Accord Announces Normal Course Issuer Bid

August 05 2010 - 10:53AM

PR Newswire (Canada)

TORONTO, Aug. 5 /CNW/ -- TORONTO, Aug. 5 /CNW/ - Accord Financial

Corp. (TSX - ACD), a leading North American provider of a wide

range of factoring and other asset-based financial services to

businesses, today announced that Toronto Stock Exchange (the "TSX")

has accepted for filing a Notice of Intention to Make a Normal

Course Issuer Bid (the "Bid"). Under the Bid, the Company may

purchase up to 470,373 common shares during the next 12 months

being 5% of the 9,407,471 issued and outstanding common shares as

at July 30, 2010. All shares purchased pursuant to the Bid will be

cancelled. Share purchases will be made through facilities of the

TSX or other Canadian marketplaces and will be in accordance with

the TSX's rules and policies. Pursuant to TSX policies, daily

purchases made by the Company will not exceed 1,000 common shares,

subject to a prescribed exception that allows for one block

purchase per calendar week. The Bid will commence on August 8, 2010

and terminate on the earlier of the date on which the Company

completes its purchases pursuant to the Bid or August 7, 2011.

Under the Company's existing Bid, which commenced August 8, 2009

and expires August 7, 2010, 14,900 shares have been repurchased for

cancellation at an average price of $5.32 for a total consideration

of $79,317. The Company believes that it may be advantageous to

engage in repurchases of its common shares, from time to time, when

they are trading at prices which the Company believes reflect a

discount from the underlying value of the common shares. %SEDAR:

00001979E Stuart Adair, Chief Financial Officer, Accord Financial

Corp., 77 Bloor Street West, 18th floor, Toronto, Ontario, M5S 1M2,

(416) 961-0304 ext. 207, sadair@accordfinancial.com

Copyright

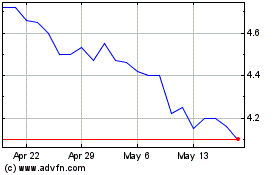

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jul 2023 to Jul 2024