Crown Point Announces Results for the Three Months Ended March 31, 2014 and Provides Operational Update

May 28 2014 - 7:05PM

Marketwired Canada

Crown Point Energy Inc. ("Crown Point" or the "Company") (TSX VENTURE:CWV) today

announces its operating and financial results for the three months ended March

31, 2014. Copies of the Company's unaudited condensed interim consolidated

financial statements and related Management's Discussion and Analysis ("MD&A")

are being filed with Canadian securities regulatory authorities and will be made

available under the Company's profile at www.sedar.com and on the Company's

website at www.crownpointenergy.com. All dollar figures are expressed in United

States dollars unless otherwise stated.

FINANCIAL AND OPERATING HIGHLIGHTS

"During the first quarter Crown Point focused on advancing initiatives designed

to grow production and capture exploration upside from our core operating

regions," said Murray McCartney, CEO of Crown Point Energy. "In the near-term,

our core objectives include drilling additional wells in our 10-well development

and exploration drilling program at Tierra del Fuego and completing and testing

the La Hoyada x-1 exploration well at Cerro de Los Leones to assess its

potential as conventional Vaca Muerta discovery."

Highlights include:

-- Cerro de Los Leones: Drilled, logged and cased the La Hoyada x-1

exploration well as a potential conventional Vaca Muerta oil discovery.

Completion operations for the La Hoyada x-1 well commenced in late May.

-- Tierra del Fuego: Signed a drilling contract with San Antonio

International to provide a drilling rig for our initial 10 well drilling

program. Contract is extendable for three years. The first well drilled

LF-1008 has been cased as a potential natural gas well with 11 metres of

gross sand in the Springhill.

-- Argentina New Gas Incentive Program: On March 30, 2014, Crown Point

submitted to the Argentine Government its formal proposal for

participation in the New Gas Incentive Program for smaller companies

announced in November 2013.

-- Average Daily Sales Volumes: 1,571 BOEPD.

-- Operating Netback per BOE: $14.19.

Q1 FINANCIAL AND OPERATING RESULTS

Results for the three months ended March 31, 2014 include:

-- Average Daily Sales Volumes: 1,571 BOEPD for the three months ended

March 31, 2014, as compared to 1,994 BOEPD for the three months ended

March 31, 2013. This decrease was in part a result of the termination of

NGL exports in mid-May 2013 in connection with the Company's decision to

leave the majority of NGL production in the gas stream, the effect of

staged compressor maintenance and natural declines in oil and gas

production.

-- Operating Netback per BOE: $14.19 for the three months ended March 31,

2014, as compared to $15.53 for the three months ended March 31, 2013.

Total Company operating netbacks decreased in the 2014 period compared

to the 2013 period due mainly to a decrease in NGL and gas prices earned

in the 2014 period which were partially offset by lower royalties and

operating costs.

-- Funds Flow From Operations: $0.75 million for the three months ended

March 31, 2014, compared to $2.32 million for the three months ended

March 31, 2013. The Company did not receive any proceeds from the sale

of Petroleo Plus Credits in the 2014 period as compared to $1.2 million

received and recognized in the 2013 period.

Operating Netbacks - Total Company

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months ended

March 31

2014 2013

----------------------------------------------------------------------------

Total sales volumes (BOE) 141,430 179,461

Average daily sales volumes

(BOEPD) 1,571 1,994

Per BOE Per BOE

--------- ---------

Total oil and gas revenue ($) 4,443,425 31.42 6,384,168 35.57

Total royalties ($) (827,858) (5.85) (1,242,077) (6.92)

Total operating costs ($) (1,609,201) (11.38) (2,354,872) (13.13)

----------------------------------------------------------------------------

Total operating netback ($) 2,006,366 14.19 2,787,219 15.53

----------------------------------------------------------------------------

----------------------------------------------------------------------------

OPERATIONS

CERRO DE LOS LEONES, NEUQUEN BASIN, ARGENTINA

The Company's 100% interest in the Cerro de Los Leones exploration concession

covers approximately 306,646 acres in the Mendoza portion of the Neuquen Basin.

On February 12, 2014 the Company announced that it had drilled, logged, cased

and rig released the La Hoyada x-1 exploration well as a potential Vaca Muerta

oil discovery. The La Hoyada x-1 well was drilled to a total depth of 1,953

metres and encountered persistent oil shows and gas while drilling through the

Vaca Muerta formation which consisted of 125 metres of shale and 84 metres of

imbedded fractured igneous intrusives. Completion operations on the La Hoyada

well commenced in late May. If the well is successfully completed it will be

placed on a production test with the potential for further drilling at Cerro de

Los Leones later in 2014.

TIERRA DEL FUEGO, ARGENTINA

The Company's 25.78% working interest in the Tierra del Fuego area of Argentina

covers approximately 489,000 acres (126,000 net acres) in the Austral Basin and

includes the Las Violetas, Angostura Sur and Rio Cullen exploitation

concessions. The primary term of all three concessions expires in November 2026.

Crown Point's Tierra del Fuego Concessions are high quality natural gas weighted

assets possessing the capability to deliver increased levels of production and

reserves in an expected increasing natural gas price market.

Drilling of the first well of the initial ten well program commenced on May 8,

2014. The well has been drilled to total depth and has been cased as a potential

gas well. The well encountered approximately 11 metres of sand in the Springhill

formation. Drilling of the second well LF-1027 is expected to commence in a few

days.

Commencing late in June, a fracture stimulation program will be performed on

four producing wells in the Los Flamencos natural gas pool. A similar program

undertaken in 2010 significantly improved deliverability from five wells in the

Los Flamencos pool.

Outlook:

The Company's efforts over the next few quarters will be focused principally on

two areas in Argentina: Tierra del Fuego for lower risk natural gas focused

repeatable drilling and Cerro de Los Leones for completion and testing of the La

Hoyada X-1 exploration well, the first in a potential high impact oil

exploration program in the Neuquen basin.

Management expects that production additions from the drilling and fracture

stimulation program will commence in July and, as a result, management expects

to see rising production volumes and field sales receipts through to the end of

the year. Financially, this is expected to have a positive impact on the

Company's income statement as spot market natural gas prices continue to rise in

Argentina. The balance of the 10 well program on the Las Violetas Exploitation

Concession will consist of seven more development wells in the Los Flamencos gas

pool and two exploration wells, one on the Puesto Quince prospect and another

near the southern San Luis natural gas pool. All of the drilling locations have

been fully imaged with 3-D seismic. The Puesto Quince prospect lies to the

northeast of the Los Flamencos and Los Patos producing pools and is adjacent to

the Rio Chico gas pool. The feature has a seismically mapped aerial extent of

approximately 50 km2. The San Luis exploration prospect has been defined with

3-D seismic and is located on a separate fault block near the San Luis gas pool.

At Cerro de Los Leones the Company has commenced completion operations on the La

Hoyada x-1 well. If the completion operations are successful, the Company plans

to place the well on a production test with the potential for further drilling

at Cerro de Los Leones in late 2014.

Oil price realizations in Argentina were temporarily impacted by the peso

devaluation and economic conditions during the first quarter of 2014. In May,

oil prices were negotiated to be greater than the price received prior to the

peso devaluation of early 2014, or approximately $9 per barrel greater than the

price realized in the first quarter. The Company believes market conditions will

continue to have a positive impact on oil and natural gas prices as there is not

sufficient hydrocarbon production in Argentina to meet the demand for energy

consumption in the country. The Company also expects to realize benefits from

the Gas Plan II natural gas subsidy program that has been applied for by Crown

Point. This new hydrocarbon subsidy program provides an incentive for producers

to effectively earn higher gas prices for increases in natural gas production

above base production levels.

About Crown Point

Crown Point Energy Inc. is an international oil and gas exploration and

development company headquartered in Calgary, Canada, incorporated in Canada,

trading on the TSX Venture Exchange and operating in South America. Crown

Point's exploration and development activities are focused in the Golfo San

Jorge, Neuquen and Austral basins in Argentina. Crown Point has a strategy that

focuses on establishing a portfolio of producing properties, plus production

enhancement and exploration opportunities to provide a basis for future growth.

Advisory

Certain Oil and Gas Disclosures: Barrels of oil equivalent (BOE) may be

misleading, particularly if used in isolation. A boe conversion ratio of six

thousand cubic feet (6 Mcf) to one barrel (1 bbl) is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. In addition, given that the

value ratio based on the current price of crude oil in Argentina as compared to

the current price of natural gas in Argentina is significantly different from

the energy equivalency of 6:1, utilizing a conversion on a 6:1 basis may be

misleading as an indication of value. "BOEPD" means barrels of oil equivalent

per day. "Mcf" means thousand cubic feet. "Mbbls" means thousands of barrels.

Non-IFRS Measures: This press release discloses "funds flow from operations" and

"operating netbacks", which do not have standardized meanings under

International Financial Reporting Standards ("IFRS") and as such may not be

comparable with the calculation of similar measures used by other entities.

Funds flow from operations should not be considered an alternative to or more

meaningful than, cash flow from operating activities as determined in accordance

with IFRS as an indicator of the Company's performance. Management uses funds

flow from operations to analyze operating performance and considers funds flow

from operations to be a key measure as it demonstrates the Company's ability to

generate cash necessary to fund future capital investment. A reconciliation of

funds flow from operations to cash flow from operating activities is presented

in the MD&A under "Non-IFRS Measures". Operating netbacks are calculated on a

per unit basis as oil, natural gas and natural gas liquids revenues less

royalties, transportation and operating costs. Management believes this measure

is a useful supplemental measures of the Company's profitability relative to

commodity prices. See "Operating Netbacks - Total Company".

Forward looking information: Certain information set forth in this document,

including: our belief that the La Hoyada x-1 well is a potential Vaca Muerta oil

discovery; our intention to perform a fracture stimulation program on four

producing wells in the Los Flamencos natural gas pool and the timing thereof and

our expectations for the results thereof; the ability of our first quarter

initiatives to grow production and capture exploration upside from our core

operating regions; our core objectives to drill additional wells in our 10-well

development and exploration drilling program at Tierra del Fuego ("TDF") and

complete and test the La Hoyada x-1 exploration well at Cerro de Los Leones to

assess its potential as a conventional Vaca Muerta discovery; our belief that

the LF-1008 well is a potential natural gas well and our expectations regarding

when completion operations will commence; our belief that our interests in the

TDF area possess the capability of delivering increased levels of production and

reserves in an expected increasing natural gas price market; our expectation

that a second well will commence drilling at TDF in a few days; our expectation

that if the La Hoyada x-1 well is successfully completed it will be placed on a

production test with the potential for further drilling at Cerro de Los Leones

later in 2014; our intention to focus our efforts over the next few quarters

principally on TDF for lower risk natural gas focused repeatable drilling and

Cerro de Los Leones for completion and testing of the La Hoyada x-1 exploration

well, the first in a potential high impact oil exploration program in the basin;

the details of our initial 10 well drilling program on the Las Violetas

Exploitation Concession at TDF, including the type and general location of wells

to be drilled; our expectation that production additions from the drilling and

fracture stimulation program at TDF will commence in July, that we will see

rising production volumes and field sales receipts through to the end of the

year, and that this will have a positive impact on our income statement as spot

market natural gas prices continue to rise in Argentina; our belief that if we

access the New Gas Subsidy Program it could further increase pricing received;

and our belief that market conditions will continue to have a positive impact on

oil and natural gas prices; is considered forward-looking information, and

necessarily involve risks and uncertainties, certain of which are beyond Crown

Point's control.

Such risks include but are not limited to: risks associated with oil and gas

exploration, development, exploitation, production, marketing and

transportation; risks associated with operating in Argentina, including risks of

changing government regulations (including the adoption of, amendments to, or

the cancellation of government incentive programs or other laws and regulations

relating to commodity prices, taxation, currency controls and export

restrictions, in each case that may adversely impact Crown Point),

expropriation/nationalization of assets, price controls on commodity prices,

inability to enforce contracts in certain circumstances, the potential for a

sovereign debt default or a hyperinflationary economic environment, and other

economic and political risks; loss of markets and other economic and industry

conditions; volatility of commodity prices; currency fluctuations; imprecision

of reserve estimates; environmental risks; competition from other producers;

inability to retain drilling services; incorrect assessment of value of

acquisitions and failure to realize the benefits therefrom; delays resulting

from or inability to obtain required regulatory approvals; the lack of

availability of qualified personnel or management; stock market volatility and

ability to access sufficient capital from internal and external sources; and

economic or industry condition changes.

Actual results, performance or achievements could differ materially from those

expressed in, or implied by, the forward-looking information and, accordingly,

no assurance can be given that any events anticipated by the forward-looking

information will transpire or occur, or if any of them do so, what benefits that

Crown Point will derive therefrom. With respect to forward-looking information

contained herein, the Company has made assumptions regarding: the impact of

increasing competition; the general stability of the economic and political

environment in Argentina; the timely receipt of any required regulatory

approvals; the ability of the Company to obtain qualified staff, equipment and

services in a timely and cost efficient manner; drilling results; the costs of

obtaining equipment and personnel to complete the Company's capital expenditure

program; the ability of the operator of the projects which the Company has an

interest in to operate the field in a safe, efficient and effective manner; the

ability of the Company to obtain financing on acceptable terms when and if

needed; field production rates and decline rates; the ability to replace and

expand oil and natural gas reserves through acquisition, development and

exploration activities; the timing and costs of pipeline, storage and facility

construction and expansion and the ability of the Company to secure adequate

product transportation; future oil and natural gas prices; currency, exchange

and interest rates; the regulatory framework regarding royalties, commodity

price controls, import/export matters, taxes and environmental matters in

Argentina; and the ability of the Company to successfully market its oil and

natural gas products. Additional information on these and other factors that

could affect Crown Point are included in reports on file with Canadian

securities regulatory authorities, including under the heading "Risk Factors" in

the Company's annual information form, and may be accessed through the SEDAR

website (www.sedar.com). Furthermore, the forward-looking information contained

in this document are made as of the date of this document, and Crown Point does

not undertake any obligation to update publicly or to revise any of the included

forward looking information, whether as a result of new information, future

events or otherwise, except as may be expressly required by applicable

securities law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this news release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Crown Point Energy Inc.

Murray McCartney

President & CEO

(403) 232-1150

mmccartney@crownpointenergy.com

Crown Point Energy Inc.

Arthur J.G. Madden

Vice-President & CFO

(403) 232-1150

amadden@crownpointenergy.com

Crown Point Energy Inc.

Brian J. Moss

Executive Vice-President & COO

(403) 232-1150

(403) 232-1158 (FAX)

bmoss@crownpointenergy.com

www.crownpointenergy.com

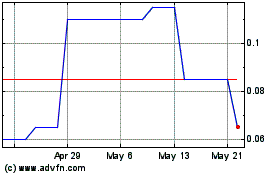

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Jun 2024 to Jul 2024

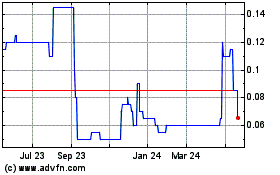

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Jul 2023 to Jul 2024