Nevada Copper (TSX: NCU) (OTC: NEVDF) (FSE: ZYTA) (“Nevada

Copper” or the “Company”) refers to its news releases

dated August 25, 2022 and September 26, 2022 with respect to the

proposed financing package expected to provide up to $93 million of

liquidity to the Company in order to support the restart and

ramp-up of its Pumpkin Hollow underground copper mine (the

“Underground Mine”) (the “Restart Financing Package”). As announced

in the Company’s news release dated September 26, 2022, the closing

of the Restart Financing Package was expected to occur on or about

October 5, 2022.

Since the Company’s news release of September

26, 2022:

- the Company has

made positive progress with the Toronto Stock Exchange (“TSX”) to

advance its previously announced financial hardship application

with respect to the Restart Financing Package;

- the Company’s

largest shareholder, Pala Investments Limited (“Pala”), has offered

additional financial support in the form of a US$25 million

backstop commitment to supplement the Restart Financing Package (on

top of Pala’s US$20 million equity investment under the Restart

Financing Package), thereby increasing the liquidity available to

the Company under the Restart Financing Package from up to US$93

million to up to US$118 million, which is expected to provide

sufficient funding of the restart plan through to positive

cashflow; and

- the Company has

been discussing a non-binding term sheet proposal received from a

third-party strategic investor for a separate investment that would

be implemented following the Restart Financing Package. This

transaction, if implemented, would provide additional funding and

result in a change of control of the Company (the “Change of

Control Proposal”).

In connection with consideration of the Change

of Control Proposal, the Company is in discussions with its various

financing parties to complete the Restart Financing Package as soon

as possible. This will allow the Company additional time to

evaluate, negotiate and, if appropriate, finalize the Change of

Control Proposal together with the implementation of the Restart

Financing Package. If agreement can be reached on the Change of

Control Proposal, such a transaction together with the Restart

Financing Package is expected to provide the Company with new

financing resources sufficient to complete the restart plan through

to positive cashflow.

There can be no assurance that the Change of

Control Proposal will be agreed upon by the parties, the terms and

conditions thereof or that any required approvals of the Company’s

stakeholders and applicable regulators will be obtained.

Operations Update

The Company has continued to make significant

progress with its previously announced restart plan which is

intended to de risk the restart process, including:

-

Completion of the Dike Crossing: In a major

milestone, the Company has substantially completed the second and

most critical dike crossing and is continuing lateral development

beyond the dike feature in order to access the larger stopes in the

higher-grade East North Zone.

-

Contractor Tender Process Advanced: The tender has

been issued for a new mining contractor for underground mine

development. Confirmations of interest have been received from a

number of highly qualified contractors that have reviewed the

tender documentation and plan to visit the site with a ‘bid walk’

to take place next week. The contract is expected to be awarded in

December.

- Restart

Execution Plan: The Company has completed a detailed

Project Execution Plan (the “PEP”) to accompany the third-party

independently reviewed mine plan which was completed in Q3 2022.

The PEP details how the phased approach to restart will be

achieved, the recruitment plan, how capital projects will be

managed, and how key risks will be mitigated, including key

learnings from the previous operations. Both the mine plan and PEP

have been reviewed in detail and approved by all of the Company’s

financing parties in their due diligence processes.

Additional Financing Support from

Pala

From April 2022 to the date hereof, Pala has

provided an aggregate of US$48.5 million of financing support to

the Company, including to bridge to the closing of the Restart

Financing Package. Pala has informed the Company that, in light of

ongoing consideration of the Change of Control Proposal, it is

willing to provide additional financing support to allow additional

time for the evaluation and negotiation of the Change of Control

Proposal and the corresponding delay in the closing of the Restart

Financing Package.

In this respect, Pala has agreed to provide

additional funding of up to US$5 million (as pre-funding of its

US$20 million equity investment under the Restart Financing

Package) pursuant to a promissory note. Draws by the Company are

subject to agreed use of proceeds and the Company reaching

satisfactory arrangements with certain creditors and vendors. The

promissory note has a maturity date of October 31, 2022 and bears

interest at 12% per annum on amounts drawn. The promissory note is

subject to approval by the TSX.

The board of directors of the Company has formed

a special committee (the ”Special Committee”) consisting of

independent directors to consider and oversee the negotiation of

the Restart Financing Package, the Change of Control Proposal and

the backstop commitment and promissory note to be provided by Pala.

The Special Committee has met continuously throughout the

evaluation and negotiation of all of such transactions and has

approved the promissory note.

Nevada Copper reminds shareholders that the

terms of the Restart Financing Package are currently non-binding

and closing is subject to, among other things, finalization of the

specific terms thereof, negotiation and execution of definitive

documentation and the satisfaction of various regulatory

requirements including approval of the TSX. There can be no

assurance that binding agreements will be entered into or completed

(or that the regulatory and third-party approvals will be obtained)

with respect to Restart Financing Package, the Change of Control

Proposal, the backstop commitment or the promissory note on terms

satisfactory to the Company and within the required timeframe, or

at all. If the Restart Financing Package is not completed, absent

other financing, the Company will not be able to continue carrying

on business in the ordinary course and may need to pursue

proceedings for creditor protection. The Company’s creditors may

also seek to commence enforcement action, including realizing on

their security over the Company’s assets.

Qualified Person

The technical information and data in this news

release has been reviewed by Steven Newman, Registered Member –

SME, Vice President, Technical Services for Nevada Copper, who is a

non-independent Qualified Person within the meaning of NI

43-101.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer

and owner of the Pumpkin Hollow copper project. Located in Nevada,

USA, Pumpkin Hollow has substantial reserves and resources

including copper, gold and silver. Its two fully permitted projects

include the high-grade Underground Mine and processing facility,

which is now in the production stage, and a large-scale open pit

project, which is advancing towards feasibility status.

Randy BuffingtonPresident &

CEO

For additional information, please see the

Company’s website at www.nevadacopper.com, or contact:

Tracey Thom | Vice President,

IR and Community Relationstthom@nevadacopper.com+1 775 391 9029

Cautionary Language on Forward Looking

Statements

This news release contains “forward-looking

information” and “forward-looking statements” within the meaning of

applicable Canadian securities laws. All statements in this news

release, other than statements of historical facts, are

forward-looking statements. Such forward-looking information and

forward-looking statements specifically include, but are not

limited to, statements that relate to the completion of the funding

package described above, including the terms and timing thereof,

the plans and requirement for supplementary financing and the

expected amounts thereof, regulatory requirements, the Company’s

“financial hardship” exemption application, the use of proceeds

from the Restart Financing Package, creditor protection

proceedings, mine planning, the execution of the mine restart plan

and expected development schedule, and the expected costs of the

restart and ramp-up process, expectations regarding the Company’s

restart and mine plans, the agreement of Pala to provide additional

funding and the terms thereof, and statements that relate to the

Change of Control Proposal. There can be no assurance that

transactions relating to the Restart Financing Package, the Change

of Control Proposal, the backstop commitment or the promissory note

will be completed or that the cost estimates for the Restart

Package will be accurate.

Forward-looking statements and information

include statements regarding the expectations and beliefs of

management. Often, but not always, forward-looking statements and

forward-looking information can be identified by the use of words

such as “plans”, “expects”, “potential”, “is expected”,

“anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates”, or “believes” or the

negatives thereof or variations of such words and phrases or

statements that certain actions, events or results “may”, “could”,

“would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements or information should not be read as

guarantees of future performance and results. They are subject to

known and unknown risks, uncertainties and other factors which may

cause the actual results and events to be materially different from

any future results, performance or achievements expressed or

implied by such forward-looking statements or information.

Such risks and uncertainties include, without

limitation, those relating to: requirements for additional capital

and no assurance can be given regarding the availability thereof;

the outcome of discussions with creditors and vendors; potential

creditor protection proceedings; the ability of the Company to

complete the ramp-up of the Underground Mine within the expected

cost estimates and timeframe; the impact of COVID-19 on the

business and operations of the Company; the state of financial

markets; history of losses; dilution; adverse events relating to

milling operations, construction, development and ramp-up,

including the ability of the Company to address underground

development and process plant issues; ground conditions; cost

overruns relating to development, construction and ramp-up of the

Underground Mine; loss of material properties; interest rate

increases; global economy; limited history of production; future

metals price fluctuations; speculative nature of exploration

activities; periodic interruptions to exploration, development and

mining activities; environmental hazards and liability; industrial

accidents; failure of processing and mining equipment to perform as

expected; labour disputes; supply problems; uncertainty of

production and cost estimates; the interpretation of drill results

and the estimation of mineral resources and reserves; changes in

project parameters as plans continue to be refined; possible

variations in ore reserves, grade of mineralization or recovery

rates from management’s expectations and the difference may be

material; legal and regulatory proceedings and community actions;

accidents; title matters; regulatory approvals and restrictions;

increased costs and physical risks relating to climate change,

including extreme weather events, and new or revised regulations

relating to climate change; permitting and licensing; dependence on

management information systems and cyber security risks; volatility

of the market price of the Company’s securities; insurance;

competition; hedging activities; currency fluctuations; loss of key

employees; other risks of the mining industry as well as those

risks discussed in the Company’s Management’s Discussion and

Analysis in respect of the year ended December 31, 2021 and the

quarter ended March 31, 2022 and in the section entitled “Risk

Factors” in the Company’s Annual Information Form dated March 31,

2022. The forward-looking statements and information contained in

this news release are based upon assumptions management believes to

be reasonable, including, without limitation: no adverse

developments in respect of the property or operations at the

project; no material changes to applicable laws; the ramp-up of

operations at the Underground Mine in accordance with management’s

plans and expectations; no worsening of the current COVID-19

related work restrictions; reduced impacts of COVID-19 going

forward; the Company will be able to obtain sufficient additional

funding to complete the ramp-up, no material adverse change to the

price of copper from current levels; and the absence of any other

factors that could cause actions, events or results to differ from

those anticipated, estimated or intended.

The forward-looking information and statements

are stated as of the date hereof. The Company disclaims any intent

or obligation to update forward-looking statements or information

except as required by law. Although the Company has attempted to

identify important factors that could cause actual actions, events,

or results to differ materially from those described in

forward-looking information and statements, there may be other

factors that could cause actions, events or results not to be as

anticipated, estimated or intended. Specific reference is made to

“Risk Factors” in the Company’s Management’s Discussion and

Analysis in respect of the year ended December 31, 2021 and the

quarter ended March 31, 2022 and “Risk Factors” in the Company’s

Annual Information Form dated March 31, 2022, for a discussion of

factors that may affect forward-looking statements and information.

Should one or more of these risks or uncertainties materialize,

should other risks or uncertainties materialize or should

underlying assumptions prove incorrect, actual results and events

may vary materially from those described in forward-looking

statements and information. For more information on the Company and

the risks and challenges of its business, investors should review

the Company’s filings that are available at www.sedar.com.

The Company provides no assurance that

forward-looking statements and information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance

on forward-looking statements or information.

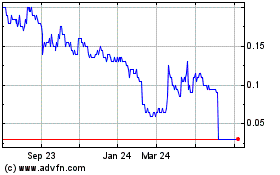

Nevada Copper (TSX:NCU)

Historical Stock Chart

From Jan 2025 to Feb 2025

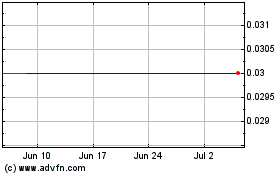

Nevada Copper (TSX:NCU)

Historical Stock Chart

From Feb 2024 to Feb 2025