Bengal Energy Announces Credit Facility Amendment and 2019 Drilling Program Update

November 19 2018 - 8:30AM

Bengal Energy Ltd. (TSX: BNG) (“Bengal” or the

“Company”) announces that it has entered into an amendment (the

“Amendment”) to its secured credit facility (the “Credit Facility”)

with the Australian based Westpac Institutional Bank (“Westpac”),

which includes a 14 month deferral of all principal payments on the

Credit Facility. Pursuant to the Amendment, the Credit

Facility has a new maturity date of February 15, 2020 (the “New

Maturity Date”) and provides the continuance of the borrowing base

of US$12.5 million, of which the full amount is currently drawn.

The Company will now be required to make a

single principal repayment of US$12.5MM on the New Maturity Date,

with no principal payments being required until such date. There

were no changes to the covenants and cash sharing requirements

under the Credit Facility.

The Company is now planning to undertake the

following development activities in calendar 2019, to be funded

from the Company’s cash balance and cash flows:

- A six well drilling program on the Barta Permit, ATP 752,

including one exploration well; and

- A water injection pilot project deployed within the Cuisinier

oil field on the Barta Permit.

Bengal will continue to hedge approximately 50%

of its crude oil production as required under the Credit

Facility.

“This extension demonstrates the strong support

from our lenders at Westpac and delivers additional value to our

shareholders,” said Chayan Chakrabarty, Bengal’s President and CEO.

“The financial flexibility afforded by the extension provides

additional liquidity to move forward with our aggressive

development drilling program in 2019 targeted at growing our

production, cash flow and reserves base, which in turn positions us

well for continuing further development of the Cuisinier oil

field.”

Copies of the Credit Facility, including the

Amendment, are available under the Company’s profile on

www.sedar.com.

CALENDAR 2019

DEVELOPMENT PROGRAM:

- Hydraulic Stimulation Program – In December

2018, the Company and its joint venture partners will hydraulically

stimulate the Cuisinier-19 well and are expected to connect it for

production by the end of 2018. This well encountered a 12.5 m

thick, oil-bearing section of Murta sandstone and is in a portion

of the oil field anticipated to have virgin reservoir pressure.

Additional locations potentially suitable for stimulation continue

to be identified by Bengal for upcoming programs.

- 2019 Drilling Program – Bengal and its joint

venture partners on the ATP 752 Barta Block (Bengal’s working

interest is 30.357%.) will participate in a six-well drilling

program commencing in Q2 2019. Five of the six wells in this

drilling program will be located in the Cuisinier oil field aimed

at high graded targets for productivity, reserves growth and pool

expansion. The sixth well will be an exploration well on the

Barta permit, proximal to the Cuisinier pool. Two of the five wells

will be directly offsetting the planned water injection pilot,

bringing the total number of wells expected to be impacted by

injection to five, thus complementing the goals of the water

injection pilot to enhance reservoir performance in that area of

the pool. Another two wells are located in the northwest portion of

the pool where thick Murta reservoir has been established in

existing wells (Cuisinier-1 & -4). These wells are targeting

increased production while extending this mapped trend, potentially

increasing reserves while providing a site for potential water

injection expansion in future phases. The fifth well is located

west of the Cuisinier-19 well, in an area where seismic attribute

mapping highlights the potential for significant reservoir sand

development. A successful outcome at this location could provide a

new development platform for subsequent years’ drilling. The

location of the exploration well is yet to be confirmed among the

joint venture partners. There are a number of dual target features

inside the Cuisinier PL 303 and immediately adjacent to

Cuisinier.

- Water Injection Pilot – A water injection

pilot project is expected to commence at Cuisinier in Q2 2019. This

program is designed to begin increasing pressure in the Cuisinier

pool and thereby increase the expected oil recovery and enhance

productivity and reserves. The location of the water injection

pilot was based on the well to well correlation of both reservoir

sand and reservoir pressure, suggesting a high degree of

continuity. Bengal expects the response to injection at

Cuisinier-24 to be recognized early through close monitoring of all

the wells offsetting injection.

“The 2019 development program represents $5.0

million of net capital expenditures and is expected to bring with

it an exciting step change in production and cash flow for the

company,” said Chayan Chakrabarty, Bengal’s President and CEO. “The

program is a well balanced portfolio expected to significantly

expand the Cuisinier platform supporting the Company’s growth

beyond 2019.”

About Bengal

Bengal Energy Ltd. is an international junior

oil and gas exploration and production company with assets in

Australia. The Company is committed to growing shareholder

value through international exploration, production and

acquisitions. Bengal’s common shares trade on the Toronto Stock

Exchange under the symbol “BNG”. Additional information is

available at www.bengalenergy.ca.

Forward-Looking Statements

This news release contains certain

forward-looking statements or information (“forward-looking

statements”) as defined by applicable securities laws that involve

substantial known and unknown risks and uncertainties, many of

which are beyond Bengal’s control. These forward-looking statements

relate to future events or our future performance. All statements

other than statements of historical fact may be forward-looking

statements. The use of any of the words “plan”, “expect”,

“prospective”, “project”, “intend”, “believe”, “should”,

“anticipate”, “estimate”, or other similar words or statements that

certain events “may” or “will” occur are intended to identify

forward-looking statements. The projections, estimates and

beliefs contained in such forward-looking statements are based on

management’s estimates, opinions, and assumptions at the time the

statements were made, including assumptions relating to: the

current commodity price environment; the impact of economic

conditions in North America, Australia and globally; industry

conditions; changes in laws and regulations including, without

limitation, the adoption of new environmental laws and regulations

and changes in how they are interpreted and enforced;

increased competition; the availability of qualified operating or

management personnel; fluctuations in commodity prices, foreign

exchange or interest rates; stock market volatility and

fluctuations in market valuations of companies with respect to

announced transactions and the final valuations thereof; results of

exploration and testing activities; and the ability to obtain

required approvals and extensions from regulatory authorities.

Bengal believes the expectations reflected in those forward-looking

statements are reasonable but, no assurances can be given that any

of the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do so, what benefits that

Bengal will derive from them. As such, undue reliance should not be

placed on forward-looking statements.

Forward-looking statements contained herein

include, but are not limited to, statements regarding: the expected

benefit of the Amendments to the Company; the Company's hedging

program; the Company's expected growth activities and development

forecast in calendar 2019 and the funding sources for such

activities; and the expected expansion of the Company's Cuisinier

platform as a result of the 2019 development program. The

forward-looking statements contained herein are subject to numerous

known and unknown risks and uncertainties that may cause Bengal’s

actual financial results, performance or achievement in future

periods to differ materially from those expressed in, or implied

by, these forward-looking statements, including but not limited to,

risks associated with: further amendments to, and extensions of,

the Credit Facility; the ability of the Company to complete the

2019 development program and activities as outlined in this news

release or at all; failure to obtain the expected results from the

water injection pilot; liabilities inherent in oil and natural gas

operations; the failure to obtain required regulatory approvals or

extensions; failure to satisfy the conditions under farm-in and

joint venture agreements; failure to secure required equipment and

personnel; changes in general global economic conditions including,

without limitations, the economic conditions in North America and

Australia; uncertainties associated with estimating oil and natural

gas reserves; increased competition for, among other things:

capital, acquisitions of reserves, undeveloped lands and skilled

personnel; the availability of qualified operating or management

personnel; incorrect assessment of the value of acquisitions;

fluctuations in commodity prices, foreign exchange or interest

rates; inability to meet commitments due to inability to raise

funds or complete farm-outs; geological, technical, drilling and

processing problems; changes in laws and regulations including,

without limitation, the adoption of new environmental, royalty and

tax laws and regulations and changes in how they are interpreted

and enforced; Bengal’s development and exploration opportunities;

the results of exploration and development drilling and related

activities; the ability to access sufficient capital from internal

and external sources; and counter-party credit risk, stock market

volatility and market valuation of Bengal’s stock. Statements

relating to "reserves" are deemed to be forward-looking statements,

as they involve the implied assessment, based on certain estimates

and assumptions, which the reserves described, can be profitably

produced in the future. Readers are encouraged to review the

material risks discussed in Bengal’s Annual Information Form under

the heading “Risk Factors” and in Bengal’s annual MD&A under

the heading “Risk Factors”. The Company cautions that the

foregoing list of assumptions, risks and uncertainties is not

exhaustive. The forward-looking statements contained in this

news release speak only as of the date hereof and Bengal does not

assume any obligation to publicly update or revise them to reflect

new events or circumstances, except as may be require pursuant to

applicable securities laws.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Bengal Energy

Ltd.Chayan Chakrabarty, President & Chief

Executive OfficerMatthew Moorman, Chief Financial

OfficerPhone: (403)

205-2526Email:

investor.relations@bengalenergy.caWebsite:

www.bengalenergy.ca

PDF

available: http://resource.globenewswire.com/Resource/Download/86b0f5f3-e304-4fa2-810d-056b69196a51

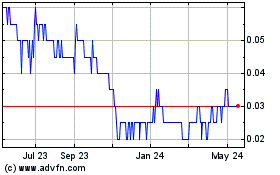

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Oct 2024 to Nov 2024

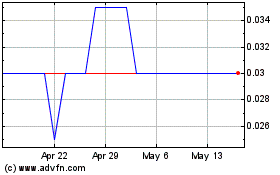

Bengal Energy (TSX:BNG)

Historical Stock Chart

From Nov 2023 to Nov 2024