VIQ Solutions Inc. (“VIQ” or the “Company”)

(TSX:VQS and OTCQX:VQSLF), a global provider of secure, AI-driven,

digital voice and video capture technology and transcription

services, today announced the launch of a proposed public offering

(the “Offering”) of common shares (“Common Shares”)

in the United States and Canada for an amount to be determined in

the market.

Trading of the Common Shares on the Nasdaq Capital Market

(“Nasdaq”) is expected to commence under the ticker symbol

“VQS” on the trading day immediately following the pricing of the

Common Shares under the Offering.

The Company intends to use the net proceeds of the Offering

primarily to fund continued development of its product and service

offerings, to fund potential future acquisitions and for general

corporate purposes.

The Offering will be conducted through a syndicate of

underwriters co-led by JMP Securities LLC and Needham &

Company, LLC as joint lead bookrunning managers (the “Lead

Underwriters”) and certain other underwriters to be added to

the syndicate (collectively with the Lead Underwriters, the

“Underwriters”). The Offering will be priced in the context

of the market. The issue price per Common Share and size of the

Offering will be confirmed at a later date commensurate with the

Company entering into an underwriting agreement with the

Underwriters in respect of the Offering (the “Underwriting

Agreement”) and reflected in a final prospectus supplement.

VIQ will also grant the Underwriters an option (the

“Over-Allotment Option”) to purchase additional Common

Shares representing in the aggregate up to 15% of the number of

Common Shares to be sold pursuant to the Offering, solely to cover

the Underwriters’ over-allocation position, if any, and for market

stabilization purposes. The Over-Allotment Option will be

exercisable by the Underwriters for a period of 30 days following

the closing of the Offering.

In connection with the Offering, the Company has filed a

preliminary prospectus supplement dated August 9, 2021 to its final

short form base shelf prospectus dated June 10, 2021 with the

securities commissions or similar regulatory authorities in each of

the provinces of Canada, except Québec. The preliminary prospectus

supplement was also filed with the U.S. Securities and Exchange

Commission as part of the Company’s registration statement on Form

F-10 in accordance with the multi-jurisdictional disclosure system

(MJDS) established between Canada and the United States.

The issuance of the Common Shares pursuant to the Offering is

subject to market and other conditions, and to customary approvals

of applicable securities regulatory authorities, including the

Toronto Stock Exchange and the Nasdaq Stock Market. There can be no

assurance as to whether or when the Offering may be completed, or

as to the actual size or terms of the Offering.

The Offering is expected to be made to the public in each of the

provinces of Canada, other than Québec, and in the United States by

means of a short form base shelf prospectus and related prospectus

supplement to be filed with applicable Canadian securities

regulatory authorities and which will form part of the Company’s

effective registration statement on Form F-10 filed with the

Securities and Exchange Commission (the “SEC”). The short

form base shelf prospectus and the related prospectus supplement

contain important information about the Common Shares. Investors

should read the short form base shelf prospectus and the related

prospectus supplement before making an investment decision.

A preliminary prospectus supplement related to the Offering has

been filed with the SEC and applicable Canadian securities

regulatory authorities and is available on the SEC’s website at

http://www.sec.gov and on SEDAR at www.sedar.com. Copies of the

Company’s base shelf prospectus and the preliminary prospectus

supplement relating to the Offering may be obtained by contacting

JMP Securities LLC, Attn: Prospectus Department, 600

Montgomery Street, Suite 1100, San Francisco, California 94111, or

via telephone: 415-835-8985 or via email at:

syndicate@jmpsecurities.com, or by contacting Needham &

Company, LLC, Attn: Prospectus Department 250 Park Avenue, 10th

Floor, New York, NY 10177, or via telephone: 800-903-3268, or via

email at prospectus@needhamco.com.

No securities regulatory authority has either approved or

disapproved the contents of this news release. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy, nor shall there be any sale of these securities in

any province, state, or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such province,

state, or jurisdiction.

VIQ is represented by McMillan LLP in Canada and Troutman Pepper

Hamilton Sanders LLP in the United States. The Underwriters are

represented by Stikeman Elliott LLP in Canada and Mintz, Levin,

Cohn, Ferris, Glovsky and Popeo, P.C. in the United States.

For more information about VIQ, please visit

viqsolutions.com.

About VIQ Solutions Inc.

VIQ Solutions is a provider of secure, AI-driven, digital voice

and video capture technology and transcription services in the

criminal justice, legal, insurance, government, corporate finance,

media, and transcription service provider markets.

Forward-looking Statements

Certain statements included in this news release constitute

forward-looking statements or forward-looking information under

applicable securities legislation. Such forward-looking statements

or information are provided for the purpose of providing

information about management's current expectations and plans

relating to the future. Readers are cautioned that reliance on such

information may not be appropriate for other purposes.

Forward-looking statements or information typically contain

statements with words such as "anticipate", "believe", "expect",

"plan", "intend", "estimate", "propose", "project" or similar words

suggesting future outcomes or statements regarding an outlook.

Forward-looking statements or information in this news release

include, but are not limited to, the anticipated timing of listing

of the Common Shares on the Nasdaq, confirmation of the size and

price of the Offering, the receipt of required regulatory

approvals, VIQ and the Underwriters entering into the Underwriting

Agreement, the completion of the Offering, VIQ’s intended use of

the net proceeds of the Offering and the potential exercise by the

Underwriters of the Over-Allotment Option.

Forward-looking statements or information is based on several

factors and assumptions which have been used to develop such

statements and information, but which may prove to be incorrect.

Although VIQ believes that the expectations reflected in such

forward-looking statements or information are reasonable, undue

reliance should not be placed on such forward-looking statements,

as VIQ can give no assurance that such expectations will prove to

be correct. In addition to other factors and assumptions which may

be identified in this news release, assumptions have been made

regarding, among other things, VIQ’s ability to obtain all

necessary regulatory and stock exchange approvals for the Offering,

VIQ’s ability to identify and acquire suitable acquisition targets,

the accuracy of VIQ’s expectations with respect to industry and

market trends and global economic conditions including the

continuing effects of COVID-19. Readers are cautioned that the

foregoing list is not exhaustive of all factors and assumptions

that have been used.

Forward-looking statements or information is based on current

expectations, estimates and projections that involve several risks

and uncertainties which could cause actual results to differ

materially from those anticipated by VIQ and described in the

forward-looking statements or information, including, without

limitation, the risks and uncertainties associated with general

economic conditions; the potential offering of any securities by

the Company; uncertainty with respect to the completion of any

future offering; the ability to obtain applicable regulatory and

stock exchange approvals for any contemplated offerings; the

ability of the Company to negotiate and complete future funding

transactions; adverse industry events; future legislative, tax and

regulatory developments; the ability of the Company to meet the

requirements to list its Common Shares on the Nasdaq; and the risks

described under the heading “Risk Factors” in VIQ’s Annual

Information Form for the year ended December 31, 2020, filed with

the Canadian securities regulatory authorities under VIQ’s SEDAR

profile at www.sedar.com and filed with the SEC as an exhibit to

the registration statement.

These risks and uncertainties may cause actual results to differ

materially from the forward-looking statements or information.

Readers are cautioned that the foregoing list is not exhaustive of

all possible risks and uncertainties. The forward-looking

statements contained in this news release are made as of the date

of this news release and, except as required by applicable law, VIQ

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210809005833/en/

Media: Laura Haggard Chief Marketing Officer VIQ

Solutions Phone: (800) 263-9947 Email:

marketing@viqsolutions.com

Investor Relations: Laura Kiernan High Touch Investor

Relations Phone: 1-914-598-7733 Email: viq@htir.net

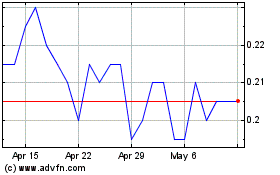

VIQ Solutions (TSX:VQS)

Historical Stock Chart

From Oct 2024 to Nov 2024

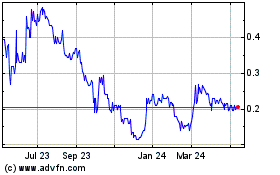

VIQ Solutions (TSX:VQS)

Historical Stock Chart

From Nov 2023 to Nov 2024