Peyto Exploration & Development Corp. (TSX:PEY) is pleased to present the

results and analysis of the independent reserve report effective December 31,

2011. The evaluation encompassed 100% of Peyto's reserve assets and was

conducted by InSite Petroleum Consultants.

Peyto successfully executed the largest capital program in its thirteen year

history during 2011, resulting in substantial growth in production and reserves.

All of the activity was focused on the company's multi-zone, liquids rich,

natural gas resource plays located in the Alberta Deep Basin. Production(1) grew

38%, from 30,600 boe/d at year end 2010 to 42,100 boe/d at year end 2011, while

reserves grew 24% from 260 mmboes to 322 mmboes (33% and 19%, respectively per

share). This represents the 13th consecutive year that Peyto has grown its

reserves per share.

Historical

-- Since the company's inception in 1998, Peyto has explored for and

discovered 2.4 Trillion Cubic Feet equivalent ("TCFe") of Alberta Deep

Basin natural gas reserves, has developed with the drill bit 1.4 TCFe,

and has recovered and sold 0.5 TCFe. Peyto is actively working to

develop the remaining 1.0 TCFe of identified reserves, all while

continuing to explore for new reserves.

-- A total of $2.26 billion was invested in the development of the 1.4 TCFe

at an average cost of $1.58/MCFe. A weighted average field netback(1) of

$5.62/MCFe was also achieved over that time, for a cumulative recycle

ratio of 3.6 times.

-- Peyto now has $36.27/share of Proved plus Probable Additional Net

Present Value ("P+P NPV" - debt adjusted, 5% discount) comprised of

$20.26/share of developed reserves and $16.01/share of undeveloped

reserves.

2011 Highlights

-- For the year ending December 31, 2011, Peyto invested $379 million of

total capital(1) to build a record 21,700 boe/d of new production(1) at

a cost of $17,500/boe/d. This is the third year in a row that Peyto has

added new production for less than $18,000/boe/d, inclusive of

acquisitions, land, seismic, facilities and all well costs.

-- This capital investment created new Proved Producing ("PP") reserves

valued at $745 million (Before Tax, NPV5) for a NPV recycle ratio of

2.0, or $5.40/share.

-- Reserves increased by 15%, 25% and 24% to 0.8 TCFe, 1.35 TCFe and 1.9

TCFe for Proved Producing, Total Proved ("TP") and Proved plus Probable

Additional ("P+P"), respectively. Per share reserves were up 11%, 20%,

and 19% for these respective categories.

-- The Reserve Life Index ("RLI") for the PP reserves was reduced to 9

years from 11 years due to the significant increase in corporate

production, while the RLI for TP and P+P also dropped to 16 and 22

years, respectively.

-- For the year, the Proved Producing, Finding, Development and Acquisition

("PP FD&A") cost, inclusive of additions, revisions and production was

$2.12/MCFe ($12.73/boe) while the average field netback(1) before

hedging was $3.98/MCFe ($23.88/boe), resulting in a 1.9 times recycle

ratio.

-- Peyto replaced 452% of production with new Total Proved reserves at a

FD&A cost of $2.13/MCFe ($12.80/boe) and 585% of production with new P+P

reserves at a FD&A cost of $1.90/MCFe ($11.40/boe) (including increases

in Future Development Capital ("FDC") of $370 million and $484 million

for the respective categories). For comparative purposes, FD&A costs

before FDC were $1.08/MCFe ($6.47/boe) and $0.83/MCFe ($5.01/boe),

respectively.

-- At year end, P+P reserves had been assigned to 18% of Peyto's total Deep

Basin lands.

-- The ratio of year end net debt to the value of the producing reserves

(PP NPV5) was maintained at 18%, consistent with historical averages.

-- Natural Gas Liquids ("NGLs") which make up 17% of Peyto's P+P reserves

increased 64% due to planned deep-cut processing facilities.

-- For every location drilled and converted to Proved Producing, Peyto was

able to recognize over two new undeveloped locations in its inventory of

future opportunities.

2012 Update

-- Based on the current commodity price forecast, Peyto plans to direct

more of the $400 to $450 million 2012 capital program towards its liquid

rich, natural gas plays, as well as accelerate the installation of deep-

cut gas processing facilities at its Oldman, Nosehill and Wildhay gas

plants. These new processing facilities are estimated to cost $60

million and are forecast to recover an incremental 12.5 mmboes of P+P

reserves and over $200 million (Before Tax, NPV5).

(1)Capital Expenditure, Field Netback, and Production are estimated and remain

unaudited at this time.

2011 RESERVES

The following table summarizes Peyto's reserves and the discounted Net Present

Value of future cash flows, before income tax, using variable pricing, at

December 31, 2011.

----------------------------------------------------------------------------

Gas Oil & NGL BCFe MBOE

Reserve Category (mmcf) (mstb) (6:1) (6:1)

----------------------------------------------------------------------------

Proved Producing 667,997 16,125 765 127,458

Proved Non-

producing 14,335 356 16 2,745

Proved

Undeveloped 421,606 24,834 571 95,101

----------------------------------------------------------------------------

Total Proved 1,103,938 41,314 1,352 225,304

Probable

Additional 495,588 14,525 583 97,123

----------------------------------------------------------------------------

Proved + Probable

Additional 1,599,526 55,839 1,935 322,427

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Before Tax Net Present Value ($thousands)

Discounted at

Reserve Category 0% 5% 8% 10%

----------------------------------------------------------------------------

Proved Producing $ 4,809,495 $ 2,624,139 $ 2,049,171 $ 1,791,531

Proved Non-

producing $ 96,555 $ 42,531 $ 28,716 $ 22,878

Proved

Undeveloped $ 2,795,600 $ 1,305,678 $ 878,074 $ 681,252

----------------------------------------------------------------------------

Total Proved $ 7,701,651 $ 3,972,348 $ 2,955,961 $ 2,495,661

Probable

Additional $ 3,554,252 $ 1,511,454 $ 1,010,077 $ 794,928

----------------------------------------------------------------------------

Proved + Probable

Additional $11,255,903 $ 5,483,802 $ 3,966,037 $ 3,290,588

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Note: Based on the InSite report effective December 31, 2011. Tables may not add

due to rounding.

Analysis

Peyto has analyzed the reserve evaluation in order to answer three fundamental

questions.

1. Base Reserves - How did the "base reserves" that were on production at

the time of the last reserve report perform during the year, and how did

any change in commodity price forecast affect their value?

2. Value Creation - How much value did the 2011 capital investments create,

both in current producing reserves and in undeveloped potential?

3. Growth and Income - Are the projected cashflows capable of funding the

growing number of undeveloped opportunities and a sustainable dividend

stream to shareholders without sacrificing financial flexibility?

BASE RESERVES

Peyto's existing Proved Producing reserves at the start of 2011 (base reserves)

were evaluated and adjusted for 2011 production as well as any technical

revisions resulting from the additional twelve months of data. As part of

InSite's independent engineering analysis, all 710 producing entities were

evaluated. These producing wells and zones represent a total gross Estimated

Ultimate Recoverable (EUR) volume of 1.2 TCF plus associated liquids.

Included in this group of producing wells are 43 horizontal wells which were

drilled and completed with multi-stage fracture stimulations prior to 2011.

Original reserve assignments for these wells were conservative due to a lack of

analog production performance data. Over time, these wells have outperformed

expectations and have received an average Proven Producing reserve increase of

10% from 3.2 BCFe/well to 3.5 BCFe/well.

In aggregate, Peyto is pleased to report that its total base reserves continue

to meet with expectation, which increases the confidence in the prediction of

future recoveries.

Price Forecasts

InSite's Alberta spot natural gas price forecast for the next 15 years, which

begins with $3.25 C$/MMBTU, is starting 18% lower today than a year ago. This is

due to a reduction in forecasted Henry Hub natural gas price and an increase in

the CND$/USD$ exchange rate.

The Insite forecast for Alberta Condensate price, which accounts for over 62% of

Peyto's total natural gas liquid production, starts 12% higher, or $102.90/bbl.

The debt adjusted NPV, discounted at 5%, of last year's Proved Producing

reserves, decreased 10% due to this change in commodity price forecasts, as

described in the following value reconciliation.

The InSite Petroleum Consultants price forecast used in the variable dollar

economics is available on their website at www.insitepc.com.

VALUE CREATION/RECONCILIATION

Peyto drilled 70 gross (62 net) wells in 2011 for a total capital investment of

$379 million. Of this total, 18% was spent on new lands, seismic and facilities,

while the remaining 82% was spent developing existing reserves and exploring for

new reserves. Of the 70 wells, 51 (46 net) were previously identified as

undeveloped reserves in last year's reserve report (27 Proved, 24 Probable

Additional). The remaining 19 wells were not recognized in last year's report as

they were deemed too exploratory in nature. The undeveloped reserves booked to

the 46 net locations at year end 2010 totaled 152 BCFe (3.3 BCFe/well) of Proved

Undeveloped plus Probable Additional reserves for a forecast capital investment

of $214 million ($1.41/Mcfe). In actuality, $209 million of capital was spent on

these 46 net wells during 2011, yielding Proved Producing plus Probable

Additional reserves of 151 BCFe ($1.39/Mcfe). The development of these 46 net

booked locations produced substantively the same outcome that was originally

projected. This analysis helps to validate the accuracy of the reserve and

capital assignments of past undeveloped locations and provides confidence in the

quality of the estimates for future undeveloped locations.

The economic result of 2011 capital investment allows Peyto to determine the

best use of shareholders capital on a go-forward basis, and demonstrates the

potential returns that can be generated from future undeveloped opportunities.

In order to measure the success of the 2011 capital program, it is necessary to

quantify the total amount of value created during the year and compare that to

the total amount of capital invested. The independent engineers have run last

year's evaluation with this year's price forecast to remove the change in value

attributable to both commodity prices and changing royalties. This approach

isolates the value created by the Peyto team from the value created (or lost) by

those changes outside of their control. Since the capital investments in 2011

were funded from a combination of cash flow, debt and equity, it is necessary to

know the change in debt and the change in shares outstanding to see if the

change in value is truly accretive to shareholders.

At year end 2011, Peyto's estimated net debt had increased by $60.7 million to

$465.6 million while the number of shares outstanding had increased by 5.6

million shares to 138.4 million shares. The change in debt includes all of the

capital expenditures, net of Drilling Royalty Credits earned, and the total

fixed and performance based compensation paid out during the year. Although

these estimates are believed to be accurate, they remain unaudited at this time

and are subject to change.

Based on this reconciliation of changes in BT NPV, the Peyto team was able to

create $928 million of Proved Producing, $1.8 billion of Total Proven, and $2.5

billion of Proved plus Probable Additional undiscounted reserve value, with $379

million of capital investment. The ratio of capital expenditures to value

creation is what Peyto refers to as the NPV recycle ratio, which is simply the

undiscounted value addition, resulting from the capital program, divided by the

capital investment. For 2011, the Proved Producing NPV recycle ratio is 2.4.

The following table breaks out the value created by Peyto's capital investments

and reconciles the changes in debt adjusted NPV of future net revenues using

forecast prices and costs as at December 31, 2011.

----------------------------------------------------------------------------

Proved Producing Total Proved

($millions)Discounted at 0% 5% 10% 0% 5%

----------------------------------------------------------------------------

Before Tax Net Present

Value at Beginning of

Year ($millions)

Dec. 31, 2010 Evaluation

using InSite Jan. 1, 2011

price forecast, less debt $4,098 $1,958 $1,177 $6,388 $2,999

----------------------------------------------------------------------------

Per Share Outstanding at

Dec. 31, 2010 ($/share) $30.85 $14.75 $ 8.86 $48.10 $22.58

----------------------------------------------------------------------------

2011 sales (revenue less

royalties and operating

costs) $ (346) $ (346) $ (346) $ (346) $ (346)

Net Change due to price

forecasts (using InSite

Jan 1, 2011 price

forecast) $ (336) $ (199) $ (144) $ (595) $ (371)

Value Change due to

discoveries (additions,

extensions, transfers,

revisions) $ 928 $ 745 $ 639 $1,789 $1,225

--------------------------------------------------

--------------------------------------------------

Before Tax Net Present

Value at End of Year

($millions)

Dec. 31, 2011 Evaluation

using InSite Jan. 1, 2012

price forecast, less debt $4,344 $2,159 $1,326 $7,236 $3,507

----------------------------------------------------------------------------

Per Share Outstanding at

Dec. 31, 2011 ($/share) $31.40 $15.60 $ 9.58 $52.30 $25.35

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Year over Year Change in

Before Tax NPV/share 2% 6% 8% 9% 12%

Year over Year Change in

Before Tax NPV/share

including Dividend

($0.72/share) 4% 11% 16% 10% 15%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total

Proved Proved + Probable Additional

($millions)Discounted at 10% 0% 5% 10%

----------------------------------------------------------------------------

Before Tax Net Present

Value at Beginning of

Year ($millions)

Dec. 31, 2010 Evaluation

using InSite Jan. 1, 2011

price forecast, less debt $ 1,727 $ 9,534 $ 4,333 $ 2,438

----------------------------------------------------------------------------

Per Share Outstanding at

Dec. 31, 2010 ($/share) $ 13.00 $ 71.79 $ 32.63 $ 18.36

----------------------------------------------------------------------------

2011 sales (revenue less

royalties and operating

costs) $ (346) $ (346) $ (346) $ (346)

Net Change due to price

forecasts (using InSite

Jan 1, 2011 price

forecast) $ (276) $ (881) $ (543) $ (400)

Value Change due to

discoveries (additions,

extensions, transfers,

revisions) $ 925 $ 2,483 $ 1,575 $ 1,134

--------------------------------------------------

--------------------------------------------------

Before Tax Net Present

Value at End of Year

($millions)

Dec. 31, 2011 Evaluation

using InSite Jan. 1, 2012

price forecast, less debt $ 2,030 $ 10,790 $ 5,018 $ 2,825

----------------------------------------------------------------------------

Per Share Outstanding at

Dec. 31, 2011 ($/share) $ 14.67 $ 77.99 $ 36.27 $ 20.42

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Year over Year Change in

Before Tax NPV/share 13% 9% 11% 11%

Year over Year Change in

Before Tax NPV/share

including Dividend

($0.72/share) 18% 10% 13% 15%

----------------------------------------------------------------------------

Tables may not add due to rounding.

GROWTH AND INCOME

As a dividend paying growth corporation, Peyto's objective is to grow the

resources which generate sustainable income (dividends) for shareholders. In

order for income to be more sustainable and grow, Peyto must profitably find and

develop more reserves. Simply increasing production from the existing reserves

will not make that income more sustainable. Reserve Life Index (RLI), or a

reserve to production ratio, provides a measure of this long term

sustainability.

During 2011, the Company was successful in replacing 230% of the annual produced

reserves, which resulted in a 15% increase in total Proved Producing reserves.

Annual production, however, increased 49%, from 8.7 mmboes to 12.9 mmboes, thus

accelerating reserve recovery and causing a 17% reduction in Proved Producing

reserve life. This acceleration has the benefit of shorter time to payout and

faster redeployment of capital for greater ultimate returns. Similarly, the

Total Proved and P+P reserve life index dropped to 16 and 22 years,

respectively. By comparison, Peyto's Proved Producing reserve life is still one

of the longest in the industry.

The following table highlights the company's historical Reserve Life Index.

RLI (years) 2003 2004 2005 2006 2007 2008 2009 2010 2011

----------------------------------------------------------------------------

Proved Producing 10 9 11 12 13 14 14 11 9

Total Proved 13 12 14 14 16 17 21 17 16

Proved + Probable Additional 19 17 19 20 21 23 29 25 22

Future Undeveloped Opportunities

With the expansion of Peyto's capital program from $261 million in 2010 to $379

million in 2011, the company has been able to increase the pace that undeveloped

opportunities are both recognized and developed. As a result, the number of

future drilling locations in the reserve report has increased to 437 gross (333

net). Of these locations, 63% are categorized by the independent reserve

evaluators as Proven Undeveloped with the remaining 37% as Probable Undeveloped.

The net reserves associated with the undeveloped locations total 971 BCFe (161.8

mmboes) or 1.2 BOEs per share. The total capital required to develop them is

estimated at $1.793 Billion or $1.85/MCFe, in order to create an associated net

present value of $2.215 Billion (5% discount) or $16.01 per share. The

development schedule for the undeveloped reserves is shown in the following

table of forecasted capital.

Forecast Capital

------------------------------------------------

Proved+ Probable

Proved Reserves Additional Reserves

Year Undisc., ($Millions) Undisc., ($Millions)

----------------------------------------------------------------------------

2012 $ 284 $ 426

2013 $ 335 $ 419

2014 $ 249 $ 418

2015 $ 184 $ 398

2016 $ 56 $ 110

----------------------------------------------------------------------------

Thereafter $ 4 $ 23

----------------------------------------------------------------------------

Total $ 1,111 $ 1,794

The existing producing reserves (PP) are forecast to generate over $4.8 billion

in undiscounted cash flow which should be more than sufficient to fund the $1.8

billion in future development capital, ensuring those reserve additions are

accretive to shareholders.

In addition to undeveloped drilling locations, the reserve report also reflects

additions to several of Peyto's 100% owned and operated gas plants that will

enhance the natural gas liquids recovery. These projects, at the Oldman,

Nosehill and Wildhay gas plants located in the Greater Sundance complex, are

forecast to occur in 2012 and 2013 for a combined capital investment of $60

million. Up to 15 bbls/mmcf of increased NGL recovery is forecast to occur which

results in an increase in the value of the P+P reserves of $206 million (Before

Tax, NPV5).

Performance Ratios

The following table outlines the 2011 performance ratios for all three reserve

categories.

----------------------------------------------------------------------------

Proved +

Proved Probable

Producing Total Proved Additional

----------------------------------------------------------------------------

2011 FD&A Cost ($/boe)

(including DRC and

change in FDC) $ 12.73 $ 12.80 $ 11.49

3 yr ave. FD&A Cost

incl. FDC ($/boe) $ 12.77 $ 12.66 $ 11.48

Reserve Life Index

(years)

Q4 2011 average

production(+) -

39,399 boe/d 9 16 22

Reserve Replacement

Ratio

2011 production(+) -

12.945 million boes 2.3 4.5 5.9

----------------------------------------------------------------------------

(+) Q4 and 2011 production are estimated and remain unaudited at this time.

-- FD&A (finding, development and acquisition) costs are used as a measure

of capital efficiency and are calculated by dividing the capital costs

for the period, including the change in undiscounted future development

capital ("FDC"), by the change in the reserves, incorporating revisions

and production, for the same period (eg. Total Proved

($379.1+$370.4)/(225.3-179.7+12.945) = $12.80).

-- The reserve life index is calculated by dividing the reserves (in boes)

in each category by the annualized average production rate in boe/year

(eg. Proved Producing 127,457/(39.399x365) = 8.9 yrs). Peyto believes

that the most accurate way to evaluate the current reserve life is by

dividing the proved developed producing reserves by the actual fourth

quarter average production. In Peyto's opinion, for comparative

purposes, the proved developed producing reserve life provides the best

measure of sustainability.

-- The reserve replacement ratio is determined by dividing the yearly

change in reserves before production by the actual annual production for

the year (eg. Total Proved ((225.3-179.7+12.945)/12.945) = 4.5).

Reserves Committee

Peyto has a reserves committee, comprised of independent board members, that

reviews the qualifications and appointment of the independent reserve

evaluators. The committee also reviews the procedures for providing information

to the evaluators. All booked reserves are based upon annual evaluations by the

independent qualified reserve evaluators conducted in accordance with the COGE

(Canadian Oil and Gas Evaluation) Handbook and National Instrument 51-101. The

evaluations are conducted using all available geological and engineering data.

The reserves committee has reviewed the reserves information and approved the

reserve report.

2012 UPDATE

Excess supply of natural gas in North America coupled with a warmer than normal

winter is expected to leave natural gas storage levels higher than usual. This

has pushed current and future natural gas prices down to decade lows. Peyto's

quick response has been to redirect more of its capital program to liquids rich

gas plays like the Cardium and Falher where revenues are enhanced by natural gas

liquids production. As well, Peyto will be installing additional facilities at

its Oldman and Nosehill gas plants to extract more natural gas liquids from

existing and future reserves. It is anticipated that these changes will improve

Peyto's netbacks and preserve the returns originally expected from the 2012

capital program.

As the lowest cost producer in Canada, with a large and growing portfolio of

proven drilling locations, Peyto remains well positioned to continue to deliver

superior returns to shareholders over the long term, despite the volatility in

natural gas prices. By maintaining a strong balance sheet and financial

flexibility, Peyto will look to capitalize on additional opportunities that

arise from slower natural gas activity created by weak prices.

General

For more in depth discussion of the 2011 reserve report, an interview with the

management will be available on Peyto's website by Friday, February 24, 2012. A

complete filing of the Statement of Reserves (form 51-101F1), Report on Reserves

(form 51-101F2), and Report of Management and Directors on Oil and Gas

Disclosure (form 51-101F3) will be available in the Annual Information Form to

be filed by the end of March 2012. Shareholders are encouraged to actively visit

Peyto's website located at www.peyto.com.

Certain information set forth in this document, including management's

assessment of Peyto's future plans and operations, contains forward-looking

statements. By their nature, forward-looking statements are subject to numerous

risks and uncertainties, some of which are beyond these parties' control,

including the impact of general economic conditions, industry conditions,

volatility of commodity prices, currency fluctuations, imprecision of reserve

estimates, environmental risks, competition from other industry participants,

the lack of availability of qualified personnel or management, stock market

volatility and ability to access sufficient capital from internal and external

sources. Readers are cautioned that the assumptions used in the preparation of

such information, although considered reasonable at the time of preparation, may

prove to be imprecise and, as such, undue reliance should not be placed on

forward-looking statements. Peyto's actual results, performance or achievement

could differ materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be given that any

of the events anticipated by the forward-looking statements will transpire or

occur, or if any of them do so, what benefits that Peyto will derive therefrom.

BOEs may be misleading, particularly if used in isolation. A BOE conversion

ratio of 6 Mcf:1 bbl is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead. Some values set forth in the tables above may not

add due to rounding. It should not be assumed that the estimates of future net

revenues presented in the tables above represent the fair market value of the

reserves. There is no assurance that the forecast prices and costs assumptions

will be attained and variances could be material. The aggregate of the

exploration and development costs incurred in the most recent financial year and

the change during that year in estimated future development costs generally will

not reflect total finding and development costs related to reserves additions

for that year.

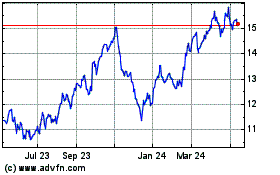

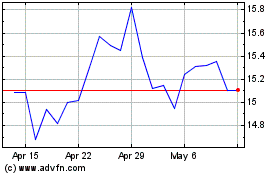

Peyto Exploration and De... (TSX:PEY)

Historical Stock Chart

From Sep 2024 to Oct 2024

Peyto Exploration and De... (TSX:PEY)

Historical Stock Chart

From Oct 2023 to Oct 2024