.

Although management of the Company has attempted

to identify important factors that could cause actual results to

differ materially from those contained in forward-looking

statements or forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such statements will prove

to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements and forward-looking information. Readers are cautioned

that reliance on such information may not be appropriate for other

purposes. The Company does not undertake to update any

forward-looking statement, forward-looking information or financial

out-look that are incorporated by reference herein, except in

accordance with applicable securities laws.

______________________________

1 31,350 metric tonnes lithium hydroxide monohydrate (“LHM”) is

equivalent to 28,000 metric tonnes lithium carbonate equivalent

(“LCE”)

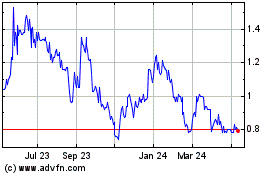

LithiumBank Resources (TSXV:LBNK)

Historical Stock Chart

From Nov 2024 to Dec 2024

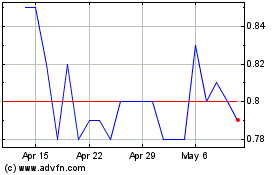

LithiumBank Resources (TSXV:LBNK)

Historical Stock Chart

From Dec 2023 to Dec 2024