NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Sherritt International Corporation ("Sherritt" or the "Corporation") (TSX:S)

today announced first-quarter 2009 results.

- Net loss of $42.9 million, or $0.15 per share, compared with net income of

$89.0 million, or $0.38 per share, for first-quarter 2008. After adjusting for

the loss on the disposal of certain Oil and Gas assets of $57.4 million

(after-tax), or $0.20 per share, first-quarter 2009 adjusted net income totaled

$14.5 million, or $0.05 per share.

- A loss on disposal of $79.5 million ($57.4 million after-tax) was recognized

in respect of the sale of certain Oil and Gas assets during the quarter,

following the termination of the Block 7 production-sharing contract in February

2009.

- Consolidated cash, cash equivalents and short-term investments were $789.6

million at March 31, 2009, of which $23.9 million was held in the Moa Joint

Venture and $68.1 million was held in the Ambatovy Project. The $182.3 million

increase in the balance from December 31, 2008 was partially attributable to the

receipt of funds relating to the termination of the Block 7 production-sharing

contract in Oil and Gas.

- Operating cash flows totaled $95.3 million for first-quarter 2009, net of a

working capital decrease of $9.3 million.

- Collections with respect to receivables due in 2009 relating to the Oil and

Gas and Power businesses in Cuba totaled $84.3 million, comprised of $62.8

million received during the first quarter and $21.5 million received subsequent

to March 31, 2009. At March 31, 2009, $49.0 million of Oil and Gas and $0.6

million of Power receivables were overdue.

- Capital expenditures totaled $416.9 million for first-quarter 2009, including

$376.9 million in capital expenditures on the Ambatovy Project (100% basis).

Sherritt's investment of $91.8 million was funded largely through borrowings

from credit facilities available from the Ambatovy Joint Venture partners.

Sustaining capital expenditures were $24.9 million for the quarter.

- Approximately $1.6 billion remains available under various credit facilities,

including approximately $1.2 billion (US$1.0 billion, 100% basis) available

under the Ambatovy senior project financing.

- At March 31, 2009, the Corporation was in compliance with all covenants

relating to its short-term credit facilities. Lenders have provided their

commitment to amend and extend the Corporation's $140.0 million revolving credit

facility. The proposed amendment provides for less restrictive financial

covenants, revises the applicable interest rates to current market benchmarks

and is expected to be effective by May 11, 2009. Lenders have also agreed that,

following the amendment, two additional short-term facilities totaling $60.0

million will be amended to track the changes on the revolving facility.

- Discussions continue to advance with the Ambatovy Joint Venture partners on a

mechanism to fund the remaining share of the capital cost in order to maintain

Sherritt's balance sheet strength and liquidity. The Corporation expects that

these revised financing agreements will be finalized in second-quarter 2009.

- Construction at Ambatovy continued, with no material disruptions due to the

political unrest in Madagascar.

Summary Financial and Sales Data (unaudited)

----------------------------------------------------------------------------

Q1 2009 Q1 2008

----------------------------------------------------------------------------

Financial Data (millions of dollars, except per share

amounts and ratios)

Revenue $ 349.0 $ 314.2

EBITDA(1) 97.2 175.7

Operating earnings 28.6 136.0

Net earnings (loss) (42.9) 89.0

Basic earnings (loss) per share (0.15) 0.38

Diluted earnings (loss) per share (0.15) 0.38

Net working capital(2) 643.2 686.1

Capital expenditures 416.9 462.2

Total assets 10,091.4 6,418.9

Shareholders' equity 3,816.6 3,243.0

Long-term debt to capitalization 32% 16%

Weighted average number of shares (millions)

Basic 293.1 232.1

Diluted 293.1 236.7

Sales Volumes (units as noted)

Nickel (thousands of pounds, 50% basis) 8,736 8,362

Cobalt (thousands of pounds, 50% basis) 998 920

Thermal coal - Prairie Operations (millions of

tonnes)(3) 8.5 9.1

Thermal coal - Mountain Operations (millions of

tonnes, 50% basis) 0.4 0.4

Oil (bpd, net production) 14,339 18,365

Electricity (GWh, 100% basis) 541 597

Average Realized Prices (units as noted)

Nickel ($/lb) $ 5.68 $ 12.93

Cobalt ($/lb) $ 16.22 $ 46.13

Thermal coal - Prairie Operations ($/tonne) $ 14.99 $ 13.66

Thermal coal - Mountain Operations ($/tonne) $ 98.76 $ 68.67

Oil ($/boe) $ 35.73 $ 51.62

Electricity ($/MWh) $ 50.46 $ 40.62

----------------------------------------------------------------------------

(1) EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at the

end of this release.

(2) Net working capital is calculated as total current assets less total

current liabilities.

(3) Prairie Operations volumes presented on a 100% basis for each period.

Review of Operations

----------------------------------------------------------------------------

Metals

Q1 2009 Q1 2008

----------------------------------------------------------------------------

Production (tonnes, 50% basis)

Nickel 4,073 3,749

Cobalt 469 407

Sales (thousands of pounds, 50% basis)

Nickel 8,736 8,362

Cobalt 998 920

Reference prices (US$/lb)

Nickel $ 4.74 $ 13.09

Cobalt(1) 13.37 46.19

Realized prices ($/lb)

Nickel $ 5.68 $ 12.93

Cobalt 16.22 46.13

Unit operating costs (US$/lb)

Mining, processing and refining costs $ 5.00 $ 5.63

Third-party feed costs 0.35 1.32

Cobalt by-product credits (1.48) (5.06)

Other 0.25 0.06

-------- ---------

Net direct cash costs of nickel(2) $ 4.12 $ 1.95

-------- ---------

Revenue ($ millions)

Nickel $ 49.7 $ 108.1

Cobalt 16.2 42.5

Fertilizer and other 13.8 11.7

-------- ---------

$ 79.7 $ 162.3

EBITDA ($ millions)(3) $ (1.4) $ 89.2

Operating earnings (loss) ($ millions) $ (8.8) $ 84.3

Capital expenditures ($millions)

Moa Joint Venture (50% basis) $ 5.5 $ 50.3

Ambatovy Joint Venture (100% basis) 376.9 382.9

-------- ---------

$ 382.4 $ 433.2

----------------------------------------------------------------------------

(1) Average Metal Bulletin: Low Grade cobalt published price.

(2) Net direct cash cost of nickel after cobalt and by-product credits.

(3) EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at

the end of this release.

Mixed-sulphide production for the first quarter was 9,372 tonnes (100% basis),

up 8% (724 tonnes) from the prior-year quarter and reflected the increased

capacity from the Phase 1 Expansion which was commissioned in the second quarter

of 2008.

Finished metal production in the first quarter was up from the prior-year period

reflecting the impact of additional capacity from the Phase 1 Expansion and

higher feed availability. Finished nickel production of 8,146 tonnes (100%

basis) and finished cobalt production of 937 tonnes (100% basis) represented a

9% (649 tonne) and 15% (123 tonne) increase over the prior-year period.

Nickel sales of 8.7 million pounds (50% basis) increased by 4% (0.4 million

pounds) from the first quarter of 2008, but did not match the increase in

finished metals production as the overall weakness in global nickel demand

limited sales. First-quarter cobalt sales of 1.0 million pounds (50% basis) were

an 8% (0.1 million pound) increase over the same period in 2008 and largely

matched production.

Average nickel reference prices declined 64% (US$8.35/lb) and average cobalt

reference prices declined 71% (US$32.82/lb) compared to the prior-year period

due to the rapid deceleration in global industrial production that negatively

impacted base metals markets.

The deterioration in cobalt prices contributed to the 111% (US$2.17/lb) increase

in net direct cash costs of nickel for the quarter, as the price decline

resulted in a 71% (US$3.58/lb) reduction in the cobalt by-product credit. The

influence of weaker cobalt prices was partially offset by lower input commodity

costs and third-party feed costs.

Sustaining capital expenditures for first-quarter 2009 were 71% ($7.2 million)

lower than the prior-year period, commensurate with lower metal prices and the

objective of remaining cash flow positive. Expansion expenditures incurred in

the Moa Joint Venture during the quarter totaled $2.6 million and reflected the

construction of certain Phase 2 Expansion assets at Fort Saskatchewan and the

ongoing capitalization of interest related to the financing of the Phase 2

Expansion and the Moa acid plant which were suspended in late October 2008.

The Ambatovy Project

In the 60,000 tonne nickel (100% basis) Ambatovy Project in Madagascar,

engineering was 95% complete and construction was 48% complete at March 31,

2009. In the first quarter of 2009, Project expenditures were $376.9 million

(100% basis), relatively unchanged from the prior-year period. As at March 31,

2009, Project expenditures totaled US$2.6 billion (100% basis).

There were no borrowings against the senior project loans during first-quarter

2009. Sherritt's share of the project capital expenditures were largely funded

by partner advances pending the finalization of arrangements with the partners

on a mechanism to fund Sherritt's remaining equity requirements for the Project.

Mechanical completion of the Ambatovy Project is on schedule for the latter part

of 2010.

Coal

Q1 2009 Q1 2008

----------------------------------------------------------------------------

Production (millions of tonnes)

Prairie Operations(1) 8.5 8.8

Mountain Operations(2) (50% basis) 0.5 0.4

Sales (millions of tonnes)

Prairie Operations(1) 8.5 9.1

Mountain Operations(2) (50% basis) 0.4 0.4

Realized prices, excluding royalties ($/tonne)

Prairie Operations(1) $ 14.99 $ 13.66

Mountain Operations(2) 98.76 68.67

Unit operating costs ($/tonne)

Prairie Operations(1) $ 11.62 $ 10.25

Mountain Operations(2) 59.11 55.90

Revenue ($ millions)

Prairie Operations(1)

Mining revenue $ 127.9 $ 123.8

Coal royalties 12.9 8.5

Potash royalties 4.3 3.5

Mountain Operations and Other

Assets(2),(3)(50% basis) 43.8 30.9

---------- ----------

188.9 166.7

Q1 2009 Q1 2008

----------------------------------------------------------------------------

EBITDA ($millions)(4)

Prairie Operations(1) $ 44.3 $ 40.8

Mountain Operations and Other Assets(2)(3)

(50% basis) 15.7 5.3

-------- ----------

60.0 46.1

Operating earnings ($ millions) $ 34.8 $ 18.8

Capital expenditures ($millions)

Prairie Operations(1) $ 8.6 $ 4.0

Mountain Operations(2) (50% basis) 1.2 0.6

Activated Carbon Project (50% basis) 1.8 -

Obed mine (50% basis) 1.2 -

-------- ----------

12.8 4.6

----------------------------------------------------------------------------

(1) Prairie Operations are presented on a 100% basis. Sherritt equity-

accounted for these operations up to the date of the acquisition of Royal

Utilities Income Fund in May 2008.

(2) Mountain Operations include the results of the Coal Valley mine, which

is primarily involved in the export of thermal coal and are presented on

a 50% basis.

(3) Other Assets include certain undeveloped reserves that produce coal-bed

methane and technologies under development, including the Dodds-Roundhill

Coal Gasification Project and are presented on a 50% basis.

(4) EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at

the end of this release.

Production and sales volumes at the Prairie Operations mines for the first

quarter were down slightly from the prior-year period due to the timing of unit

outages at the generating stations supplied by the contract mines. A 25% (0.1

million tonne) volume increase in production at the Mountain Operations,

relative to the first quarter of 2008, was achieved through improved equipment

availability.

Realized prices improved at both the Prairie and Mountain Operations when

compared to the prior-year period. At the Prairie Operations, the pricing

increase was attributable to both positive index adjustments at owned mines and

higher unit costs and corresponding cost recoveries at the contract and Genesee

mines. The 44% ($30.09/tonne) increase in realized prices at the Mountain

Operations was the result of stronger contract pricing for the April 2008 to

March 2009 coal year and the impact of a weaker Canadian dollar.

Relative to first-quarter 2008, unit costs were higher for all Coal operations

in first-quarter 2009. Unit costs at the Prairie Operations were most affected

by the need for higher cost mining techniques due to unseasonably cold weather

in Saskatchewan and unplanned dragline outages at the Boundary Dam mine. Unit

costs at the Mountain Operations were impacted by higher labour and contractor

costs required to maintain the larger equipment fleet.

Coal royalties increased by 52% ($4.4 million) and potash royalties by 23% ($0.8

million) compared to first-quarter 2008 due to the timing of mining in coal

royalty areas and higher relative market prices for potash.

Total sustaining capital expenditures for the first quarter in the Coal Division

were 113% ($5.2 million) higher than the prior-year period largely due to the

impact of a reduction in lease capacity that resulted in a requirement for cash

payments for equipment that would have otherwise been lease-financed. For the

last five years, Prairie Operations have leased the majority of their mobile

equipment fleet. As such, these payments have historically been presented as

lease payments, not capital expenditures. With the decline in global economic

conditions, the availability of lease financing on acceptable terms has been

significantly reduced. As a result, approximately $6.6 million of the capital

expenditures in the Prairie Operations for the first quarter of 2009 represents

equipment that in the past would have been lease-financed.

Oil and Gas

Q1 2009 Q1 2008

----------------------------------------------------------------------------

Production (boepd)(1),(2)

Gross working interest - Cuba(3),(5) 21,687 31,005

Net working interest(4)

Cuba - cost recovery(5) 8,180 8,045

Cuba - profit oil(5) 5,486 9,427

--------- ---------

Cuba - total 13,666 17,472

Spain(4) 303 495

Pakistan(4) 370 398

--------- ---------

Total net working-interest production 14,339 18,365

Reference prices (US$/bbl)

US Gulf Coast Fuel Oil No. 6 $ 38.86 $ 69.59

Brent crude 44.60 97.35

Realized prices

Cuba ($/bbl) $ 36.01 $ 51.34

Spain ($/bbl) 55.69 97.32

Pakistan ($/boe) 8.94 7.07

Unit operating costs

Cuba ($/bbl) $ 9.03 $ 6.12

Spain ($/bbl) 55.55 30.37

Pakistan ($/boe) 1.32 0.94

Revenue ($ millions) $ 46.6 $ 87.5

EBITDA ($ millions)(6) $ 27.2 $ 68.0

Operating earnings ($ millions) $ - $ 44.3

Capital expenditures ($ millions) $ 12.1 $ 24.3

----------------------------------------------------------------------------

(1) Production figures exclude production from wells for which commerciality

has not been established.

(2) Oil production is stated in barrels per day ("bpd"). Natural gas

production is stated in barrels of oil equivalent per day ("boepd"), which

is converted at 6,000 cubic feet per barrel.

(3) In Cuba, Oil and Gas delivers all of its gross working-interest oil

production to CUPET at the time of production. Gross working-interest oil

production excludes (i) production from wells for which commerciality has

not been established in accordance with production-sharing contracts; and

(ii) working interests of other participants in the production-sharing

contracts.

(4) Net production (equivalent to net sales volume) represents the

Corporation's share of gross working-interest production. In Spain and

Pakistan, net oil production volumes equal 100% of gross working-interest

production volumes.

(5) Gross working-interest oil production is allocated between Oil and Gas

and CUPET in accordance with production-sharing contracts. The Corporation's

share, referred to as 'net oil production', includes (i) cost recovery oil

(based upon the recoverable capital and operating costs incurred by Oil and

Gas under each production-sharing contract) and (ii) a percentage of profit

oil (gross working-interest production remaining after cost recovery oil is

allocated to Oil and Gas). Cost recovery pools for each production-sharing

contract include cumulative recoverable costs, subject to certification by

CUPET, less cumulative proceeds from cost recovery oil allocated to Oil and

Gas. Cost recovery revenue equals capital and operating costs eligible for

recovery under the production- sharing contracts. Therefore, cost recovery

oil volumes increase as a result of higher capital expenditures and decrease

when selling prices increase. When oil prices increase, the resulting

reduction in cost recovery oil volumes is partially offset by an increase

in profit oil barrels.

(6) EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at the

end of this release.

During first-quarter 2009, Sherritt's joint venture partner in Block 7 in Cuba

entered into an agreement with an agency of the Cuban government which resulted

in the termination of the production-sharing contract related to Block 7. As a

result, no Block 7 production was recorded in the first quarter. For comparison,

gross working-interest production in Cuba, excluding Block 7, for first-quarter

2008 was 22,300 bpd and net working-interest production was 13,131 bpd.

The 3% (613 bpd) decline in gross working-interest production compared to the

prior-year period, excluding Block 7, resulted from the suspension of

development drilling in late 2008 and early 2009 due to cash flow restrictions

in the Division. The increase in net production in Cuba for first-quarter 2009,

excluding Block 7, of 11% (1,250 bpd) over the prior-year period was due mainly

to the effect of the significant decline in oil prices. Total net production for

Sherritt was also affected by reservoir declines in Spain and Pakistan.

Declines in realized prices reflected the weaker market pricing environment that

was only partially offset by a weaker Canadian dollar. Unit operating costs in

Cuba were 48% ($2.91/bbl) higher than in the prior-year period due to a

retroactive adjustment to 2008 treatment and transportation rates, the

re-categorization of certain administrative expenses as operating expenses, and

the weaker Canadian dollar. Excluding these items, first-quarter 2009 unit

operating costs are consistent with the 2008 full-year operating costs of

$7.28/bbl.

Following the termination of the Block 7 production-sharing contract in February

2009, a loss on disposal of $79.5 million ($57.4 million after-tax) was

recognized in respect of the Block 7 assets.

Capital expenditures were 50% ($12.2 million) lower than the prior-year period,

a consequence of both the Division's objective to restrict its capital

expenditures to its available cash flow and the timing of the receipt of payment

of receivables. As a result, there were no new wells initiated or completed

during first-quarter 2009.

Power

Q1 2009 Q1 2008

----------------------------------------------------------------------------

Electricity sold (GWh, 100% basis) 541 597

Realized price ($/MWh) $ 50.46 $ 40.62

Unit cash operating cost ($/MWh) $ 17.78 $ 8.55

Net capacity factor 75% 79%

Revenue ($ millions) $ 30.4 $ 29.8

EBITDA ($ millions)(1) $ 19.7 $ 23.8

Operating earnings ($ millions) $ 12.1 $ 16.3

Capital expenditures ($ millions)

Cuba $ 5.6 $ 3.8

Madagascar 3.4 -

---------- ----------

$ 9.0 $ 3.8

----------------------------------------------------------------------------

(1) EBITDA is a non-GAAP measure. See the "Non-GAAP Measures" section at

the end of this release.

Electricity production for the first quarter of 2009 was 9.4% (56 GWh) lower

than the prior-year period due to scheduled maintenance and the failure of two

turbines. Unit cash operating costs doubled over the same period due to the same

factors. The net capacity factor reflected the lower availability due to

downtime resulting from the scheduled maintenance and the turbine failures.

The majority of the capital spending increase in Cuba during the first quarter

was for infrastructure and engineering related to the Phase 8 Expansion that is

currently under review. In addition to capital expenditures, progress payments

on major components amounted to $10.3 million for the first quarter. The

progress payments and engineering were necessary to maintain the Project option

value while the Project is under review. Capital spending in Madagascar was

directed to the construction of the 25 MW Project in Antananarivo, which is

expected to be operational in June 2009. Progress payments on major components

for the Madagascar Project were $6.6 million in first-quarter 2009.

Cash, Debt and Financing

Cash, cash equivalents and short-term investments were $789.6 million at March

31, 2009. Of that amount 3% ($23.9 million) was held by the Moa Joint Venture

and 9% ($68.1 million) was held by the Ambatovy Project. These funds are for the

use of each joint venture, respectively.

At March 31, 2009, the amount of credit available under various credit

facilities, inclusive of approximately US$1.0 billion (100% basis) under the

Ambatovy project financing, remained relatively unchanged from December 31, 2008

at $1.6 billion. Of the US$1.1 billion Ambatovy financing drawn, approximately

US$0.4 billion could be considered Sherritt's proportionate share.

Sherritt and its affiliates were in compliance with their financial covenants as

at March 31, 2009. Lenders have provided their commitment to amend and extend

the Corporation's $140.0 million revolving credit facility. The proposed

amendment provides for less restrictive financial covenants, revises the

applicable interest rates to market benchmarks and is expected to be effective

by May 11, 2009. Lenders have also agreed that, following the amendment, two

additional short-term facilities totaling $60.0 million will be amended to track

the changes on the revolving facility.

A new $38.0 million demand non-revolving credit facility was established during

the quarter between a subsidiary of the Coal Valley Partnership (50% Sherritt

interest) and a Canadian financial institution for the purpose of financing

certain equipment and to provide working capital in relation to the start-up of

the Obed mine.

Outlook

Sherritt's actual and projected production volumes, royalties and capital

expenditures for first-quarter 2009 and the year 2009 are shown below:

Projected

Actual for the year

for the three ending

months ended December 31,

March 31, 2009 2009

----------------------------------------------------------------------------

Production

Mixed sulphides (tonnes, 100% basis) 9,372 37,000

Nickel (tonnes, 100% basis) 8,146 33,500

Cobalt (tonnes, 100% basis) 937 3,500

Coal - Prairie Operations (millions of tonnes,

100% basis) 8.5 36

Coal - Mountain Operations (millions of tonnes,

100% basis) 0.5 4.4

Oil - Gross working interest (Cuba) (bpd) 21,687 22,150

Oil - Net production, all operations (bpd)(1) 14,339 15,690

Power - Electricity (GWh) 541 1,959

Royalties

Coal ($ millions) $ 12.9 $ 41

Potash ($ millions) 4.3 15

Capital Expenditures ($ millions, unless

otherwise noted)

Metals - Moa Joint Venture (50% basis) $ 5.5 $ 36

Coal - Prairie Operations 8.6 35

Coal - Mountain Operations (50% basis) 1.2 9

Coal - Activated Carbon Project (50% basis) 1.8 27

Coal - Obed mine (50% basis) 1.2 8

Oil and Gas - Cuba 9.7 122

Oil and Gas - Other 2.4 13

Power - Cuba 5.6 10

Power - Madagascar 3.4 19

-------------- ------------

$ 39.4 $ 279

-------------- ------------

Metals - Ambatovy (100% basis, US$ millions) $ 303.3 $ 1,800

----------------------------------------------------------------------------

(1) Net oil production is predicated on the WTI/Fuel Oil No.6 price

differential remaining consistent with historical levels.

The Corporation's results in 2009 may continue to be negatively impacted by low

nickel, cobalt and oil prices. Accordingly, the Corporation intends to remain

focused on maintaining a strong liquid balance sheet, controlling capital and

operating costs and improving cash flows from the current asset base while

preserving growth opportunities. The objective of all Divisions is to be cash

flow positive in 2009. This mandate may impact the production levels and capital

expenditures at all Sherritt operations, and so all estimates for the year are

expected to vary to a certain degree with market pricing and general global

economic conditions. Further issues impacting the 2009 estimates are presented

below.

- In Metals, the realization of lower commodity input costs is expected to

result in lower unit production costs over the balance of 2009 and, in

conjunction with higher expected cobalt prices, lower net direct cash costs

throughout the year. The 2009 annual maintenance shutdown plan at the Fort

Saskatchewan refinery has been modified in favour of maintenance windows in May,

June and September, which are expected to be less disruptive and more cost

effective than a single shutdown. Refining costs, production and sales volumes

are expected to be negatively impacted in the months in which these maintenance

opportunities are undertaken. No major elements of the Phase 2 Moa Joint Venture

Expansion are expected to begin construction in 2009.

- In the Ambatovy Project, it is expected that approximately US$0.6 billion of

the estimated US$1.8 billion in 2009 capital expenditures will be funded by

Project financing drawdowns.

- In Coal, annual production levels are expected to be consistent with prior

years and all production has been contracted. Price settlement for the majority

of the Mountain Operations contracts occurred in late March and early April

2009. As expected, settlement prices will be down significantly from the record

prices of 2008 due to market conditions. Approximately 50% of the Coal Valley

mine's 2009 contract-year production will be linked to the Newcastle FOB

settlement price which is expected to settle at approximately US$70.00/tonne,

down over 40% from last year. This will reduce the average realized price per

tonne at Mountain Operations for 2009, although the impact will be somewhat

offset if the Canadian dollar remains weaker than last year. Additional

production from the Obed mine (scheduled to reopen in the third quarter) is

estimated to be approximately 0.4 million tonnes for the year. Sustaining

capital expenditures for Prairie Operations are expected to increase as working

capital or other credit facilities are used to fund capital purchases that

otherwise would have been leased. Due to weather-related construction delays,

the commissioning of the activated carbon plant is now expected to occur in

early 2010 compared to the prior estimate of November 2009.

- In Oil and Gas, the extent of the drilling program in 2009 will be dictated

largely by the receipt of payments in Cuba. The controllable operating costs are

targeted to be 15% lower than the prior year. Activity in Cuba includes

approximately $14.4 million in expenditures for the enhanced oil recovery pilot

project that is expected to be operational in early 2010. The Corporation will

participate in an exploratory well in Turkey beginning in the second quarter of

2009 in partnership with partners including a Turkish conglomerate and an

international oil and gas company with experience in Turkey.

- In Power, production for 2009 will be impacted by planned maintenance activity

and the two unplanned turbine outages that occurred in the first quarter. As a

result of these events, unit operating costs for 2009 are expected to be higher

than in 2008, but lower than the first quarter of 2009. The 150 MW Boca de

Jaruco Combined Cycle Project in Cuba continues to be reviewed in light of

current economic conditions. Sherritt will continue with engineering and

progress payments to maintain the Project option value while it is under review.

Construction on the 25 MW Madagascar Thermal Power Project is nearing

completion, and is expected to be operational in June 2009.

Non-GAAP Measures

The Corporation discloses EBITDA in order to provide an indication of revenue

less cash operating expenses. Operating earnings is a measure used by Sherritt

to evaluate the operating performance of its businesses as it excludes interest

charges, which are a function of the particular financing structure for the

business, and certain other charges. EBITDA and operating earnings do not have

any standardized meaning prescribed by Canadian generally accepted accounting

principles and, therefore, they may or may not be comparable with similar

measures presented by other issuers.

About Sherritt

Sherritt is a diversified natural resource company that produces nickel, cobalt,

thermal coal, oil, gas and electricity. It also licenses its proprietary

technologies to other metals companies. Sherritt's common shares are listed on

the Toronto Stock Exchange under the symbol "S".

Forward-looking Statements

This press release contains certain forward-looking statements. Forward-looking

statements generally can be identified by the use of statements that include

words such as "believe", "expect", "anticipate", "intend", "plan", "forecast",

"likely", "may", "will", "could", "should", "suspect", "outlook", "projected",

"continue" or other similar words or phrases. Similarly, statements with respect

to expectations concerning assets, prices, costs, dividends, foreign-exchange

rates, earnings, production, market conditions, capital expenditures, commodity

demand, risks, availability of regulatory approvals, the impact of investments

in Master Asset Vehicles, corporate objectives and plans or goals, are or may be

forward-looking statements. These forward-looking statements are not based on

historic facts, but rather on current expectations, assumptions and projections

about future events. There is significant risk that predictions, forecasts,

conclusions or projections will not prove to be accurate, that those assumptions

may not be correct and that actual results may differ materially from such

predictions, forecasts, conclusions or projections. Sherritt cautions readers of

this press release not to place undue reliance on any forward-looking statements

as a number of factors could cause actual future results, conditions, actions or

events to differ materially from the targets, expectations, estimates or

intentions expressed in the forward-looking statements. By their nature,

forward-looking statements require Sherritt to make assumptions and are subject

to inherent risks and uncertainties. Key factors that may result in material

differences between actual results and developments and those contemplated by

this press release include business and economic conditions in Canada, Cuba,

Madagascar, and the principal markets for Sherritt's products.

Other such factors include, but are not limited to, uncertainties in the

development and construction of large mining projects; risks related to the

availability of capital to develop the Ambatovy Project; risks associated with

Sherritt's joint venture partners; potential interruptions in transportation;

Sherritt's reliance on key personnel and skilled workers; the possibility of

equipment and other unexpected failures; the potential for shortages of

equipment and supplies; risks associated with mining, processing and refining

activities; uncertainties in oil and gas exploration; risks related to

collecting accounts receivable and repatriating profits and dividends from Cuba;

risks related to foreign-exchange controls on Cuban government enterprises to

transact in foreign currency; risks associated with the United States embargo on

Cuba and the Helms-Burton legislation; development programs; uncertainties in

reserve estimates; uncertainties in asset retirement and reclamation cost

estimates; Sherritt's reliance on significant customers; foreign exchange and

pricing risks; uncertainties in commodity pricing; credit risks; competition in

product markets; Sherritt's ability to access markets; risks in obtaining

insurance; uncertainties in labour relations; uncertainties in pension

liabilities; the ability of Sherritt to enforce legal rights in foreign

jurisdictions; the ability of Sherritt to obtain government permits; risks

associated with government regulations and environmental health and safety

matters; and other factors listed from time to time in Sherritt's continuous

disclosure documents.

Further, any forward-looking statement speaks only as of the date on which such

statement is made, and except as required by law, Sherritt undertakes no

obligation to update any forward-looking statements.

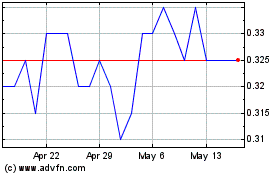

Sherritt (TSX:S)

Historical Stock Chart

From Jun 2024 to Jul 2024

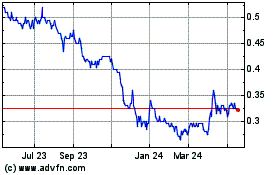

Sherritt (TSX:S)

Historical Stock Chart

From Jul 2023 to Jul 2024