(All monetary figures are expressed in U.S dollars unless otherwise

stated)

Dundee Precious Metals Inc. ("DPM" or the "Company") (TSX:

DPM)(TSX: DPM.WT)(DPM.WT.A) today announced its unaudited results

for the fourth quarter ended December 31, 2010. DPM reported fourth

quarter of 2010 net earnings attributable to equity shareholders of

the Company of $20.9 million (basic net earnings per share of $0.17

and diluted net earnings per share of $0.15). This compares with

fourth quarter of 2009 net earnings attributable to equity

shareholders of the Company of $3.5 million (basic and diluted net

earnings per share of $0.04).

For the year 2010, the Company had net earnings attributable to

equity shareholders of the Company of $23.5 million (basic net

earnings per share of $0.20 and diluted net earnings per share of

$0.19). This compares with net earnings attributable to equity

shareholders of the Company of $5.1 million (basic and diluted net

earnings per share of $0.05) for the year 2009.

"2010 was an important year for DPM," said Jonathan Goodman,

President and Chief Executive Officer. "In addition to reaching the

one million tonne a year production milestone at Chelopech and

securing downstream processing for our Chelopech concentrate

through the smelter purchase, we achieved a 25% increase in gross

profit, year over year. With Deno Gold operating at its expanded

annual capacity of 600,000 tonnes and Chelopech completing its mill

expansion, we expect that 2011 will prove to be even more

profitable for our shareholders."

The following table summarizes the Company's financial and operating

results for the periods indicated:

---------------------------------------------------------------------------

$ millions, except per share amounts

Ended December 31, Three Months Twelve Months

------------------- -------------------

2010 2009 2010 2009

---------------------------------------------------------------------------

Net Revenue $ 61.4 $ 42.1 $ 201.8 $ 137.5

Cost of Sales 43.8 29.5 150.1 96.8

---------------------------------------------------------------------------

Gross Profit 17.6 12.6 51.7 40.7

---------------------------------------------------------------------------

Investment and Other Income 12.6 0.4 51.4 1.4

Net Impairment Provisions (3.6) (0.3) (54.6) (4.4)

Exploration Expense (3.2) (1.3) (7.3) (4.8)

Administrative and Other Expenses (5.1) (4.5) (15.7) (15.4)

Net Earnings 19.4 3.5 20.5 5.1

Net Earnings Attributable to Equity

Shareholders of the Company 20.9 3.5 23.5 5.1

Basic Net Earnings per Share $ 0.17 $ 0.04 $ 0.20 $ 0.05

Diluted Net Earnings per Share $ 0.15 $ 0.04 $ 0.19 $ 0.05

Net Cash Provided by Operating

Activities 28.8 22.3 50.3 21.2

Net Cash Used in Investing

Activities (43.3) (23.5) (88.7) (31.6)

Net Cash Provided by (Used in)

Financing Activities 26.1 (1.6) 103.9 (4.7)

---------------------------------------------------------------------------

Net Increase (Decrease) in Cash $ 11.6 $ (2.8)$ 65.5 $ (15.1)

---------------------------------------------------------------------------

Concentrate Produced (mt)

Chelopech 20,259 15,634 75,278 71,657

Deno 6,969 3,999 20,757 10,144

NCS - concentrate processed (mt) 37,635 - 119,557 -

Cash Cost per tonne Ore Processed

($/t)(1)

Chelopech (excluding royalties) $ 56.34 $ 65.26 $ 51.54 $ 55.23

Deno Gold (excluding royalties) $ 63.66 $ 72.01 $ 66.33 $ 72.27

---------------------------------------------------------------------------

Fourth Quarter 2010 and Year-End - Financial Highlights

-- In the fourth quarter of 2010, the Company recorded net earnings

attributable to equity shareholders of $20.9 million compared to $3.5

million in the corresponding prior year period. The period over period

increase in net earnings attributable to equity shareholders was

primarily due to unrealized favourable mark-to-market adjustments of

$11.6 million in the Company's holdings of Sabina Gold & Silver Corp.

("Sabina")special warrants and higher gross profit from mining and

processing operations.

-- DPM recorded a gross profit from mining and processing operations of

$17.6 million in the fourth quarter of 2010 compared to $12.6 million in

the corresponding prior year period. The period over period increase was

due primarily to higher metal prices partially offset by lower gold in

concentrate sold. Deliveries of concentrates in the fourth quarter of

2010 of 23,346 tonnes were marginally higher than the corresponding

prior year period deliveries of 23,009 tonnes but contained 20,469

ounces of gold compared to 25,540 ounces in the corresponding prior year

period due to a drawdown of 2,157 tonnes of high grade gold concentrate

inventory in the fourth quarter of 2009.

-- In the twelve months of 2010, the Company recorded net earnings

attributable to equity shareholders of $23.5 million compared to $5.1

million in the corresponding prior year period. The higher, period over

period, net earnings attributable to equity shareholders was due

primarily to unrealized favourable mark-to-market adjustments of $49.7

million in the Company's holdings of Sabina special warrants and higher

gross profit from mining and processing operations partially offset by a

$54.0 million impairment provision taken against the MPF at Chelopech.

The write-down in the carrying value of the metals processing facility

("MPF") project to its estimated fair value was partially offset by the

reversal of $3.4 million of royalties accrued in respect of the MPF

project. In view of the Bulgarian court's final decision to revoke the

MPF Environmental Impact Asssessment ("EIA"), it is unlikely

that the MPF project will proceed. In addition, the July 2008 amendments

to Chelopech's mining concession contract with the Bulgarian government,

as they relate to the royalty provisions, no longer apply and no excess

royalty above the 1.5% fixed rate is required to be accrued. As a

result, the excess royalty accrual above the 1.5% was reversed in the

first quarter of 2010 and applied against the MPF property impairment

provision.

-- DPM recorded a gross profit from mining and processing operations of

$51.7 million in the twelve months of 2010 compared to $40.7 million in

the corresponding prior year period. The period over period increase was

due primarily to higher gold, copper and zinc prices and an increase in

concentrate deliveries partially offset by unfavourable mark-to-market

adjustments and final settlements on provisional sales and lower gold in

concentrate sold. In the twelve months of 2010, gold in concentrate sold

totalled 80,352 ounces compared to 104,314 ounces in the corresponding

prior year period. The decrease in gold in concentrate sold was

primarily due to lower gold grades at Chelopech in 2010 relative to 2009

and lower gold recoveries, which were adversely impacted by the

processing of high sulphur to copper ratio ore (Block 151) in 2010.

Chelopech ore mined in 2009 contained lower sulphur to copper ratio ore

resulting in higher gold recoveries. Deliveries of concentrates in the

twelve months of 2010 of 91,157 tonnes were 4,982 tonnes higher than the

corresponding prior year period deliveries of 86,175 tonnes due

primarily to increased production of concentrates at Deno Gold in 2010.

-- As at December 31, 2010, DPM had cash and cash equivalents of $96.2

million (including Avala's cash and cash equivalents of $16.9 million)

and short-term investments of $13.2 million. Investments at fair value

totalled $174.5 million at December 31, 2010 compared to $34.4 million

at December 31, 2009.

Significant Items and 2011 Outlook

Chelopech

-- In the year 2010, Chelopech continued to advance its mine and mill

expansion project to approximately double its annual concentrate

production capacity to 150,000 tonnes. The commissioning of the new

paste fill plant was successfully completed in the third quarter of 2010

and the commissioning of the new semi-autogenous grinding ("SAG") mill

was completed successfully in January 2011. Construction of the mine and

mill expansion is expected to be completed in the fourth quarter of

2011.

-- On December 3, 2010, DPM and Chelopech finalized a $66.75 million long-

term loan agreement with the European Bank for Reconstruction and

Development ("EBRD") and Unicredit Bulbank ("UCB"). The proceeds from

this loan agreement are to be used to assist in the financing of the

Chelopech mine and mill expansion and to refinance existing debt. As of

December 31, 2010, $44.25 million had been drawn under the facility, of

which $16.25 million was used to refinance existing EBRD debt. The loan,

which is guaranteed by DPM and secured by a first ranking charge over

the shares of Chelopech, is repayable in ten equal semi-annual

instalments, commencing June 2013 and bears interest at a rate of LIBOR

plus 3.25% until completion of the Chelopech mine and mill expansion and

LIBOR plus 2.80% thereafter.

-- In compliance with its obligations under its Concession Contract, on

November 15, 2010, Chelopech delivered a $25 million insurance

policy/performance bond to the Bulgarian Ministry of Economy, Energy and

Tourism ("MoEET") to ensure the performance of Chelopech's obligations

for the planned or pre-term closure and rehabilitation of the Chelopech

operations.

-- Under the terms of its loan agreement with the EBRD and UCB, the Company

is required to provide metal price protection on 15% of Chelopech's

2012, 2013 and 2014 projected payable copper production. In fulfillment

of this obligation, in January 2011, the Company entered into monthly

settled forward sales contracts to fix 2,868 tonnes of the year 2012

projected payable copper production at a fixed price of $9,224/tonne

($4.18/lb), 3,036 tonnes of the year 2013 projected payable copper

production at a fixed price of $8,814/tonne ($4.00/lb) and 3,264 tonnes

of the year 2014 projected payable copper production at a fixed price of

$8,386/tonne ($3.80/lb). All gains and losses on these contracts will be

reported through the income statement.

Acquisition of Tsumeb Smelter Assets and Related Business

-- On March 24, 2010, DPM completed the acquisition of NCS from

WeatherlyInternational plc ("WTI") through the purchase of 100% of

the shares of NCS. The total consideration paid to WTI for NCS was

$33.0 million consisting of: (i) $18.0 million in cash and (ii) the

issuance of 4,446,420 fully paid common shares of DPM.

-- On May 26, 2010, DPM completed its agreement with Louis Dreyfus

Commodities Metals Suisse SA ("LDC") to settle approximately $11.4

million of financial obligations owed by NCS to LDC, through a cash

payment of $2.0 million and the issuance of 2,903,525 common shares of

DPM. LDC will continue to have exclusive rights to purchase the

Chelopech concentrate for toll processing through NCS (including return

of blister copper to LDC) and to source the balance of the concentrate

for the Tsumeb smelter through to and including 2020.

Sale of Serbian Assets

-- In July 2010, DPM concluded its agreement with PJV Resources Inc.

("PJV") and Rodeo Capital Corp. (now Avala Resources Ltd.) wherein

it received a 50.3% direct controlling interest in Avala, 36.7

million share purchase

warrants exercisable at Cdn$0.50 per share and $1.6 million cash in

exchange for Dundee Plemeniti Metali d.o.o ("Metali"). DPM was also

issued Special Rights to acquire an aggregate of 50,000,000 additional

Avala common shares for no additional consideration, of which

25,000,000 are issuable upon a positive decision to proceed to a

feasibility study on all or part of the projects and an additional

25,000,000 are issuable upon a positive decision to bring all

or part of the projects into production. As at December 31, 2010, DPM

held 50.9% of Avala common shares.

-- Pursuant to the certificates and indenture governing certain of the

Avala warrants issued on July 30, 2010, Avala had the right to

accelerate the expiry date of such warrants any time after October 25,

2010 if the closing price of its common shares is above Cdn$1.00 for 20

consecutive trading days. On December 13, 2010, having met this

precondition, Avala issued notification of its decision to accelerate

the expiry date of this portion of the share purchase warrants to

January 14, 2011. In response, DPM exercised 2,428,500 full warrants to

purchase the same number of Avala common shares at Cdn$0.50 per share in

December 2010. Avala also has the right to accelerate the expiry date on

the 34,290,179 common share purchase warrants issued to DPM on July 30,

2010, as part of the consideration for its acquisition of Metali, any

time after January 26, 2011 if the closing price of its common share is

above Cdn$1.00 for 20 consecutive trading days. Upon notification of

acceleration, the Company will have 30 days to exercise such warrants.

Krumovgrad

-- On February 9, 2011, it was announced that the Council of Ministers of

the Republic of Bulgaria had approved the granting of a 30 year

concession to BMM to develop the Khan Krum Deposit in Krumovgrad. The

council of Minister's resolution is subject to publication in the State

Gazette of the Republic of Bulgaria. The Council of Minister's

resolution was published in the State Gazette on February 18, 2011.

Exercise of the concession rights by the Company is also subject to a

positive EIA resolution being issued by the Bulgarian Minister of

Environment and Waters ("MoEW").

-- In January 2011, the MoEW delivered a "positive grade" to both the EIA

and the Natura 2000 Compatibility Assessment Report for

the Krumovgrad Gold Project proposal, which had been submitted in

October 2010, meaning that all information required under the EIA

regulation is complete. Based on this positive assessment of the quality

of the submissions, and in compliance with the requirements under the

Bulgarian environmental legislation, DPM has commenced the public

dissemination of the EIA documentation which will culminate with

organized public hearings with the municipality of Krumovgrad and other

potentially affected municipalities or villages.

2011 Outlook

-- Total capital expenditures for the year 2011 are expected to range

between $155 million and $165 million, including $62 million to complete

the mine and mill expansion at Chelopech, $35 million for environmental

and plant optimizations projects at NCS and $25 million at Deno Gold to

further enhance underground operations and advance the proposed open pit

project. This current estimate is about $15 million higher than the

guidance provided in November 2010 due to additional expenditures for

environmental and operating improvements at NCS. Pending completion of

the definitive feasibility study for the Krumovgrad project in Bulgaria

and receipt of approvals of its EIA, the

Company also expects to move forward with the construction of this

project.

-- For the year 2011, mine output at Chelopech is expected to range between

1.2 million and 1.3 million tonnes of ore, in line with its planned ramp

up to an annualized production rate of two million tonnes of ore. At

this level, Chelopech is expected to produce approximately 100,000

tonnes of concentrate. Following completion of its mine/mill expansion

to 600,000 tonnes of ore in 2010, Deno Gold is expected to produce

between 25,000 and 30,000 tonnes of concentrate.

-- The Company's estimated metals in concentrate produced for the year 2011

is set forth in the following table:

----------------------------------------------------------------------------

Metals in Concentrate

Produced: Chelopech Deno Gold Total

----------------------------------------------------------------------------

Gold (ounces) 90,000 - 92,000 30,000 - 33,000 120,000 - 125,000

Copper (million

pounds) 32.5 - 35.5 3.0 - 3.5 35.5 - 39.0

Zinc (million pounds) - 21.0 - 23.0 21.0 - 23.0

Silver (ounces) 150,000 - 160,000 500,000 - 530,000 650,000 - 690,000

----------------------------------------------------------------------------

-- Unit cash cost per tonne of ore processed, excluding royalties, at

Chelopech for the year 2011 is expected to be approximately 5% lower

than the year 2010 average unit cash cost of ore processed assuming

current exchange rate Euro to U.S. dollar. Unit cash cost per tonne of

ore processed, excluding royalties, at Deno Gold for the year 2011 is

expected to be comparable to the fourth quarter of 2010 average cash

cost per tonne of ore processed.

A complete set of DPM's Consolidated Financial Statements, Notes

to the Consolidated Financial Statements and Management's

Discussion and Analysis for the twelve months ended December 31,

2010 will be posted on the Company's website at

www.dundeeprecious.com and will be filed on Sedar at

www.sedar.com.

Conference Call

DPM will be holding an analyst call on Thursday, February 24,

2010 at 8.30 a.m. (EST).

The call will be webcast live (audio only) at:

http://www.gowebcasting.com/2181. Listen only call 416-340-2220 or

toll free 866-542-4237.

The audio webcast for this conference call will be archived and

available on the Company's website at www.dundeeprecious.com.

Overview

DPM is a Canadian-based, international mining company engaged in

the acquisition, exploration, development, mining and processing of

precious metals properties. Its common shares and share purchase

warrants (symbols: DPM; DPM.WT; DPM.WT.A) are traded on the Toronto

Stock Exchange ("TSX"). DPM's business objectives are to identify,

acquire, finance, develop and operate low-cost, long-life mining

properties.

The Company's operating interests include its 100% ownership of

Chelopech Mining EAD ("Chelopech"), its principal asset being the

Chelopech mine, a gold, copper, silver concentrates producer,

located approximately 70 kilometres east of Sofia, Bulgaria, 100%

ownership of Namibia Custom Smelters (Pty) Ltd. ("NCS"), a copper

concentrate processing facility located in Tsumeb, Namibia, and a

100% interest in Deno Gold Mining Company CJSC ("Deno Gold"), its

principal asset being the Kapan mine, a gold, copper, zinc, silver

concentrates producer located about 320 kilometres south east of

the capital city of Yerevan in Southern Armenia. DPM's interests

also include a 100% interest in the Krumovgrad development stage

gold property located in south eastern Bulgaria, near the town of

Krumovgrad, and certain exploration and exploitation properties in

Serbia. The Company also presently holds a 50.9% controlling

interest in Avala Resources Ltd., a TSX Venture Exchange ("TSXV")

listed company (TSX VENTURE: AVZ) focused on the exploration and

development of the Timok and Potoj Cuka copper and gold projects in

Serbia. In July 2010, the Company established DPM Assurance

(Barbados) Inc. ("DPMA"), a qualifying insurance company in

Barbados, principally to provide reinsurance coverage for surety

risks originating from its affiliates.

Summarized Financial Results

Net revenue

Net revenue of $61.4 million in the fourth quarter of 2010 was

$19.3 million higher than the corresponding prior year period net

revenue of $42.1 million due primarily to a 24% increase in gold

prices and 30% increase in copper prices partially offset by lower

gold in concentrate sold. The drawdown and sale of higher grade

gold concentrate in the fourth quarter of 2009 contributed to the

relative reduction in gold in concentrate sold in the fourth

quarter of 2010. Also contributing to the period over period

increase in net revenue was the inclusion of NCS's revenue

following its acquisition by DPM in March 2010. Net unfavourable

mark-to-market adjustments and final settlements of $0.5 million,

related to the open positions of provisionally priced concentrate

sales, were recorded in the fourth quarter of 2010 compared to net

favourable mark-to-market adjustments and final settlements of $0.4

million in the fourth quarter of 2009.

Deliveries of concentrates produced at Chelopech of 17,883

tonnes in the fourth quarter of 2010 were comparable to the fourth

quarter of 2009 deliveries of 17,791 tonnes. Gold in concentrate

sold in the fourth quarter of 2010 of 13,076 ounces was 31% lower

than the corresponding prior year period. Copper in concentrate

sold of 6.1 million pounds was comparable to the corresponding

prior year period.

Deliveries of copper and zinc concentrates produced at Deno Gold

of 1,828 tonnes and 3,635 tonnes in the fourth quarter of 2010

were, respectively, 194 tonnes and 51 tonnes higher than the

corresponding prior year period. Gold in concentrate sold in the

fourth quarter of 2010 of 7,393 ounces was 10% higher than the

corresponding prior year period. Copper and zinc in concentrate

sold in the fourth quarter of 2010 of 0.8 million pounds and 4.1

million pounds were, respectively, 2% and 6% higher than the

corresponding prior year period.

Net revenue of $201.8 million in the twelve months of 2010 was

$64.3 million higher than the corresponding prior year period net

revenue of $137.5 million due to a 26% increase in gold prices, a

46% increase in copper prices, a 31% increase in zinc prices and

higher deliveries of concentrates partially offset by lower gold in

concentrate sold. Net unfavourable mark-to-market adjustments and

final settlements of $3.3 million, related to the open positions of

provisionally priced concentrate sales, were recorded in the twelve

months of 2010 compared to net favourable mark-to-market

adjustments and final settlements of $6.5 million in the twelve

months of 2009. In the twelve months of 2010, DPM recorded net

losses on its copper and zinc derivatives of $0.2 million, compared

to net losses on copper derivatives of $4.4 million in the twelve

months of 2009. Also contributing to the period over period

increase in net revenue was the inclusion of NCS's revenue

following its acquisition by DPM in March 2010.

Deliveries of concentrates produced at Chelopech of 73,061

tonnes in the twelve months of 2010 were 3% lower than the

corresponding prior year period deliveries of 75,542 tonnes. Gold

in concentrate sold in the twelve months of 2010 of 58,065 ounces

was 38% lower than the corresponding prior year period. Copper in

concentrate sold of 25.0 million pounds was 4% lower than the

corresponding prior year period.

Deliveries of copper and zinc concentrates produced at Deno in

the year 2010 of 5,478 tonnes and 12,618 tonnes were, respectively,

2,921 tonnes and 4,542 tonnes higher than the corresponding prior

year period due to operational improvements and the ramp-up of the

mine/mill expansion. In addition, Deno Gold was on care and

maintenance in the first quarter of 2009. Gold in concentrate sold

in the twelve months of 2010 of 22,287 ounces was 98% higher than

the corresponding prior year period. Copper in concentrate sold in

the twelve months of 2010 was 2.4 million compared to 1.2 million

pounds in the corresponding prior year period. Zinc in concentrate

sold in the twelve months of 2010 of 14.3 million pounds was 62%

higher than the corresponding prior year period.

The average London Bullion gold price(2) in the fourth quarter

of 2010 of $1,369 per ounce was 24% higher than the fourth quarter

of 2009 average price of $1,102 per ounce. The average London Metal

Exchange ("LME") cash copper price(2) in the fourth quarter of 2010

of $3.92 per pound was 30% higher than the fourth quarter of 2009

average price of $3.02 per pound. The average LME cash zinc

price(2) in the fourth quarter of 2010 of $1.05 per pound was 5%

higher than the fourth quarter of 2009 average price of $1.00 per

pound.

The average London Bullion gold price(2) in the twelve months of

2010 of $1,224 per ounce was 26% higher than the corresponding

prior year period average price of $973 per ounce. The average LME

cash copper price(2) in the twelve months of 2010 of $3.42 per

pound was 46% higher than the corresponding prior year period

average price of $2.34 per pound. The average LME cash zinc

price(2) in the twelve months of 2010 of $0.98 per pound was 31%

higher than the corresponding prior year period average price of

$0.75 per pound.

Cost of sales

Cost of sales of $43.8 million and $150.1 million in the fourth

quarter and twelve months of 2010 were $14.3 million and $53.3

million higher than the corresponding prior year periods cost of

sales of $29.5 million and $96.8 million, respectively, due

primarily to the inclusion of expenses related to the processing of

concentrates at NCS.

Cash cost per tonne of ore processed(1), excluding royalties, at

Chelopech in the fourth quarter of 2010 of $56.34 was 14% lower

than the corresponding prior year period cash cost per tonne of ore

processed(1), excluding royalties, of $65.26 due to higher volume

of material mined and processed, the favourable impact of an 8%

depreciation of the Euro relative to the U.S. dollar period over

period and lower cement usage in backfill activities partially

offset by higher consumption of and prices for power and diesel,

higher employment expenses and increased maintenance costs. Cash

cost per tonne of ore processed(1), including royalties, at

Chelopech in the fourth quarter of 2010 of $61.66 was 14% lower

than fourth quarter of 2009 cash cost per tonne of ore

processed(1), including royalties, of $71.61.

Cash cost per tonne of ore processed(1), excluding royalties, at

Chelopech in the twelve months of 2010 of $51.54 was 7% lower than

the corresponding prior year period cash cost per tonne of ore

processed(1), excluding royalties, of $55.23 due primarily to

higher volume of material mined and processed, the favourable

impact of a weaker Euro relative to the U.S. dollar, period over

period and lower cement usage in backfill activities partially

offset by higher pending on supplies and services, higher

employment expenses and increased prices for and consumption of

power and fuels. Cash cost per tonne of ore processed(1), including

royalties, at Chelopech in the twelve months of 2010 of $56.22 was

8% lower than the corresponding prior year period cash cost per

tonne of ore processed(1), including royalties, of $61.00.

Cash cost per tonne of ore processed(1), excluding royalties, at

Deno Gold in the fourth quarter and twelve months of 2010 of $63.66

and $66.33 were, respectively, 12% and 8% lower than the

corresponding prior year periods cash cost per tonne of ore

processed(1), excluding royalties, of $72.01 and $72.27 due to

higher volume of material processed partially offset by higher

maintenance costs, higher vein drive development costs to access

additional working spaces and higher employment expenses. Cash cost

per tonne of ore processed(1), including royalties, at Deno Gold in

the fourth quarter and twelve months of 2010 were $69.87 and

$70.31, respectively. Deno Gold did not pay a profit based royalty

in 2009.

Gross profit

The following table shows the breakdown of gross profit (loss) by location:

--------------------------------------------------------------------------

$ thousands

Ended December 31, Three Months Twelve Months

---------------------- ---------------------

2010 2009 2010 2009

-------------------------------------------------------------- -----------

Chelopech $ 14,444 $ 9,698 $ 41,214 $ 41,594

Deno Gold 6,865 2,888 13,558 (865)

NCS (3,682) - (3,132) -

--------------------------------------------------------------------------

Total gross profit $ 17,627 $ 12,586 $ 51,640 $ 40,729

--------------------------------------------------------------------------

--------------------------------------------------------------------------

In December 2010, a year-to-date charge of $2.1 million on the

net value of the metals in concentrate held by the smelter and

smelter fee advances, as per the tolling agreement between LDC and

NCS, was reclassified from financing costs to net revenue,

resulting in a reduction in net revenue. Included in the NCS gross

loss in the fourth quarter and twelve months of 2010 was a

depreciation expense of $1.4 million and $2.4 million,

respectively, on the intangible assets identified as part of the

finalization of the purchase price allocation for the acquisition

of NCS which was completed in the fourth quarter.

Investment and other income

Investment and other income were $12.6 million and $51.4 million

in the fourth quarter and twelve months of 2010, respectively,

compared to investment and other income of $0.4 million and $1.4

million in the corresponding prior year periods. Included in the

fourth quarter and twelve months of 2010 were unrealized favourable

mark-to-market adjustments related to the Sabina Special Warrants,

which are held for trading, of $11.6 million and $49.7 million

respectively.

Income tax expense

In the fourth quarter of 2010, DPM reported an income tax

recovery of $5.1 million at an effective tax recovery rate of 36%

on earnings before income taxes of $14.3 million. At a 31%

statutory tax rate for 2010, the expected income tax expense was

$4.4 million. The variance was due primarily to the lower rates on

foreign earnings and the non-taxable portion of unrealized gains on

warrants.

For the year ended December 31, 2010, DPM reported an income tax

recovery of $9.5 million at an effective tax recovery rate of 86%

on earnings before income taxes of $11.0 million. At a 31%

statutory tax rate for 2010, the expected income tax expense was

$3.4 million. The variance was due primarily to the reversal of the

tax valuation allowance and the non-taxable portion of capital

gains and unrealized gains on special warrants, partially offset by

an unrecognized tax benefit relating to foreign losses. The

valuation allowance was reversed since it is more likely than not

that DPM will be able to recognize future tax assets against future

taxable income.

Summary of Operating Cash Flow, Investing and Financing Activities

The following table summarizes the Company's cash flow activities for the

periods indicated:

---------------------------------------------------------------------------

$ thousands

Ended December 31, Three Months Twelve Months

-------------------- --------------------

2010 2009 2010 2009

---------------------------------------------------------------------------

Net cash provided by operating

activities $ 28,821 $ 22,325 $ 50,287 $ 21,233

Net cash used in investing

activities (43,333) (23,522) (88,725) (31,639)

Net cash provided by (used in)

financing activities 26,064 (1,631) 103,894 (4,741)

---------------------------------------------------------------------------

Increase (decrease) in cash and

cash equivalents 11,552 (2,828) 65,456 (15,147)

Cash and cash equivalents at

beginning of period 84,673 33,034 30,769 42,169

Change due to conversion to

U.S. dollar reporting - 563 - 3,747

---------------------------------------------------------------------------

Cash and cash equivalents at

end of period $ 96,225 $ 30,769 $ 96,225 $ 30,769

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Operating Activities

Cash provided by operating activities in the fourth quarter of

2010 was $28.8 million compared to $22.3 million in the fourth

quarter of 2009. The increase in cash provided by operating

activities, period over period, was due to improved gross profit

from mining and processing operations resulting from stronger metal

prices partially offset by lower gold in concentrate sold.

Cash provided by operating activities in the twelve months of

2010 was $50.3 million compared to $21.2 million in the

corresponding prior year period. The period over period increase in

cash provided by operating activities was due primarily to improved

gross profit from mining and processing operations resulting from

stronger metal prices and higher deliveries of concentrates

partially offset by lower gold in concentrate sold.

Investing Activities

Cash used in investing activities in the fourth quarter and

twelve months of 2010 was $43.3 million and $88.7 million,

respectively, compared to cash used in investing activities of

$23.5 million and $31.6 million in the corresponding prior year

periods.

Proceeds on sale of short-term investments totalled $31.6

million in the twelve months of 2010 compared to $3.8 million in

the corresponding prior year period. Short-term investments include

bankers' acceptances and treasury bills with original maturities

between three months and less than one year at the time the

investment is made.

In the twelve months of 2010, there was an increase in

restricted cash of $15.1 million due primarily to the funding of

DPMA, a qualifying insurance company established to provide

reinsurance coverage for surety risks originating from DPM's

affiliates.

On December 22, 2010, DPM, through a wholly owned subsidiary

company, purchased the remaining five percent interest in Vatrin it

did not own, resulting in DPM holding a 100% equity interest, for

net cash consideration of $1.5 million and the elimination of all

associated third party indebtedness. Vatrin holds 100% of Deno

Gold.

In August 2010, DPM purchased 1,539,713 common shares of Sabina

for $4.0 million (Cdn$4.2 million).

In April 2010, the Company subscribed for 4,857,000 units of PJV

Resources at a unit price of Cdn$0.35 per unit for total cash

consideration of $1.7 million (Cdn$1.7 million). Each unit

consisted of one common share of PJV and one half of one common

share purchase warrant. Each full warrant was exercisable to

purchase a common share of Avala at Cdn$0.50 per share. The shares

of PJV were converted to shares of Avala as part of the July 2010

business combination between PJV, Avala and Metali and are

eliminated on consolidation.

On March 24, 2010, the Company completed the acquisition of NCS

from WTI through the purchase of 100% of the shares of NCS. The

cash consideration provided to WTI by DPM was $17.0 million, net of

cash acquired of $1.0 million.

Prior to its acquisition of NCS in March 2010, DPM advanced $3.0

million to NCS in accordance with the binding letter of intent

signed in January 2010 with WTI for the purchase of NCS. In the

twelve months ended December 31, 2009, DPM advanced $4.0 million to

NCS in accordance with the agreement DPM signed with NCS in

December 2008.

In June 2009, DPM completed the sale of its Back River

exploration project in Nunavut to Sabina for a cash payment of $6.2

million (Cdn $7.0 million), 17 million Sabina common shares and 10

million Sabina special warrants.

The following table provides a summary of the Company's capital

expenditures:

---------------------------------------------------------------------------

$ thousands

Ended December 31, Three Months Twelve Months

------------------------- -------------------------

2010 2009 2010 2009

---------------------------------------------------------------------------

Chelopech $ (17,562) $ (9,510) $ (47,495) $ (27,347)

Deno Gold (4,344) (1,861) (18,894) (6,067)

NCS (3,407) - (8,357) -

BMM (1,776) (909) (4,650) (1,001)

Other (27) (136) (334) (356)

---------------------------------------------------------------------------

Total capital

expenditures $ (27,116) $ (12,416) $ (79,730) $ (34,771)

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Capital expenditures at Chelopech in the fourth quarter and

twelve months of 2010 were, respectively, 85% and 74% higher than

the corresponding prior year periods due to the ramp-up of the mine

and mill expansion project in 2010. Capital expenditures at Deno

Gold in the fourth quarter and twelve months of 2010 were

significantly higher than the corresponding prior year periods due

to the mine and mill expansion and land acquisition in 2010.

Financing Activities

Cash provided by financing activities in the fourth quarter and

twelve months of 2010 totalled $26.1 million and $103.9 million,

respectively, compared to cash used in financing activities of $1.6

million and $4.7 million in the corresponding prior year

periods.

In the twelve months of 2010, debt and leases repayments were

$2.4 million and $3.8 million, respectively, compared to $3.6

million and $1.1 million in the corresponding prior year

period.

On December 3, 2010, DPM and Chelopech finalized a $66.75

million long-term loan agreement with the EBRD and UCB. The

proceeds from this loan financing are to be used to refinance

existing EBRD debt and to assist in the financing of the Chelopech

mine and mill expansion. As of December 31, 2010, $44.25 million

had been drawn under the facility, of which $16.25 million was used

to refinance the existing EBRD debt. The proceeds from debt

financing, net of fees and expenses, were $27.1 million.

On July 30, 2010, DPM concluded its previously announced

agreement with PJV and Avala wherein it received a 50.3% direct

controlling interest in Avala, 36.7 million warrants (including the

April 2010 subscription of shares and warrants), $1.6 million in

cash as well as Special Rights to acquire an additional 50 million

Avala common shares for no additional consideration if certain

events occur in exchange for DPM's Serbian subsidiary, Metali. Net

proceeds on the sale of DPM's interest in Metali were $20.9

million.

In the first quarter of 2010, the Company completed an equity

financing for gross proceeds of $64.8 million (Cdn$66.0 million).

The equity financing consisted of the sale of 20,000,000 common

shares at Cdn$3.30 per share. The proceeds, net of expenses and

fees, were $62.0 million (Cdn$63.1 million).

Average Metal Prices

The following table, summarizing the average metal prices for

the London Bullion Market Association ("LBMA") gold, LME copper

Grade A, LME special high grade ("SHG") zinc and LBMA silver

prices, is used to illustrate the Company's average metal price

exposures based on its key reference prices for the periods

indicated.

----------------------------------------------------------------------------

Average

Ended December 31, Three Months Twelve Months

------------------ ------------------

2010 2009 2010 2009

----------------------------------------------------------------------------

London Bullion gold ($/oz) $ 1,369 $ 1,102 $ 1,224 $ 973

LME settlement copper ($/lb) 3.92 3.02 3.42 2.34

LME settlement SHG zinc ($/lb) 1.05 1.00 0.98 0.75

LBMA spot silver ($/oz) $ 26.43 $ 17.58 $ 20.16 $ 14.65

----------------------------------------------------------------------------

Non-GAAP Financial Measures

Reference is made to cash cost per tonne of ore processed

because it is understood that certain investors use this

information to assess the Company's performance and also determine

the Company's ability to generate cash flow for investing

activities. This measurement captures all of the important

components of the Company's production and related costs. In

addition, management utilizes this metric as an important

management tool to monitor cost performance of the Company's

operations. This measurement, which is a non-GAAP measure, has no

standardized meaning under Canadian GAAP and is therefore unlikely

to be comparable to similar measures presented by other companies.

This measurement is intended to provide additional information and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with Canadian GAAP.

The following table provides, for the periods indicated, a

reconciliation of the Company's cash cost measure and Canadian GAAP

cost of sales:

----------------------------------------------------------------------------

$ thousands, unless otherwise

indicated

For the year ended December 31,

2010 Chelopech Deno Gold Other Total

----------------------------------------------------------------------------

Ore processed (mt) 1,000,781 428,865

Cost of sales $ 72,579 $ 32,743 $ 44,833 $ 150,155

Add/(deduct):

Amortization (12,960) (5,374)

Reclamation costs and other (1,337) (788)

Change in concentrate inventory (2,018) 3,572

----------------------------------------------------------------------------

Total cash cost of production $ 56,264 $ 30,153

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash cost per tonne of ore

processed, including royalties $ 56.22 $ 70.31

Cash cost per tonne of ore

processed, excluding royalties $ 51.54 $ 66.33

----------------------------------------------------------------------------

----------------------------------------------------------------------------

$ thousands, unless otherwise Total

indicated

For the year ended December 31, Deno

2009 Chelopech Gold

----------------------------------------------------------------------------

Ore processed (mt) 980,928 218,235

Cost of sales $ 75,647 $ 21,197 $ 96,844

Add/(deduct):

Amortization (12,401) (3,170)

Reclamation costs and other (1,841) (752)

Care and maintenance costs - (3,074)

Change in concentrate inventory (419) 1,696

Foreign exchange (1,148) (125)

Total cash cost of production $ 59,838 $ 15,772

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Cash cost per tonne of ore

processed, including royalties $ 61.00 $ N/A

Cash cost per tonne of ore

processed, excluding royalties $ 55.23 $ 72.27

----------------------------------------------------------------------------

Mineral Reserves and Resources

The Chelopech Mineral Resources, as of September 2010, are set out below.

Mineral Resources Gold Silver Copper

---------------- ---------------- ----------------

Tonnes Grade Ounces Grade Ounces Grade Lbs

(million) (g/t) (M) (g/t) (M) (%) (M)

----------------------------------------------------------------------------

Measured 15.84 4.2 2.14 10.9 5.55 1.6 558.7

Indicated 12.70 4.0 1.63 7.2 2.94 1.1 307.9

----------------------------------------------------------------------------

Measured and

Indicated 28.54 4.1 3.77 9.1 8.49 1.4 866.6

Inferred 8.10 2.9 0.76 10.3 2.68 0.9 160.7

----------------------------------------------------------------------------

(1) The rounding of tonnage and grade figures has resulted in some columns

showing relatively minor discrepancies in sum totals.

(2) All Mineral Resource Estimates have been determined and reported in

accordance with National Instrument 43-101("NI 43-101") and the

classification adopted by the Canadian Institute of Mining ("CIM") Council

in August 2000.

(3) Cut-off Grade @ 3.2g/t Gold Equivalent is based on the following

formula: (Au g/t + 2.5xCu%). The Mineral Resource has been depleted as of

September 30, 2010. Resource estimates are based on various other

assumptions and key parameters and are subject to risks as more fully

described in the supporting technical report (see note 4).

(4) The "Chelopech Cu-Au Resource and Reserve, Bulgaria, Technical Report

for the Chelopech Project" is currently being prepared by Brian R. Wolfe

from Coffey Mining Pty Ltd. ("Coffey"), and Gordon Fellows from Chelopech

Mining, both of whom are Qualified Persons under NI 43-101. The former is

independent of the Company. The report will be filed on Sedar at

www.sedar.com by March 31, 2011.

(5) The information in the above table has been prepared under the

supervision of Dr. Julian Barnes, a Qualified Person within the meaning of

NI 43-101 and independent of the Company.

The Chelopech Mineral Reserves, as of January 1, 2011, are set out below.

Mineral Reserves Gold Copper

-------------------- --------------------

Tonnes Grade Ounces Grade Lbs

(million) (g/t) (M) (%) (M)

----------------------------------------------------------------------------

Proven 14.59 3.66 1.72 1.37 439

Probable 6.26 4.37 0.88 1.04 144

----------------------------------------------------------------------------

Total Reserves 20.85 3.87 2.60 1.27 583

----------------------------------------------------------------------------

(1) The rounding of tonnage and grade figures has resulted in some columns

showing relatively minor discrepancies in sum totals.

(2) All Mineral Reserve Estimates have been determined and reported in

accordance with NI 43-101 and the classifications adopted by the CIM Council

in August 2000.

(3) All Mineral Reserves are completely included within the quoted Mineral

Resources.

(4) NSR cut-off is +$10/t; the average sulphur content in mill feed is

14.0%; Mineral Reserves are depleted, and are based on metal prices of

$900/oz gold and copper price of $2.50/lb; metallurgical recoveries are

based on current and modelled algorithms for each block. The weighted

average recoveries are 84.4%CuRec, 54.89%AuRec and 21.48%AgRec.Smelting and

Transport costs are $189/t and $139/t, respectively with smelter recoveries

of 93%AuRec, 94%CuRec and 90%AgRec. Reserve estimates are based on various

other assumptions and key parameters and are subject to risks as more fully

described in the supporting technical report (see note 5).

(5) The "Chelopech Cu-Au Resource and Reserve, Bulgaria, Technical Report

for the Chelopech Project" is currently being prepared by Brian R. Wolfe

from Coffey and Gordon Fellows from Chelopech Mining, both of whom are

Qualified Persons under NI 43-101. The former is independent of the Company.

The report will be filed on Sedar at www.sedar.com by March 31, 2011.

(6) The information in the above table has been prepared under the

supervision of Dr. Julian Barnes, a Qualified Person within the meaning of

NI 43-101 and independent of the Company.

Definition of Mineral Resource and Reserve

The Mineral Resource and Reserve estimate has been performed in

compliance with the NI 43-101 and as defined by the CIM Standards.

According to the standards, a Mineral Resource is defined as "a

concentration or occurrence of base and/or precious metals in or on

the earth's crust in such form and quantity and of such grade or

quality that it has reasonable prospects for economic extraction.

The location, quantity, grade, geological characteristics and

continuity of a Mineral Resource are known, estimated or

interpreted from specific geological evidence and knowledge". A

Mineral Reserve is defined as "the economically mineable part of a

Measured or Indicated Mineral Resource demonstrated by at least a

Preliminary Feasibility Study. This Study must include adequate

information on mining, processing, metallurgical, economic and

other relevant factors that demonstrate, at the time of reporting,

that economic extraction can be justified. A Mineral Reserve

includes diluting materials and allowances for losses that may

occur when the material is mined" (CIM Definitions Standards

November 27, 2010).

Scientific and Technical Data

Since the 2008 Mineral Resource and 2009 Mineral Reserve

estimate had been computed, additional drilling, development and

mapping have better defined the resources at depth while, the

updated reserves have been calculated using the newly adopted net

smelter return ("NSR") methodology instead of the previously

practised single cut-off grade and Mineable Reserves Optimizer

("MRO") analysis.

The Mineral Resource estimate is based on a single cut-off grade

of 3.2g/tAuEq using a gold equivalent formula of AuEq = 2.5xCu + Au

with wireframes based on geological and grade continuity (greater

than 3g/tAuEq). On evaluation of the results and comparison with

the 2008 Mineral Resource estimate, not taking into consideration

the mined out material from the period between the estimates, the

tonnes were reduced by 22% for Measured and Indicated Resources and

21% for Inferred Resources. Gold and copper grades increased by 8%

and 9%, respectively, for Measured and Indicated Resources, while

Inferred Resources saw a 7% increase in gold grade and no change to

copper grade compared to the 2008 Mineral Resource. Gold and copper

metal decreased by 12% and 11% for Measured and Indicated Resources

while, down 13% and 21% for Inferred Resources, respectively.

Primarily, the changes in the Mineral Resource estimate compared

to the 2008 Mineral Resource have been attributed to a number of

factors including an updated void model, additional drilling and

improved ore body delineation. At depth, Blocks 16, 18, 19 and 151

were better constrained due to the "Deeps" drilling while grade

control drilling tightened the boundaries of Blocks 19 and 151.

Additional Mineral Resources with higher gold grades were gained

from Blocks 145, 147 and 149 while, in areas where the Mineral

Resource wireframes were expanded, more low-grade material was

included inside the modeled wireframe, which resulted in a lower

overall grade estimate and a reduction in the volume influenced by

higher grade intersections.

For the January 1, 2011, Mineral Reserve estimate, DPM applied

the NSR methodology with designed stopes and development instead of

a single cut-off grade and MRO analysis. This approach was adopted

after the completion of a "hill of values" study in 2009 conducted

by Coffey. It was shown that the break-even grade of Block 151 is

significantly higher than the other mining blocks. This implies the

use of a single mine cut-off grade was not the economic

optimum.

NSR refers to the revenues expected from the mill feed, taking

into consideration metal prices, mill and smelter recoveries,

concentrate grades, transportation costs of the concentrate to the

smelter, treatment and refining charges, and other deductions at

the smelter. There are numerous benefits of a net smelter return

model compared to a single metal cut off grade approach. These

benefits include a) polymetallic ores can be converted into a

dollar per tonne variable; b) investigation of the potential

viability of selected reserve blocks can be quickly assessed; c)

the profitability of planned stopes can be assessed as a daily

task; d) the effect of commodity price fluctuations can be quickly

applied to the reserve model and e) minimum profit per tonne

appraisals can be easily applied prior to a decision to mine a

stope.

Limitations of the NSR block valuation approach include a

tendency to smooth the statistical distribution of block values,

relative to the statistical distribution of the copper, gold and

additional element block estimates.

Recovery algorithms used for the Mineral Reserve estimate are

based on the current Chelopech operation using gold, copper, silver

and sulphur grades, DPM long term metal price forecasts for gold of

$900 per ounce, for copper of $2.50 per pound and for silver $17

per ounce and smelter costs and transport costs of $185 per tonne

and $139 per tonne, respectively. Also, based on the results

presented by Coffey, a fair and responsible cut-off grade that

balances economic risk and mine life was chosen at +$10 per

tonne.

Therefore, due to the higher than average sulphur content of

Block 151, recoveries are lower compared to all other blocks, hence

a higher grade cut-off should be applied. The NSR methodology

automatically takes this into account while previous reserves did

not. To illustrate the difference in recoveries, Blocks 19 and 150

return an average recovery range of 86-88% for copper and 63-66%

for gold while Block 151 has an average recovery of 82% for copper

and 47% for gold.

This change in methodology from a single cut-off of 3.2g/tAuEq

to an NSR model has therefore reduced the Mineral Reserves of Block

151 by 3%, compared to the 2009 Mineral Reserves. A majority of the

uneconomical material in Block 151 under NSR methodology is in the

lower levels where gold and sulphur grades are high (greater than

4g/tAu and greater than 23%S) and copper grades are low (less than

0.5%Cu). Petrological and metallurgical analysis is planned to

determine if changes to the current processing workflow can occur,

in order to convert this material to Mineral Reserves.

A direct comparison between the 2009 and 2010 Proven Reserves

saw a tonnage increase of 34% and a drop in gold and copper grade

of 4% and 2%, respectively. This resulted in an increase in gold

and copper metal of 32% and 29%, respectively. Probable Reserves,

on the other hand, dropped with tonnes down 49%, gold grade up 28%,

copper grade down 5% and gold and copper metal both down 32% and

52%, respectively. This change in Proven and Probable Reserves was

due to the increase in the amount of capital and ore development

conducted in 2010, in order to ramp up production to 2 million

tonnes per annum. The definition used for Probable Reserves is

defined as designed stopes and development that lies more than 15

metres (1/2 stope height) below any level with crosscutting ore

development. Data was unavailable to compare the Proven and

Probable Reserves separately, taking into account what was mined

out between the 2009 and 2010 Mineral Reserve.

However, when taking into consideration the mined out material

between Mineral Reserve estimates, the total Chelopech Mineral

Reserve (Proven and Probable) result is positive. The 2010 Mineral

Reserve contains 4% less tonnes, a 7% increase in gold grade and a

2% increase in gold metal, a 7% increase in copper grade and a 1%

decrease in copper metal. These differences are attributed to the

updated voids model and additional exploration and grade control

drilling which has better defined the extents and boundaries of

Blocks 19, 103, 150, 151 and 149 while new discoveries, Blocks 145

and 147, added high-grade gold Mineral Reserves.

Risks and Uncertainties

The figures for Mineral Resources and Mineral Reserves disclosed

by the Company in this press release and other disclosure documents

of the Company are estimates only and no assurance can be given

that the anticipated tonnages and grades will be achieved or that

the indicated level of recovery will be realized. There are

numerous uncertainties inherent in estimating Mineral Resources,

including many factors beyond the Company's control. Such

estimation is a subjective process and the accuracy of any resource

estimate is a function of the quantity and quality of available

data and of the assumptions made and judgments used in engineering

and geological interpretation. Short-term operating factors, such

as the need for orderly development of the ore bodies or the

processing of new or different ore grades, may cause the mining

operation to be unprofitable in any particular accounting period.

In addition, there can be no assurance that gold, silver, zinc or

copper recoveries in small scale laboratory tests will be

duplicated in larger scale tests under on-site conditions or during

production.

This press release uses the terms "Measured", "Indicated" and

"Inferred" Mineral Resources. United States investors are advised

that while such terms are recognized and required by Canadian

regulations, the U.S. Securities and Exchange Commission ("SEC")

does not recognize them. "Inferred Mineral Resources" have a great

amount of uncertainty as to their existence and as to their

economic and legal feasibility. It cannot be assumed that all or

any part of an Inferred Mineral Resource will ever be upgraded to a

higher category. Under Canadian rules, estimates of Inferred

Mineral Resources may not form the basis of feasibility or other

economic studies. United States investors are cautioned not to

assume that all or any part of Measured or Indicated Mineral

Resources will ever be converted into Mineral Reserves. United

States investors are also cautioned not to assume that all or any

part of an Inferred Mineral Resource exists, or is economically or

legally mineable.

(1) Cash cost per tonne ore processed is a non-GAAP measure. A

reconciliation of the Company's cash cost per tonne ore processed to cost of

sales under Canadian GAAP for the years 2010 and 2009 is shown in the table

entitled "Non-GAAP Financial Measures."

(2) Refer to the Average Metal Prices section for the average metal prices

used to illustrate the Company's average metal price exposure based on its

key reference prices.

To view the Financial Statements, please click the following

link: http://media3.marketwire.com/docs/dpmfin223.pdf

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" that

involve a number of risks and uncertainties. Forward-looking

statements include, but are not limited to, statements with respect

to the future price of gold, copper, zinc and silver the estimation

of mineral reserves and resources, the realization of mineral

estimates, the timing and amount of estimated future production,

costs of production, capital expenditures, costs and timing of the

development of new deposits, success of exploration activities,

permitting time lines, currency fluctuations, requirements for

additional capital, government regulation of mining operations,

environmental risks, unanticipated reclamation expenses, title

disputes or claims, limitations on insurance coverage and timing

and possible outcome of pending litigation. Often, but not always,

forward-looking statements can be identified by the use of words

such as "plans", "expects", or "does not expect", "is expected",

"budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates", or "does not anticipate", or "believes", or

variations of such words and phrases or state that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved. Forward-looking statements are based

on the opinions and estimates of management as of the date such

statements are made, and they involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially

different from any other future results, performance or

achievements expressed or implied by the forward-looking

statements. Such factors include, among others: the actual results

of current exploration activities; actual results of current

reclamation activities; conclusions of economic evaluations;

changes in project parameters as plans continue to be refined;

future prices of gold, copper, zinc and silver; possible variations

in ore grade or recovery rates; failure of plant, equipment or

processes to operate as anticipated; accidents, labour disputes and

other risks of the mining industry; delays in obtaining

governmental approvals or financing or in the completion of

development or construction activities, fluctuations in metal

prices, as well as those risk factors discussed or referred to in

Management's Discussion and Analysis under the heading "Risks and

Uncertainties" and other documents filed from time to time with the

securities regulatory authorities in all provinces and territories

of Canada and available at

www.sedar.com. Although the Company has attempted to identify

important factors that could cause actual actions, events or

results to differ materially from those described in

forward-looking statements, there may be other factors that cause

actions, events or results not to be anticipated, estimated or

intended. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements.

Unless required by securities laws, the Company undertakes no

obligation to update forward-looking statements if circumstances or

management's estimates or opinions should change. Accordingly,

readers are cautioned not to place undue reliance on

forward-looking statements.

Contacts: Dundee Precious Metals Inc. Jonathan Goodman President

and Chief Executive Officer (416) 365-2408

jgoodman@dundeeprecious.com Dundee Precious Metals Inc. Stephanie

Anderson Executive Vice President and Chief Financial Officer (416)

365-2852 sanderson@dundeeprecious.com Dundee Precious Metals Inc.

Lori Beak Vice President, Investor Relations and Corporate

Secretary (416) 365-5165 lbeak@dundeeprecious.com

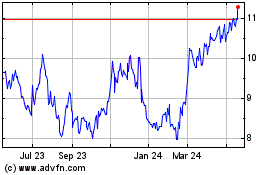

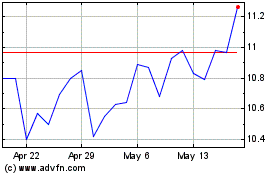

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Nov 2023 to Nov 2024