(NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA)

Desert Gold Ventures Inc. (TSX VENTURE:DAU)(OTCQX:DAUGF) (the "Company" or

"Desert Gold") is pleased to announce that it has entered into a definitive sale

of shares agreement (the "Share Exchange Agreement") dated June 20, 2011 with

TransAfrika Resources Cyprus Limited (the "Vendor"), a Cypriot company, pursuant

to which Desert Gold has agreed to acquire all of the issued and outstanding

shares of TransAfrika Belgique S.A. ("TransAfrika"), a Belgian company, from the

Vendor (the "Proposed Acquisition"). The Vendor is an indirect subsidiary of

TransAfrika Resources Limited, a widely held private company existing under the

laws of Mauritius.

Transaction Highlights

-- Desert Gold intends to acquire TransAfrika which has an extensive

portfolio of advanced mineral projects in Central and West Africa,

including Mali, Senegal and Rwanda.

-- The Byumba Project in Rwanda has an initial inferred resource of 5.5

million tonnes grading 1.48 grams per tonne ("g/t") gold. A National

Instrument 43-101 ("NI 43-101") report has confirmed 257,000 ounces of

inferred gold for the Byumba Project.

-- The Mali concessions cover 112 sq. kilometers with seven discovered gold

occurrences highlighted by drill results ranging from 4 meters ("m") at

9.31 g/t gold to 18 m at 1.26 g/t gold.

-- The accumulated loss of TransAfrika as reflected in the unaudited

financial statements for the period ending March 31, 2011 was US$15

million, which includes exploration expenditures incurred on its

subsidiary companies in Rwanda, Mali and Senegal.

-- Desert Gold intends to conduct a concurrent financing to be led by MGI

Securities Inc., the proceeds of which will be used to conduct further

drilling on the most promising of these projects during the next twelve

months and for general corporate purposes.

Summary of the Proposed Transaction

Under the terms of the Share Exchange Agreement, Desert Gold will acquire all of

the issued and outstanding shares of TransAfrika from the Vendor in exchange for

the issuance to the Vendor and it nominees, of an aggregate of 20,000,000 common

shares of Desert Gold. In addition, Desert Gold will be required to issue a

further 12,000,000 common shares, in aggregate, to the Vendor and its nominees

in the event that within a two year period from the closing of the Proposed

Acquisition, Desert Gold publishes a NI 43-101 compliant resource calculation

disclosing that the mineral properties located in Rwanda, Mali and Senegal which

were acquired from TransAfrika pursuant to the implementation of the Proposed

Acquisition (the "Mineral Properties") contain an additional 1,000,000 ounces of

gold. The common shares issuable by Desert Gold pursuant to the Proposed

Acquisition may be subject to escrow conditions as determined in accordance with

TSX Venture Exchange ("TSX-V") policies.

No Non-Arm's Length Party (as that term is defined under TSX-V policies) of the

Company has any direct or indirect beneficial interest in TransAfrika or is an

insider of TransAfrika, and there is no relationship between any Non-Arm's

Length Party of the Company and any Non-Arm's Length Party of TransAfrika.

The Proposed Acquisition is conditional upon, among other things, receipt of all

necessary regulatory, stock exchange, director and shareholder approvals and the

completion of satisfactory due diligence by both Desert Gold and the Vendor. The

Proposed Acquisition is also subject to the completion of a brokered private

placement financing (the "Financing") for minimum gross proceeds which, together

with cash on hand, will result in Desert Gold having at least CDN $10,000,000 in

available cash upon the closing of the Proposed Acquisition. The Financing will

be on a best efforts basis to consist of subscription receipts at an issue price

of CDN$0.75. If all of the conditions to the closing of the Proposed Acquisition

are satisfied, each Subscription Receipt will, without payment of any additional

consideration or taking further action, entitle the holder to receive one unit

("Unit") of the Company. Each Unit will consist of one common share of the

Company and one-half of one common share purchase warrant of the Company (each

whole common share purchase warrant, a "Warrant"). Each Warrant will entitle the

holder to purchase one common share of the Company at a purchase price of

CDN$1.50 per share for a period of 24 months after completion of the Proposed

Acquisition. The proceeds of the Financing will be used to fund future

exploration expenditures in respect of the Mineral Properties and for working

capital and general corporate purposes. Desert Gold has engaged MGI Securities

Inc. to act as agent on a best efforts agency basis in connection with the

Financing. Consequently, it is anticipated that the Proposed Acquisition will be

exempt from the sponsorship requirements of the TSX-V.

TransAfrika was incorporated on December 28, 2007 under the laws of Belgium. As

reflected in the audited financial statements of TransAfrika prepared based on

IFRS for the periods ended December 31, 2010 and 2009, TransAfrika had total

assets of US$1,585,548 (US$2,538,078 - December 31, 2009), working capital of

US$1,096,429 (US$1,925,714 - December 31, 2009), total liabilities of US$265,967

(US$192,356), shareholder equity of US$1,319,581 (US$2,345,722 - December 31,

2009) and a net operating loss of US$1,076,701(US$4,031,025 - December 31,

2009). The accumulated loss of TransAfrika as reflected in the unaudited

financial statements for the period ending March 31, 2011 was US$15 million,

which includes exploration expenditures incurred on its subsidiary companies in

Rwanda, Mali and Senegal (US$11,016,480 - March 31, 2010).

Upon completion of the Proposed Acquisition, it is anticipated that the board of

directors of the Company will consist of three members of the current board of

directors designated by Desert Gold and three nominees of the Vendor, which will

include Theo Christodoulou. In addition, it is expected that Ayub Khan, Desert

Gold's current President and Chief Executive Officer will resign from that

position and will hold the position of non-executive Chairman of the board of

directors of Desert Gold. Further, on completion of the Proposed Acquisition,

the following persons will be appointed to positions as executive officers of

Desert Gold: Roeland van Kerckhoven (President and Chief Executive Officer),

Jared Scharf (Chief Financial Officer) and Louw van Schalkwyk (Vice-President,

Exploration).

Roeland van Kerckhoven (59), spent more than 29 years of his career with the

Anglo American group of companies, serving for the last 15 years as CFO and

business development director of Anglo Platinum until he retired in March 2007.

Since joining TransAfrika in 2008 as President and Chief Executive Officer, he

has overseen the discovery and evaluation of a portfolio of assets and has been

actively involved in negotiations with African governments and joint venture

partners.

Theo Christodoulou (38), CA(SA) (MBA-Duke USA) worked at PricewaterhouseCoopers

for nearly 5 years, after which he joined Deutsche Bank He worked for the bank

for 11 years which included 5 years as Director (and head of Metals and Mining

in South Africa). Theo then founded the corporate finance company, AC Squared

Solutions in 2010. Theo has extensive experience in advising on mining

initiatives, project finance planning and management, M&A, IPO's and BEE

structuring across Africa.

Louw van Schalkwyk (51), BSc. Hons (Geology), started his career as an

exploration geologist with Gold Fields of South Africa Limited in 1984 and was

promoted to senior geologist. In 1992 he moved to consulting and contracting

geology, working on gold and base metal exploration for various major and junior

exploration and mining companies in sub-Saharan Africa. These include Rio Tinto

Plc, Anglo American, Iscor Limited and Pangea Minerals Ltd. His ability to

integrate geology with applied exploration techniques led to the discovery of

the Gams East Zinc deposit while working as project manager for Anglo American.

It is anticipated that following completion of the Proposed Acquisition and the

Financing, no person or company will own more than 10%, calculated on an

undiluted basis, of the issued and outstanding Desert Gold common shares.

Ayub Khan, President and CEO of Desert Gold said, "The acquisition of

TransAfrika and the experienced technical team which comes with the company,

melds well with Desert Gold's strategy of focusing on advanced stage mineral

projects in established and recognized mining countries. TransAfrika's gold

projects in Central and Western Africa, especially the Byumba Concession in

Rwanda, are a perfect complement to Desert Gold's emerging gold production

profile in North America."

"Following this transaction, the new Desert Gold will have sufficient funds to

explore the mineral properties in Western Africa. We're excited about combining

our skill sets in Africa and North America to develop and grow this company,"

added Roeland van Kerckhoven President and Chief Executive Officer of

TransAfrika and incoming and President and Chief Executive Officer of Desert

Gold.

About TransAfrika Belgique S.A.

TransAfrika has acquired a portfolio of advanced mineral projects in Central and

West Africa the most important of which include:

Rwanda: TransAfrika, through its wholly owned subsidiary TransAfrika Rwanda Gold

Ltd., has acquired 100% ownership of two exploration permits in the two main

gold domains in Rwanda. These include permit No 107/16.03/05 issued on 13

November 2007 covering 90,119 hectares ("ha") (Byumba) and 7,044 ha (Rusizi),

and permit No 0040/16.03/05 issued on 1 September 2008 covering 14,754 ha

(Nyamugali) and 684 ha (Rusizi Extension). The exploration permits lie within

the Central African Kibaran Orogen stretching from Katanga, Democratic Republic

of Congo, into Uganda. The Kibaran hosts Banro's Twangiza, Namoya, Lugushwa and

Kamitunga deposits with a total resource of 10.5 million ounces of gold ("Au").

Whilst Rwanda hosts a number of coltan, tin and tungsten mines as well as small

artisanal gold mines, TransAfrika's Byumba Project is the first significant gold

resource discovered in the country. These properties currently represent early

stage exploration targets. The Byumba Project is located in the Gicumbi District

in the Northern Province of the Republic of Rwanda. A diamond drilling program,

comprising 33 holes for 5,183 m was carried out between July 2008 and August

2009 by TransAfrika on the Byumba Project and an inferred resource of 5,551 kt

at a grade of 1.48 g/t for 257,000 ounces Au was declared for the Rubaya

deposit. Mineralization is of the disseminated type and occurs in 14 parallel

higher grade zones within a broad mineralized zone of up to 80 m wide and is

expected to be amenable to open pit mining. Drilling tested the mineralization

over a strike of 1,160 m. The Rubaya deposit is open down dip and along strike

and has yet to be fully delineated. The next phase of drilling is intended to

increase the resource. To date TransAfrika has spent USD $7.6 million in

exploration expenses in respect of its properties in Rwanda.

Mali: TransAfrika, through its subsidiaries and joint venture agreements, has

three exploration permits (EP) focused on gold in Mali. The permits in Mali are

held by TransAfrika Mali SA, a joint venture company incorporated in Mali held

74% by TransAfrika and 13% by each of the two joint venture partners. The

permits include Farabantourou, PR08/3549 covering 112 km2, Loulo-Est, PR 08/349

covering 52 km(2)and Segala-Ouest, PR 09/396 covering 16 km2. The permits are

underlain by Birimien volcano-sedimentary formations of the Kenieba inlier.

Several gold mines occur within the Kenieba inlier, including Loulo, Sadiola,

Yatela, Tabakoto, Segala and Sabodala. Realization of the importance of the

Birimian rocks as the major source of gold in West Africa led to a series of

discoveries and mine development over the last two decades in the West African

countries of Ghana, Ivory Coast, Guinea Mali and Burkino Faso, leading to Ghana

and Mali becoming the second and third largest producers of gold in Africa. The

Senegal-Mali Fault Zone ("SMFZ") straddles the Farabantourou permit. Mines

associated with the SMFZ include Loulo (11.5 million ounce gold resource) and

Sadiola (9.2 million ounce gold resource). The Loulo-Est and Segala Ouest

permits are adjacent to the Segala/Tabakoto Mines (3.32 million ounce gold

resource) with gold mineralization extending from the Segala Mine onto the

Segala Ouest permit. All of these mines are open pit operations with underground

potential. The TransAfrika permits have potential to host similar deposits.

Since acquiring the permits, TransAfrika has conducted exploration work on these

permits including soil sampling, trenching, auger drilling, IP surveys, reverse

circulation ("RC") drilling and diamond drilling. On Loulo-Est, TransAfrika

drilled 60 RC holes and 12 diamond drill holes on soil anomalies for a total of

8,224 m. 29 of the holes intersected more than 1 g/t Au. Intersections include

values of up to 21 g/t Au over 1 m and intersection widths of up to 7 m at 1.95

g/t Au.

Between 2001 and 2003, 823 RC holes were drilled on Frabantourou for a total of

53,139 m. This drilling program was a follow-up on targets identified by

geochemical surveys, aeromagnetic surveys and artisanal workings. Gold

mineralization was discovered in six areas; Barani, Barani East, Keniegoulou,

Dambamba, Kousilli and Linnguekoto. Significant mineral intercepts include 4 m

at 9.31 g/t Au and 6m at 7.90 g/t Au at Barani East, 4 m at 5.90 g/t Au and 20 m

at 1.62g/t Au at Keniegoulou, 7 m at 2.04 g/t Au and 12 m at 1.88 g/t Au at

Dambamba and 4 m at 6.16g/t Au at Kousilli. Further TransAfrika drilling gave

values of 1.26 g/t over 18 m. Since 2008 TransAfrika spent a total of USD $5.4

million in exploration expenses in respect of its properties in Mali.

Senegal: TransAfrika through its subsidiary TAR Senegal SA has acquired the

Souroundou gold exploration permit with an area of 299.33 km2 in eastern Senegal

on the Faleme river on the border with Mali. The geological setting is similar

to that of the Malian permits. The permit is immediately north of and adjacent

to the exploration permit area held by Mineral Deposits Limited which operates

the Sabodala Mine. Exploration work carried out up until May 2010 included a

soil geochemical covering the south-western part of the permit (a total of 1,612

soil samples were collected), hard rock grab sampling of outcrops in areas of

anomalous soil values, and an IP survey over areas with anomalous gold in soil

values. To date TransAfrika has spent a total of USD $347,000 in exploration

expenses in respect of its properties in Senegal.

NI 43-101 technical reports have been completed for all projects in Rwanda, Mali

and Senegal and were prepared by Coffey Mining, an independent geological

consulting firm. The authors Mark McKinney, Janine Flemming and Kathleen Body

are Qualified Persons as defined by NI 43-101 for the purposes of this news

release. Copies of the technical reports will be available on SEDAR following

review and approval by the TSX-V.

About Desert Gold Ventures Inc.

Desert Gold Ventures Inc. is an advanced exploration and development company

which holds a 50% participating interest in a joint venture agreement with

Kinross Goldbanks Mining Company (a subsidiary of Kinross Gold Corporation) of

Toronto, Ontario in respect of the Goldbanks Mining property located in Pershing

County, Nevada, USA.

This news release does not constitute an offer to sell or a solicitation of an

offer to buy any of the securities in the United States. The securities have not

been and will not be registered under the United States Securities Act of 1933,

as amended (the "U.S. Securities Act") or any state securities laws and may not

be offered or sold within the United States or to U.S. Persons unless registered

under the U.S. Securities Act and applicable state securities laws or an

exemption from such registration is available. All dollars in this release are

in Canadian funds.

Completion of the transaction is subject to a number of conditions, including

exchange acceptance and disinterested shareholder approval. The transaction

cannot close until the required shareholder approval is obtained. There can be

no assurance that the transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in a Filing Statement to be

prepared in connection with the transaction, any information released or

received with respect to the Proposed Transaction may not be accurate or

complete and should not be relied upon. Trading in the securities of Desert Gold

should be considered highly speculative.

FORWARD-LOOKING STATEMENTS

This press release includes certain "forward-looking statements". All statements

regarding the ability of the Company to successfully complete the Proposed

Acquisition and the Financing, to successfully integrate the businesses of

Desert Gold and TransAfrika and to delineate new resources in proposed drilling

programs are forward-looking statements that involve various risks and

uncertainties. There can be no assurance that such statements will prove to be

accurate and actual results and future events could differ materially from those

anticipated in such statements. All statements that are not historical facts,

including without limitation statements regarding future estimates, plans,

objectives, assumptions or expectations of future performance, are "forward -

looking statements". We caution you that such "forward looking statements"

involve known and unknown risks and uncertainties that could cause actual

results and future events to differ materially from those anticipated in such

statements. Such risks and uncertainties include the inability of the Company to

close the Proposed Acquisition and the Financing due to the state of the capital

markets and other risk factors as discussed in the Company's filings with

Canadian securities regulatory agencies. The Company expressly disclaims any

obligation to update any forward - looking statements except as may be required

by law.

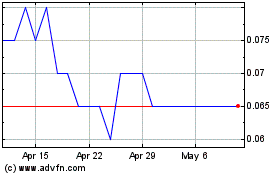

Common Shares (TSXV:DAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Common Shares (TSXV:DAU)

Historical Stock Chart

From Jul 2023 to Jul 2024