Itafos Announces Amendment and Extension of Its Existing Credit Facilities

September 09 2024 - 7:30AM

Itafos Inc. (TSX-V: IFOS) (“Itafos” or the “Company”) announced

today that it has entered into an amendment of its existing credit

facilities with a syndicate of lenders led by RBC Capital Markets,

pursuant to which the Company will refinance its existing $85

million loan (with $35.4 million outstanding) and its $35 million

letter of credit facility (together, the “Existing Term Loan

Agreement”) for a new commitment of $100 million and a $30 million

letter of credit facility and will extend the maturity date under

the Existing Term Loan Agreement (as so amended, the “Amended Term

Loan Agreement”). The Company also announced that it has entered

into an amendment to its revolving asset-based credit facility with

a syndicate of lenders led by RBC Capital Markets to extend the

maturity date of such facility and to effect certain other

amendments to such facility (the “Amended ABL Agreement”). All

figures are in US Dollars except as otherwise noted.

David Delaney, Chief Executive Officer of

Itafos, commented: “The amendment and extension of our credit

facilities provide enhanced financial flexibility and liquidity for

the Company through the development phase of the H1/NDR project.

Execution of the H1/NDR project remains on schedule and will extend

the Conda mine life through 2037. Over the last three years, the

Company has prioritized deleveraging its balance sheet and

enhancing its available liquidity to improve its ability and

flexibility to execute on its strategic initiatives and deliver

value to its shareholders.”

The key terms of the Amended Term Loan Agreement

are set out below:

- Extension of maturity date to

September 6, 2027.

- Term loan upsized from the original

$85 million (currently $35.4 million outstanding) to $100

million.

- Dedicated letter of credit facility

reduced from $35 million to $30 million.

- Annual principal amortization

reduced from 33.33% to 10%.

- Further amendments to the facility

that provide the Company greater flexibility and enhance its

ability to distribute capital to shareholders.

The key terms of the Amended ABL Agreement are

set out below:

- Extension of maturity date to

September 6, 2027.

- Enhancements to the facility that

provide the company additional flexibility and capacity under the

borrowing base calculation.

The proceeds of the Amended Term Loan Agreement

and Amended ABL Agreement are expected to be used to refinance the

Company’s indebtedness under the Existing Term Loan Agreement,

repayment of all outstanding ABL Borrowings, and for general

corporate purposes.

Upon closing the refinancing, the Amended Term

Loan will have an outstanding balance of $100 million, the ABL

Facility will be undrawn, and the LC Facility will have an

outstanding balance of $12.5 million.

About Itafos

The Company is a phosphate and specialty fertilizer company. The

Company’s businesses and projects are as follows:

- Conda – a vertically integrated phosphate fertilizer business

located in Idaho, US with production capacity as follows:

- approximately 550kt per year of monoammonium phosphate (“MAP”),

MAP with micronutrients, superphosphoric acid (“SPA”), merchant

grade phosphoric acid and ammonium polyphosphate; and

- approximately 27kt per year of hydrofluorosilicic acid;

- Arraias – a vertically integrated phosphate fertilizer business

located in Tocantins, Brazil with production capacity as follows:

- approximately 500kt per year of single superphosphate (“SSP”)

and SSP with micronutrients (“SSP+”); and

- approximately 40kt per year of excess sulfuric acid (220kt per

year gross sulfuric acid production capacity);

- Farim – a high-grade phosphate mine project located in Farim,

Guinea-Bissau;

- Santana – a vertically integrated high-grade phosphate mine and

fertilizer plant project located in Pará, Brazil.

The Company is a Delaware corporation that is headquartered in

Houston, TX. The Company’s shares trade on the TSX-V under the

ticker symbol “IFOS”. The Company’s principal shareholder is CL

Fertilizers Holding LLC (“CLF”). CLF is an affiliate of Castlelake,

L.P., a global private investment firm.

For more information, or to join the Company’s mailing list to

receive notification of future news releases, please visit the

Company’s website at www.itafos.com.

Forward-Looking Information

Certain information contained in this news

release constitutes forward-looking information (“FLI”), including

statements with respect to the refinancing and any information

related to: statements with respect to the use of proceeds from the

Amended Term Loan Agreement and the Amended ABL Agreement and the

potential impact of the agreements on the Company’s financial

performance. All information other than information of historical

fact may constitute forward-looking information. The use of any of

the words “intend”, “anticipate”, “plan”, “continue”, “estimate”,

“expect”, “may”, “will”, “project”, “should”, “would”, “believe”,

“predict” and “potential” and similar expressions are intended to

identify forward-looking information.

The FLI contained in this news release is based

on the opinions, assumptions and estimates of management set out

herein, which management believes are reasonable as at the date the

statements are made. Those opinions, assumptions and estimates are

inherently subject to a variety of risks and uncertainties and

other known and unknown factors that could cause actual events or

results to differ materially from those projected in the FLI. These

include the Company’s expectations and assumptions with respect to

the following: commodity prices; operating results; safety risks;

changes to the Company’s mineral reserves and resources; risk that

timing of expected permitting will not be met; changes to mine

development and completion; foreign operations risks; changes to

regulation; environmental risks; the impact of adverse weather and

climate change; general economic changes, including inflation and

foreign exchange rates; the actions of the Company’s competitors

and counterparties; financing, liquidity, credit and capital risks;

the loss of key personnel; impairment risks; cybersecurity risks;

risks relating to transportation and infrastructure; changes to

equipment and suppliers; adverse litigation; changes to permitting

and licensing; geo-political risks; loss of land title and access

rights; changes to insurance and uninsured risks; the potential for

malicious acts; market volatility; changes to technology; changes

to tax laws; the risk of operating in foreign jurisdictions; and

the risks posed by a controlling shareholder and other conflicts of

interest. Readers are cautioned that the foregoing list of risks,

uncertainties and assumptions is not exhaustive.

Although the Company has attempted to identify

crucial factors that could cause actual actions, events or results

to differ materially from those described in the FLI, there may be

other factors that cause actions, events or results not to be as

anticipated, estimated or intended. There can be no assurance that

FLI will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such information.

The reader is cautioned not to place undue reliance on FLI. The

Company undertakes no obligation to update forward-looking

statements if circumstances or management’s estimates, assumptions

or opinions should change, except as required by applicable

securities law. Additional risks and uncertainties affecting the

FLI contained in this news release are described in greater detail

in the Company’s current Annual Information Form and current

Management’s Discussion and Analysis available under the Company’s

profile on SEDAR+ at www.sedarplus.ca and on the Company’s website

at www.itafos.com. The FLI included in this news release is

expressly qualified by this cautionary statement and is made as of

the date of this news release.

NEITHER THE TSX-V NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX-V) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS

NEWS RELEASE.

For further information, please contact:

Matthew O’NeillExecutive Vice President & Chief Financial

Officerinvestor@itafos.com 713-242-8446

For Media and Investor Relations:

irlabsAlyssa BarryPrincipal and Co-Founderalyssa@irlabs.ca

1-833-947-5227

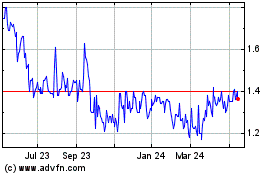

Itafos (TSXV:IFOS)

Historical Stock Chart

From Feb 2025 to Mar 2025

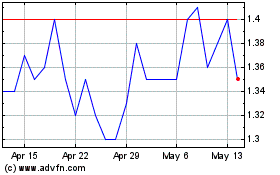

Itafos (TSXV:IFOS)

Historical Stock Chart

From Mar 2024 to Mar 2025