Bragg Gaming Group (TSX:BRAG, OTC: BRGGF) ("Bragg" or the

"Company"), a global B2B gaming technology and content

provider, today provided an update on several aspects of its

business including preliminary revenue estimates for the three

month period ended June 30, 2021.

“Our financial growth as well as the operational and strategic

development momentum we demonstrated in 2020, and in the first

quarter of this year, continued in the second quarter,” said

Richard Carter, CEO of Bragg. “We are making consistent progress

with our growth initiatives including the introduction of new

proprietary online games with better economics while expanding our

footprint into new iGaming markets. The integration and performance

of Wild Streak Gaming and the anticipated closing of the Spin Games

acquisition later this year will position Bragg to leverage our

existing technology platform, which includes in-demand player

engagement tools, with new proprietary content and customer

relationships positioning Bragg to address the large U.S. iGaming

market opportunity. Our ongoing progress and success across the

business has further established Bragg’s foundation to achieve

long-term growth.”

Preliminary Q2 2021 Revenue

Bragg expects to report 2021 Q2 total revenues of approximately

EUR €15.0 million (USD $17.71 million) pre-acquisition,

representing a year-over-year increase of 23.5% compared to the

2020 second quarter period, and a 5.7% quarterly sequential

increase. Reflecting this expectation, total revenues for the first

half of 2021 are expected to be approximately EUR €29.2 million

(USD $34.5 million). The Company’s revenue guidance for 2021

remains unchanged at EUR €47 million (USD $55.5 million) with

adjusted EBITDA of EUR €4 million (USD $4.7 million)

pre-acquisition.

This updated financial outlook is based on information available

to the Company as of the date of this release and is subject to the

completion of quarterly closing procedures.

The Company is pleased with its overall operational progress and

performance, and in particular, the performance of two new

proprietary games that were launched in Q2 on its Oryx Gaming

(“Oryx”) network from its in-house Oryx studio. In addition,

the Company successfully launched a series of exclusive licenced

casino games from third-party studios supported by the Oryx player

engagement and data analytics tools.

The Company anticipates releasing its 2021 second quarter

results on August 11, 2021 and will provide a more detailed update

on the second quarter’s performance during its Q2 earnings

call.

Updates on Wild Steak Games Acquisition and Closing of Spin

Gaming Acquisition

Following the Company's acquisition of Wild Streak in early

June, Wild Streak has continued the revenue growth it demonstrated

in FY 2020 and in Q1 2021 across both land-based and online

casinos, with online revenue growth outpacing the growth in

land-based revenue.

In Q2 2021, Wild Streak launched two online casino games:

Amazing Money Machine and Lucky Lightning. These games, together

with Congo Cash and Temujin Treasures (launched in Q1 2021), have

demonstrated solid performance (e.g., wagering, gross gaming

revenue and unique players).

As of June 30, 2021, Wild Streak had seven online casino games

live in key iGaming markets including in New Jersey, the UK and

other regulated jurisdictions in Europe.

The Company continues to make progress with the U.S. and

Canadian licencing process in connection with its previously

announced acquisition of Spin Games LLC (“Spin”), and

continues to expect to complete this acquisition in Q4 2021 pending

approval from state gaming commissions. The Company has already

been granted licensing approval from GPEB, the British Columbia

regulator, subject to the closing of the Spin transaction. Further,

the Company has submitted its licensing application to the New

Jersey Gaming Commission and expects to submit its remaining two

U.S. licensing applications, in Pennsylvania and Michigan, in Q3

2021.

The technical integration between Spin and the Company’s Oryx

Hub distribution platform has been completed. The combined offering

will deliver the benefits of Oryx’s advanced player engagement,

data tools and platform technology alongside Spin’s U.S. market

content and operator relationships and is expected to provide a

differentiated and widely distributed iGaming product offering.

German Facing Market Regulatory Regime Update

The anticipated new iGaming regulatory regime in Germany, the

country where the Company derived the largest portion of its

revenue in 2020, became effective on July 1, 2021. All operators in

Germany are now required to comply with the new regulations.

The Company will continue to monitor how the German facing

market adjusts to the new regulatory framework and is closely

working with its German customers to help navigate the changing

regulatory landscape.

NASDAQ Listing

The Company has filed an application for the direct listing of

its shares on the Nasdaq Stock Exchange. The Company remains

committed to this goal and expects to complete the direct listing

of its shares on the NASDAQ exchange in Q3 2021.

Cautionary Statement Regarding Forward-Looking

Information

This news release may contain forward-looking statements or

"forward-looking information" within the meaning of applicable

Canadian securities laws ("forward-looking statements"), including,

without limitation, statements regarding the Company's preliminary

estimates for revenue for the three months ended June 30, 2021.

Forward-looking statements are provided for the purpose of

presenting information about management’s current expectations and

plans relating to the future and allowing readers to get a better

understanding of the Company's anticipated financial position,

results of operations, and operating environment. Often, but not

always, forward-looking statements can be identified by the use of

words such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes",

or describes a "goal", or variation of such words and phrases or

state that certain actions, events or results "may", "could",

"would", "might" or "will" be taken, occur or be achieved.

All forward-looking statements reflect the Company's beliefs and

assumptions based on information available at the time the

statements were made. Actual results or events may differ from

those predicted in these forward-looking statements. All of the

Company's forward-looking statements are qualified by the

assumptions that are stated or inherent in such forward-looking

statements, including the assumptions listed below. Although the

Company believes that these assumptions are reasonable, this list

is not exhaustive of factors that may affect any of the

forward-looking statements. The key assumptions that have been made

in connection with the forward-looking statements include the

following: the impact of COVID-19 on the business of the Company;

the countercyclical growth of the business of the Company; the

regulatory regime governing the business of the Company; the

operations of the Company; the products and services of the

Company; the Company's customers; the growth of Company's business,

the meeting minimum listing requirements of Nasdaq; which may not

be achieved or realized within the time frames stated or at all;

the integration of technology; and the anticipated size and/or

revenue associated with the gaming market globally.

Forward-looking statements involve known and unknown risks,

future events, conditions, uncertainties and other factors that may

cause actual results, performance or achievements to be materially

different from any future results, prediction, projection,

forecast, performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

following: risks related to the Company’s business and financial

position; risks related to changes and adjustments to these

preliminary estimates resulting from the Company's management and

Audit Committee reviews and/or regular financial closing and review

procedures and audit procedures; that the Company may not be able

to accurately predict its rate of growth and profitability; the

risks associated with the completion of the acquisition of Spin;

risks associated with general economic conditions; adverse industry

events; future legislative and regulatory developments; the

inability to access sufficient capital from internal and external

sources; the inability to access sufficient capital on favorable

terms; realization of growth estimates, income tax and regulatory

matters; the increased costs associated with meeting the minimum

listing requirements on Nasdaq; the ability of the Company to

implement its business strategies; competition; economic and

financial conditions, including volatility in interest and exchange

rates, commodity and equity prices; changes in customer demand;

disruptions to our technology network including computer systems

and software; natural events such as severe weather, fires, floods

and earthquakes; and risks related to health pandemics and the

outbreak of communicable diseases, such as the current outbreak of

COVID-19. Although the Company has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to

be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

The Company disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events, or otherwise, except in accordance with

applicable securities laws.

About Bragg Gaming Group

Bragg Gaming Group (TSX:BRAG, OTC: BRGGF) ("Bragg") is a growing

global gaming technology and content group and owner of leading B2B

companies in the iGaming industry. Since its inception in 2018,

Bragg has grown to include operations across Europe, North America

and Latin America and is expanding into an international force

within the global online gaming market.

Through its wholly owned subsidiary ORYX Gaming, Bragg delivers

proprietary, exclusive and aggregated casino content via its

in-house remote games server (RGS) and ORYX Hub distribution

platform. ORYX offers a full turnkey iGaming solution, including

its Player Account Management (PAM) platform, as well as managed

operational and marketing services.

Nevada-based Wild Streak Gaming is Bragg's wholly owned premium

U.S. gaming content studio. Wild Streak has a popular portfolio of

casino games that are offered across land-based, online and social

casino operators in global markets including the U.S. and UK.

In May 2021, Bragg announced its planned acquisition of

Nevada-based Spin Games, B2B gaming technology and content provider

currently servicing the U.S. market. Spin holds licenses in key

iGaming-regulated U.S. states and supplies Tier 1 operators in the

region.

Find out more.

1 Bragg’s reporting currency is Euros. The exchange rate

provided for US dollars is 1.18. Due to fluctuating currency

exchange, this rate is provided for convenience only.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210714005525/en/

Yaniv Spielberg Chief Strategy Officer Bragg Gaming Group

info@bragg.games

Joseph Jaffoni, Richard Land, James Leahy JCIR 212-835-8500 or

bragg@jcir.com

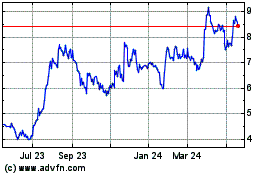

Bragg Gaming (TSX:BRAG)

Historical Stock Chart

From Dec 2024 to Jan 2025

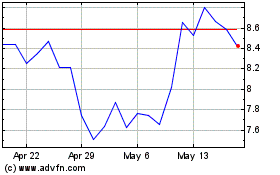

Bragg Gaming (TSX:BRAG)

Historical Stock Chart

From Jan 2024 to Jan 2025