Endeavour Silver Corp.

(“Endeavour” or the

“Company”) (NYSE: EXK; TSX: EDR) reports

third quarter 2023 production of 1,148,735 silver ounces (oz) and

9,089 gold oz, for silver equivalent1 (“AgEq”) production of 1.9

million oz. Production continues to track in-line with the 2023

production guidance of 8.6-9.5 million silver equivalent ounces,

totaling 6.5 million AgEq oz for the nine months ended September

30, 2023.

“Our production decreased this quarter compared

to previous quarters due to lower throughput and ore grades

processed at Guanacevi. We mined lower grades due to mine

sequencing changes related to access and ventilation, whereas

throughput was impacted due to an extended scheduled maintenance

program. The mine sequencing is now back to plan, which will result

in access to improved ore grades going forward. Additionally, the

maintenance program has been executed successfully to minimize

operational risks in the mill,” stated Dan Dickson, Chief Executive

Officer. “We anticipate improved operational performance and

operational efficiency in the last quarter.”

Q3 2023 Highlights

-

Guanacevi Performance: Production was below plan

due to a reduction in silver and gold grades and also impacted by

lower processed tonnes due to a scheduled maintenance shutdown.

Mine sequencing changes that were initiated in Q2 have resulted in

lower grades compared to plan and historical comparisons. It is

expected that the grades will increase in Q4 and stabilize going

forward.

-

Bolañitos’ Performance Remained Steady: Strong

gold production, higher gold grades and increased throughput were

offset by the impact of lower silver production and silver

grades.

- Metal

Sales and Inventories: Sold 1,370,032 oz silver and 8,760

oz gold during the quarter. Held 416,033 oz silver and 1,253 oz

gold of bullion inventory and 8,184 oz silver and 436 oz gold in

concentrate inventory at quarter end.

-

Completed the sale of the Cozamin Royalty to Gold Royalty

Corp: Total consideration of US$7,500,000 was received by

the Company in cash upon closing on the sale of the 1% Cozamin

royalty (see news release dated August 30, 2023).

-

Published Mid-Term Update on our 2022-2024 Sustainability

Strategy: This publication describes the Company’s

progress in executing the first half (18 months) of its three-year

plan. Of the 39 targets that were set in the 2022-2024

Sustainability Strategy, 21 have been completed or achieved, 13 are

on track or underway and 5 require more improvement.

Subsequent to Q3

-

Obtained US$120 Million Project Financing for

Terronera: Societe Generale and ING Capital LLC (together

with ING Bank N.V.) have signed a definitive credit agreement for a

senior secured debt facility of US$120 million (see news release

dated October 10, 2023).

Q3 2023 Mine Operations

Consolidated silver production decreased 21% to

1,148,735 ounces in Q3, 2023 compared to Q3, 2022, primarily driven

by decreased silver production at the Guanacevi mine due to a

reduction in silver grade partially offset by higher milling rates.

Although historically higher grades have been mined from the El

Curso orebody, mine sequencing changes during Q2, 2023 have

resulted in lower grades compared to both Q3, 2022 and Q2, 2023. It

is expected that grades will increase in Q4, 2023. Local

third-party ores continued to supplement mine production, totaling

21% of quarterly throughput.

Consolidated gold production decreased by 1% to

9,089 ounces primarily due to increased throughput at both the

Guanacevi and Bolanitos mines offset by a reduction in gold grade

mined at the Guanacevi mine.

Guanacevi Q3, 2023 throughput was 6% higher than

Q3, 2022 with silver grades 27% lower and gold grades 20% lower.

Silver production decreased by 22% while gold production decreased

by 13% at the Guanacevi mine.

Bolañitos Q3, 2023 throughput was 6% higher than

Q3, 2022 with silver grades 15% lower and gold grades 1% higher.

Silver production decreased by 15% while gold production increased

by 7% at the Bolañitos mine. The change in grades was due to

typical variations in the ore body.

Scheduled Maintenance at

Guanacevi

Towards the end of the third quarter, Guanacevi

entered its scheduled maintenance shutdown, which took place in the

last week of September and the first week of October. Repairs and

maintenance work were performed on a filter press transformer, the

primary thickener, and the secondary crushing circuit.

Concurrently, mining activities have been focused on building

stockpiles. With the maintenance work now complete, both the mine

and the plant are back to operating according to plan. The Company

believes that it is well positioned to complete this year within

the previously stated production guidance of between 8.6-9.5

million silver equivalent ounces.

Production Highlights for the Three and Nine Months

Ended September 30, 2023

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2023 |

2022 |

% Change |

|

2023 |

2022 |

% Change |

|

214,270 |

202,745 |

6% |

Throughput (tonnes) |

653,918 |

610,253 |

7% |

|

1,148,735 |

1,458,448 |

(21%) |

Silver ounces produced |

4,266,280 |

4,132,610 |

3% |

|

9,089 |

9,194 |

(1%) |

Gold ounces produced |

28,250 |

27,178 |

4% |

|

1,140,597 |

1,445,880 |

(21%) |

Payable silver ounces produced |

4,231,064 |

4,095,696 |

3% |

|

8,929 |

9,039 |

(1%) |

Payable gold ounces produced |

27,749 |

26,705 |

4% |

|

1,875,855 |

2,193,968 |

(14%) |

Silver equivalent ounces produced |

6,526,280 |

6,306,850 |

3% |

|

1,370,032 |

1,327,325 |

3% |

Silver ounces sold |

4,337,112 |

3,647,987 |

19% |

|

8,760 |

8,852 |

(1%) |

Gold ounces sold |

27,769 |

27,025 |

3% |

Production Tables for Q3 2023 by Mine

Mine-by-mine production in the third quarter and the nine months

ended September 30th, 2023 was:

|

Production |

Tonnes |

Tonnes |

Grade |

Grade |

Recovery |

Recovery |

Silver |

Gold |

|

by mine |

Processed |

per day |

Ag gpt* |

Au gpt* |

Ag % |

Au % |

Oz |

Oz |

|

Guanaceví |

103,345 |

1,123 |

341 |

1.03 |

91.9% |

92.4% |

1,041,211 |

3,161 |

|

Bolañitos |

110,925 |

1,206 |

37 |

1.89 |

82.6% |

87.9% |

107,524 |

5,928 |

|

Consolidated |

214,270 |

2,329 |

183 |

1.48 |

90.9% |

89.4% |

1,148,735 |

9,089 |

*gpt = grams per tonneTotals may not add due to rounding

Production Tables for the Nine Months Ended September

30, 2023 by Mine

|

Production |

Tonnes |

Tonnes |

Grade |

Grade |

Recovery |

Recovery |

Silver |

Gold |

|

by mine |

Processed |

per day |

Ag gpt* |

Au gpt* |

Ag % |

Au % |

Oz |

Oz |

|

Guanaceví |

322,628 |

1,182 |

416 |

1.18 |

88.8% |

91.8% |

3,833,558 |

11,234 |

|

Bolañitos |

331,290 |

1,214 |

48 |

1.81 |

84.6% |

88.3% |

432,722 |

17,016 |

|

Consolidated |

653,918 |

2,395 |

230 |

1.50 |

88.4% |

89.6% |

4,266,280 |

28,250 |

*gpt = grams per tonneTotals may not add due to rounding

Qualified Person

Dale Mah, P.Geo., Vice President Corporate Development, a

qualified person under NI 43-101, has reviewed and approved the

scientific and technical information related to operational matters

contained in this news release.

Q3 2023 Financial Results and Conference

Call

The Company’s Q3 2023 financial results will be

released before markets open on Tuesday, November 7, 2023, and a

telephone conference call will be held the same day at 10:00 a.m.

PT / 1:00 p.m. ET. To participate in the conference call, please

dial the numbers below.

| Date &

Time: |

|

Tuesday,

November 7, 2023 at 10:00 a.m. PT / 1:00 p.m. ET |

| |

|

|

| Telephone: |

|

Toll-free in Canada and the US +1-800-319-4610 |

| |

|

Local or International +1-604-638-5340 |

| |

|

Please allow up to 10 minutes to be connected to the conference

call. |

| |

|

|

| Replay: |

|

A replay of the conference call will be available by dialing

(toll-free) |

| |

|

+1-800-319-6413 in Canada and the US (toll-free) or

+1-604-638-9010 outside of Canada and the US. The replay passcode

is 0484#. The replay will also be available on the Company’s

website at www.edrsilver.com. |

About Endeavour Silver –

Endeavour is a mid-tier precious metals mining company that

operates two high-grade underground silver-gold mines in Mexico.

Endeavour is advancing construction of the Terronera Project and

exploring its portfolio of exploration projects in Mexico, Chile

and the United States to facilitate its goal to become a premier

senior silver producer. Our philosophy of corporate social

integrity creates value for all stakeholders.

Contact Information:

Galina Meleger, VP, Investor RelationsEmail:

gmeleger@edrsilver.comWebsite: www.edrsilver.comFollow Endeavour

Silver on Facebook, Twitter, Instagram and LinkedIn.

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” within the meaning of the United States private

securities litigation reform act of 1995 and “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Such forward-looking statements and information herein

include but are not limited to statements regarding the development

and financing of the Terronera Project, Endeavour’s anticipated

performance in 2023 including changes in mining operations and

forecasts of production levels, anticipated production costs and

all-in sustaining costs and the timing and results of various

activities. The Company does not intend to and does not assume any

obligation to update such forward-looking statements or

information, other than as required by applicable law.

Forward-looking statements or information

involve known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, production

levels, performance or achievements of Endeavour and its operations

to be materially different from those expressed or implied by such

statements. Such factors include but are not limited changes in

production and costs guidance; the ongoing effects of inflation and

supply chain issues on mine economics; national and local

governments, legislation, taxation, controls, regulations and

political or economic developments in Canada and Mexico; financial

risks due to precious metals prices; operating or technical

difficulties in mineral exploration, development and mining

activities; risks and hazards of mineral exploration, development

and mining; the speculative nature of mineral exploration and

development; risks in obtaining necessary licenses and permits; and

challenges to the Company’s title to properties; as well as those

factors described in the section “risk factors” contained in the

Company’s most recent form 40F/Annual Information Form filed with

the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on

assumptions management believes to be reasonable, including but not

limited to: the continued operation of the Company’s mining

operations, no material adverse change in the market price of

commodities, forecasted mine economics as of 2023, mining

operations will operate and the mining products will be completed

in accordance with management’s expectations and achieve their

stated production outcomes, and such other assumptions and factors

as set out herein. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements or

information, there may be other factors that cause results to be

materially different from those anticipated, described, estimated,

assessed or intended. There can be no assurance that any

forward-looking statements or information will prove to be accurate

as actual results and future events could differ materially from

those anticipated in such statements or information. Accordingly,

readers should not place undue reliance on forward-looking

statements or information.

1 Silver equivalent calculated using an 80:1 silver:gold

ratio.

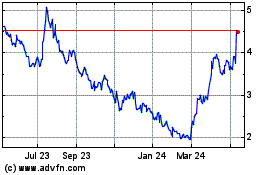

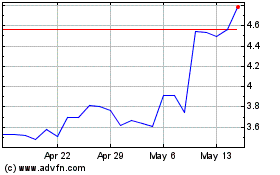

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Endeavour Silver (TSX:EDR)

Historical Stock Chart

From Feb 2024 to Feb 2025