Galantas Gold Corporation (TSX-V & AIM: GAL; OTCQX: GALKF)

(“Galantas” or the “Company”) is pleased to provide an update on

the Gairloch Project in Scotland.

Galantas Gold, in collaboration with the

University of Edinburgh, is currently undertaking a sampling

program of drill core and outcrop to establish the Kerry Road

deposit’s geochemical signature which will be used to locate new

mineralization in the Gairloch Schist Belt. The work will include

petrology, scanning electron microscope (SEM) and electron

microprobe (EMP) analysis on selected rock samples. This sampling

work is expected to help identify new target areas for follow-up

exploration work and drilling.

Mario Stifano, CEO of Galantas, commented: “We

are honored to collaborate with the University of Edinburgh and

look forward to the results of this detailed work. The team at the

university’s School of Geosciences brings experience in

cutting-edge research and expert knowledge of VMS systems to help

us better understand the Kerry Road deposit and determine the

location of other mineralized bodies in the vicinity.”

Overview of VMS deposits and work with

the University of Edinburgh

The green energy transition will require

significant amounts of metals such as copper, zinc and cobalt to

enable the growth of clean technologies, electric vehicles and

renewables. The Kerry Road copper-zinc-gold deposit at the Gairloch

Project is classified as a Besshi-type VMS deposit, which is

associated with cobalt enrichment. Additionally, its host rocks

appear to be geologically similar to those in the Trans-Hudson

Orogen in Manitoba and Saskatchewan which contain the prolific Flin

Flon and Snow Lake VMS mining camps. This makes the Kerry Road

deposit an important potential resource for the future.

VMS deposits are rarely solitary and typically

exhibit multiple mineralized bodies in each system. These systems

are formed through hydrothermal activity, which alters the

surrounding rock and leaves a geochemical signature (or alteration

halo) which can be detected through certain types of detailed

analysis and observations. Each mineral deposit will have its own

unique geochemical signature based on the composition of the local

rock. This project with the University of Edinburgh aims to

identify the Kerry Road’s unique signature using garnet, chlorite,

white mica and other silicate minerals. The results will be

compared to new and existing data from other metamorphosed VMS

deposits of the Yilgarn Craton, Western Australia – for example,

Teutonic Bore, Wheatley, King, and Nimbus. The work is supported by

grants from the Geological Society of London and Geological Society

of Glasgow to the University of Edinburgh PhD student Cendi

Dana.

Representative footwall, ore horizon and

hanging-wall samples from drill core and outcrops have been

collected for petrography, mineral chemistry, and whole-rock

geochemical analysis. Whole-rock geochemical analysis will be

carried out using x-ray fluorescence and inductively coupled plasma

mass spectrometry to establish geochemical trends and alteration

halos. Mineralogy will be characterized by petrographic

observations (transmitted and reflected light petrology, and

scanning electron microscopy), coupled with mineral chemical

analysis using an electron microprobe at the University of

Edinburgh’s Materials and Micro-Analysis Centre. When coupled with

whole-rock geochemical data, the EMP data will allow geologists to

determine the factors involved in the changes of mineral chemistry.

This project will further characterize the alteration mineralogy of

the Kerry Road deposit, and aid exploration efforts toward

additional discoveries in the regional stratigraphy.

For more information on the Gairloch Project and drill results

to date, see Galantas’ press releases dated July 10, 2023; July 27,

2023; August 29, 2023; and October 16, 2023.

Figures 1 & 2: Outcrop of chalcopyrite and

pyrrhotite mineralization found 300 metres northwest along trend

from the Kerry Road deposit.

Galantas Gold announces marketing

contracts

The Company announces that it engaged GRIT

Capital Corp (“Grit”) of Toronto, Ontario, to create print

advertising campaigns, including in GRIT’s flagship newsletter, a

landing page for advertising campaigns and CEO presentations on

Twitter spaces, to provide the Company with exposure to potential

investors, in accordance with Policy 3.4 – Investor Relations,

Promotional and Market-Making Activities of the TSX Venture

Exchange (the "Exchange"). The activity undertaken by GRIT occurred

in its newsletter at gritcap.io and on a partner’s Twitter account

@WOLF_Financial. Grit was engaged in March 2023 for a period of 26

weeks, which arrangements are now complete at a fee of USD$65,000

(plus HST). The USD$65,000 was paid as to USD$5,000 in cash on

entering into the agreement and USD$60,000 through the issuance of

units. No buying or selling recommendations are made, no price

projections on the Company are given and nor do they give any

financial advice. The arrangements with Grit were and are an arm’s

length relationship with the Company. Grit is operated by Genevieve

Sarah Roch-Decter. Pursuant to the arrangements Grit subscribed for

and were issued 228,333 common shares (the “Grit Shares”) and

228,333 share purchase warrants (the “Grit Warrants”) (collectively

the “Grit Units”) of the Company under the private placement

completed by the Company on March 27, 2023. The issuance of the

Grit Units has been reviewed by the Exchange pursuant to policy 3.4

which states that compensation in the form of shares is not

acceptable and payment should be in the form of cash. The Exchange

has requested that the Grit Units be cancelled. Grit agreed that

the Grit Warrants issued to them will be cancelled by the Company.

Mr. Stifano, the CEO of the Company, has agreed to cancel 228,333

common shares of the Company (“Shares”) owned by him. As of the

date hereof, to the Company’s knowledge, after the cancellation of

the Shares held by Mr. Stifano and the Grit Warrants, GRIT

(including its directors and officers) owns directly or indirectly

228,333 Shares of the Company and does not have any right or intent

to acquire any additional Shares of the Company. The 228,333 Shares

and 228,333 Grit Warrants were cancelled effectively February 27,

2024.

The Company also announces that it engaged ABR

Media Company (“ABR”), of Langley, British Columbia, covering a

sponsorship of the Rocks and Stocks News website, whereby ABR will

provide certain video interview services to the Company in

accordance with Policy 3.4 – Investor Relations, Promotional and

Market-Making Activities of the Exchange. ABR has been engaged

since March 2023 for a period of one year, for a total fee of

C$36,000. The C$36,000 was paid as to C$9,000 cash on closing of a

private placement and C$27,000 through the issuance of Units. ABR

conducts interviews with the Company which is distributed to ABR's

subscriber base. There are no performance factors related to ABR’s

services. No buying or selling recommendations are made, no price

projections on the Company are given and nor do they give any

financial advice. The arrangements with ABR were and are an arm’s

length relationship with the Company. ABR and Rocks and Stocks News

are operated by Allan Barry Laboucan who resides in Mexico.

Pursuant to the arrangements Mr. Laboucan subscribed for 77,777

shares (the “Laboucan Shares”) and 77,777 warrants “the Labouchan

Warrants”) (collectively the “Labouchan Units”) of the Company

under the private placement completed by the Company on March 27,

2023. The issuance of the Laboucan Units has been reviewed by the

Exchange pursuant to policy 3.4 which states that compensation in

the form of shares is not acceptable and payment should be in the

form of cash. The Exchange has requested that the Labouchan Units

be cancelled. Mr. Laboucan agreed that the Labouchan Warrants

issued to him will be cancelled by the Company. Mr. Stifano has

agreed to cancel 77,777 Shares owned by him. As of the date hereof,

to the Company’s knowledge, after the cancellation of the 77,777

Shares held by Mr. Stifano and the Labouchan Warrants, Mr. Laboucan

does not own directly or indirectly any Shares of the Company and

does not have any right or intent to acquire Shares of the Company.

The 77,777 Shares and 77,777 Labouchan Warrants were cancelled

effectively February 27, 2024.

Following the cancellation of the 306,110 Shares

held by Mr. Stifano, Mr. Stifano will be interested in a total of

156,445 Shares representing 0.14% of the Company's issued share

capital.

Amendment to March 27, 2023 press

release

The Company advises that because of the reversal

of the issuance of Grit Units and Labouchan Units described above,

the press release of March 27, 2023, announcing the closing of the

private placement for cash gross proceeds of $2,963,142.36 should

have been for closing cash proceeds of $2,825,942.64. Following the

cancellation of the 228,333 Shares and the 77,777 Shares, the

issued and outstanding Shares of the Company is 114,535,293.

Qualified Person

The technical and historical information

pertaining to the Gairloch Project in this release has been

reviewed and approved by Gavin Berkenheger (CGeol, EurGeol) who is

considered, by virtue of his education, experience and professional

association, a Qualified Person under the terms of NI 43-101. Mr.

Berkenheger is not considered independent under NI 43-101 as he is

a consultant of Galantas Gold Corporation.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

About Galantas Gold

Corporation

Galantas Gold Corporation is a Canadian public

company that trades on the TSX Venture Exchange and the London

Stock Exchange AIM market, both under the symbol GAL. It also

trades on the OTCQX Exchange under the symbol GALKF. The Company's

strategy is to create shareholder value by operating and expanding

gold production and resources at the Omagh Project in Northern

Ireland, and exploring the Gairloch Project hosting the Kerry Road

gold-bearing VMS deposit in Scotland.

Enquiries

Galantas Gold CorporationMario Stifano: Chief

Executive OfficerEmail: info@galantas.comWebsite:

www.galantas.comTelephone: +44(0)28 8224 1100

Grant Thornton UK LLP (AIM Nomad)Philip Secrett,

Harrison Clarke, Enzo AliajTelephone: +44(0)20 7383 5100

SP Angel Corporate Finance LLP (AIM Broker)David

Hignell, Charlie Bouverat (Corporate Finance)Grant Barker (Sales

& Broking) Telephone: +44(0)20 3470 0470

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws, including results of exploration and sampling

programs at the Gairloch Project. Forward-looking statements are

based on estimates and assumptions made by Galantas in light of its

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors that

Galantas believes are appropriate in the circumstances. Many

factors could cause Galantas’ actual results, the performance or

achievements to differ materially from those expressed or implied

by the forward looking statements or strategy, including: gold

price volatility; discrepancies between actual and estimated

production, actual and estimated metallurgical recoveries and

throughputs; mining operational risk, geological uncertainties;

regulatory restrictions, including environmental regulatory

restrictions and liability; risks of sovereign involvement;

speculative nature of gold exploration; dilution; competition; loss

of or availability of key employees; additional funding

requirements; uncertainties regarding planning and other permitting

issues; and defective title to mineral claims or property. These

factors and others that could affect Galantas’ forward-looking

statements are discussed in greater detail in the section entitled

“Risk Factors” in Galantas’ Management Discussion & Analysis of

the financial statements of Galantas and elsewhere in documents

filed from time to time with the Canadian provincial securities

regulators and other regulatory authorities. These factors should

be considered carefully, and persons reviewing this press release

should not place undue reliance on forward-looking statements.

Galantas has no intention and undertakes no obligation to update or

revise any forward-looking statements in this press release, except

as required by law.

(UK) DEALING NOTIFICATION

FORM FOR USE BY PERSONS DISCHARGING

MANAGERIAL RESPONSIBILITY AND THEIR CLOSELY ASSOCIATED

PERSONS

|

1. |

Details of the person discharging managerial

responsibilities/person closely associated |

|

a) |

Name: |

Mario Stifano |

|

2. |

Reason for the notification |

|

a) |

Position/status: |

Chief Executive Officer |

|

b) |

Initial notification/Amendment: |

Initial Notification |

|

3. |

Details of the issuer, emission allowance market

participant, auction platform, auctioneer or auction

monitor |

|

a) |

Name: |

Galantas Gold Corporation |

|

b) |

LEI: |

LEI: 213800JKVPLLKO4KVB93 |

|

4. |

Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted |

|

a) |

Description of the financial instrument type of instrument |

Common

Shares of nil par value |

|

|

Identification Code |

ISIN: CA36315W3012 |

|

b) |

Nature of the transaction |

Cancellation of shares |

|

c) |

Price(s) and volume |

Price |

Volume |

|

N/A |

306,110 |

|

d) |

Aggregated information |

N/A single transaction |

|

e) |

Date of the transaction |

February 27, 2024 |

|

f) |

Place of the transaction |

Outside of a trading venue |

Photos accompanying this announcement are available

athttps://www.globenewswire.com/NewsRoom/AttachmentNg/7b39289a-c31d-43fd-a84e-a41eda725dcehttps://www.globenewswire.com/NewsRoom/AttachmentNg/d1e33473-42ce-4717-b6aa-c43a1362d8f9

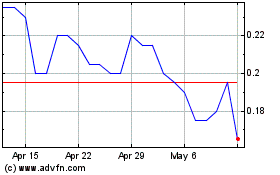

Galantas Gold (TSXV:GAL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Galantas Gold (TSXV:GAL)

Historical Stock Chart

From Nov 2023 to Nov 2024