Afri-Can Marine Reaches Agreement for Development and Mining of Diamond Fields Mining Lease 111 and EPL 3403 Off Coast of Nam...

December 05 2013 - 8:58AM

Marketwired Canada

Afri-Can Marine Minerals Corporation ("Afri-Can") (TSX VENTURE:AFA) announces

that it has signed a Memorandum of Understanding with International Mining and

Dredging Holding Ltd ("IMDH") for the development and mining of the Mining

Leases ("ML") under option with Diamond Fields International Ltd ("DFI") and of

the Exclusive Prospecting License ("EPL") 3403, both situated off the coast of

Namibia (see Map 1).

Salient features of the Memorandum of Understanding are:

-- IMDH will design and operate a large sampling program of up to 800

samples mainly on ML 111 and, to a lesser extent, on EPL 3403. The

sampling program will serve to establish mining blocks and grades in

preparation for mining and to upgrade some of the NI 43-101 inferred

resources to the indicated category, as well as further the development

of EPL 3403. Afri-Can will fund the program on or before March 1st,

2014. Budgets will be prepared by IMDH and approved by Afri-Can. The

Company is currently revising various options in order to raise the

funds needed;

-- Afri-Can and IMDH will create a joint-venture company, which will fund

and operate the mining program on ML 111 and EPL 3403 if deemed

economically viable. IMDH will fund the preparation of the mining vessel

and Afri-Can will fund the vessel operating costs for the 3 first months

of the mining program;

-- Afri-Can and IMDH will share equally in the net profits from production

after payment of 10% of the net profits to DFI and 10% of the net

profits to Woduna Mining Holding (PTY) Ltd.;

-- Afri-Can is currently preparing a pre-feasibility study and a

preliminary economic assessment (PEA). IMDH will prepare the mining plan

from the PEA and from the results of the sampling program;

-- The first funding phase of the program will include a payment of

US$350,000 to IMDH by Afri-Can, which is due from the last sampling

program on EPL 3403 carried out in December 2012. Afri-Can will also

deposit US$500,000 with AfrAsia Corporate Finance (Africa) Limited, the

first US$200,000 of which will be paid to IMDH in order to complete the

transfer of ownership of the remaining 80% of the shares of Thyme

Investment (PTY) Ltd ("Thyme"), the owner of EPL 3403. The balance of

US$300,000 will serve as a deposit for the funding of the sampling

program;

-- Upon payment of the US$200,000 to IMDH, Afri-Can will complete the

acquisition of all the shares of Thyme and in accordance with the

agreement signed with IMDH on September 27th 2010, Afri-Can will issue

9,750,000 of its common shares to IMDH and 3,250,000 of its common

shares to BV Investment (PTY) Ltd. Afri-Can will then hold 100% of EPL

3403.

Afri-Can's immediate goal is to focus on ML 111's existing resources in order to

resume production in the shortest time frame possible. There are also several

other features, additional to those containing resources, within the four DFI

leases that hold potential for diamond mineralisation but have been

insufficiently sampled, and these features will be investigated. The second goal

is to complete the sampling program on EPL 3403, which remains a high priority

exploration target.

Pierre Leveille, President and CEO of Afri-Can, stated that, "We are very

pleased with this agreement as it gets us to a level that will allow mining and

provide regular development and value for our shareholders. The DFI portfolio of

Mining Leases complements EPL 3403 and offers very good development potential.

We feel that we are sitting in a strong project in a very solid industry."

About ML 111

ML 111 lies between 5 and 20 kilometres north of Luderitz. It covers 312 square

kilometres and sits in water ranging from 30 to 70 metres in depth. ML 111 hosts

at least 3 mineralised geological features. The ML was originally granted for a

period of 15 years and is renewable on December 4th, 2015. A recent NI 43-101

report estimates 413,000 carats of indicated diamond resources and 453,000

carats of inferred diamond resources remain on ML 111. A portion of the

indicated resources, some 255,000 carats grading at 0.30 carats per square

metre, will be the first focus for mining development. The company is currently

preparing a pre-feasibility study and a PEA on this resource and until the study

is completed it is uncertain that the resource will prove to be economic.

The resource exists in the Marshall Fork, Staple Basin/Conical Beach and Diaz

Reef areas. DFI produced intermittently between 2001 and 2007 some 158,200

carats, mainly from the Marshall Fork area. Special stones recovered from

Marshall Fork included a gem quality 17.42 carat stone, a rare 5.26 carat light

blue diamond which sold for US$10,457 per carat, and a 2.45 carat pink gem

diamond which sold for US$16,771 per carat. DFI ceased production following the

world financial crisis.

About EPL 3403

EPL 3403 covers 800 square kilometres and is adjacent to the Atlantic One

deposit (operated by De Beers Marine), which is the world's largest marine

diamond deposit with a resource estimated at about 100 million carats. Previous

sampling on EPL 3403 by Afri-Can and IMDH discovered 3 diamond deposits and

recovered 117 diamonds. The 4 largest diamonds were of 2.69, 1.76, 1.60 and 1.30

carats. Several stones weighed over 0.50 carats. The average diamond sizes found

in EPL 3403 are similar to those in adjacent concessions.

Richard Foster, B.Sc. (Hons. Geology), Pr. Sci. Nat., is the Qualified Person

who has prepared the NI 43-101 report, reviewed this press release and is

responsible for the technical part of this press release, and is the designated

Qualified Person under the terms of National Instrument 43-101.

About Afri-Can Marine Minerals Corporation

Afri-Can is a Canadian company, actively involved in the acquisition,

exploration and development of major mineral properties in Namibia. Afri-Can's

creative and scientific approach targets large marine diamond deposits in

prospective territories.

This press release contains certain "forward-looking statements," as identified

in the Afri-Can's periodic filings with Canadian Securities Regulators that

involve a number of risks and uncertainties. There can be no assurance that such

statements will prove to be accurate and actual results and future events could

differ materially from those anticipated in such statements. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term is defined

in the policies of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

Shares outstanding: 91,527,864

To view Map 1 please click on the following link:

http://media3.marketwire.com/docs/AFA1205.pdf

FOR FURTHER INFORMATION PLEASE CONTACT:

Afri-Can Marine Minerals Corporation

Pierre Leveille, President & CEO

(514) 846-2133

Afri-Can Marine Minerals Corporation

Bernard J. Tourillon, Executive V.P. and CFO

(514) 846-2133

TOLL FREE North America: 1 (866) 206-7475

(514) 372-0066 (FAX)

info@afri-can.com

www.afri-can.com

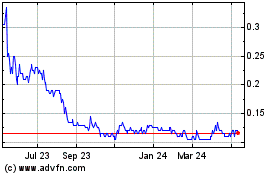

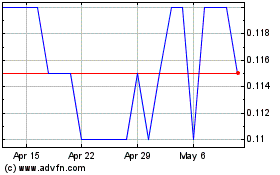

Common Stock (TSXV:EPL)

Historical Stock Chart

From Apr 2024 to May 2024

Common Stock (TSXV:EPL)

Historical Stock Chart

From May 2023 to May 2024