Canoe Financial Renews At-The-Market Equity Program for Canoe EIT Income Fund

December 09 2022 - 9:14AM

Canoe EIT Income Fund (the “Fund”) (TSX: EIT.UN) (TSX: EIT.PR.A)

(TSX: EIT.PR.B) is pleased to announce that it is renewing its

at-the-market equity program (the “ATM Program”) that will allow

the Fund to issue up to $625,000,000 of units of the Fund (the

“Units”) to the public from time to time, at the discretion of

Canoe Financial LP (the “Manager”). Any ATM Program Units issued

will be sold at the prevailing market price at the time of sale

through the Toronto Stock Exchange (the “TSX”) or any other

marketplace in Canada on which the Units are listed, quoted or

otherwise traded. This ATM Program replaces the prior program

established in December 2021 that has terminated.

The volume and timing of distributions under the ATM Program, if

any, will be determined at the Manager’s sole discretion. The ATM

Program will be effective until January 7, 2025 unless terminated

prior to such date by the Fund. The Fund intends to use the

proceeds from the ATM Program in accordance with the Fund’s

investment objectives and strategies, subject to the Fund’s

investment restrictions.

The Fund’s regular monthly distribution of $0.10 per Unit

remains unchanged. The Fund has maintained the $0.10 per Unit

monthly distribution since August 2009, through varying market

conditions. The Fund’s annual voluntary redemption feature for

unitholders also remains unchanged.

Sales of the Units through the ATM Program will be made pursuant

to the terms of an equity distribution agreement dated December 8,

2022 with National Bank Financial Inc. (the “Agent”).

Sales of Units will be made by way of “at-the-market

distributions” as defined in National Instrument 44-102 Shelf

Distributions on the TSX or on any marketplace for the Units in

Canada. Since the Units will be distributed at prevailing market

prices at the time of the sale, prices may vary among purchasers

during the period of distribution. In order to ensure that the

price at which the Units are sold under the ATM Program is at least

equal to the most recent net asset value per Unit, the Manager may

make voluntary cash contributions per Unit to the Fund depending on

the price at which Units are sold during the period of any

distribution. The ATM Program is being offered pursuant to a

prospectus supplement dated December 8, 2022 to the Fund’s short

form base shelf prospectus dated December 7, 2022. Copies of the

prospectus supplement and the short form base shelf prospectus may

be obtained from your registered financial advisor using the

contact information for such advisor, or from representatives of

the Agent, and are available on SEDAR at www.sedar.com.

The Units have not been, nor will be, registered under the

United States Securities Act of 1933, as amended, or any state

securities laws and may not be offered or sold in the United States

or to U.S. persons absent registration or applicable exemption from

the registration requirement of such Act and applicable state

securities laws. This news release shall not constitute an offer to

sell, or the solicitation of an offer to buy, nor shall there be

any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to

qualification under the securities laws of any such

jurisdiction.

About Canoe EIT Income Fund

Canoe EIT Income Fund is one of Canada’s largest closed-end

investment funds, designed to maximize monthly distributions and

capital appreciation by investing in a broadly diversified

portfolio of high quality securities. The Fund is listed on the TSX

under the symbols EIT.UN, EIT.PR.A and EIT.PR.B, and is actively

managed by Robert Taylor, Senior Vice President and Chief

Investment Officer, Canoe Financial.

About Canoe Financial

Canoe Financial is one of Canada’s fastest growing independent

mutual fund companies managing over $12.0 billion in assets across

a diversified range of award-winning investment solutions. Founded

in 2008, Canoe Financial is an employee-owned investment management

firm focused on building financial wealth for Canadians. Canoe

Financial has a significant presence across Canada, including

offices in Calgary, Toronto and Montreal.

For further information, please

contact:Investor

Relations1-877-434-2796www.canoefinancial.cominfo@canoefinancial.com

Forward Looking Statement: Certain statements

included in this news release constitute forward looking statements

which reflect Canoe Financial LP’s current expectations regarding

future results or events. Words such as “may,” “will,” “should,”

“could,” “anticipate,” “believe,” “expect,” “intend,” “plan,”

“potential,” “continue” and similar expressions have been used to

identify these forward-looking statements. In addition, any

statement regarding future performance, strategies, prospects,

action or plans is also a forward-looking statement. Market

predictions and forward-looking statements are subject to known and

unknown risks and uncertainties and other factors that may cause

actual results, performance, events, activity and achievements to

differ materially from those expressed or implied by such

statements. Forward looking statements involve significant risks

and uncertainties and a number of factors could cause actual

results to materially differ from expectations discussed in the

forward looking statements including, but not limited to, changes

in general economic and market conditions and other risk factors.

Although the forward-looking statements are based on what Canoe

Financial LP believes to be reasonable assumptions, we cannot

assure that actual results will be consistent with these

forward-looking statements. Investors should not place undue

reliance on forward-looking statements. These forward-looking

statements are made as of the current date and we assume no

obligation to update or revise them to reflect new events or

circumstances.

The Fund makes monthly distributions of an

amount comprised in whole or in part of return of capital (ROC) of

the net asset value per Unit. A ROC reduces the amount of your

original investment and may result in the return to you of the

entire amount of your original investment. ROC that is not

reinvested will reduce the net asset value of the Fund, which could

reduce the Fund’s ability to generate future income. You should not

draw any conclusions about the Fund’s investment performance from

the amount of this distribution.

Commissions, trailing commissions, management

fees and expenses all may be associated with investment funds.

Please read the information filed about the Fund on www.sedar.com

before investing. Investment funds are not guaranteed and past

performance may not be repeated.

This communication is not to be construed as a

public offering to sell, or a solicitation of an offer to buy

securities. Such an offer can only be made by way of a prospectus

or other applicable offering document and should be read carefully

before making any investment. This release is for information

purposes only. Investors should consult their Investment Advisor

for details and risk factors regarding specific strategies and

various investment products.

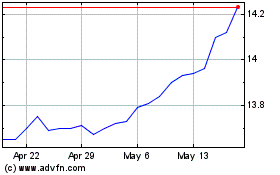

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

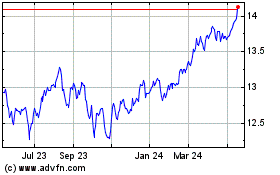

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024