IsoEnergy Ltd. (“IsoEnergy” or the “Company”) (TSXV: ISO;

OTCQX: ISENF) is pleased to announce that it has entered

into an amended agreement with Eight Capital, as co-lead

underwriter and joint bookrunner on behalf a syndicate of

underwriters (collectively, the “

Underwriters”),

including Haywood Securities Inc., as co-lead underwriter and joint

bookrunner, pursuant to which the Underwriters will now purchase

for resale, on a “bought deal” basis, 3,200,000 federal

flow-through common shares of the Company (the “

Premium FT

Shares”) at an offer price of C$6.25 per Premium FT Share

(the “

Issue Price”), for aggregate gross proceeds

of C$20,000,000 (the “

Offering”).

The Company has granted the Underwriters an

option to purchase for resale up to an additional 15% of the

Premium FT Shares at the Issue Price (the “Over-Allotment

Option”). The Over-Allotment Option will be exercisable in

whole or in part, up to 48 hours prior to the closing date of the

Offering.

The proceeds from the issuance of the Premium FT

Shares are expected to be used to incur eligible “Canadian

exploration expenses” (“CEE") as defined in the

ITA that will qualify as “flow-through critical mineral mining

expenditures” as defined in the ITA, after the closing date and on

or prior to December 31, 2025 in the aggregate amount of not less

than the total amount of the gross proceeds raised from the

issuance of Premium FT Shares. IsoEnergy will renounce the CEE (on

a pro rata basis) to the applicable subscriber of Premium FT Shares

with an effective date of no later than December 31, 2024 in

accordance with the ITA. The proceeds from the Offering are

expected to be used for exploration of the Company’s Athabasca

Basin Portfolio, including the Larocque East Project and Hawk

Project, and for exploration of the Company’s Quebec

properties.

The Offering is scheduled to close on or about

February 9, 2024, and is subject to certain conditions, including,

but not limited to, the receipt of all necessary regulatory and

other approvals, including the approval of the TSX Venture Exchange

(the “TSXV”). The Premium FT Shares issued

pursuant to the Offering will be subject to a hold period of

four-months and one day from the closing date of the Offering.

In connection with the Offering, the

Underwriters will receive a cash commission equal to 6.0% of the

gross proceeds of the Offering.

None of the securities to be issued pursuant to

the Offering have been or will be registered under the United

States Securities Act of 1933, as amended (the “U.S.

Securities Act”), and such securities may not be offered

or sold within the United States absent U.S. registration or an

applicable exemption from U.S. registration requirements. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy any securities.

About IsoEnergy Ltd.

IsoEnergy Ltd. (TSXV: ISO) (OTCQX: ISENF) is a

leading, globally diversified uranium company with substantial

current and historical mineral resources in top uranium mining

jurisdictions of Canada, the U.S., Australia, and Argentina at

varying stages of development, providing near, medium, and

long-term leverage to rising uranium prices. IsoEnergy is currently

advancing its Larocque East Project in Canada’s Athabasca Basin,

which is home to the Hurricane deposit, boasting the world’s

highest grade Indicated uranium Mineral Resource.

IsoEnergy also holds a portfolio of permitted,

past-producing conventional uranium and vanadium mines in Utah with

a toll milling arrangement in place with Energy Fuels Inc. These

mines are currently on stand-by, ready for rapid restart as market

conditions permit, positioning IsoEnergy as a near-term uranium

producer.

For More Information, Please Contact:

Philip WilliamsCEO and Directorinfo@isoenergy.ca1-833-572-2333X:

@IsoEnergyLtdwww.isoenergy.ca

Neither the TSXV nor its Regulations Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Forward-Looking Information

The information contained herein contains

“forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

“forward-looking information” within the meaning of applicable

Canadian securities legislation. “Forward-looking information”

includes, but is not limited to, statements with respect to the

activities, events or developments that the Company expects or

anticipates will or may occur in the future, including, without

limitation, statements with respect to, the completion of the

Offering; the expected gross proceeds of the Offering; the receipt

of all necessary regulatory and other approvals, including approval

of the TSXV; the expected incurrence by the Company of eligible

Canadian exploration expenses that will qualify as flow-through

critical mineral mining expenditures; the renunciation by the

Company of the Canadian exploration expenses (on a pro rata basis)

to each subscriber of FT Shares by no later than December 31, 2024;

and the use of proceeds from the Offering; the anticipated date for

closing of the Offering. Generally, but not always, forward-looking

information and statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “scheduled”,

“estimates”, “forecasts”, “intends”, “anticipates”, or “believes”

or the negative connotation thereof or variations of such words and

phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved” or the negative connotation thereof.

Such forward-looking information and statements

are based on numerous assumptions, including among others, that the

results of planned exploration activities are as anticipated, the

price of uranium, the anticipated cost of planned exploration

activities, that general business and economic conditions will not

change in a material adverse manner, that financing will be

available if and when needed and on reasonable terms, that third

party contractors, equipment and supplies and governmental and

other approvals required to conduct the Company’s planned

exploration activities will be available on reasonable terms and in

a timely manner. Although the assumptions made by the Company in

providing forward-looking information or making forward-looking

statements are considered reasonable by management at the time,

there can be no assurance that such assumptions will prove to be

accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: negative operating cash flow

and dependence on third party financing, uncertainty of additional

financing, no known mineral reserves, the limited operating history

of the Company, the influence of a large shareholder, alternative

sources of energy and uranium prices, aboriginal title and

consultation issues, reliance on key management and other

personnel, actual results of exploration activities being different

than anticipated, changes in exploration programs based upon

results, availability of third party contractors, availability of

equipment and supplies, failure of equipment to operate as

anticipated; accidents, effects of weather and other natural

phenomena and other risks associated with the mineral exploration

industry, environmental risks, changes in laws and regulations,

community relations and delays in obtaining governmental or other

approvals and the risk factors with respect to the Company set out

in the Company’s filings with the Canadian securities regulators

and available under IsoEnergy’s profile on SEDAR+ at

www.sedarplus.ca.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

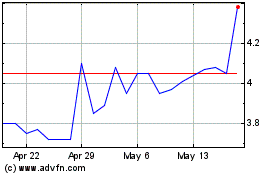

Isoenergy (TSXV:ISO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Isoenergy (TSXV:ISO)

Historical Stock Chart

From Dec 2023 to Dec 2024