Black Diamond Group Limited ("Black Diamond", the "Company" or

"we"), (TSX:BDI), a leading provider of space rental and workforce

accommodation solutions, today announced its operating and

financial results for the three and six months ended June 30,

2024 (the "Quarter") compared with the three and six months ended

June 30, 2023 (the "Comparative Quarter"). All financial

figures are expressed in Canadian dollars.

Key Highlights from the Second Quarter

of 2024

- Consolidated rental revenue of $35.3 million was

essentially flat as compared to the Comparative Quarter. Adjusted

EBITDA1 of $27.9 million was up 24% from the Comparative Quarter,

driven primarily by higher total revenues and gross

profit.

- Quarterly profit of $7.5 million was 63% higher than the

Comparative Quarter. Diluted earnings per share ("EPS") of $0.12

was 50% higher than the Comparative Quarter.

- Return on Assets1 of 19.9% was a 300 basis point improvement

over the Comparative Quarter.

- Consolidated contracted future rental revenue at the end of the

Quarter grew 16% from $120.1 million at the end of the

Comparative Quarter to $139.6 million.

- Consolidated utilization was 75.5%, with Modular Space

Solutions ("MSS") at 80.7% and Workforce Solutions ("WFS") at 62.4%

compared to 79.3%, 83.4%, and 69.8% in the Comparative Quarter,

respectively. These utilization levels remain healthy in the

context of current and historical industry averages.

- MSS rental revenue of $22.2 million, was a quarterly

record and an increase of 6% from $21.0 million in the

Comparative Quarter.

- MSS average monthly rental rate per unit increased 9% from the

Comparative Quarter (or 8% on a constant currency basis), while

contracted future rental revenue increased 26% to

$107.7 million at the end of the Quarter from

$85.4 million at the end of the Comparative Quarter. Average

rental duration of the MSS lease portfolio at the end of the

Quarter also increased to 58.7 months from 51.1 months from the

Comparative Quarter.

- WFS total revenue of $44.0 million was essentially flat

from the Comparative Quarter. WFS rental revenue was

$13.1 million, a decrease of 7% compared to $14.1 million

from the Comparative Quarter due to the completion of two large

pipeline projects at the end of 2023, which was slightly offset by

continued redeployments of equipment at meaningfully higher average

rates during the Quarter. WFS Adjusted EBITDA of $17.3 million

was up 49% from the Comparative Quarter.

- LodgeLink net revenue was a record $2.9 million, an

increase of 26% from $2.3 million in the Comparative Quarter

on higher booking volumes as total room nights sold increased 28%

from the Comparative Quarter, to a record rate of

129,737.

- Total capital expenditures were $53.5 million for the Quarter,

including the acquisition of a fleet of 329 space rental units for

$20.5 million, and maintenance capital of $3.4 million. Total

capital commitments at the end of the Quarter in the amount of

$32.3 million is 36% greater than the Comparative Quarter, with the

majority of growth capital being allocated to contracted project

specific fleet units.

- Long term debt and Net Debt1 at the end of the Quarter

increased 26% and 23% since December 31, 2023, to

$239.7 million and $225.9 million, respectively. The

increase is primarily attributable to the $20.5 million MSS

asset acquisition which closed on June 28, 2024. Net Debt to

trailing twelve month ("TTM") Adjusted Leverage EBITDA1 of 2.1x is

at the low-end of the Company's target range of 2.0x to 3.0x, while

available liquidity was $101.0 million at the end of the

Quarter.

- Subsequent to the end of the Quarter, the Company declared a

third quarter dividend of $0.03 payable on or about October 15,

2024 to shareholders of record on September 30, 2024.

Outlook

The Company’s outlook for the remainder of 2024

remains positive, driven in-part by over $139.6 million of

contracted future rental revenue, up 16% from the end of the

Comparative Quarter. Capital commitments of $32.3 million at the

end of the Quarter are 36% higher than at the end of the

Comparative Quarter and the Company continues to see opportunities

to compound and reinvest shareholder capital through organic fleet

growth along with additional potential tuck-in

acquisitions.

During the Quarter, MSS generated a record $22.2

million in rental revenue, up 6% from the Comparative Quarter,

largely driven by increased average rental rates and ongoing

organic fleet investment, slightly offset by a moderate decline in

utilization. Current utilization remains at healthy levels for the

MSS platform and above long-term industry trends. Sales revenue

declined 8% from the Comparative Quarter, but increased 103%, or

$6.7 million from the first quarter of 2024 as projects that had

been delayed were completed in the Quarter. Non-rental revenue in

the Quarter was up 31% from the Comparative Quarter, as

installation activity increased, pointing to an active market

within the rental fleet. MSS contracted future rental revenue

continues to grow and ended the Quarter at $107.7 million, up 26%

or $22.3 million from the Comparative Quarter, with an average

rental duration of 59 months. Demand remains robust in key

infrastructure and education verticals which continued to support

ongoing deployment of organic fleet growth in the Quarter.

On June 28, 2024, Black Diamond closed a $20.5

million MSS asset purchase in British Columbia. Given healthy

demand in the region stemming from both construction and

infrastructure end-markets, management expects the 329 space

rentals assets to fit seamlessly into the fleet and enhance our

ability to service active clients across British Columbia and the

Prairies, which is expected to drive further growth in high margin

rental revenue.

WFS had a strong quarter despite a modest 7%

reduction in rental revenue from the Comparative Quarter to $13.1

million, as a result of the completion of two large pipeline

projects at the end of 2023. The business unit has continued to

backfill these rental revenues through improved utilization in

other parts of the business unit, as well as through generally

higher average rental rates as evidenced by the 49% increase in

Adjusted EBITDA1 from the Comparative Quarter to $17.3 million in

the Quarter. Management continues to see a robust opportunity set

in both North America and Australia and believes core WFS rental

revenue will improve from current levels in the remaining half of

2024.

LodgeLink continues to scale with Gross

Bookings1 up 25%, to $24.4 million and net revenue increasing 26%

from the Comparative Quarter to a record $2.9 million. Total room

nights sold in the Quarter rose 28% from the Comparative Quarter to

a record 129,737. Net Revenue Margins1 for the Quarter were up 10

basis points versus the Comparative Quarter, reaching 11.9%, driven

by higher margin ancillary revenue. The Company continues to

believe that LodgeLink is well-positioned for continued growth

within a large, addressable North American workforce travel market

with an expanding base of corporate customers. The LodgeLink supply

network also continues to scale with over 1.6 million rooms of

capacity in over 17,000 North American properties. During the

Quarter, LodgeLink announced an expansion into the Australian

workforce travel market, aligned with the platform’s long-term

strategy of exponentially scaling to become the pre-eminent

ecosystem for workforce travel.

Black Diamond remains focused on driving

profitable growth while compounding the Company’s high-margin,

recurring rental revenue streams in both North America and

Australia. The Company is well positioned to fund continued organic

and inorganic growth with liquidity of $101.0 million, and Net

Debt to TTM Adjusted Leverage EBITDA1 of 2.1x, which is at the low

end of the Company's targeted range of 2.0x to 3.0x. The outlook

for the balance of 2024 remains positive, supported by growing

contracted rental revenues, a growing fleet of long-lived assets, a

robust sales pipeline, and the continued scaling of LodgeLink.

1 Adjusted EBITDA, Net Debt and Gross Bookings

are non-GAAP financial measures. Return on Assets, Net Revenue

Margin and Net Debt to TTM Adjusted Leverage EBITDA are non-GAAP

ratios. Refer to the Non-GAAP Measures section of this news release

for more information on each non-GAAP financial measure and

ratio.

| Second

Quarter 2024 Financial Highlights |

| |

|

|

| |

Three months

ended June 30, |

Six months

ended June 30, |

| ($ millions, except as noted) |

2024 |

|

2023 |

|

Change |

2024 |

|

2023 |

|

Change |

| Financial

Highlights |

$ |

$ |

% |

$ |

$ |

% |

| Total

revenue |

95.5 |

|

91.1 |

|

5 |

% |

169.1 |

|

172.6 |

|

(2 |

)% |

| Gross profit |

46.0 |

|

39.4 |

|

17 |

% |

81.8 |

|

76.7 |

|

7 |

% |

| Administrative expenses |

19.9 |

|

16.8 |

|

18 |

% |

36.8 |

|

32.8 |

|

12 |

% |

| Adjusted EBITDA(1) |

27.9 |

|

22.5 |

|

24 |

% |

47.3 |

|

43.9 |

|

8 |

% |

| Adjusted EBIT(1) |

16.8 |

|

11.9 |

|

41 |

% |

25.5 |

|

23.5 |

|

9 |

% |

| Funds from Operations(1) |

29.9 |

|

26.0 |

|

15 |

% |

49.3 |

|

47.4 |

|

4 |

% |

| Per share ($) |

0.49 |

|

0.43 |

|

14 |

% |

0.81 |

|

0.79 |

|

3 |

% |

| Profit before income taxes |

10.0 |

|

6.9 |

|

45 |

% |

12.3 |

|

13.4 |

|

(8 |

)% |

| Profit |

7.5 |

|

4.6 |

|

63 |

% |

9.0 |

|

9.0 |

|

— |

% |

| Earnings per share - Basic ($) |

0.12 |

|

0.08 |

|

50 |

% |

0.15 |

|

0.15 |

|

— |

% |

| Earnings per share -

Diluted ($) |

0.12 |

|

0.08 |

|

50 |

% |

0.14 |

|

0.15 |

|

(7 |

)% |

| Capital expenditures |

53.5 |

|

19.3 |

|

177 |

% |

70.8 |

|

35.1 |

|

102 |

% |

|

Property & equipment |

563.1 |

|

500.0 |

|

13 |

% |

563.1 |

|

500.0 |

|

13 |

% |

| Total assets |

721.5 |

|

653.6 |

|

10 |

% |

721.5 |

|

653.6 |

|

10 |

% |

| Long-term debt |

239.7 |

|

219.2 |

|

9 |

% |

239.7 |

|

219.2 |

|

9 |

% |

| Cash and cash

equivalents |

14.1 |

|

15.4 |

|

(8 |

)% |

14.1 |

|

15.4 |

|

(8 |

)% |

| Return on Assets

(%)(1) |

19.9 |

% |

16.9 |

% |

300 bps |

17.1 |

% |

16.6 |

% |

50 bps |

| Free Cashflow(1) |

18.3 |

|

17.0 |

|

8 |

% |

27.7 |

|

30.1 |

|

(8 |

)% |

| (1) Adjusted EBITDA, Adjusted EBIT, Funds from

Operations and Free Cashflow are non-GAAP financial measures.

Return on Assets is a non-GAAP ratio. Refer to the Non-GAAP

Measures section of this news release for more information on each

non-GAAP financial measure and ratio. |

Additional Information

A copy of the Company's unaudited interim

condensed consolidated financial statements for the three and six

months ended June 30, 2024 and 2023 and related management's

discussion and analysis have been filed with the Canadian

securities regulatory authorities and may be accessed through the

SEDAR+ website (www.sedarplus.ca) and

www.blackdiamondgroup.com.

About Black Diamond Group

Black Diamond is a specialty rentals and

industrial services company with two operating business units - MSS

and WFS. We operate in Canada, the United States, and

Australia.

MSS through its principal brands, BOXX Modular,

CLM, MPA Systems, and Schiavi, owns a large rental fleet of modular

buildings of various types and sizes. Its network of local branches

rent, sell, service, and provide ancillary products and services to

a diverse customer base in the construction, industrial, education,

financial, and government sectors.

WFS owns a large rental fleet of modular

accommodation assets of various types. Its regional operating

terminals rent, sell, service, and provide ancillary products and

services including turnkey operated camps to a wide array of

customers in the resource, infrastructure, construction, disaster

recovery, and education sectors.

In addition, WFS includes LodgeLink which

operates a digital marketplace for business-to-business crew

accommodation, travel, and logistics services across North America.

The LodgeLink proprietary digital platform enables customers to

efficiently find, book, and manage their crew travel and

accommodation needs through a rapidly growing network of hotel,

remote lodge, and travel partners. LodgeLink exists to solve the

unique challenges associated with crew travel and applies

technology to eliminate inefficiencies at every step of the crew

travel process from booking, to management, to payments, to cost

reporting.

Learn more at www.blackdiamondgroup.com.

For investor inquiries please contact Jason Zhang at

403-206-4739 or investor@blackdiamondgroup.com.

Conference Call

Black Diamond will hold a conference call and

webcast at 9:00 a.m. MT (11:00 a.m. ET) on Friday, August 2, 2024.

CEO Trevor Haynes and CFO Toby LaBrie will discuss Black Diamond’s

financial results for the Quarter and then take questions from

investors and analysts.

To access the conference call by telephone dial toll free

1-844-763-8274. International callers should use 1-647-484-8814.

Please connect approximately 10 minutes prior to the beginning of

the call.

To access the call via webcast, please log into

the webcast link 10 minutes before the start time at:

https://www.gowebcasting.com/13402

Following the conference call, a replay will be available on the

Investor Centre section of the Company’s website at

www.blackdiamondgroup.com, under Presentations & Events.

Reader Advisory

Forward-Looking

StatementsCertain information set forth in this news

release contains forward-looking statements including, but not

limited to, the Company's outlook for the remainder of 2024,

opportunities to compound and reinvest shareholder capital,

expectations for the effect of the June 28, 2024 MSS asset

purchase, expectations for and opportunities in different

geographic areas, opportunities for organic investment, potential

for tuck-in acquisitions, the sales and opportunity pipeline,

timing and payment of a third quarter dividend, management's

assessment of Black Diamond's future operations and what may have

an impact on them, opportunities and effect of deploying investment

capital, financial performance, business prospects and

opportunities, changing operating environment including changing

activity levels, effects on demand and performance based on the

changing operating environment, expectations for demand and growth

in the Company's operating and customer segments, future deployment

of assets, amount of revenue anticipated to be derived from current

contracts, ongoing contractual terms and debt obligations,

liquidity, working capital and other requirements, sources and use

of funds, economic life of the Company's assets, expected length of

existing contracts and future growth and profitability of the

Company. With respect to the forward-looking statements in this

news release, Black Diamond has made assumptions regarding, among

other things: future commodity prices, the future rate environment,

that Black Diamond will continue to raise sufficient capital to

fund its business plans in a manner consistent with past

operations, timing and cost estimates of the Enterprise Resource

Planning ("ERP") system, that counterparties to contracts will

perform the contracts as written and that there will be no

unforeseen material delays in contracted projects. Although Black

Diamond believes that the expectations reflected in the

forward-looking statements contained in this news release, and the

assumptions on which such forward-looking statements are made, are

reasonable, there can be no assurances that such expectations or

assumptions will prove to be correct. Readers are cautioned that

assumptions used in the preparation of such statements may prove to

be incorrect. Events or circumstances may cause actual results to

differ materially from those predicted, as a result of numerous

known and unknown risks, uncertainties and other factors, many of

which are beyond the control of Black Diamond. These risks include,

but are not limited to: volatility of industry conditions, the

Company's ability to attract new customers, political conditions,

dependence on agreements and contracts, competition, credit risk,

information technology systems and cyber security, vulnerability to

market changes, operating risks and insurance, weakness in

industrial construction and infrastructure developments, weakness

in natural resource industries, access to additional financing,

dependence on suppliers and manufacturers, reliance on key

personnel, and workforce availability. The risks outlined above

should not be construed as exhaustive. Additional information on

these and other factors that could affect Black Diamond's

operations and financial results are included in Black Diamond's

annual information form for the year ended December 31, 2023

and other reports on file with the Canadian securities regulatory

authorities which can be accessed on Black Diamond's profile on

SEDAR+. Readers are cautioned not to place undue reliance on these

forward-looking statements. Furthermore, the forward-looking

statements contained in this news release are made as at the date

of this news release and Black Diamond does not undertake any

obligation to update or revise any of the forward-looking

statements, except as may be required by applicable securities

laws.

Non-GAAP MeasuresIn this news

release, the following specified financial measures and ratios have

been disclosed: Adjusted EBITDA, Adjusted EBIT, Adjusted EBITDA as

a % of Revenue, Return on Assets, Net Debt, Net Debt to TTM

Adjusted Leverage EBITDA, Funds from Operations, Free Cashflow,

Gross Bookings, and Net Revenue Margin. These non-GAAP and other

financial measures do not have any standardized meaning prescribed

under International Financial Reporting Standards ("IFRS") and

therefore may not be comparable to similar measures presented by

other entities. Readers are cautioned that these non-GAAP measures

are not alternatives to measures under IFRS and should not, on

their own, be construed as an indicator of the Company's

performance or cash flows, a measure of liquidity or as a measure

of actual return on the common shares of the Company. These

non-GAAP measures should only be used in conjunction with the

consolidated financial statements of the Company.

Adjusted EBITDA is not a measure recognized

under IFRS and does not have standardized meanings prescribed by

IFRS. Adjusted EBITDA refers to consolidated earnings before

finance costs, tax expense, depreciation, amortization, accretion,

foreign exchange, share-based compensation, acquisition costs,

non-controlling interests, share of gains or losses of an

associate, write-down of property and equipment, impairment,

non-recurring costs, and gains or losses on the sale of non-fleet

assets in the normal course of business.

Black Diamond uses Adjusted EBITDA primarily as

a measure of operating performance. Management believes that

operating performance, as determined by Adjusted EBITDA, is

meaningful because it presents the performance of the Company's

operations on a basis which excludes the impact of certain non-cash

items as well as how the operations have been financed. In

addition, management presents Adjusted EBITDA because it considers

it to be an important supplemental measure of the Company's

performance and believes this measure is frequently used by

securities analysts, investors and other interested parties in the

evaluation of companies in industries with similar capital

structures.

Adjusted EBITDA has limitations as an analytical

tool, and readers should not consider this item in isolation, or as

a substitute for an analysis of the Company's results as reported

under IFRS. Some of the limitations of Adjusted EBITDA are:

- Adjusted EBITDA excludes certain income tax payments and

recoveries that may represent a reduction or increase in cash

available to the Company;

- Adjusted EBITDA does not reflect the Company's cash

expenditures, or future requirements, for capital expenditures or

contractual commitments;

- Adjusted EBITDA does not reflect changes in, or cash

requirements for, the Company's working capital needs;

- Adjusted EBITDA does not reflect the significant interest

expense, or the cash requirements necessary to service interest

payments on the Company's debt;

- depreciation and amortization are non-cash charges, thus the

assets being depreciated and amortized will often have to be

replaced in the future and Adjusted EBITDA does not reflect any

cash requirements for such replacements; and

- other companies in the industry may calculate Adjusted EBITDA

differently than the Company does, limiting its usefulness as a

comparative measure.

Because of these limitations, Adjusted EBITDA

should not be considered as a measure of discretionary cash

available to invest in the growth of the Company's business. The

Company compensates for these limitations by relying primarily on

the Company's IFRS results and using Adjusted EBITDA only on a

supplementary basis. A reconciliation to profit, the most

comparable GAAP measure, is provided below.

Adjusted EBIT is Adjusted

EBITDA less depreciation and amortization. Black Diamond uses

Adjusted EBIT primarily as a measure of operating performance.

Management believes that Adjusted EBIT is a useful measure for

investors when analyzing ongoing operating trends. There can be no

assurances that additional special items will not occur in future

periods, nor that the Company's definition of Adjusted EBIT is

consistent with that of other companies. As such, management

believes that it is appropriate to consider both profit determined

on a GAAP basis as well as Adjusted EBIT. A reconciliation to

profit, the most comparable GAAP measure, is provided below.

Adjusted EBITDA as a % of

Revenue is calculated by dividing Adjusted EBITDA by total

revenue for the period. Black Diamond uses Adjusted EBITDA as a %

of Revenue primarily as a measure of operating performance.

Management believes this ratio is an important supplemental measure

of the Company's performance and believes this measure is

frequently used by securities analysts, investors and other

interested parties in the evaluation of companies in industries

with similar capital structures.

Return on Assets is calculated

as annualized Adjusted EBITDA divided by average net book value of

property and equipment. Annualized Adjusted EBITDA is calculated by

multiplying Adjusted EBITDA for the Quarter and Comparative Quarter

by an annualized multiplier. Management believes that Return on

Assets is a useful financial measure for investors in evaluating

operating performance for the periods presented. When read in

conjunction with our profit and property and equipment, two GAAP

measures, this non-GAAP ratio provides investors with a useful tool

to evaluate Black Diamond's ongoing operations and management of

assets from period-to-period.

|

Reconciliation of Consolidated Profit to Adjusted EBITDA,

Adjusted EBIT, Adjusted EBITDA as a % of Revenue and Return on

Assets: |

| |

|

|

| |

Three months

ended June 30, |

Six months

ended June 30, |

| ($

millions, except as noted) |

2024 |

|

2023 |

|

Change % |

2024 |

|

2023 |

|

Change % |

|

Profit |

7.5 |

|

4.6 |

|

63 |

% |

9.0 |

|

9.0 |

|

— |

% |

| Add: |

|

|

|

|

|

|

|

Depreciation and amortization(1) |

11.1 |

|

10.6 |

|

5 |

% |

21.8 |

|

20.4 |

|

7 |

% |

|

Finance costs(1) |

3.4 |

|

3.7 |

|

(8 |

)% |

7.2 |

|

6.6 |

|

9 |

% |

|

Share-based compensation(1) |

1.6 |

|

1.3 |

|

23 |

% |

3.0 |

|

3.5 |

|

(14 |

)% |

|

Non-controlling interest(1) |

0.4 |

|

0.3 |

|

33 |

% |

0.7 |

|

0.6 |

|

17 |

% |

|

Current income taxes(1) |

— |

|

0.1 |

|

(100 |

)% |

0.2 |

|

0.1 |

|

100 |

% |

|

Deferred income taxes |

2.1 |

|

1.9 |

|

11 |

% |

2.5 |

|

3.7 |

|

(32 |

)% |

| Non-recurring

costs: |

|

|

|

|

|

|

|

ERP implementation

and related costs(2) |

1.8 |

|

— |

|

100 |

% |

2.3 |

|

— |

|

100 |

% |

|

Acquisition

costs |

— |

|

— |

|

— |

% |

0.6 |

|

— |

|

100 |

% |

|

Adjusted EBITDA |

27.9 |

|

22.5 |

|

24 |

% |

47.3 |

|

43.9 |

|

8 |

% |

| Less: |

|

|

|

|

|

|

|

Depreciation and amortization(1) |

11.1 |

|

10.6 |

|

5 |

% |

21.8 |

|

20.4 |

|

7 |

% |

|

Adjusted EBIT |

16.8 |

|

11.9 |

|

41 |

% |

25.5 |

|

23.5 |

|

9 |

% |

| |

|

|

|

|

|

|

| Total

revenue(1) |

95.5 |

|

91.1 |

|

5 |

% |

169.1 |

|

172.6 |

|

(2 |

)% |

|

Adjusted EBITDA as a % of Revenue |

29.2 |

% |

24.7 |

% |

450 bps |

28.0 |

% |

25.4 |

% |

260 bps |

| |

|

|

|

|

|

|

|

Annualized multiplier |

4 |

|

4 |

|

|

2 |

|

2 |

|

|

| Annualized adjusted

EBITDA |

111.6 |

|

90.0 |

|

24 |

% |

94.6 |

|

87.8 |

|

8 |

% |

| Average

net book value of property and equipment |

562.6 |

|

534.3 |

|

5 |

% |

553.8 |

|

529.5 |

|

5 |

% |

| Return

on Assets |

19.9 |

% |

16.9 |

% |

300 bps |

17.1 |

% |

16.6 |

% |

50 bps |

| (1) Sourced from

the Company's unaudited interim condensed consolidated financial

statements for the three and six months ended June 30, 2024

and 2023.(2) This relates to the corporate structure reorganization

costs that have been incurred in preparation of a new ERP system in

which the first phase of implementation went live on May 1,

2024. |

Net Debt to TTM Adjusted Leverage

EBITDA is a non-GAAP ratio which is calculated as Net Debt

divided by trailing twelve months Adjusted Leverage EBITDA.

Net Debt, a non-GAAP financial measure, is

calculated as long-term debt minus cash and cash equivalents. A

reconciliation to long-term debt, the most comparable GAAP measure,

is provided below. Net Debt and Net Debt to TTM Adjusted Leverage

EBITDA removes cash and cash equivalents from the Company's debt

balance. Black Diamond uses this ratio primarily as a measure of

operating performance. Management believes this ratio is an

important supplemental measure of the Company's performance and

believes this measure is frequently used by securities analysts,

investors and other interested parties in the evaluation of

companies in industries with similar capital structures. In the

quarter ended June 30, 2022, Net Debt to TTM Adjusted EBITDA was

renamed Net Debt to TTM Adjusted Leverage EBITDA, to provide

further clarity on the composition of the denominator to include

pre-acquisition estimates of EBITDA from business combinations.

Management believes including the additional information in this

calculation helps provide information on the impact of trailing

operations from business combinations on the Company's leverage

position.

|

Reconciliation of Consolidated Profit to Adjusted EBITDA,

Net Debt and Net Debt to TTM Adjusted Leverage

EBITDA: |

|

($ millions, except as noted) |

2024 |

2024 |

2023 |

2023 |

2023 |

2023 |

2022 |

|

2022 |

Change |

| |

Q2 |

Q1 |

Q4 |

Q3 |

Q2 |

Q1 |

Q4 |

Q3 |

|

| Profit |

7.5 |

1.5 |

7.8 |

13.6 |

4.6 |

4.4 |

9.4 |

|

9.0 |

|

|

Add: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

11.1 |

10.7 |

11.2 |

12.6 |

10.6 |

9.8 |

8.6 |

|

9.2 |

|

|

Finance costs |

3.4 |

3.8 |

3.7 |

3.7 |

3.7 |

2.9 |

3.6 |

|

2.1 |

|

|

Share-based compensation |

1.6 |

1.5 |

1.1 |

1.6 |

1.3 |

2.2 |

1.3 |

|

1.3 |

|

|

Non-controlling interest |

0.4 |

0.3 |

0.3 |

0.3 |

0.3 |

0.3 |

0.4 |

|

0.5 |

|

|

Current income taxes |

— |

0.2 |

0.1 |

— |

0.1 |

— |

0.1 |

|

— |

|

|

Deferred income taxes |

2.1 |

0.3 |

0.4 |

4.8 |

1.9 |

1.8 |

3.7 |

|

3.9 |

|

|

Impairment reversal |

— |

— |

— |

— |

— |

— |

(6.3 |

) |

— |

|

|

Non-recurring costs |

|

|

|

|

|

|

|

|

|

|

ERP implementation and related costs (1) |

1.8 |

0.5 |

1.5 |

— |

— |

— |

— |

|

— |

|

|

Acquisition costs |

— |

0.6 |

— |

— |

— |

— |

1.2 |

|

— |

|

|

Adjusted EBITDA |

27.9 |

19.4 |

26.1 |

36.6 |

22.5 |

21.4 |

22.0 |

|

26.0 |

|

|

Acquisition pro-forma adjustments(2) |

— |

— |

— |

— |

— |

— |

0.5 |

|

2.3 |

|

|

Adjusted Leverage EBITDA |

27.9 |

19.4 |

26.1 |

36.6 |

22.5 |

21.4 |

22.5 |

|

28.3 |

|

| |

|

|

|

|

|

|

|

|

|

| TTM Adjusted Leverage

EBITDA |

110.0 |

|

|

|

94.7 |

|

|

|

16 |

% |

| |

|

|

|

|

|

|

|

|

|

| Long-term debt |

239.7 |

|

|

|

219.2 |

|

|

|

9 |

% |

| Cash and cash equivalents |

14.1 |

|

|

|

15.4 |

|

|

|

(8 |

)% |

| Current

portion of long term debt (3) |

0.3 |

|

|

|

0.3 |

|

|

|

— |

% |

| Net

Debt |

225.9 |

|

|

|

204.1 |

|

|

|

11 |

% |

| Net

Debt to TTM Adjusted Leverage EBITDA |

2.1 |

|

|

|

2.2 |

|

|

|

(5 |

)% |

| (1) This relates

to the corporate structure reorganization costs that have been

incurred in preparation of a new ERP system in which the first

phase of implementation went live on May 1, 2024. (2) Includes

pro-forma pre-acquisition EBITDA estimates as if the acquisition

that occurred in the fourth quarter 2022, occurred on January 1,

2022.(3) Current portion of long-term debt relating to the payments

due within one year on the bank term loans assumed as part of the

acquisition in the fourth quarter of 2022. |

Funds from Operations is

calculated as the cash flow from operating activities, the most

comparable GAAP measure, excluding the changes in non-cash working

capital. Management believes that Funds from Operations is a useful

measure as it provides an indication of the funds generated by the

operations before working capital adjustments. Changes in long-term

accounts receivables and non-cash working capital items have been

excluded as such changes are financed using the operating line of

Black Diamond's credit facilities. A reconciliation to cash flow

from operating activities, the most comparable GAAP measure, is

provided below.

Free Cashflow is calculated as

Funds from Operations minus maintenance capital, net interest paid

(including lease interest), payment of lease liabilities, net

current income tax expense (recovery), distributions declared to

non-controlling interest, dividends paid on common shares and

dividends paid on preferred shares plus net current income taxes

received (paid). Management believes that Free Cashflow is a useful

measure as it provides an indication of the funds generated by the

operations before working capital adjustments and other items noted

above. Management believes this metric is frequently used by

securities analysts, investors and other interested parties in the

evaluation of companies in industries with similar capital

structures. A reconciliation to cash flow from operating

activities, the most comparable GAAP measure, is provided

below.

|

Reconciliation of Cash Flow from Operating Activities to

Funds from Operations and Free Cashflow: |

| |

Three months ended June 30, |

Six months ended June 30, |

| ($

millions, except as noted) |

2024 |

|

2023 |

|

Change |

2024 |

|

2023 |

|

Change |

| |

|

|

|

|

|

|

|

Cash Flow from Operating Activities(1) |

27.3 |

|

32.7 |

|

(17 |

)% |

49.7 |

|

64.4 |

|

(23 |

)% |

| Add/(Deduct): |

|

|

|

|

|

|

|

Change in other long term assets(1) |

(1.1 |

) |

(0.2 |

) |

(450 |

)% |

(1.6 |

) |

(0.4 |

) |

(300 |

)% |

|

Changes in non-cash operating working capital(1) |

3.7 |

|

(6.5 |

) |

157 |

% |

1.2 |

|

(16.6 |

) |

107 |

% |

| Funds

from Operations |

29.9 |

|

26.0 |

|

15 |

% |

49.3 |

|

47.4 |

|

4 |

% |

| Add/(deduct): |

|

|

|

|

|

|

|

Maintenance capital |

(3.4 |

) |

(2.0 |

) |

(70 |

)% |

(6.1 |

) |

(4.3 |

) |

(42 |

)% |

|

Payment for lease liabilities |

(2.1 |

) |

(1.9 |

) |

(11 |

)% |

(4.2 |

) |

(3.7 |

) |

(14 |

)% |

|

Interest paid (including lease interest) |

(3.7 |

) |

(3.6 |

) |

(3 |

)% |

(7.3 |

) |

(6.4 |

) |

(14 |

)% |

|

Net current income tax expense |

— |

|

— |

|

— |

% |

0.2 |

|

0.1 |

|

100 |

% |

|

Dividends paid on common shares |

(1.8 |

) |

(1.2 |

) |

(50 |

)% |

(3.6 |

) |

(2.4 |

) |

(50 |

)% |

|

Distributions paid to non-controlling interest |

(0.6 |

) |

(0.3 |

) |

(100 |

)% |

(0.6 |

) |

(0.6 |

) |

— |

% |

|

Free Cashflow |

18.3 |

|

17.0 |

|

8 |

% |

27.7 |

|

30.1 |

|

(8 |

)% |

|

(1) Sourced from the Company's unaudited interim

condensed consolidated financial statements for the three and six

months ended June 30, 2024 and 2023. |

Gross Bookings, a non-GAAP

measure, is total revenue billed to the customer which includes all

fees and charges. Net revenue, a GAAP measure, is Gross Bookings

less costs paid to suppliers. Revenue from bookings at third party

lodges and hotels through LodgeLink are recognized on a net revenue

basis. LodgeLink is an agent in the transaction as it is not

responsible for providing the service to the customer and does not

control the service provided by a supplier. Management believes

this ratio is an important supplemental measure of LodgeLink's

performance and cash generation and believes this ratio is

frequently used by interested parties in the evaluation of

companies in industries with similar forms of revenue

generation.

Net Revenue Margin is

calculated by dividing net revenue by Gross Bookings for the

period. Management believes this ratio is an important supplemental

measure of LodgeLink's performance and profitability and believes

this ratio is frequently used by interested parties in the

evaluation of companies in industries with similar forms revenue

generation where companies act as agents in transactions.

|

Reconciliation of Net Revenue to Gross Bookings and Net

Revenue Margin: |

| |

Three months ended June 30, |

Six months ended June 30, |

| ($

millions, except as noted) |

2024 |

|

2023 |

|

Change |

2024 |

|

2023 |

|

Change |

|

Net revenue(1) |

2.9 |

|

2.3 |

|

26 |

% |

5.5 |

|

4.5 |

|

22 |

% |

| Costs

paid to suppliers(1) |

21.5 |

|

17.2 |

|

25 |

% |

40.4 |

|

33.5 |

|

21 |

% |

| Gross

Bookings(1) |

24.4 |

|

19.5 |

|

25 |

% |

45.9 |

|

38.0 |

|

21 |

% |

| Net

Revenue Margin |

11.9 |

% |

11.8 |

% |

10 bps |

12.0 |

% |

11.8 |

% |

20 bps |

| (1) Includes

intercompany transactions. |

Readers are cautioned that the non-GAAP measures

are not alternatives to measures under IFRS and should not, on

their own, be construed as an indicator of Black Diamond's

performance or cash flows, a measure of liquidity or as a measure

of actual return on the shares of Black Diamond. These non-GAAP

measures should only be used in conjunction with the consolidated

financial statements of Black Diamond.

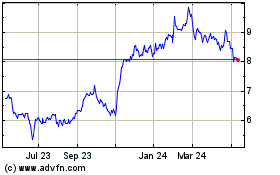

Black Diamond (TSX:BDI)

Historical Stock Chart

From Feb 2025 to Mar 2025

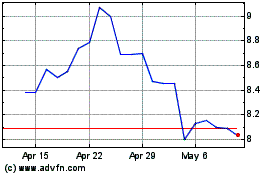

Black Diamond (TSX:BDI)

Historical Stock Chart

From Mar 2024 to Mar 2025