SYNEX INTERNATIONAL INC. FIRST QUARTER OF FISCAL 2011

November 09 2010 - 12:02PM

PR Newswire (Canada)

VANCOUVER, Nov. 9 /CNW/ -- TSX : SXI VANCOUVER, Nov. 9 /CNW/ - For

the three months ended September 30, 2010 ("Q1 2011"), energy sales

and consulting revenue increased to $424,526 as compared to

$374,199 in the corresponding period in fiscal 2010 ("Q1 2010").

The increase in revenue in Q1 2011 as compared to Q1 2010 is due to

increases in electricity sales from each of the Mears Plant, the

Cypress Plant and the Kyuquot Utility and an increase in consulting

revenue. In addition to energy sales and consulting revenue, Q1

2011 includes other income of $300,000 from the proceeds of an

option with a third party for the purchase of some water licences

of the Engineering Division (the "Option Payment"). The net loss

for Q1 2011 was $73,672 as compared to a net loss of $478,051 in Q1

2010. A net loss in the first quarter is expected as the generation

from hydro plants in the first quarter normally represents less

than 10% of annual forecast generation. Excluding the Option

Payment, Q1 2011 is comparable to Q1 2010 with Q1 2011 having

increased interest on long term debt being offset by higher

revenue. The loss per share in Q1 2011 was $0.00 as compared to a

loss per share of $0.02 in Q1 2011. On August 19, 2010, the Company

announced that the Engineering Division had entered into an Option

Agreement dated July 23, 2010 with an unrelated third party. The

Option Agreement provides the third party with the right to

purchase a number of applications for water licences and land

tenures held by the Engineering Division as well as other related

rights. The Option Agreement has a latest exercise date of December

2011. The Option Payment was $300,000 and has been included as

other income in the financial statements of the Company. During Q1

2011, the Barr Creek Limited Partnership ("BCLP") and its general

partner Barr Creek Hydro Ltd. ("BCHL") continued to advance the

Barr Creek Hydro Project including initial construction of access

roads. Subsequent to the end of Q1 2011, the Company announced that

the Power Division and the Ehattesaht Tribe had subscribed for

partnership units of BCLP and shares of BCHL. The Power Division

subscribed for 90% of the units and shares and EFN subscribed for

10% of the units and shares. Under a separate agreement, EFN has

the option up until January 14, 2011 to purchase from the Power

Division an additional 10% of the units and shares. At September

30, 2011, the Company had a cash balance of $637,471 which includes

$287,181 of cash held within BCLP. The Company has drawn down

$360,000 of its $500,000 revolving credit line with the Canadian

Western Bank. BCLP has executed a Preliminary Credit Agreement in

respect of the Barr Creek Hydro Project with the Canadian Western

Bank and the Company is not expecting in the near future to provide

additional cash to BCLP. Synex International Inc. is a public

company, trading on the TSX since 1987, with business interests

that cover the development, ownership and operation of electrical

generation facilities and the provision of consulting engineering

services in water resources, particularly hydroelectric facilities.

"signed" _____________________________________ Greg Sunell,

President p400 - 1444 Alberni Street, Vancouver BC V6G 2Z4br/ Phone

(604) 688 8271 Ext. 309 Fax (604) 688 1286br/ E-mail: a

href="mailto:gsunell@synex.com"gsunell@synex.com/a Web Site: a

href="http://www.synex.com"www.synex.com/a/p

Copyright

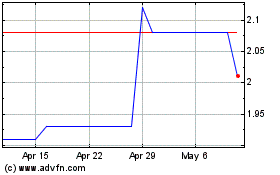

Synex Renewable Energy (TSX:SXI)

Historical Stock Chart

From Sep 2024 to Oct 2024

Synex Renewable Energy (TSX:SXI)

Historical Stock Chart

From Oct 2023 to Oct 2024