AuRo Resources Amends LOI with Minerales Del Puerto

April 20 2011 - 11:46AM

Marketwired Canada

AuRo Resources Corp. (TSX VENTURE:ARU) (the "Company") reports that it has

amended the letter of intent (the "LOI") with Minerales Del Puerto

("Minerales"), previously announced on March 21, 2011. The Company will now

solely acquire a 90% interest in the Argentina Mine, within the municipality of

Puerto Berrio, Colombia. The Argentina Mine is contiguous to the Company's

flagship "El Tesoro" Project. This property resides within an elevation of less

than 1,000 meters, and is therefore unaffected by Law 1382 of 2010, restricting

mining above 3,200 meters. It is also proximal to a major highway, the Autopista

62, and necessary infrastructure.

Pursuant to the amended LOI, the Company has agreed to pay Minerales an

aggregate amount not to exceed $500,000 over 2 years and issue common shares in

the capital of the Company, such shares not to exceed 1.5 million common shares.

The final terms of the acquisition will be contained in the definitive agreement

to be entered into by the Company and Minerales, subject to final, and ongoing

legal and technical due diligence.

FOR THE PURPOSE OF PROVIDING INFORMATION RELATING TO THE MINE, THE COMPANY IS

RELYING ON INFORMATION PROVIDED TO IT BY MINERALES. SUCH INFORMATION WAS DERIVED

FROM HISTORICAL GEOLOGICAL INFORMATION AND DOES NOT PRESENTLY CONFORM TO THE

STANDARDS AS OUTLINED IN NATIONAL INSTRUMENT 43-101.

The Argentina Mine, which has historically produced small quantities of gold, is

contiguous to the southeast section of the Company's flagship "El Tesoro"

project, and is dually proximal to the Palestina and Nus fault. Recent grab

samples taken and analyzed by SGS Medellin S.A. have returned results including

110.0 g/t Au and 240.0 g/t Au.

AuRo Resources Corp. is also pleased to announce that it has retained Trident

Financial Corp. ("Trident") as its investor relations and corporate

communications service provider. Trident has been retained for an initial period

of six months at $7,500 (plus HST) per month as remuneration and will be

reimbursed for all approved expenses. The Company will grant Trident stock

options to acquire 250,000 shares in the capital of the Company at an exercise

price of $0.18. The options are granted pursuant to the Company's Stock Option

Plan and will vest in accordance with the provisions therein and the policies of

the TSX Venture Exchange.

Trident is a Vancouver-based company headed by Mr. Robert Riley, a former

investment advisor with 17 years of experience in the venture capital markets

and will be responsible for designing and implementing a comprehensive marketing

and shareholder communications plan.

The content of this news release has been reviewed by Mr. Ken Thorsen, P. Eng.,

who serves as the Qualified Person in accordance with National Instrument

43-101.

ON BEHALF OF THE BOARD

Mark Lawson, President & CEO

Cautionary Note Regarding Forward-looking Statements

Certain statements contained in this news release may constitute forward-looking

information, within the meaning of Canadian securities laws. Forward-looking

information may relate to this news release and other matters identified in the

Company's public filings, Forward-looking information and anticipated events or

results and can be identified by terminology such as "may", "will", "could",

"should", "expect", "plan", "anticipate", "believe", "intend", "estimate",

"projects", "predict", "potential", "continue" or other similar expressions

concerning matters that are not historical facts and include, but are not

limited in any manner to, those with respect to capital and operating

expenditures, economic conditions, availability of sufficient financing, receipt

of approvals, satisfaction of closing conditions and any and all other timing,

development, operational, financial, economic, legal, regulatory and/or

political factors that may influence future events or conditions. Such

forward-looking statements are based on a number of material factors and

assumptions, including, but not limited in any manner, those disclosed in any

other public filings of the Company, and include the ultimate availability and

final receipt of required approvals, sufficient working capital for development

and operations, access to adequate services and supplies, availability of

markets for products, commodity prices, foreign currency exchange rates,

interest rates, access to capital markets and other sources of financing and

associated cost of funds, availability of a qualified work force, availability

of manufacturing equipment, no material changes to the tax and regulatory regime

and the ultimate ability execute its business plan on economically favorable

terms. While we consider these assumptions to be reasonable based on information

currently available to us, they may prove to be incorrect. Actual results may

vary from such forward-looking information for a variety of reasons, including

but not limited to risks and uncertainties disclosed in other Company filings at

www.sedar.com and other unforeseen events or circumstances. Other than as

required by law, the Company does not intend, or undertake any obligation to

update any forward looking information to reflect, among other things, new

information or future events.

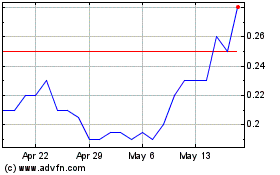

Aurania Resources (TSXV:ARU)

Historical Stock Chart

From Sep 2024 to Oct 2024

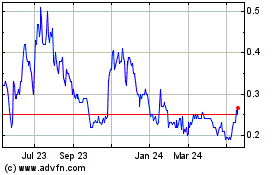

Aurania Resources (TSXV:ARU)

Historical Stock Chart

From Oct 2023 to Oct 2024