Peyto Increases Share Exchange Ratio in Favour of Open Range

August 06 2012 - 11:00PM

Marketwired Canada

Peyto Exploration & Development Corp. (TSX:PEY) ("Peyto") has entered into an

amended and restated arrangement agreement (the "Amended and Restated

Arrangement Agreement") with Open Range Energy Corp. ("Open Range") to amend

certain terms of the arrangement agreement (the "Arrangement Agreement") dated

July 2, 2012 between Peyto and Open Range, whereby Peyto agreed to acquire all

of the common shares of Open Range ("Open Range Shares") pursuant to a plan of

arrangement (the "Arrangement") under the Business Corporations Act (Alberta).

Pursuant to the Arrangement Agreement, Open Range shareholders were to receive

0.0696 (the "Exchange Ratio") of a common share of Peyto ("Peyto Share") for

each Open Range Share held.

Under the terms of the Amended and Restated Arrangement Agreement, Peyto will

increase the consideration payable to holders of Open Range Shares by increasing

the Exchange Ratio to 0.0723 of a Peyto Share for each Open Range Share. The

increase in the consideration resulted from Open Range having received an

unsolicited proposal from a third party.

Commenting on the increased consideration, Don Gray, Chairman of the Board of

Peyto said:

"The team at Open Range has built a very impressive asset over the years. In our

thirteen year corporate history we have not come across another company that has

fit so well with our build it yourself model. Open Range is our immediate

neighbor in the Sundance area of the Deep Basin. We are very confident that our

expertise in this area and the obvious geographical synergies between our assets

make the combination of Peyto and Open Range the perfect fit."

The Amended and Restated Arrangement Agreement provides that the termination fee

payable to Peyto in certain circumstances will be increased from $5.0 million to

$8.5 million. Substantially all other terms of the Arrangement Agreement,

including non-solicitation and right to match provisions remain the same. It is

anticipated that the special meeting of shareholders of Open Range will still be

held on August 14, 2012 and closing of the amended Arrangement will occur on or

about August 14, 2012.

The Board of Directors of Open Range has unanimously approved the Amended and

Restated Arrangement Agreement and determined that the consideration to be

received by Open Range shareholders pursuant to the amended Arrangement is fair

to holders of Open Range Shares, is in the best interests of Open Range and

unanimously resolved to recommend that holders of Open Range Shares vote in

favour of the amended Arrangement. Management and directors of Open Range

holding approximately 8.3 percent of the issued and outstanding Open Range

Shares have entered into support agreements to vote their Open Range Shares in

favour of the amended Arrangement at the meeting of Open Range shareholders.

The Board of Directors of Peyto has also unanimously approved the Amended and

Restated Arrangement Agreement. BMO Capital Markets acted as financial advisor

to Peyto.

Complete details of the terms of the amended Arrangement are set out in the

Amended and Restated Arrangement Agreement, which will be filed by Open Range on

SEDAR under Open Range's profile on www.sedar.com.

Darren Gee, President and CEO

This press release contains forward-looking statements and forward-looking

information within the meaning of applicable securities laws. The use of any of

the words "expect", "anticipate", "continue", "estimate", "objective",

"ongoing", "may", "will", "project", "should", "believe", "plans", "intends" and

similar expressions are intended to identify forward-looking statements or

information. In particular, forward looking statements in this press release

include, but are not limited to, statements regarding the completion of the

Arrangement, the timing of the meeting of Open Range shareholders and the

anticipated results therefrom.

The forward-looking statements and information are based on certain key

expectations and assumptions made by Peyto, including, but not limited to,

expectations and assumptions concerning the ability of Peyto and Open Range, as

applicable, to obtain all required regulatory approvals for the transaction,

including, but not limited to, shareholder, Court and regulatory approvals.

Although Peyto believes that the expectations and assumptions on which such

forward-looking statements and information are based are reasonable, undue

reliance should not be placed on the forward looking statements and information

because there can be no assurance that they will prove to be correct.

Since forward-looking statements and information address future events and

conditions, by their very nature they involve inherent risks and uncertainties.

Actual results could differ materially from those currently anticipated due to a

number of factors and risks. These include, but are not limited to, the risk

that the transaction may not close when planned or at all or on the terms and

conditions set forth in the Amended and Restated Arrangement Agreement; the

failure of Peyto and Open Range, as applicable, to obtain the necessary

shareholder, Court, regulatory and other third party approvals required in order

to proceed with the transaction; operational risks in development, exploration

and production for natural gas; delays or changes in plans with respect to

exploration or development projects or capital expenditures; the uncertainty of

reserve and resource estimates; health, safety and environmental risks;

commodity price and exchange rate fluctuations; marketing and transportation;

loss of markets; environmental risks; competition; incorrect assessment of the

value of acquisitions; ability to access sufficient capital from internal and

external sources; and changes in legislation, including but not limited to tax

laws, royalties and environmental regulations. Readers are cautioned that the

foregoing list of factors is not exhaustive.

Management has included the above summary of assumptions and risks related to

forward-looking statements and information provided in this press release in

order to provide securityholders with a more complete perspective on the

Arrangement and such information may not be appropriate for other purposes.

Actual results, performance or achievement could differ materially from those

expressed in, or implied by, these forward-looking statements and, accordingly,

no assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of them do so,

what benefits that Peyto will derive there from.

The forward-looking statements and information contained in this press release

are made as of the date hereof and Peyto undertakes no obligation to update

publicly or revise any forward-looking statements or information, whether as a

result of new information, future events, or results or otherwise, other than as

required by applicable securities laws.

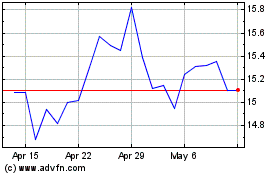

Peyto Exploration and De... (TSX:PEY)

Historical Stock Chart

From Sep 2024 to Oct 2024

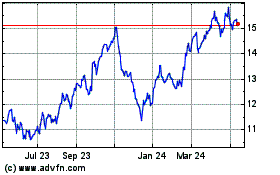

Peyto Exploration and De... (TSX:PEY)

Historical Stock Chart

From Oct 2023 to Oct 2024