ATHA Energy Announces Proposed Option Agreements with Terra Uranium

for Spire, Horizon, and Pasfield Projects

VANCOUVER, British Columbia, Aug. 20, 2024

(GLOBE NEWSWIRE) -- ATHA Energy Corp.

(TSXV: SASK) (FRA: X5U)

(OTCQB: SASKF) (“ATHA”) is

pleased to announce that it has entered into a non-binding letter

of intent (the “LOI”) with Terra Uranium Ltd.

(ASX: T92) (“T92”), whereby the

parties will work to negotiate a definitive option and joint

venture agreement for T92 to earn an option to acquire a 70%

interest in ATHA’s Spire and Horizon properties (together, the

“Spire Horizon Projects”) and a definitive option

and joint venture agreement for ATHA to earn an option to acquire

up to a 60% interest in T92’s Pasfield Lake property (the

“Pasfield Project”).

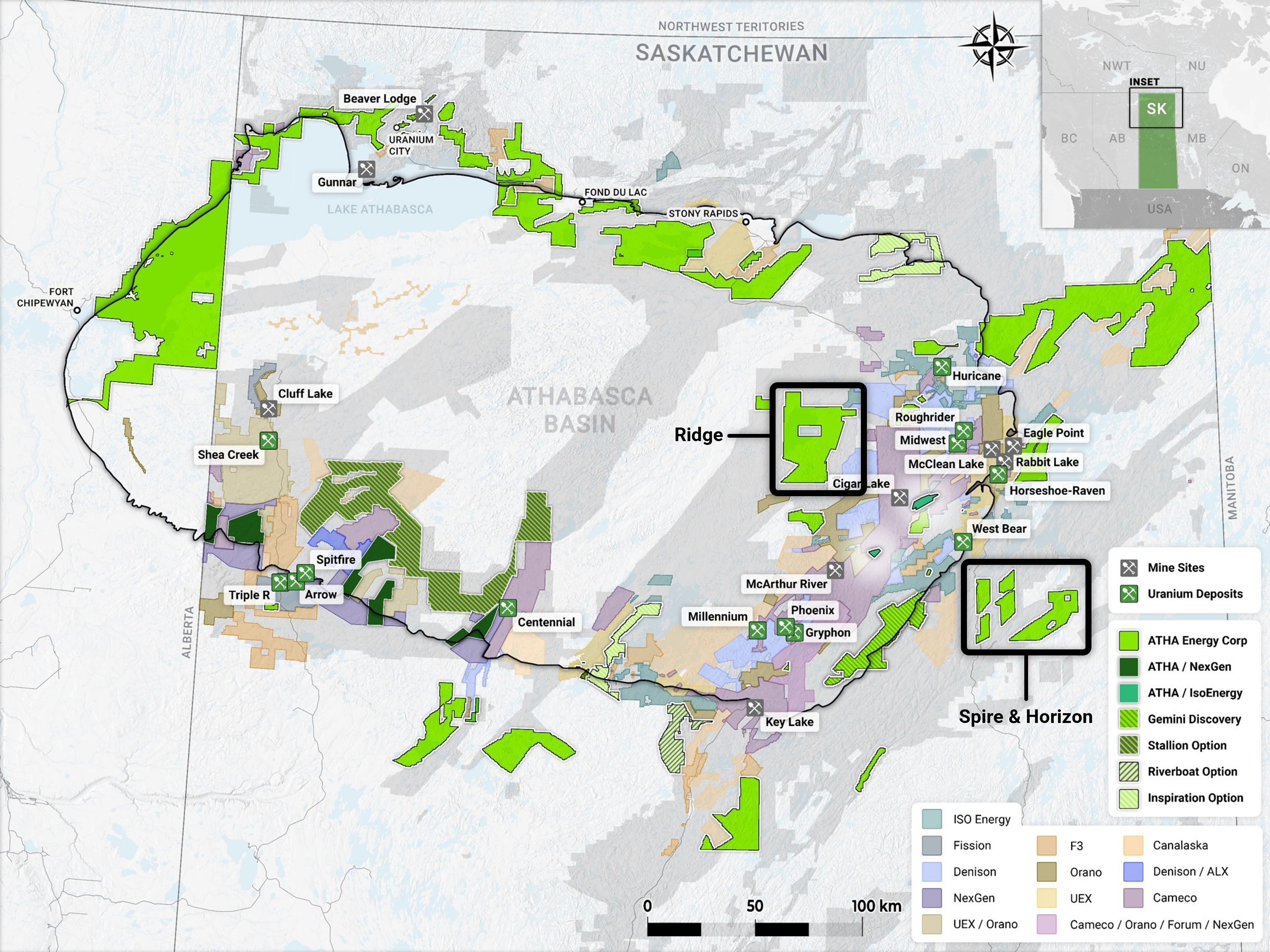

SPIRE HORIZON PROJECTS

The Spire Horizon Projects are comprised of 12

mineral claims totalling 60,965 hectares, located on the eastern

rim of the Athabasca Basin, Saskatchewan, within the Company’s East

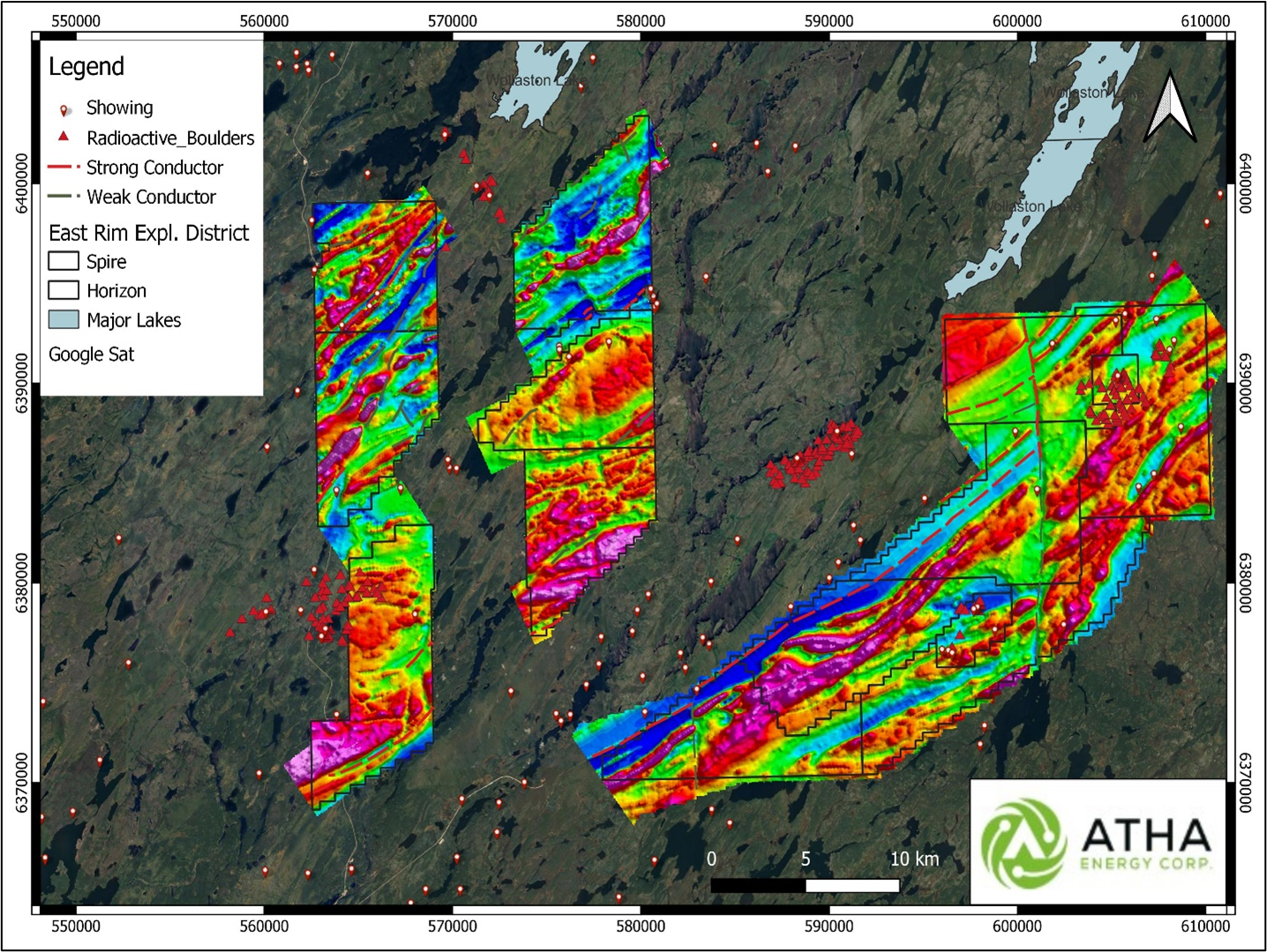

Rim Exploration District (Figure 1). The properties are situated

within the Needle Falls Shear Zone (“NFSZ”), where

associated cross cutting regional scale tabernor fault – known for

hosting uranium mineralization – have been identified. The Spire

Horizon Projects are highly prospective for uranium exploration

with numerous uraniferous boulders and outcrops, associated with

NFSZ, have been discovered (Figure 2). Recent exploration

activities in the area include ATHA’s Gemini Project, which

contains the shallow basement-hosted, high-grade uranium GMZ

discovery. In addition to uranium prospectivity, high-grade copper

showings in outcrops have been identified, along with anomalous

copper returned from testing of lake sediments. During ATHA’s

maiden 2023 Exploration Program, the Company completed

electromagnetic (“EM”) surveys utilizing Xcite’s

MobileMT (MMT) & Mag system, as well as Geotech’s VTEM-max

system. Those surveys identified approximately 144 km of cumulative

conductors, associated with the NFSZ and regional cross-cutting

structures. These results demonstrate that the Spire Horizon

Projects have a high concentration of shallow prospective

exploration targets for discovery of uranium mineralization.

Figure 1: ATHA Energy – Mineral claims

Athabasca Basin

Figure 2: Spire Horizon Project (ATHA Energy

Corp)

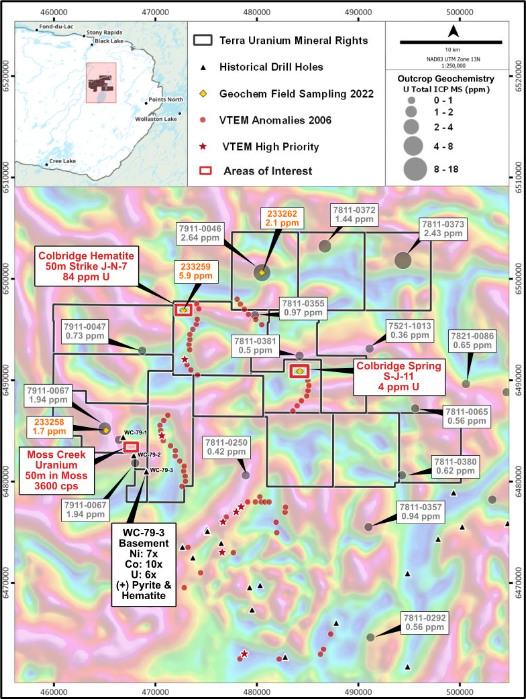

PASFIELD LAKE PROJECT

The Pasfield Project is comprised of 16 mineral

claims totalling 68,768 hectares, located within the Athabasca

Basin, Saskatchewan (Figure 3). The Pasfield Project is situated

within the Cable Bay Shear Zone, contiguous to the north of ATHA’s

Ridge Project (“Ridge”) within the Company’s Cable

Bay Exploration District. During ATHA’s maiden 2023 Exploration

Program, the Company completed an EM survey on Ridge using Xcite’s

MMT system. Subsequently, in Q1 of 2024 ATHA deployed GNR’s

airborne gravity system and Space Fleet’s Ambient Noise Tomography

(“ANT”). Those surveys resulted in the

identification of structural corridors that extend from Ridge

through to the Pasfield Project – along which T92’s 2023 ANT survey

previously detected a low velocity anomaly – evidence of a

prospective alteration halo. In 2023, T92 completed a Reverse

Circulation (RC) drill exploration program targeting the

prospective structural corridor. Drilling intersected anomalous

uranium within the sandstone, in addition to the detection of

significant helium anomalies – a decay product, and potential

pathfinder for uranium mineralization.

Figure 3: Pasfield Project (Terra Uranium

Ltd)

T92 has previously made significant investments

into project infrastructure at their Pasfield Project, including

road access and a year-round exploration camp. As part of the

option ATHA will have access to this infrastructure, which will

significantly decrease capital costs for any future exploration

programs at Ridge and the Pasfield Project.

SPIRE HORIZON OPTION

In accordance with the terms of the LOI and upon

entering into a Definitive Agreement, ATHA shall grant T92 the sole

and exclusive right and option to acquire up to a 70% interest in

the Spire Horizon Projects (the “Spire Horizon

Option”) in consideration for incurring a minimum of

$4,750,000 exploration expenditures as set out below:

(i) on or

before December 20, 2024, T92 must incur at least $750,000 of

statutory exploration expenditure, which must also include the

costs associated with the payment for a mineral exploration

assessment report (the “First Expenditure”);

(ii) on or

before September 21, 2025, T92 must incur additional statutory

exploration expenditures of at least $1,000,000 (the

“Second Expenditure”);

(iii) on or

before September 21, 2026, T92 must incur additional statutory

exploration expenditures of at least $1,000,000 (the “Third

Expenditure”);

(iv) on or

before September 21, 2027, T92 must incur additional statutory

exploration expenditures of at least $1,000,000 (the

“Fourth Expenditure”); and

(v) on or

before September 21, 2028, T92 must incur additional statutory

exploration expenditures of at least $1,000,000 (the “Fifth

Expenditure”).

ATHA and T92 agree to form a joint venture on

the Spire Horizon Projects upon the satisfaction of the First

Expenditure, Second Expenditure, and the Third Expenditure, with

the initial interest of T92 being a 50% participating interest and

ATHA’s being a 50% carried interest (subject to the 5% carried

interest in favour of a third party).

Upon the satisfaction of the Fourth Expenditure

and the Fifth Expenditure, T92’s interest will increase to a 70%

participation interest and ATHA’s interest will adjust to a 30%

participation interest. If at any time during the period where ATHA

holds a carried interest, T92 prepares and delivers a “preliminary

economic assessment” prepared in accordance with National

Instrument 43-101 - Standards of Disclosure for Mineral

Projects in respect of the Spire Horizon Projects to ATHA,

ATHA’s carried interest may be converted into a participating

interest at the election of ATHA.

PASFIELD OPTION

In accordance with the terms of the LOI and upon

entering into a Definitive Agreement, T92 shall grant to ATHA the

four exclusive and separate rights and options to acquire undivided

legal and beneficial interests in the Pasfield Project (together

the “Pasfield Options” and each, a

“Pasfield Option”) as follows:

(i) an

undivided 15% interest in the Pasfield Project, which may be

exercised by either: (a) funding exploration expenditures totalling

$1,000,000 or (b) successfully completing one deep hole of at least

1,000 m into the geophysical target on or before December 31,

2025;

(ii) an

undivided 15% interest for a total of 30% interest in the Pasfield

Project, which may be exercised by either: (a) funding exploration

expenditures totalling $2,000,000 or (b) successfully completing

two deep holes of at least 1,000 m into the geophysical target on

or before December 31, 2026;

(iii) an

undivided 15% interest in the Pasfield Project, which may be

exercised by either: (a) funding exploration expenditures totalling

$3,000,000 or (b) successfully completing three deep holes of at

least 1,000 m into the geophysical target on or before December 31,

2027; and

(iv) an

undivided 15% interest in the Pasfield Project (the “Fourth

CP Option”), which may be exercised by either: (a) funding

exploration expenditures totalling $4,000,000 or (b) successfully

completing four deep holes of at least 1,000 m into the geophysical

target on or before December 31, 2028.

After exercising each Pasfield Option and upon

written notice by ATHA to T92, each undivided 15% interest in the

Pasfield Project can, at ATHA’s election, be converted into a 1%

net smelter returns royalty (“NSR”) for an

aggregate maximum NSR of 4%. Upon the satisfaction of the Fourth CP

Option and assuming ATHA has not converted its interests in the

Pasfield Project into a NSR, the parties will be deemed to form a

joint venture on the Pasfield Project (the “Pasfield Joint

Venture”) with T92 holding an initial 40% participating

interest in the Pasfield Joint Venture and ATHA holding a 60%

participation interest. ATHA will also have the sole and exclusive

right to access and use all camp facilities located on the Pasfield

Project for a daily fee to be negotiated between ATHA and T92.

The full details of the terms will be released

in a future press release if the parties proceed to a Definitive

Agreement. The closing of the Definitive Agreements will be subject

to due diligence results, as well as receipt of stock exchange and

other third-party approvals.

About ATHA

ATHA is a Canadian mineral company engaged in

the acquisition, exploration, and development of uranium assets in

the pursuit of a clean energy future. With a strategically balanced

portfolio including three 100%-owned post discovery uranium

projects (the Angilak Project located in Nunavut, and CMB

Discoveries in Labrador hosting historical resource estimates of

43.3 million lbs and 14.5 million lbs U3O8 respectively, and the

newly discovered basement hosted GMZ high-grade uranium discovery

located in the Athabasca Basin). In addition, the Company holds the

largest cumulative prospective exploration land package (8.1

million acres) in two of the world’s most prominent basins for

uranium discoveries - ATHA is well positioned to drive value. ATHA

also holds a 10% carried interest in key Athabasca Basin

exploration projects operated by NexGen Energy Ltd. and IsoEnergy

Ltd. For more information visit www.athaenergy.com.

1,2,3.

For more information, please

contact:

Troy Boisjoli

Chief Executive Officer

Email: info@athaenergy.com

www.athaenergy.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Historical Mineral Resource

Estimates

All mineral resources estimates presented in

this news release are considered to be “historical estimates” as

defined under NI 43-101, and have been derived from the following

(See notes below). In each instance, the historical estimate is

reported using the categories of mineral resources and mineral

reserves as defined by the CIM Definition Standards for Mineral

Reserves, and mineral reserves at that time, and these “historical

estimates” are not considered by ATHA to be current. In each

instance, the reliability of the historical estimate is considered

reasonable, but a Qualified Person has not done sufficient work to

classify the historical estimate as a current mineral resource, and

ATHA is not treating the historical estimate as a current mineral

resource. The historical information provides an indication of the

exploration potential of the properties but may not be

representative of expected results.

Notes on the Historical Mineral Resource

Estimate for the Angilak Deposit:

1. This estimate is considered

to be a “historical estimate” under NI 43-101 and is not considered

by any of to be current. See below for further details regarding

the historical mineral resource estimate for the Angilak

Property.

- Mineral

resources which are not mineral reserves do not have demonstrated

economic viability.

- The estimate of

mineral resources may be materially affected by geology,

environment, permitting, legal, title, taxation, sociopolitical,

marketing or other relevant issues.

- The quality and

grade of the reported inferred resource in this estimation are

uncertain in nature and there has been insufficient exploration to

define these inferred resources as an indicated or measured mineral

resource, and it is uncertain if further exploration will result in

upgrading them to an indicated or measured resource category.

- Contained value

metals may not add due to rounding.

- A 0.2% U3O8

cut-off was used.

- The mineral

resource estimate contained in this press release is considered to

be “historical estimates” as defined under NI 43-101 and is not

considered to be current.

- The “historical

estimate” is derived from a Technical Report entitled “Technical

Report and Resource Update For The Angilak Property, Kivalliq

Region, Nunavut, Canada”, prepared by Michael Dufresne, M.Sc.,

P.Geol. of APEX Geosciences, Robert Sim, B.Sc., P.Geo. of SIM

Geological Inc. and Bruce Davis, Ph.D., FAusIMM of BD Resource

Consulting Inc., dated March 1, 2013 for ValOre Metals Corp.

- As disclosed in

the above noted technical report, the historical estimate was

prepared under the direction of Robert Sim, P.Geo, with the

assistance of Dr. Bruce Davis, FAusIMM, and consists of

three-dimensional block models based on geostatistical applications

using commercial mine planning software. The project limits area

based in the UTM coordinate system (NAD83 Zone14) using nominal

block sizes measuring 5x5x5m at Lac Cinquante and 5x3x3 m (LxWxH)

at J4. Grade (assay) and geological information is derived from

work conducted by Kivalliq during the 2009, 2010, 2011 and 2012

field seasons. A thorough review of all the 2013 resource

information and drill data by a Qualified Person, along with the

incorporation of subsequent exploration work and results, which

includes some drilling around the edges of the historical resource

subsequent to the publication of the 2013 technical report, would

be required in order to verify the Angilak Property historical

estimate as a current mineral resource.

- The historical

mineral resource estimate was calculated in accordance with NI

43-101 and CIM standards at the time of publication and predates

the current CIM Definition Standards for Mineral Resources and

Mineral Reserves (May, 2014) and CIM Estimation of Mineral

Resources & Mineral Reserves Best Practices Guidelines

(November, 2019).

- A thorough

review of all historical data performed by a Qualified Person,

along with additional exploration work to confirm results would be

required to produce a current mineral resource estimate prepared in

accordance with NI 43-101.

2. Notes on the

Historical Mineral Resource Estimate for the Moran Lake

Deposit:

- Jeffrey A.

Morgan, P.Geo. and Gary H. Giroux, P.Eng. completed a NI 43-101

technical report titled “Form 43-101F1 Technical Report on the

Central Mineral Belt (CMB) Uranium Project, Labrador, Canada,

Prepared for Crosshair Exploration & Mining Corp.” and dated

July 31, 2008, with an updated mineral resource estimate for the

Moran Lake C-Zone along with initial mineral resources for the

Armstrong and Area 1 deposits. They modelled three packages in the

Moran Lake Upper C-Zone (the Upper C Main, Upper C Mylonite, and

Upper C West), Moran Lake Lower C-Zone, two packages in Armstrong

(Armstrong Z1 and Armstrong Z3), and Trout Pond. These mineral

resources are based on 3D block models with ordinary kriging used

to interpolate grades into 10 m x 10 m x 4 m blocks. A cut-off

grade of 0.015% U3O8 was used for all zones other than the Lower C

Zone which employed a cut-off grade of 0.035%. A thorough review of

all historical data performed by a Qualified Person, along with

additional exploration work to confirm results, would be required

to produce a current mineral resource estimate prepared in

accordance with NI 43-101 standards.

3. Notes on the

Historical Mineral Resource Estimate for the Anna Lake

Deposit:

- The mineral

resource estimate contained in this table is considered to be a

“historical estimate” as defined under NI 43-101, and is not

considered to be current and is not being treated as such. A

Qualified Person has not done sufficient work to classify the

historical estimate as current mineral resources. A qualified

person would need to review and verify the scientific information

and conduct an analysis and reconciliation of historical drill and

geological data in order to verify the historical estimate as a

current mineral resource.

- Reported by

Bayswater Uranium Corporation in a Technical Report entitled “Form

43-101 Technical Report on the Anna Lake Uranium Project, Central

Mineral Belt, Labrador, Canada”, prepared by R. Dean Fraser, P.Geo.

and Gary H. Giroux, P.Eng., dated September 30, 2009.

- A 3-dimensional

geologic model of the deposit was created for the purpose of the

resource estimate using the Gemcom/Surpac modeling software. A

solid model was created using a minimum grade x thickness cutoff of

3 meters grading 0.03% U3O8. Intersections not meeting this cutoff

were generally not incorporated into the model. The shell of this

modeled zone was then used to constrain the mineralization for the

purpose of the block model. Assay composites 2.5 meters in length

that honoured the mineralized domains were used to interpolate

grades into blocks using ordinary kriging. An average specific

gravity of 2.93 was used to convert volumes to tonnes. The specific

gravity data was acquired in-house and consisted of an average of

seventeen samples collected from the mineralised section of the

core. The resource was classified into Measured, Indicated or

Inferred using semi-variogram ranges applied to search ellipses.

All resources estimated at Anna Lake fall under the “Inferred”

category due to the wide spaced drill density. An exploration

program would need to be conducted, including twinning of

historical drill holes in order to verify the Anna Lake Project

estimate as a current mineral resource.

Cautionary Statement Regarding

Forward-Looking Information

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, or “believes”, or variations of such words

and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved”. These forward-looking statements or information may

relate to the transactions contemplated herein, including

statements with respect to the expected benefits of the

transactions described herein to ATHA and the ATHA shareholders,

the expectation that the parties will successfully negotiate the

terms of the Definitive Agreement, the approval by the securities

exchanges, the successful incurrence of exploration expenditure as

required to earn the options, any results that may be derived from

the diversification of ATHA’s portfolio, the prospects of ATHA’s

projects, including mineral resources estimates and mineralization

of each project, the prospects of ATHA’s business plans and any

expectations with respect to defining mineral resources or mineral

reserves on any of ATHA’s projects, and any expectation with

respect to any permitting, development or other work that may be

required to bring any of the projects into development or

production.

Forward-looking statements are necessarily

based upon a number of assumptions that, while considered

reasonable by management at the time, are inherently subject to

business, market and economic risks, uncertainties and

contingencies that may cause actual results, performance or

achievements to be materially different from those expressed or

implied by forward-looking statements. Such assumptions include,

but are not limited to, assumptions regarding ATHA following

completion of the transactions, that the anticipated benefits of

the transactions will be realized, completion of the transactions,

including receipt of required stock exchange approvals, the ability

of ATHA and T92 to satisfy, in a timely manner, the other

conditions to the closing of the transactions or earning the

option, other expectations and assumptions concerning the

transactions, the ability of ATHA and T92 to complete its

exploration activities as currently expected, assumptions that the

anticipated benefits of ATHA’s proposed exploration program will be

realized, that no additional permit or licenses will be required in

connection with ATHA’s exploration programs, the ability of ATHA to

complete its exploration activities as currently expected and on

the current anticipated timelines, including ATHA’s proposed

exploration program, that ATHA will be able to execute on its

current plans, and that general business and economic conditions

will not change in a material adverse manner. Although each of ATHA

and T92 have attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information.

Such statements represent the current views

of ATHA and T92 with respect to future events and are necessarily

based upon a number of assumptions and estimates that, while

considered reasonable by ATHA and T92, are inherently subject to

significant business, economic, competitive, political and social

risks, contingencies and uncertainties. Risks and uncertainties

include, but are not limited to the following: the parties being

unable to negotiate the terms of the Definitive Agreement,

inability of ATHA to complete the exploration expenditures to earn

the option, a material adverse change in the timing of any

completion and the terms and conditions upon which the transactions

is completed; inability to satisfy or waive all conditions to

closing the transactions as set out in the Definitive Agreement;

inability of ATHA to realize the benefits anticipated from the

exploration and drilling targets described herein or elsewhere;

inability of ATHA to complete current exploration plans as

presently anticipated or at all; inability for ATHA to economically

realize on the benefits, if any, derived from the exploration

program; failure to complete business plans as it currently

anticipated; overdiversification of ATHA’s portfolio; failure to

realize on benefits, if any, of a diversified portfolio;

unanticipated changes in market price for ATHA shares; and changes

to ATHA’s current and future business and exploration plans and the

strategic alternatives available thereto. Other factors which could

materially affect such forward-looking information are described in

the filings of ATHA with the Canadian securities regulators which

are available, respectively, on ATHA’s profile on SEDAR+ at

www.sedarplus.ca. ATHA does not undertake to update

any forward-looking information, except in accordance with

applicable securities laws.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/79c8df06-6c78-46bb-9fd5-b5969a668349

https://www.globenewswire.com/NewsRoom/AttachmentNg/d9a0f7ea-9742-49a0-be1e-627796b6123e

https://www.globenewswire.com/NewsRoom/AttachmentNg/2003d2d2-e3b5-45e0-946c-27e96493100a

ATHA Energy (TG:X5U)

Historical Stock Chart

From Jan 2025 to Feb 2025

ATHA Energy (TG:X5U)

Historical Stock Chart

From Feb 2024 to Feb 2025