Nevada Copper Corp. (TSX: NCU) (OTC: NEVDF) (FSE:

ZYTA) (“

Nevada Copper” or the

“

Company”) is pleased to announce that it has

filed a preliminary short form prospectus with the securities

commissions in all provinces of Canada, except Quebec, in

connection with a marketed public offering (the

“

Offering”) of units (the

“

Units”) of the Company seeking to raise aggregate

gross proceeds of approximately C$

75,000,000. The

Company’s largest shareholder, Pala Investments Limited

(“

Pala”), has committed to purchase, on a private

placement basis, an aggregate number of Units to maintain its

current shareholding percentage in the Company (the

“

Private Placement”) after giving effect to both

the Offering and the Private Placement (the “

Purchased

Units”) at the price per Purchased Unit determined in

connection with the Offering.

Each Unit will consist of one common share of

the Company (each a “Common Share”) and one-half

of one common share purchase warrant (each full warrant, a

“Warrant” and collectively the

“Warrants”). Each Warrant will be exercisable for

one Common Share at any time for a period of 18 months following

closing of the Offering. Final pricing of the Units, the Warrant

exercise price and the determination of the number of Units to be

sold pursuant to the Offering will be determined following

marketing. The Offering will be conducted on an overnight marketed

“best efforts” basis by a syndicate of underwriters to be formed

and led by Scotiabank, as lead underwriter and sole-bookrunner

(collectively, the “Underwriters”).

The Company intends to grant the Underwriters an

option, exercisable in whole or in part, at the sole discretion of

the Underwriters, at any time for a period of 30 days from and

including the closing of the Offering, to purchase from the Company

up to an additional 15% of the Units sold under the Offering, on

the same terms and conditions of the Offering to cover

over-allotments, if any, and for market stabilization purposes (the

“Over-Allotment Option”). The Over-Allotment

Option may be exercised by the Underwriters to purchase additional

Units, Common Shares, Warrants or any combination thereof.

As announced on October 12, 2021, the Company

entered into amendments to its amended and restated credit facility

(the “KfW Facility”) with its senior project

lender, KfW-IPEX Bank, for a significant deferral and extension of

its debt facilities, providing substantially greater balance sheet

flexibility and support for the completion of the ramp-up of its

underground mining operations and subsequent advancement of its

open pit project and broader property exploration targets. The

Company expects the effectiveness of the deferral and extensions

agreed under the KFW Facility to occur upon the closing of the

Offering and the Private Placement.

Additionally, in connection with the Offering,

the Company and Pala have agreed to amend the existing non-binding

term sheet as previously announced on October 12, 2021 to provide

for a binding commitment (the “Binding Term

Sheet”) in respect of certain amendments to the credit

facility entered into between Company and Pala on February 3, 2021

(as amended, the “Amended Credit Facility”). The

Amended Credit Facility will consolidate all outstanding loans

owing to Pala and the maturity date will be extended by two years

from 2024 to 2026. Net proceeds raised in the Offering will replace

the new tranche of up to US$41 million that was contemplated by the

non-binding term sheet, which will be a significant improvement to

the Company’s balance sheet. See the Company’s October 12, 2021

news release for additional details on the terms of the Amended

Credit Facility.

The Company intends to use the net proceeds of

the Offering for: (i) the development and ramp-up of the

underground mine at the Company’s Pumpkin Hollow project (the

“Underground Mine”); (ii) the repayment of bridge

loans advanced under the promissory note issued by the Company to

Pala on October 1, 2021, as amended and restated on November 1,

2021; and (iii) general corporate purposes. The net proceeds from

the Private Placement will be utilized to retire and prepay an

equivalent portion of the existing loans outstanding under the

promissory note issued by the Company to Pala on June 10, 2021, as

amended and restated (the “June Promissory

Note”), such that Pala will continue to maintain its

current shareholding percentage in the Company after giving effect

to the Offering and the Private Placement. The balance of the June

Promissory Note will be consolidated and extended under the Amended

Credit Facility in accordance with the Binding Term Sheet.

The Offering is expected to close on or about

November 29, 2021, or such other date as the Company and the

Underwriters may agree. Closing of the Offering is subject to

customary closing conditions, including, but not limited to, the

execution of an underwriting agreement and the receipt of all

necessary regulatory approvals, including the approval of the

securities regulatory authorities and the Toronto Stock Exchange.

The Private Placement is conditional on the closing of the

Offering.

The preliminary short form prospectus is

available on SEDAR at www.sedar.com. The Company has also today

filed on SEDAR its condensed interim financial statements and the

related management’s discussion and analysis for the quarter ended

September 30, 2021.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of securities in

the United States. The securities have not been and will not be

registered under the U.S. Securities Act or any state securities

laws and may not be offered or sold within the United States or to

U.S. Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

About Nevada Copper

Nevada Copper (TSX: NCU) is a copper producer

and owner of the Pumpkin Hollow copper project. Located in Nevada,

USA, Pumpkin Hollow has substantial reserves and resources

including copper, gold and silver. Its two fully permitted projects

include the high-grade Underground Mine and processing facility,

which is now in the production stage, and a large-scale open pit

project, which is advancing towards feasibility status.

NEVADA COPPER

CORP.www.nevadacopper.com

Randy Buffington, President and

CEO

For further information

contact:Rich Matthews, Investor RelationsIntegrous

Communicationsrmatthews@integcom.us+1 604 757 7179

Cautionary Language

This news release includes certain statements

and information that constitute forward-looking information within

the meaning of applicable Canadian securities laws. All statements

in this news release, other than statements of historical facts are

forward-looking statements. Such forward-looking statements and

forward-looking information specifically include, but are not

limited to, statements that relate to the completion of the

Offering and the Private Placement and the timing in respect

thereof, the entering into of the Amended Credit Facility and the

use of proceeds of the Offering and the Private Placement.

Forward-looking statements and information

include statements regarding the expectations and beliefs of

management. Often, but not always, forward-looking statements and

forward-looking information can be identified by the use of words

such as “plans”, “expects”, “potential”, “is expected”,

“anticipated”, “is targeted”, “budget”, “scheduled”, “estimates”,

“forecasts”, “intends”, “anticipates”, or “believes” or the

negatives thereof or variations of such words and phrases or

statements that certain actions, events or results “may”, “could”,

“would”, “might” or “will” be taken, occur or be achieved.

Forward-looking statements or information should not be read as

guarantees of future performance and results. They are subject to

known and unknown risks, uncertainties and other factors which may

cause the actual results and events to be materially different from

any future results, performance or achievements expressed or

implied by such forward-looking statements or information.

Such risks and uncertainties include, without

limitation, those relating to: the ability of the Company to

complete the ramp-up of the Underground Mine within the expected

cost estimates and timeframe; requirements for additional capital

and no assurance can be given regarding the availability thereof;

the impact of the COVID-19 pandemic on the business and operations

of the Company; the state of financial markets; history of losses;

dilution; adverse events relating to milling operations,

construction, development and ramp-up, including the ability of the

Company to address underground development and process plant

issues; failure to obtain the effectiveness of extensions under and

amendments to the KfW Facility; failure to enter into the Amended

Credit Facility; ground conditions; cost overruns relating to

development, construction and ramp-up of the Underground Mine; loss

of material properties; interest rates increase; global economy;

limited history of production; future metals price fluctuations;

speculative nature of exploration activities; periodic

interruptions to exploration, development and mining activities;

environmental hazards and liability; industrial accidents; failure

of processing and mining equipment to perform as expected; labor

disputes; supply problems; uncertainty of production and cost

estimates; the interpretation of drill results and the estimation

of mineral resources and reserves; changes in project parameters as

plans continue to be refined; possible variations in ore reserves,

grade of mineralization or recovery rates from management’s

expectations and the difference may be material; legal and

regulatory proceedings and community actions; accidents; title

matters; regulatory approvals and restrictions; increased costs and

physical risks relating to climate change, including extreme

weather events, and new or revised regulations relating to climate

change; permitting and licensing; volatility of the market price of

the Company’s securities; insurance; competition; hedging

activities; currency fluctuations; loss of key employees; other

risks of the mining industry as well as those risks discussed in

the Company’s Management’s Discussion and Analysis in respect of

the year ended December 31, 2020 and in the section entitled “Risk

Factors” in the Company’s Annual Information Form dated March 18,

2021. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those described in

forward-looking statements or information. The forward-looking

information or statements are stated as of the date hereof. Nevada

Copper disclaims any intent or obligation to update forward-looking

statements or information except as required by law. Readers are

referred to the additional information regarding Nevada Copper’s

business contained in Nevada Copper’s reports filed with the

securities regulatory authorities in Canada. Although the Company

has attempted to identify important factors that could cause actual

actions, events, or results to differ materially from those

described in forward-looking statements, there may be other factors

that could cause actions, events or results not to be as

anticipated, estimated or intended. For more information on Nevada

Copper and the risks and challenges of its business, investors

should review Nevada Copper’s filings that are available at

www.sedar.com.

Nevada Copper provides no assurance that

forward-looking statements and information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance

on forward-looking statements or information.

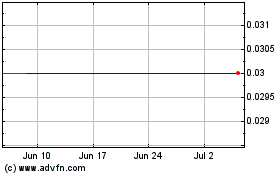

Nevada Copper (TSX:NCU)

Historical Stock Chart

From Jan 2025 to Feb 2025

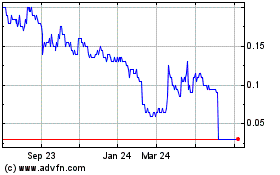

Nevada Copper (TSX:NCU)

Historical Stock Chart

From Feb 2024 to Feb 2025