Inception Mining, Inc Announces Mid-Quarter Production Results

Mid-Q3 numbers show increase of

400% over Q3 2018, and YTD results 30% higher than

2018

Salt Lake City Utah, August 28, 2019 (GLOBE NEWSWIRE)

Inception Mining Inc. (OTCQB: IMII) (the “Company”) reported

today preliminary production results of 975 ounces of gold and 272

ounces of silver for the first 45 days of the third quarter, from

July 1, 2019 through August 14, 2019.

Production from the Company’s Clavo Rico project totaled 2,508

ounces of gold and 960 ounces of silver YTD at the time of this

release. The mid-quarter numbers show an increase of

400% over Q3 2018/mid-Q3 2018, and the YTD figures

reflect growth of 30% over the same time last

year/higher than the total production volume from 2018.

The Company also announced that it maintains plans to increase

production outlook, with the expanded operations of the Clavo Rico

project in Honduras commencing after a 24-month process, and the

partnership with Glen Eagle Resources (TSX-V: GER) allowing the

Company to accelerate its production through the toll processing

agreement signed in May 2019.

Trent D’Ambrosio, CEO of Inception Mining, stated, “Inception’s

2019 gains are a direct result of our commitment to continually

monitor, evaluate and improve our extraction operations, which we

have accomplished without losing sight of development and

exploration opportunities to sustain our future momentum. We

believe our continued production growth and expansion as

illustrated by these mid-quarter numbers and will raise Inception’s

profile as an efficient, high-margin producer of gold and

silver.

Full financial results for Q2 2019 are available in the report

on Form 10-Q filed with the Securities and Exchange

Commission.

About Inception Mining, Inc.

Inception Mining Inc., a Nevada corporation, is

engaged in the acquisition, exploration, and development of gold

projects in Central and North America. Inception’s core asset is

the Clavo Rico gold project in Honduras, which features a heap

leach facility and on-site ADR plant.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking

statements and information within the meaning of applicable

Canadian and US securities legislation. All statements, other than

statements of historical fact, included herein including, without

limitation, statements regarding the anticipated content,

commencement and cost of exploration programs, anticipated

exploration program results and the timing thereof, the discovery

and delineation of mineral deposits/resources/reserves, the

potential for the identification of multiple deposits in the

Project area, the potential for a low capex and/or opex heap leach

mine operation, the potential for a production decision to be made,

the potential commencement of any development of a mine following a

production decision, the potential for any mining or production,

the potential for additional resources to be located between

certain of the existing deposits, business and financing plans and

business trends, are forward-looking statements. Information

concerning mineral resource estimates are deemed to be

forward-looking statements in that it reflects a prediction of the

mineralization that would be encountered, and the results of mining

it, if a mineral deposit were developed and mined. Although the

Company believes that such statements are reasonable, it can give

no assurance that such expectations will prove to be correct.

Forward-looking statements are typically identified by words such

as: believe, expect, anticipate, intend, estimate, postulate and

similar expressions, or are those, which, by their nature, refer to

future events. The Company cautions investors that any

forward-looking statements by the Company are not guarantees of

future results or performance, and that actual results may differ

materially from those in forward looking statements as a result of

various factors, including, but not limited to, variations in the

nature, quality and quantity of any mineral deposits that may be

located, variations in the market price of any mineral products the

Company may produce or plan to produce, the Company's inability to

obtain any necessary permits, consents or authorizations required

for its activities, significant increases in the cost of labor,

materials, equipment and supplies required to develop and operate

any mine, the Company's inability to produce minerals from its

properties successfully or profitably, to continue its projected

growth, to raise the necessary capital or to be fully able to

implement its business strategies, and other risks and

uncertainties disclosed in the Company's latest filings with the

SEC. All of the Company's public disclosure filings may be accessed

via www.sec.gov and readers are urged to review these materials

with respect to the Company's mineral properties.

Cautionary Note Regarding References to Resources and

Reserves

National Instrument 43 101 - Standards of

Disclosure for Mineral Projects ("NI 43-101") is a rule developed

by the Canadian Securities Administrators which establishes

standards for all public disclosure an issuer makes of scientific

and technical information concerning mineral projects. Unless

otherwise indicated, all resource estimates contained in or

incorporated by reference in this press release have been prepared

in accordance with NI 43-101 and the guidelines set out in the

Canadian Institute of Mining, Metallurgy and Petroleum (the "CIM")

Standards on Mineral Resource and Mineral Reserves, adopted by the

CIM Council on November 14, 2004 (the "CIM Standards") as they may

be amended from time to time by the CIM. While the Company is not

listed on any Canadian exchange or subject to NI 43-101, and the

Technical Report will not be filed with any Canadian authorities,

it elected to have the 43-101 report completed for informational,

voluntary purposes. United States shareholders are cautioned that

the requirements and terminology of NI 43-101 and the CIM Standards

differ significantly from the requirements and terminology of the

SEC set forth in the SEC's Industry Guide 7 ("SEC Industry Guide

7") and Subpart 1300 of Regulation S-K. Accordingly, the Company's

disclosures regarding mineralization may not be comparable to

similar information disclosed by companies subject to SEC Industry

Guide 7 or Subpart 1300 of Regulation S-K. Without limiting the

foregoing, while the terms "mineral resources", "inferred mineral

resources", "indicated mineral resources" and "measured mineral

resources" are recognized and required by NI 43-101 and the CIM

Standards, they are not recognized by the SEC and are not permitted

to be used in documents filed with the SEC by companies subject to

SEC Industry Guide 7. These definitions also differ from the

requirements of the disclosure and technical report requirements of

Subpart 1300 of Regulation S-K, which the Company will fully comply

with according to the SEC’s required timeline of the fiscal year

following January 1, 2021. Mineral resources which are not

mineral reserves do not have demonstrated economic viability, and

US investors are cautioned not to assume that all or any part of a

mineral resource will ever be converted into reserves. Further,

inferred resources have a great amount of uncertainty as to their

existence and as to whether they can be mined legally or

economically. It cannot be assumed that all or any part of the

inferred resources will ever be upgraded to a higher resource

category. Under Canadian rules, estimates of inferred mineral

resources may not form the basis of a feasibility study or

prefeasibility study, except in rare cases. The SEC normally only

permits issuers to report mineralization that does not constitute

SEC Industry Guide 7 compliant "reserves" as in-place tonnage and

grade without reference to unit amounts. The term "contained

ounces" is not permitted under the rules of SEC Industry Guide 7.

In addition, the NI 43-101 and CIM Standards definition of a

"reserve" differs from the definition in SEC Industry Guide 7. In

SEC Industry Guide 7, a mineral reserve is defined as a part of a

mineral deposit which could be economically and legally extracted

or produced at the time the mineral reserve determination is made,

and a "final" or "bankable" feasibility study is required to report

reserves, the three-year historical price is used in any reserve or

cash flow analysis of designated reserves and the primary

environmental analysis or report must be filed with the appropriate

governmental authority.

Forward-Looking Statements

This news release includes certain

forward-looking statements or information. All statements other

than statements of historical fact included in this release are

forward-looking statements that involve various risks and

uncertainties. Forward-looking statements in this news

release include statements with respect to the potential

mineralization and geological merits of the Company properties.

There can be no assurance statements will prove to be accurate and

actual results and future events could differ materially from

anticipated in such statements.

Inception Mining Inc. disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events except as

required by applicable securities legislation.

Contact:

SOURCE: Inception Mining Inc.

(OTC QB: IMII)

5330 South 900 East, Suite 280

Salt Lake City, Utah 84117

Trent D’Ambrosio CEO

(801) 312-8113 Ext. 101

info@inceptionmining.com

www.inceptionmining.com

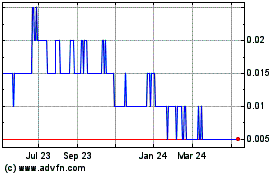

Glen Eagle Resources (TSXV:GER)

Historical Stock Chart

From Dec 2024 to Jan 2025

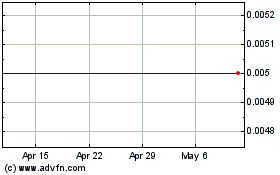

Glen Eagle Resources (TSXV:GER)

Historical Stock Chart

From Jan 2024 to Jan 2025