E-L Financial Corporation Announced Offering of C$100 Million of Preference Shares

March 09 2012 - 8:50AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES

E-L Financial Corporation Limited (the "Corporation")

(TSX:ELF)(TSX:ELF.PR.F)(TSX:ELF.PR.G) announced today that it has entered into

an agreement with Scotia Capital Inc. and TD Securities Inc., on behalf of a

syndicate of underwriters, under which the underwriters have agreed to buy, on a

bought deal basis, 4,000,000 First Preference Shares, Series 3 (the "Series 3

Preference Shares"). The total gross proceeds of the financing will be $100.0

million.

The Series 3 Preference Shares will be priced at $25.00 per share and will pay

non-cumulative quarterly dividends that will yield 5.50% per annum. The net

proceeds of the offering will be added to the Corporation's capital base to

supplement the Corporation's financial resources and used for general corporate

purposes. The transaction is subject to the receipt of all necessary regulatory

and stock exchange approvals. The offering is expected to close on or about

April 2, 2012.

The Preference Shares being offered have not been and will not be registered

under the U.S. Securities Act of 1933, as amended, and may not be offered or

sold in the United States absent registration or an applicable exemption from

the registration requirements. This media release does not constitute an offer

to sell or the solicitation of an offer to buy, nor shall there be any offer,

solicitation or sale of the securities in the United States or any state thereof

or in any province or territory of Canada in which such offer, solicitation or

sale would be unlawful.

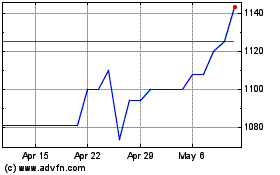

E L Financial (TSX:ELF)

Historical Stock Chart

From Jun 2024 to Jul 2024

E L Financial (TSX:ELF)

Historical Stock Chart

From Jul 2023 to Jul 2024