E-L Financial Corporation Limited Announces March 31, 2012 Interim Financial Results

May 10 2012 - 11:51AM

Marketwired Canada

E-L Financial Corporation Limited ("E-L Financial")

(TSX:ELF)(TSX:ELF.PR.F)(TSX:ELF.PR.G)(TSX:ELF.PR.H) today reported that for the

quarter ended March 31, 2012, consolidated net operating income(1) of $44.9

million or $10.80 per share(2) compared with $25.1 million or $5.74 per share in

2011.

The $19.8 million increase in net operating income in 2012 versus 2011 is

principally attributable to an $11.9 million increase in net operating income

for the general insurance operation (The Dominion). The Dominion's increase in

net operating income is due mainly to improved automobile claims experience,

lower weather-related claims costs for personal and commercial property and

lower claims frequency for non-weather-related personal property claims. Net

operating income for the life insurance operation (Empire Life) improved $4.0

million primarily due to the favourable impact of higher long-term interest

rates on the Individual Insurance product line.

Net income

E-L Financial earned consolidated net income of $155.7 million or $38.99 per

share compared with $50.2 million or $12.11 per share in 2011.

In addition to the increase in net operating income described above, 2012 net

income was positively impacted by improvements in the global equity markets.

Fair value through profit or loss investments held at E-L Corporate increased

$70.3 million compared to $6.0 million in 2011. As well, increases in the value

of the Company's interest in Economic Investment Trust Limited and United

Corporations Limited, partially offset by losses from Algoma Central

Corporation, resulted in income from associates of $31.4 million for the first

three months of 2012 compared to $7.1 million in 2011.

Comprehensive income

E-L Financial earned consolidated comprehensive income of $168.6 million or

$42.26 per share for the first three months of 2012 compared of $45.8 million or

$11.01 per share in 2011. Consolidated other comprehensive income was $12.9

million or $3.27 per share compared with other comprehensive loss of $4.4

million or $1.10 per share in 2011. The improvement in other comprehensive

income for the quarter reflected a larger unrealized fair value increase on

available for sale investments compared to the prior period.

"Strong equity markets and improved profitability across all business segments

helped us finish the quarter on a high note", said Duncan Jackman, Chairman,

President and CEO of E-L Financial.

CONSOLIDATED SUMMARY OF COMPREHENSIVE INCOME

----------------------------------------------------------------------------

Period ended March 31, 2012

------------------------------------------------------

E-L The

(thousands of dollars) Corporate Dominion Empire Life Total

----------------------------------------------------------------------------

Net operating income $ 7,227 $ 25,322 $ 12,393 $ 44,942

Realized gain on

available for sale

investments including

impairment write

downs 528 7,099 1,485 9,112

Share of income of

associates 31,370 - - 31,370

E-L Corporate's fair

value change in fair

value through profit

or loss investments 70,304 - - 70,304

----------------------------------------------------------------------------

Net income 109,429 32,421 13,878 155,728

Other comprehensive

income (loss) 8,436 5,401 (984) 12,853

----------------------------------------------------------------------------

Comprehensive income $ 117,865 $ 37,822 $ 12,894 $ 168,581

----------------------======================================================

----------------------------------------------------------------------------

Period ended March 31, 2011

------------------------------------------------------

E-L The

(thousands of dollars) Corporate Dominion Empire Life Total

------------------------------------------------------

Net operating income $ 3,308 $ 13,389 $ 8,387 $ 25,084

Realized gain on

available for sale

investments including

impairment write

downs 1,125 8,027 2,778 11,930

Share of income of

associates 7,142 - - 7,142

- -

E-L Corporate's fair

value change in fair

value through profit

or loss investments 6,018 - - 6,018

------------------------------------------------------

Net income 17,593 21,416 11,165 50,174

Other comprehensive

(loss) income (2,587) (4,911) 3,122 (4,376)

------------------------------------------------------

Comprehensive income $ 15,006 $ 16,505 $ 14,287 $ 45,798

----------------------======================================================

(1)Use of non-GAAP measures:

"net operating income" is net income excluding realized gain on available for

sale investments including impairment write downs, the Company's share of income

from associates and the fair value change in fair value through profit or loss

investments in the E-L Corporate portfolio, all net of tax. The term net

operating income does not have any standardized meaning according to GAAP and

therefore may not be comparable to similar measures presented by other

companies.

(2)All earnings per share figures are net of dividends paid on First Preference

shares.

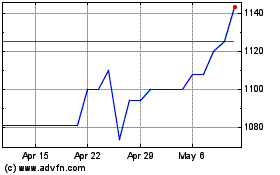

E L Financial (TSX:ELF)

Historical Stock Chart

From Jun 2024 to Jul 2024

E L Financial (TSX:ELF)

Historical Stock Chart

From Jul 2023 to Jul 2024