CanElson Announces Strong Fourth Quarter and Annual Financial Results and Declares Fourth Quarter Dividend

March 04 2013 - 6:45AM

Marketwired Canada

CanElson Drilling Inc. (TSX:CDI) today announced strong financial results for

the fourth quarter and the year ending December 31, 2012 compared with a year

earlier and declares a fourth quarter dividend of $0.05 per share.

FOURTH QUARTER 2012 SUMMARY (Compared with a year earlier)

-- Services revenue $67.8 million, up 6% from $64.1 million

-- EBITDA $24.6 million, consistent with $24.8 million

-- Income attributable to shareholders of the Corporation $13.9 million, up

23% from $11.3 million

-- EPS (diluted) $0.18, up 20% from $0.15

-- Weighted average diluted shares outstanding 77.0 million, up 4% from

73.7 million

-- Declared fourth quarter dividend of $0.05 per share, unchanged.

-- Foreign segment revenue $31.6 million, up 32% from $24.0 million,

representing 47% of total service revenue for the quarter, up from 37%

-- Sold 50% interests in two drilling rigs for aggregate proceeds of $8.7

million and a before tax net cash inflow of $1.6 million (not recognized

in statement of comprehensive income nor within EBITDA)

THE YEAR ENDED 2012 SUMMARY (Compared with a year earlier)

-- Services revenue $229.3 million, up 24% from $184.8 million

-- EBITDA $84.9 million, up 29% from $66.1 million

-- Income attributable to shareholders of the Corporation $43.6 million, up

38% from $31.3 million

-- EPS (diluted) $0.58, up 29% from $0.45

-- Weighted average diluted shares outstanding 75.5 million, up 9% from

69.5 million

-- Foreign segment (United States and Mexico) revenue $110.2 million, up

51% from $73.0 million, representing 48% of total service revenue for

the year, up from 40%.

Notably, CanElson's Canadian utilization rate (spud to rig release days) in the

fourth quarter of 2012 was 63%, or 1.6 times the industry average with average

revenue rates increasing 7% over 2011. CanElson's fourth quarter 2012

outperformance increased significantly from the fourth quarter of 2011, when

CanElson's Canadian outperformance rate was 1.3 times the industry average.

CanElson's US utilization for the fourth quarter was 84% (2011: 84%). Total

corporate utilization was 71% during the fourth quarter of 2012 (2011: 79%).

For 2012 as a whole, CanElson's Canadian utilization rate was 55%, or 1.3 times

the industry average (2011: 1.3 times industry average). CanElson's US

utilization for the year was 80% (2011: 84%). Total corporate utilization was

64% during 2012 (2011: 71%).

"During the year our return on equity was 15.2%, which improved on last year's

impressive rate of

13.6%. This rate of return for our shareholders is particularly satisfying in

light of our disciplined use of leverage, exiting 2012 with a debt to trailing

funds flow of only 0.4 times" stated Randy Hawkings, President and CEO of

CanElson. "This leaves us in an ideal financial position to selectively choose

the best growth opportunities to continue delivering industry leading returns

for our shareholders."

Fleet

deployment

(by rigs)

Mexico

North Drilling Mexico

Canada Texas Dakota (Leased) Service Total

----------------------------------------------------------------------------

December 31, 23 (net 10 (net 1 (net 40 (net

2012 22.5) 8.5) 4 0.5) 2 (net 1) 36.5)

December 31, 35 (net

2011 21 6 (net 5) 4 2 (net 1) 2 (net 1) 32)

----------------------------------------------------------------------------

Change % 10% 67% unchanged -50% unchanged 14%

----------------------------------------------------------------------------

Gross fleet

deployment

(by %)

Mexico

North Drilling Mexico

Canada Texas Dakota (Leased) Service Total

----------------------------------------------------------------------------

December 31,

2012 57% 25% 10% 3% 5% 100%

December 31,

2011 60% 17% 11% 6% 6% 100%

----------------------------------------------------------------------------

OUTLOOK

Drilling Services

CanElson outperformed the drilling services industry in both Canada and the US

amid continued subdued markets in the fourth quarter of 2012. We believe that

our strategy has uniquely positioned us to sustain relatively strong

profitability during the full drilling industry cycle. The cornerstones to our

relative industry strength, profitability, and top quartile financial results

are:

1. Strategically diversified operations in oil-weighted regions within two

balanced geographical segments which provide diversity of earnings and

less seasonality while maintaining focus and operational efficiency

2. Standardized deep, modern rigs (average age of approximately 4.5 years

and average vertical rating of greater than 4000 metres) allowing us to

outperform peers when considering the total costs of safely drilling

wells

3. A problem-solving culture as evidenced by innovative cost saving

initiatives such as our natural gas fuel and flare gas initiative with

CanGas and the development of our new proprietary triple rig design

4. A history of developing mutually-beneficial partnerships and strong

client relationships, such as our joint venture Diavaz CanElson de

Mexico, S.A. de C.V. ("DCM"), which has an established foot print and a

growing reputation for efficiency in optimization of drilling practices

in Mexico where the market appears to be poised for performance-driven

growth

5. Prudent financial management, which allows the company to be

opportunistic at any point in the cycle

Mexico

In Mexico, DCM is retrofitting and modernizing two recently acquired tele-double

rigs at an estimated total investment of approximately $6.5 million per rig. The

new rigs are expected to be deployed in Q2 2013. The drilling industry in Mexico

appears to be somewhat countercyclical relative to Canada and the US because

PEMEX, the state-owned petroleum company, is dedicated to stemming Mexico's oil

production decline and increasing domestic gas production throughout price

cycles.

We have demonstrated our ability to successfully do business in Mexico. We

believe our performance in the region and our alignment with an experienced and

strong local partner (Grupo Diavaz, with 40 years of experience serving PEMEX)

provides an excellent opportunity for our joint venture DCM to expand its range

of services, including potentially expanding its drilling rig fleet beyond the

two rigs currently anticipated for deployment in Q2 of 2013.

As previously disclosed DCM's customer is transitioning to a production sharing

style of contract with PEMEX. Therefore, DCM is experiencing a temporary lull in

activity and we expect this to continue during the transition period until the

newly acquired rigs are retrofitted and deployed.

Texas

CanElson has 25% of its fleet focused on oil-directed drilling in the Permian

Basin in Texas. The rig count in this area has recently declined due to the

macro industry trends described above. This may result in minor downward

pressure on revenue rates for CanElson's Texas rigs in 2013 compared with 2012.

We do not expect that this pressure will significantly impact our overall

utilization in Texas and anticipate that we will still achieve capacity

utilization in excess of 90% for 2013, with downtime caused only by rig move

intervals and planned re-certifications of some drilling equipment.

Canada and North Dakota

Our customers in Canada and North Dakota are cautious with respect to their

capital spending programs as a result of the volatility in oil and natural gas

commodity prices, increased price differentials, reduced access to capital,

transportation challenges, and global macro concerns. Consequently, we

anticipate that subdued fourth quarter 2012 revenue rate conditions will prevail

through the first quarter of 2013. We also expect typical seasonal utilization

increases through the winter. Beyond the first quarter we have less certainty as

to the market direction but we expect to have a competitive edge due to our

strong relationships, cost reduction initiatives (e.g. CanGas) and the long term

contracts we have established with our customers.

Rig Assembly

At our Nisku, Alberta facility one tele-double drilling rig has been assembled

and deployed in the first quarter of 2013 under a long term contract, with a

second tele-double drilling rig anticipated to be fully assembled and deployed

under long-term contract by the end of the first quarter of 2013. The estimated

investment for each of the rigs is $8 million. These new rigs will increase the

gross size of the fleet to 42 rigs, excluding the two recently purchased rigs in

Mexico. As in the past, we continue to order long lead items for an additional

tele-double drilling rig, with full construction dependent upon obtaining

customer commitments. In addition, progress is continuing on finalizing the

detail design of a proprietary triple drilling rig that will incorporate many

characteristics of our successful tele-doubles.

2013 Primary Objectives

Looking to 2013, CanElson's primary objectives are to maintain and strengthen

its industry leading position by consistently providing operational excellence

and drilling efficiencies to its customers. With this focus, we will be well

positioned to obtain strong customer commitments and to capitalize on new

opportunities. Subject to obtaining customer commitments, we intend to carry out

the following activities that will enhance our competitive positioning:

-- Expand our service offering in Mexico;

-- Continue with strategic conversion of the diesel engines in our fleet to

bi-fuel capacity;

-- Tactically develop and contract a proprietary triple drilling rig to

complement our core tele-double fleet; and

-- Continue to expand our standard tele-double fleet.

Achieving these objectives will present new opportunities for CanElson, its

customers and shareholders.

MANAGEMENT APPOINTMENT

CanElson is pleased to announce the appointment of Rob Logan as President and

CEO of CanElson's wholly owned subsidiary CanGas. Mr. Logan has been an

independent board member serving on the Audit

Committee and chairing the board of our US Subsidiary since March 2010. Mr.

Logan's experience with high-growth, early-stage businesses as well as his

strategic focus will complement CanGas management's strong technical and

marketing capabilities as the company prepares to significantly expand its

service offerings. Given the anticipated time requirement of the CanGas

position, Mr. Logan has resigned from the CanElson board of directors effective

March 1, 2013.

"While Rob's contributions to CanElson as a board member will be missed, we are

extremely excited to add him to the CanGas management team" stated Randy

Hawkings. "Not only will management benefit from the knowledge he has gained as

a CanElson board member, but his past experience with early stage enterprises

and extensive investment banking experience should prove extremely beneficial to

CanGas in this early development stage of its business."

DIVIDEND

On February 28, 2013, the Board of Directors declared a third quarter dividend

of $0.05 per share for the three month period ended December 31, 2012, payable

on April 2, 2013 to shareholders of record at the close of business on March 22,

2013.

FINANCIAL SUMMARY

(Tabular amounts are stated in thousands of Canadian dollars, except per share

amounts and rig operating

days)

For the three months For the year ended

ended December 31, December 31,

% %

2012 2011 change 2012 2011 change 2010

----------------------------------------------------------------------------

Services

revenue $ 67,758 $ 64,098 6% $229,348 $184,758 24% $ 67,825

EBITDA $ 24,598 $ 24,779 -1% $ 84,935 $ 66,067 29% $ 1,389

Net income

attributable

to

shareholders

of the

Corporation $ 13,926 $ 11,324 23% $ 43,582 $ 31,329 39% $ 4,808

Net income per

share

Basic $ 0.18 $ 0.15 20% $ 0.58 $ 0.45 29% $ 0.12

Diluted $ 0.18 $ 0.15 20% $ 0.58 $ 0.45 27% $ 0.12

Funds flow $ 23,348 $ 20,665 13% $ 79,713 $ 59,787 33% $ 12,890

Gross Margin

(services) $ 28,721 $ 28,831 0% $101,025 $ 76,654 32% $ 18,328

Gross Profit on

rig sale $ - $ - nm $ - $ 788 -100% $ 1,115

Weighted

average

diluted shares

outstanding 76,953 73,666 4% 75,514 69,536 9% 39,242

----------------------------------------------------------------------------

FINANCIAL STATEMENTS AND MD&A

CanElson's complete unaudited interim financial results and Management's

Discussion and Analysis (MD&A) for the fourth quarter and the year ended

December 31, 2012 have been filed on SEDAR and posted to the company's website

at this link:

http://www.canelsondrilling.com/investor-relations/financial-reports

FORWARD-LOOKING INFORMATION

This press release contains certain statements or disclosures relating to

CanElson that are based on the expectations of CanElson as well as assumptions

made by and information currently available to CanElson which may constitute

forward-looking information under applicable securities laws. In

particular, this press release contains forward-looking information related to:

our belief that our strategy positions us to sustain strong profitability during

the full drilling industry cycle; deployment of rigs to Mexico in Q2 2013 and

estimated costs of these rigs; our belief that our performance in the region and

our alignment with a local partner provides an opportunity for DCM to expand its

drilling services in the region; the temporary lull in our activity in Mexico

will be limited only until our newly acquired rigs are re-deployed; expected

minor downward pressure on revenue rates for CanElson's Texas rigs in 2013

compared with 2012; our expectation that revenue rate pressure will not

significantly impact our overall utilization in Texas; our expectation that we

will achieve capacity utilization in excess of 90% in Texas for 2013; our

anticipation that subdued fourth quarter 2012 revenue rate conditions will

prevail through the first quarter of 2013; our expectation of typical seasonal

utilization increases through the winter;our expected competitive edge in the

market place due to our strong relationships, cost reduction initiatives and the

long term contracts; the estimated assembly cost for two additional tele-doubles

the expected time of deployment of an additional new rig in Q1 of 2013; and our

2013 primary objectives. Such forward looking information involves material

assumptions and known and unknown risks and uncertainties, certain of which are

beyond CanElson's control. Many factors could cause the performance or

achievement by CanElson to be materially different from any future results,

performance or achievements that may be expressed or implied by such forward

looking information. CanElson's Annual Information Form and other documents

filed with securities regulatory authorities (accessible through the SEDAR

website at www.sedar.com) describe the risks, material assumptions and other

factors that could influence actual results and which are incorporated herein by

reference. CanElson disclaims any intention or obligation to publicly update or

revise any forward looking information, whether as a result of new information,

future events or otherwise, except as may be expressly required by applicable

securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

CanElson Drilling Inc.

Randy Hawkings

President and CEO

(403) 266-3922

CanElson Drilling Inc.

Robert Skilnick

Chief Financial Officer

(403) 266-3922

www.canelsondrilling.com

Data Communications Mana... (TSX:DCM)

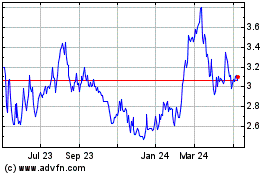

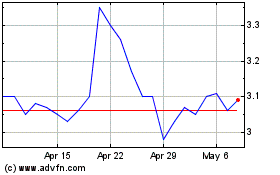

Historical Stock Chart

From Jun 2024 to Jul 2024

Data Communications Mana... (TSX:DCM)

Historical Stock Chart

From Jul 2023 to Jul 2024