Athabasca Minerals Subsidiary – Aggregates Marketing Inc $1,500,000 Contract

April 30 2019 - 7:01AM

Athabasca Minerals Inc. (“AMI” or the “Corporation”) (TSX Venture:

ABM) announces that its wholly-owned subsidiary Aggregates

Marketing Inc. (“Aggregates Marketing”) has secured a Cdn

$1,500,000 order to supply aggregates for a major industrial

operator located in the Regional Municipality of Wood Buffalo in

northern Alberta.

Aggregates Marketing Inc.

(www.aggregatesmarketing.com) is an emerging technology-enabled

company developed in 2018 by the Corporation, focused on achieving

enhanced price/delivery solutions in mapping customer requirements

(orders) to aggregates suppliers and transportation companies with

greater speed and efficiency.

Chief Executive Officer, Robert Beekhuizen,

states: “In today’s economy, the goal of Aggregates Marketing is to

leverage technology and keep pace with progressive trends in

e-commerce to creatively disrupt a widely pervasive bulk

construction materials market with improved connectivity, supplier

utilization, and pricing. Aggregates Marketing’s growing database,

and iterative, algorithmic approach is increasing optionality and

deriving further value enhancements that can be passed on to

customers. We are very excited about the future growth potential of

this division within the Corporation’s portfolio, and the

geographic extent to which Aggregates Marketing can cater, both

nationally and internationally, as this midstream business

expands.”

About Athabasca Minerals

The Corporation is an integrated group of

aggregates companies involved in resource development, aggregates

marketing and midstream supply-logistics solutions. Business

activities include aggregate production, pit management services,

sales from corporate-owned and third-party pits, acquisitions of

sand and gravel operations, and new venture development. Athabasca

Minerals is the parent company of Aggregates Marketing Inc. – a

midstream business providing integrated supply and transportation

solutions for industrial and construction markets. It is also the

parent company of AMI Silica Inc. – a subsidiary positioning to

become a leading supplier of premium domestic in-basin frac sand

with regional deposits in Alberta and NE British Columbia. It is

the joint venture owner of the Montney In-Basin and Duvernay Basin

Frac Sand Projects. Additionally, the Corporation has industrial

mineral leases, such as those supporting the Richardson Quarry

Project, that are strategically positioned for future development

in industrial regions of high potential aggregates demand.

For further Information on

Athabasca, please contact:

Dean StuartT: 403-617-7609E:

dean@boardmarker.net

Robert BeekhuizenT: 780-465-5696

Neither the TSX Venture Exchange

nor its Regulation Services Provider (as that term is defined in

the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

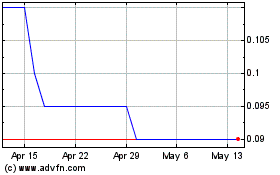

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Nov 2024 to Dec 2024

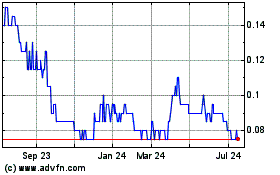

Aben Minerals (TSXV:ABM)

Historical Stock Chart

From Dec 2023 to Dec 2024