Glacier Media Inc. (“Glacier” or the “Company”) reported revenue

and earnings for the period ended June 30, 2019.

Summary Results

| |

|

|

|

|

|

|

|

|

|

|

|

|

Three months ending June 30, |

|

Six month ending June 30, |

|

|

thousands of dollars, except share and per share amounts |

|

2019 |

|

|

|

2018 |

|

|

|

2019 |

|

|

|

2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

45,673 |

|

|

$ |

46,228 |

|

|

$ |

89,935 |

|

|

$ |

91,086 |

|

|

| EBITDA |

|

$ |

2,284 |

|

|

$ |

1,499 |

|

|

$ |

4,245 |

|

|

$ |

5,246 |

|

|

| EBITDA margin |

|

|

5.0 |

% |

|

|

3.2 |

% |

|

|

4.7 |

% |

|

|

5.8 |

% |

|

| EBITDA per share |

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.04 |

|

|

$ |

0.05 |

|

|

| Capital expenditures |

|

$ |

1,701 |

|

|

$ |

1,929 |

|

|

$ |

6,548 |

|

|

$ |

3,350 |

|

|

| Debt net of cash

outstanding before deferred financing |

|

|

|

|

|

|

|

|

|

charges and other expenses |

|

$ |

22,730 |

|

|

$ |

39,159 |

|

|

$ |

22,730 |

|

|

$ |

39,159 |

|

|

| Net income attributable to common

shareholder |

|

$ |

40,057 |

|

|

$ |

4,939 |

|

|

$ |

38,581 |

|

|

$ |

4,891 |

|

|

| Net income

attributable to common shareholder per share |

$ |

0.36 |

|

|

$ |

0.04 |

|

|

$ |

0.35 |

|

|

$ |

0.04 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Weighted average shares

outstanding, net |

|

|

109,828,731 |

|

|

|

109,828,731 |

|

|

|

109,828,731 |

|

|

|

109,828,731 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Results including joint ventures

and associates: |

|

|

|

|

|

|

|

|

|

| Revenue (1) |

|

$ |

56,620 |

|

|

$ |

60,101 |

|

|

$ |

114,124 |

|

|

$ |

118,370 |

|

|

| EBITDA (1) |

|

$ |

4,096 |

|

|

$ |

4,900 |

|

|

$ |

8,991 |

|

|

$ |

11,158 |

|

|

| EBITDA margin (1) |

|

|

7.2 |

% |

|

|

8.2 |

% |

|

|

7.9 |

% |

|

|

9.4 |

% |

|

|

EBITDA per share (1) |

|

$ |

0.04 |

|

|

$ |

0.04 |

|

|

$ |

0.08 |

|

|

$ |

0.10 |

|

|

| (1) Certain

results are presented to include the Company’s proportionate share

of its joint venture and associate operations, as this is the basis

on which management bases its operating decisions and performance.

The Company’s joint ventures and associates include Continental

Newspapers Ltd, Great West Newspapers Limited Partnership, the

Victoria Times-Colonist, Rhode Island Suburban Newspapers, Inc.,

Village Media Inc. and Borden Bridge Development Corporation. These

reported results have been reconciled to IFRS results in

Management’s Discussion and Analysis (“MD&A”). |

|

Highlights for the Period

Consolidated revenue was $45.7 million for the

period, down $0.6 million or 1.2%. Consolidated EBITDA was $2.3

million for the period, up $0.8 million or 52.4% from the prior

year.

Including the Company’s share of joint ventures

and associates, revenue was $56.6 million, down $3.5 million or

5.8% and EBITDA was $4.1 million, down $0.8 million or 16.4%. The

decreases were partially the result of the sale of Fundata in April

2019.

The Company continues to make progress in its

key growth areas in business information and digital media, which

are offsetting expected print revenue declines, as demonstrated by

the overall revenue performance. Revenue has also been positively

impacted by the acquisition of Castanet. Digital focused businesses

typically have higher margins and higher valuations than print

revenue businesses once sufficient scale is achieved, so the

Company can achieve higher value with lower consolidated revenue

going forward. However, continued investment in product development

and softness in print media community advertising are still

constraining EBITDA growth.

During the quarter, the Company acquired the

assets of Castanet Media Ltd. (“Castanet”) and related radio

assets. The purchase price was $22.0 million for the Castanet

assets and $2.0 million for the shares of the company that owns the

radio station. $19.0 million was paid at closing and the remainder

is payable over two years. The acquisition of the radio station

shares is subject to Canadian Radio-television and

Telecommunications Commission approval. The acquisition of Castanet

bolsters the Company’s digital media presence.

During the quarter, the Company sold its 50%

interest in Fundata for a sale price of $55.0 million. $45.0

million of the sale price was received at closing and $10.0 million

is receivable over four years through a vendor take-back. As a

result of the sale, the Company was able to repay the term loan and

a portion of the revolving loan, significantly reducing overall

debt levels. The purchase price highlights the value of the data,

analytics and intelligence products and services the Company owns

and is focused on. These products and services provide high value

to their users through the nature of their data and functionality,

and fulfill a high level of need. They also generate strong

recurring revenue and cash flows.

During the quarter, the Company borrowed $10.0

million through an unsecured loan that was arranged from Madison

Venture Corporation (“Madison”) in order to provide certainty of

funding for the Castanet acquisition and allow greater financial

flexibility compared to increased senior debt borrowing. It was not

clear while the Castanet acquisition was being pursued and

negotiated that the Fundata disposition would occur, and certainty

of financing was required for the Castanet acquisition to be

undertaken on an exclusive and confidential basis. During the

quarter, the Company repaid $6.0 million of the unsecured loan,

with $4.0 million outstanding at June 30, 2019. Subsequent to June

30, 2019, the Company repaid the remaining $4.0 million. The

unsecured loan was repaid and replaced with senior debt to reduce

the overall cost of borrowing

Subsequent to June 30, 2019, the Company

completed a private placement of 15,384,615 common shares at a

price of $0.65 per share for gross proceeds of $10.0 million. The

net proceeds of the Private Placement were initially used to reduce

the overall debt level, but ultimately shall be used for investment

purposes and general working capital needs. The Private Placement

will allow the Company to pursue strategic investments as they

arise to increase its scale, competitiveness and operating strength

while maintaining lower debt levels.

Operational Overview

ERIS experienced strong growth in both Canada

and the U.S., with significant new customer additions and renewals

including new mid-sized customers in the U.S. market. REW, the

Company’s online real estate portal, continues to grow in terms of

site features, traffic and revenues. Revenue grew despite the

slower real estate conditions in the Vancouver market; however,

growth was bolstered by the market in Toronto which continues to

strengthen.

Conditions in the agricultural market continue

to be soft amid uncertainty from trade disputes and the

consolidation of major crop input companies. These adverse

conditions weighed on second quarter performance. The Company did,

however, continue to invest in and see solid growth in key

agricultural information operations such as outdoor shows and

online listings.

The energy group remains stable for the period

after the substantial restructurings enacted over the last two

years. The Company’s mining operations, the Northern Miner and

Infomine, operated in choppy market conditions.

Community media print advertising revenues

declined as anticipated, while digital revenues grew substantially.

It is becoming apparent that a viable long-term digital community

media business model exists where the Company can leverage its

broad presence in local markets across Western Canada and offer

local websites, digital marketing services and specialty digital

products. Additionally, the acquisition of Castanet will have a

positive effect on digital revenue growth going forward.

The Company is investing in the digital business

by hiring and training to broaden our skills and experience base in

line with market needs and opportunities, as well as product and

services development.

Outlook

The Company continues to find meaningful growth

opportunities in each of its sectors with which to increase value,

and is achieving market traction in each one.

Management will focus on making progress in its

growth areas, improving profitability and reducing debt further in

order to maintain financial flexibility and be in a position to

exploit opportunities should they arise.

Financial Position

At June 30, 2019, senior debt decreased to $20.0

million. The proceeds from the sale of Fundata were used to

extinguish the term loan and reduce the revolving loan. $4.0

million of unsecured Madison debt was outstanding at June 30, 2019,

the balance of which was paid off in July 2019. The unsecured loan

was repaid and replaced with senior debt to lower overall cost of

borrowing. Increased capital investments were made in the Company’s

key growth initiatives, particularly ERIS, REW and the agricultural

shows. The Company’s consolidated non-recourse, non-mortgage debt

has been reduced to a nil position net of cash on hand as a result

of significant debt repayment. This will allow for increased

distributions to the Company in the future.

Shares in Glacier are traded on the Toronto

Stock Exchange under the symbol GVC. For further information,

please contact Mr. Orest Smysnuik, Chief Financial Officer, at

604-708-3264. About the Company:

Glacier Media Inc. is an information & marketing

solutions company pursuing growth in sectors where the provision of

essential information and related services provides high customer

utility and value. Glacier’s strategy is implemented through two

operational areas: content and marketing solutions; and data,

analytics and intelligence.

Financial MeasuresTo supplement

the consolidated financial statements presented in accordance with

International Financial Reporting Standards, Glacier uses certain

non-IFRS measures that may be different from the performance

measures used by other companies. These non-IFRS measures include

earnings before interest, taxes, depreciation and amortization

(EBITDA) and all measures including joint ventures and associates

which are not alternatives to IFRS financial measures. These

non-IFRS measures do not have any standardized meanings prescribed

by IFRS and accordingly they are unlikely to be comparable to

similar measures presented by other issuers.

Forward Looking StatementsThis

news release contains forward-looking statements that relate to,

among other things, the Company’s objectives, goals, strategies,

intentions, plans, beliefs, expectations and estimates. These

forward-looking statements include, among other things, statements

relating to our expectations regarding revenues, expenses, cash

flows, future profitability, the effect of the proposed share

consolidation and the effect of our strategic initiatives and

restructuring, including our expectations to grow certain

operations, invest in key strategic areas, to reduce debt levels

and that reduced debt levels in investment entities will result in

further distributions to the Company. These forward-looking

statements are based on certain assumptions, including continued

economic growth and recovery and the realization of cost savings in

a timely manner and in the expected amounts, which are subject to

risks, uncertainties and other factors which may cause results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements, and undue

reliance should not be placed on such statements.

Important factors that could cause actual

results to differ materially from these expectations include

failure to implement or achieve the intended results from our

strategic initiatives, the failure to reduce debt and the other

risk factors listed in our Annual Information Form under the

heading “Risk Factors” and in our Interim MD&A under the

heading “Business Environment and Risks”, many of which are out of

our control. These other risk factors include, but are not limited

to, the ability of the Company to sell advertising and

subscriptions related to its publications, foreign exchange rate

fluctuations, the seasonal and cyclical nature of the agricultural

and energy sectors, discontinuation of government grants, general

market conditions in both Canada and the United States, changes in

the prices of purchased supplies including newsprint, the effects

of competition in the Company’s markets, dependence on key

personnel, integration of newly acquired businesses, technological

changes, tax risk, financing risk, debt service risk and

cybersecurity risk.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, the

Company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

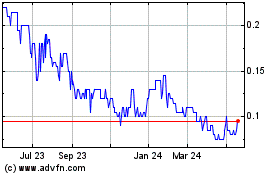

Glacier Media (TSX:GVC)

Historical Stock Chart

From Nov 2024 to Dec 2024

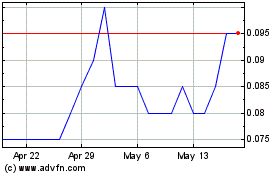

Glacier Media (TSX:GVC)

Historical Stock Chart

From Dec 2023 to Dec 2024