Aben Minerals Amends Terms of Private Placement

April 18 2023 - 9:30AM

Aben

Minerals Ltd.

(TSX-V: ABM) (OTCQB: ABNAF)

(Frankfurt: R26)

(“Aben” or “the Company”) announces that it has amended the terms

of the non-brokered private placement, as announced on April 4,

2023 (the “Placement”).

The Company has reduced the price of the units

issuable under the Placement (the “Units”) from $0.12 per Unit to

$0.10 per Unit. The Company shall issue up to 5,000,000 Units of

the Company for gross proceeds of up to CAD $500,000.

Each Unit will now be comprised of one common

share and one transferable warrant, entitling the holder to

purchase one additional common share for a period of four (4) years

at a price of CAD $0.15 per share.

The Company intends to use the proceeds from

this private placement towards exploration expenditures and general

working capital purposes. The private placement is subject to TSX

Venture Exchange approval, and all securities are subject to a

four-month-and-one-day hold period. Finder’s fees may be payable in

connection with the private placement, all in accordance with the

policies of the TSX Venture Exchange.

About Aben

Minerals

Projects:

Justin Gold Project

The 7,400-hectare Justin Gold property is 100%

owned by Aben Minerals Ltd and has had 27 diamond and 20 Rotary Air

Blast (RAB) drill holes completed since 2011. Drilling has shown

that precious metal mineralization at Justin is part of an

Intrusion Related Gold System (IRGS) featuring multiple

mineralization styles including sheeted vein arrays, vein breccias,

stockwork veining, fault-controlled mineralization and skarn-hosted

gold horizons. Drilling in 2011 and 2012 at the POW Zone

successfully discovered intrusion-related gold mineralization with

intercepts reported ranging from trace values to highs of

1.19 g/t Au over 60.0m (including 2.47 g/t Au over 21.0m)

and 1.49 g/t Au over 46.4m. Additionally, in 2018, trenching

at the Lost Ace Zone returned values ranging from trace to

20.8 g/t gold over 4.4m including 88.2 g/t gold (Au) over

1.0m.

The Justin Project is located in the

southeastern portion of the prolific Tombstone Gold Belt, part of

the Tintina Gold Province, host to world class Reduced Intrusion

Related Gold deposits and recent gold discovery by Snowline Gold

Corp. The Company will be using some proceeds of the financing to

apply for a new multi year exploration permit to allow for further

exploration of the Justin Project.

Forrest Kerr Gold Project

The Forrest Kerr property is 100% owned by Aben

Minerals Ltd and consists of 56 contiguous mineral claims covering

23,397 hectares in the center of the Golden Triangle of British

Columbia, an area that hosts significant Au-Cu±Mo porphyry

deposits, intrusion-related Au±Ag vein deposits and high-grade

Au-Ag volcanogenic massive sulphide deposits. Forrest Kerr boasts a

database comprised of 190 drill holes, 2,500 rock and 20,000 soil

and silt samples. Highlight drill results include hole FK18-10

which intersected multiple high grade gold horizons including

38.7 g/t Au over 10.0m, 3.9 g/t Au over 13.0m,

22.0 g/t Au over 4.0m, and 8.2 g/t Au over

14.0m.

The property hosts 40 polymetallic mineral

occurrences with mineralization styles ranging from discrete

intrusion related Au + Cu +/- Ag veins to breccia, shear and

stockwork zones in addition to areas with massive sulfide

potential. The Company has a MX Permit for exploration in good

standing and will entertain third party involvement to move the

project forward.

Pringle North Property Gold Project

Aben Minerals Ltd has an option to acquire a

100% interest in the Pringle North Gold Property in Red Lad

Ontario. The Pringle North Property straddles the interpreted

northern extension of the deep-seated geologic structures that host

several gold deposits within the Red Lake Gold Camp, located

approximately 55 km to the south. The property consists of 5

contiguous mining claims covering approximately 1,881 hectares and

is host to multiple surface samples that tested at or above the

95th percentile in an overburden sampling program conducted by

Agnico Eagle in 2009. Pringle North hosts a substantial belt of

mafic to ultramafic rocks that parallel the Nungesser Deformation

Zond (NDZ) and a full spectrum of structural controls that may

provide fluid pathways and traps for economic gold

mineralization.

Slocan Graphite Project

Aben Minerals Ltd has an option to acquire a

100% interest in the road accessible 2,868-hectare Slocan Graphite

Property consists of 13 contiguous mineral claims and hosts several

large flake graphite-bearing outcrops (high values of 3.36 and 4.43

% organic Carbon) at the Tedesco Zone, which is coincident with a

strong conductive anomaly identified in 2010 that is interpreted to

extend up to 2.0km from the known surficial occurrences. The Slocan

Graphite Project benefits from excellent infrastructure including a

high-voltage transmission line within 1.2 km of the property

boundaries, an extensive network of forestry roads on and around

the property, and an existing graphite processing plant and

facilities located 1.5 km west of the property.

Aben

Minerals:

Aben Minerals is a diversified Canadian gold and

graphite exploration company with exploration projects in British

Columbia, Ontario, and the Yukon Territory. Cornell McDowell,

P.Geo., V.P. of Exploration for Aben Resources, has reviewed and

approved the technical aspects of this news release and is the

Qualified Person as defined by National Instrument 43-101.

For further information on Aben Minerals Ltd. (TSX-V: ABM),

visit our Company’s web site at www.abenminerals.com.

ABEN MINERALS LTD.

“Jim Pettit”______________________JAMES G.

PETTITPresident & CEO

For further information contact:Aben Minerals Ltd.Riley Trimble,

Corporate CommunicationsTelephone: 604-416-2978Toll Free:

800-567-8181Facsimile: 604-687-3119Email: info@abenminerals.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

This release includes certain statements that

may be deemed to be "forward-looking statements". All statements in

this release, other than statements of historical facts, that

address events or developments that management of the Company

expects, are forward-looking statements. Although management

believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, and actual results or

developments may differ materially from those in the

forward-looking statements. The Company undertakes no obligation to

update these forward-looking statements if management's beliefs,

estimates or opinions, or other factors, should change. Factors

that could cause actual results to differ materially from those in

forward-looking statements, include market prices, exploration and

development successes, continued availability of capital and

financing, and general economic, market or business conditions.

Please see the public filings of the Company at www.sedar.com for

further information.

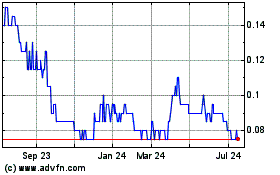

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Nov 2024 to Dec 2024

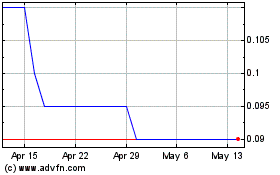

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Dec 2023 to Dec 2024