1 Palliser Square Announces Private Placement of Trust Units

July 10 2024 - 12:05PM

Timbercreek Alternatives LP, a subsidiary of Timbercreek Capital

(“Timbercreek Alternatives” or the “Manager”) and Aspen Properties

(“Aspen”) are pleased to announce they have entered into a joint

venture to form 1 Palliser Square LP (the “LP”), which intends to

complete a private placement offering of up to 3,000,000 Series A

units (“Series A Units”), Series C units (“Series C Units”) and

Series F units (“Series F Units”, and together with Series A Units

and Series C Units, “Units”) at an initial offering price of $10.00

per Unit.

The LP intends to use net proceeds for the

purchase of the Palliser One Office building for the purpose of

converting approximately 418,000 SF of office into approximately

420 residential units and amenities. The Palliser One Office

building is located next to the Calgary Tower in downtown, Calgary,

Alberta.

The Trust has engaged Raymond James Ltd. and

Canaccord Genuity Corp. (the “Lead Agents”) as co-lead agents and

joint bookrunners on behalf of a syndicate of agents, which

includes, iA Private Wealth Inc., Richardson Wealth Limited and

Wellington-Altus Financial Inc. (collectively, the “Agents”) to

offer for sale on a private placement basis up to a maximum of

$30,000,000 of Series A Units and/or Series F Units at a price of

$10.00 per Unit (the “Syndicated Offering”). Subscribers are

required to purchase a minimum of 1,000 Series A Units, a minimum

of 100,000 Series C Units or a minimum of 1,000 Series F Units, in

the discretion of the Manager. No Series C Units will be sold

through the Syndicated Offering.

It is expected that the closing date will be on

or about September 10, 2024, or such other dates as the Manager and

the Lead Agents may determine.

About Timbercreek

Founded in 1999, Timbercreek is one of Canada’s

leading alternative asset class investment managers, focused on

debt and equity investments in high-quality, value-add commercial

real estate in Canada, the United States and Europe. Through active

and direct investment, Timbercreek employs a thematic approach to

deliver compelling risk-adjusted returns for their investors and

partners, leveraging the diversified expertise and relationships of

their highly experienced team to invest capital across a wide range

of asset classes. Timbercreek’s team of 50+ investment

professionals have extensive domain expertise in these markets and

combine an entrepreneurial growth focus with institutional risk

management. Since 2000, the Timbercreek team has deployed more than

$18 billion in equity and debt investments focused on value-add

real estate, on behalf of their broad range of capital partners.

Timbercreek has offices in Toronto, Vancouver, Montreal, New York,

Dallas and Dublin.

About Aspen

Aspen Properties is a fully integrated and

privately held boutique real estate company with over 25 years of

experience in owning and managing real estate in downtown Calgary

and Edmonton. Driven by an entrepreneurial spirit, Aspen is

committed to creating and delivering inspiring amenity-rich real

estate with innovative technology and processes that help people

thrive and contribute to the development and sustainability of the

communities they serve. Together with their investment partners,

Aspen Properties owns and manages approximately 4.25 million square

feet of office space and nearly 3,800 parking spaces in downtown

Calgary and Edmonton. Aspen’s portfolio is comprised of 15

buildings—eleven in Calgary, three in Edmonton and a development

site in Calgary.

Disclaimers

This news release contains forward-looking

statements within the meaning of that phrase under Canadian

securities laws, including, but not limited to, the proposed use of

proceeds from the offering. When used in this news release, the

words “may”, “would”, “should”, “could”, “will”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “expect”, “objective” and

similar expressions may be used to identify forward looking

statements. By their nature, forward looking statements reflect the

Company’s current views, beliefs, assumptions, and intentions and

are subject to certain risks and uncertainties, known and unknown,

including, without limitation, those risks disclosed in the

Company's public filings. Many factors could cause actual results,

performance or achievements to be materially different from any

future results, performance or achievements that may be expressed

or implied by these forward-looking statements. The Company does

not intend to nor assumes any obligation to update these

forward-looking statements whether as a result of new information,

plans, events or otherwise, unless required by law.

CONTACT:

Timbercreek AlternativesFraser

McEwenPresidentfmcewenf@timbercreek.comwww.timbercreek.com

Aspen PropertiesScott HutchesonExecutive Chair of the

Boardrsh@aspenproperties.cawww.aspenproperties.ca

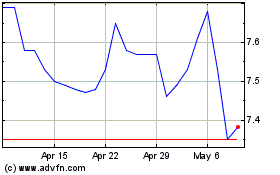

Timbercreek Financial (TSX:TF)

Historical Stock Chart

From Oct 2024 to Nov 2024

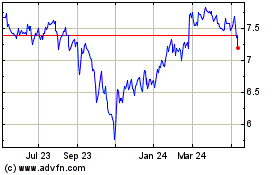

Timbercreek Financial (TSX:TF)

Historical Stock Chart

From Nov 2023 to Nov 2024