Canadian Utilities Reports 2014 Second Quarter Earnings

July 28 2014 - 7:36AM

Marketwired Canada

Canadian Utilities Limited (TSX:CU) (TSX:CU.X)

Canadian Utilities today reported second quarter adjusted earnings of $85

million in 2014 compared to $131 million in 2013. Adjusted earnings were $271

million for the six months ended June 30, 2014 compared to $311 million for the

same period of 2013. Major drivers of this decrease were unfavourable market

conditions in the Company's power generation business and an Alberta Utilities

Commission (AUC) decision received by the Utilities in the second quarter.

The decrease in earnings in ATCO Power was primarily due to a 66% decline in the

average Alberta Power Pool price in the second quarter of 2014 over the same

period in 2013 and higher natural gas input costs. Also contributing to the

decrease were higher business development costs to pursue power generation

opportunities and the launch of ATCO Power's recently announced commercial and

industrial sales program.

The decrease in earnings was also impacted by the AUC decision for information

technology (IT) in the second quarter of 2014. The decision covers an unusually

long period from the start of 2010 to the end of 2014. It reduced the Company's

adjusted earnings in the second quarter by $26 million, of which only $2 million

related to the second quarter of 2014, and $24 million related to prior periods.

The Utilities continued to invest in electricity and natural gas transmission

and distribution facilities to support growth in the province and replace aging

infrastructure. ATCO Electric, ATCO Gas and ATCO Pipelines collectively invested

$501 million in the second quarter, bringing the total for the first half of

2014 to $1 billion.

Earnings attributable to equity owners were $115 million for the quarter ended

June 30, 2014 compared to $160 million in the same period of 2013. Earnings

attributable to equity owners were $336 million for the six months ended June

30, 2014 compared to $343 million in the same period of 2013.

RECENT DEVELOPMENTS

-- Canadian Utilities declared a third quarter dividend for 2014 of 26.75

cents per Class A non-voting and Class B common share. Canadian

Utilities' annual dividend per share has increased for 42 consecutive

years.

-- The Company announced it has competitively outsourced its information

technology (IT) services to Wipro Ltd. (Wipro), a global IT, consulting

and business process services company. Wipro will provide the Company

with a complete suite of IT services. Wipro will also acquire the shares

of ATCO I-Tek and the assets of ATCO I-Tek Australia. The sale is

expected to close in the third quarter of 2014 subject to customary

closing conditions.

FINANCIAL SUMMARY AND RECONCILIATION OF ADJUSTED EARNINGS

A financial summary and reconciliation of adjusted earnings to earnings

attributable to equity owners is provided below:

For the Three Months For the Six Months

Ended June 30 Ended June 30

----------------------------------------------------------------------------

($ Millions except share

data) 2014 2013 2014 2013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Adjusted earnings (1) 85 131 271 311

Adjustments for rate-

regulated activities (2) 28 17 51 12

Impairment (3) (11) - (11) -

Dividends on equity

preferred shares 13 12 25 20

----------------------------------------------------------------------------

Earnings attributable to

equity owners 115 160 336 343

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Revenues 856 845 1,873 1,721

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Funds generated by

operations (4) 366 431 883 842

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Weighted average shares

outstanding (millions of

shares) 261.7 257.9 261.3 257.5

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Adjusted earnings are earnings attributable to equity owners after

adjusting for the timing of revenues and expenses associated with rate-

regulated activities and dividends on equity preferred shares of

Canadian Utilities. Adjusted Earnings also exclude one-time gains and

losses, significant impairments and items that are not in the normal

course of business or day-to-day operations. Adjusted earnings present

earnings on the same basis as was used prior to adopting International

Financial Reporting Standards (IFRS) - that basis being the U.S.

accounting principles for rate-regulated entities - and they are a key

measure used to assess segment performance, to reflect the economics of

rate regulation and to facilitate comparability of Canadian Utilities'

earnings with other Canadian rate-regulated companies.

(2) Refer to Note 3 to the consolidated financial statements for

descriptions of the adjustments for rate-regulated activities and the

timing of their recovery from or refund to customers.

(3) Refer to Note 4 to the consolidated financial statements for an

explanation of ATCO Power Australia's Bulwer Island power station

impairment.

(4) This measure is cash flow from operations before changes in non-cash

working capital. It does not have standardized meaning under IFRS and

may not be comparable to similar measures used by other companies.

The increase in revenues in the second quarter and the first six months of 2014

was due primarily to increased rate base in the Utilities segment, and higher

recoveries from customers related to colder weather and increased recoverable

costs.

The $65 million decrease in funds generated by operations for the second quarter

was due primarily to lower earnings and lower contributions from utility

customers, while year-to-date funds generated by operations increased overall

due to higher contributions received from customers in the first quarter for

utility capital expenditures.

Canadian Utilities' consolidated financial statements and management's

discussion and analysis for the three and six months ended June 30, 2014, will

be available on the Canadian Utilities website (www.canadianutilities.com), via

SEDAR (www.sedar.com) or can be requested from the Company.

Canadian Utilities Limited, an ATCO company, with more than 7,400 employees and

assets of approximately $16 billion, delivers service excellence and innovative

business solutions worldwide with leading companies engaged in Utilities

(pipelines, natural gas and electricity transmission and distribution), Energy

(power generation, natural gas gathering, processing, storage and liquids

extraction) and Technologies (business systems solutions). More information can

be found at www.canadianutilities.com.

Forward-Looking Information:

Certain statements contained in this news release may constitute forward-looking

information. Forward-looking information is often, but not always, identified by

the use of words such as "anticipate", "plan", "estimate", "expect", "may",

"will", "intend", "should", and similar expressions. Forward-looking information

involves known and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those anticipated in such

forward-looking information. The Company believes that the expectations

reflected in the forward-looking information are reasonable, but no assurance

can be given that these expectations will prove to be correct and such

forward-looking information should not be unduly relied upon.

Any forward-looking information contained in this news release represents the

Company's expectations as of the date hereof, and is subject to change after

such date. The Company disclaims any intention or obligation to update or revise

any forward-looking information whether as a result of new information, future

events or otherwise, except as required by applicable securities legislation.

FOR FURTHER INFORMATION PLEASE CONTACT:

Canadian Utilities Limited

B.R. (Brian) Bale

Senior Vice President & Chief Financial Officer

(403) 292-7502

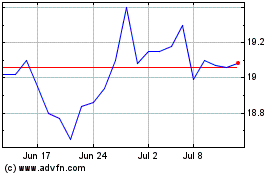

Canadian Utilities (TSX:CU.PR.D)

Historical Stock Chart

From Oct 2024 to Nov 2024

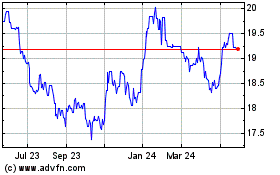

Canadian Utilities (TSX:CU.PR.D)

Historical Stock Chart

From Nov 2023 to Nov 2024