Astur Gold Expands Salave Concessions by Over 600%

August 15 2011 - 7:46AM

Marketwired Canada

Astur Gold Corp. (TSX VENTURE:AST)(FRANKFURT:CDC) ("Astur Gold" or the

"Company") announces success in securing additional concessions totaling 2765

contiguous hectares surrounding its Salave deposit. The Exploration Permit

granted by the General Directorate of Mines and Energy of the Principality of

Asturias allows Astur Gold to explore for additional gold resources in the area

surrounding the Salave deposit. The Company has committed to invest at least

EUR570,000 over the next 3 years to maintain the property in good standing. This

increases the total mineral rights area owned by the Company in Asturias to 3198

hectares and includes the area under consideration for operations and processing

of the planned mine.

Cary Pinkowski, CEO & Director, commented, "We are pleased to have obtained

these concessions surrounding Salave. It substantially expands our project area

and includes the land we are evaluating for the processing plant and tailings

area. This is a significant step toward increasing activities related to mine

development and possible expansion of the resource. We are fulfilling our

commitment to our supporters in Asturias awaiting jobs and economic growth

resulting from the success this project."

There is excellent exploration potential at Salave, with four of the principal

high grade zones of mineralization open at depth. Additional exploration areas

to the west have also yet to be tested. Previous metallurgical tests indicate

gold recoveries in the order of 90% are possible. The region boasts excellent

infrastructure and a history of mining that will help support future mine

development. Astur Gold is advancing Salave towards production and cultivating

an enduring partnership with the people of Asturias in developing economic

prosperity for the region.

ABOUT ASTUR GOLD

The Company is developing its 100% owned Salave Gold Project in northern Spain.

Salave is one of the largest undeveloped gold deposits in western Europe,

containing a NI 43-101 compliant mineral resource estimate of 1,683,000 oz Au in

the Measured & Indicated category (2,155,000 tonnes grading 3.88 g/t Au Measured

and 15,790,000 tonnes grading 2.79 g/t Au Indicated) with an additional 338,000

oz Au in the Inferred category (3,770,000 tonnes grading 2.8 g/t Au). The

mineral resource was estimated by Scott Wilson RPA in the NI 43-101 report,

"Technical Report on Salave Gold Deposit, Spain", dated March 5, 2010 available

on SEDAR.

Salave is also subject to a Preliminary Economic Assessment ("PEA") by Golder

Associates titled, "Preliminary Economic Assessment on the Salave Gold Project,

Asturias Region, Spain", dated February 12, 2011 available on SEDAR. The PEA

investigates three mining methods and two processing options using a base case

gold price of US$1,100 per ounce and throughput rate of 1.1 million tonnes per

year. It shows NPV ranging from US$374 Million to US$576 Million using a 5%

discount rate; IRR ranging from 34% to 54%; and pre-production capital

expenditure payback period ranging from 2.0 to 3.1 years.

ON BEHALF OF THE BOARD

Cary Pinkowski, Chief Executive Officer and Director

Mineral resources that are not mineral reserves do not have demonstrated

economic viability. This document contains certain forward looking statements

which involve known and unknown risks, delays and uncertainties not under the

Company's control which may cause actual results, performance or achievements of

the Company to be materially different from the results, performance or

expectation implied by these forward looking statements.

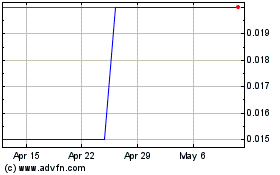

Astron Connect (TSXV:AST)

Historical Stock Chart

From Jun 2024 to Jul 2024

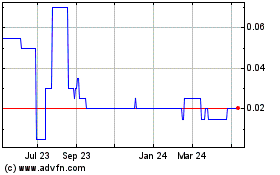

Astron Connect (TSXV:AST)

Historical Stock Chart

From Jul 2023 to Jul 2024