Uranium Producers Slow Production to Conserve Margins

October 17 2011 - 8:16AM

Marketwired

Uranium prices are finally starting to stabilize as companies are

cutting back on production. Demand has softened following the

Fukushima nuclear disaster, leading producers to slow production to

conserve margins. The Bedford Report examines the outlook for

companies in the Uranium Sector and provides investment research on

Cameco Corporation (NYSE: CCJ) (TSX: CCO) and Denison Mines

Corporation (NYSE Amex: DNN) (TSX: DML). Access to the full company

reports can be found at:

www.bedfordreport.com/CCJ

www.bedfordreport.com/DNN

Uranium prices have yet to recover from the aftermath of Japan's

devastating earthquake in March. Demand has slumped as Germany

announced plans to close all 17 of its nuclear power reactors by

2022. Until recently, production remained on the upswing. However,

earlier this month the world's top producer, Kazakhstan, announced

that it has stabilized production to around 20,000 metric tons

annually in order to avoid further depressing prices.

Sergei Dara, Director of Strategic Development and International

Projects at Kazatomprom, the state nuclear company, said as long as

prices remain at their current low levels, "Kazakhstan will not

develop new projects and our production will remain at the current

level."

The Bedford Report releases stock research on the Uranium Sector

so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.bedfordreport.com and get exclusive

access to our numerous analyst reports and industry

newsletters.

Cameco, with its head office in Saskatoon, Saskatchewan, is one

of the world's largest uranium producers. The company's uranium

products are used to generate electricity in nuclear energy plants

around the world. The company said it now sees global uranium

demand in 2011 at 175 million pounds, compared with a previous

estimate of 180 million pounds. It forecasts world uranium demand

in 2020 at 225 million pounds, down from an earlier estimate of 230

million pounds.

Denison Mines Corp. is an intermediate uranium producer with

production in the U.S., combined with a diversified development

portfolio of projects in the U.S., Canada, Zambia and Mongolia. The

Company recorded a net loss of $13,749,000 or $0.04 per share for

the three months ended June 30, 2011 compared with net income of

$16,744,000 or $0.05 per share for the same period in 2010.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above-mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

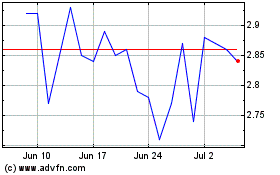

Denison Mines (TSX:DML)

Historical Stock Chart

From Jul 2024 to Aug 2024

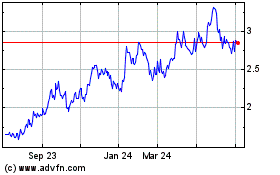

Denison Mines (TSX:DML)

Historical Stock Chart

From Aug 2023 to Aug 2024