Sartorius (FWB:SRT), a leading international laboratory and

pharmaceutical equipment provider, grew dynamically again in fiscal

2012 and further increased its profitability. This summarizes the

preliminary figures for 2012 that the company released today.

According to these results, the Bioprocess Solutions Division that

primarily specializes in single-use products for pharmaceutical

drug manufacture performed highly successfully. In addition,

initial consolidation of the Biohit Liquid Handling business

substantially boosted growth for the Lab Products & Services

Division. The company slightly outperformed its financial targets

that it had already raised twice during 2012.

CEO Dr. Joachim Kreuzburg was satisfied with the results of the

past fiscal year: “Our bioprocess business has performed

excellently over the last years. In 2012, we grew again at

double-digit rates, more strongly than the market and also at a

slightly faster pace than we ourselves expected. Especially in the

USA, we have gained market share. Our newly realigned Lab Products

& Services Division also showed positive development and is

well positioned for further growth. The Industrial Weighing

Division has held its own quite well in its markets and fully met

our expectations in fiscal 2012. Despite high investments in

additional manufacturing capacity, new products and in the

expansion of our sales organization, our considerable growth has

enabled us to increase our bottom-line earnings more strongly than

expected at the outset of the year and to further lift our profit

margin.“

Company management projects significant growth in sales revenue

and a continued rise profitability for 2013 as well.

Dynamic growth of sales revenue and order intake

According to preliminary figures, Sartorius generated

consolidated sales revenue of 845.7 million euros in fiscal 2012,

up from 733.1 million euros a year ago. This equates to an increase

of 15.4%, or 11.7% in constant currencies. The Biohit Liquid

Handling business acquired at the end of 2011 added approximately

six percentage points to this expansion of sales revenue. The gain

in order intake reached a similarly strong level: it jumped 15.7%,

or 12.0% in constant currencies, to 866.8 million euros.

Accounting for more than half of consolidated revenue, the

Bioprocess Solutions Division continued on track, extending its

success of the previous year: It reported strong organic sales

growth of 15.6%, or 11.8% in constant currencies, to 474.2 million

euros and an increase in order intake of 11.0%, or 7.3% in constant

currencies, to 479.5 million euros. Demand was especially high for

single-use products for biopharmaceutical manufacture, and the

division posted solid growth for its equipment business with

biotech production systems, above all in North America.

The Lab Products & Services Division, a supplier of premium

laboratory instruments and lab consumables, reported a significant

gain of 21.1%, or 17.1% based on constant currencies, in sales

revenue, which soared to 268.9 million euros. Compared with sales,

order intake rose at a slightly sharper rate, 30.5%, or 26.2% in

constant currencies, to 282.0 million euros. Initial consolidation

of the Biohit Liquid Handling business contributed around 19.0

percentage points in constant currencies to this growth.

The smallest Group division, Industrial Weighing, showed stable

development, as projected. Its sales revenue of 102.7 million euros

reached the good level reported for the previous year (+1.8%;

currency-adjusted: -0.2%). Its order intake moved up 3.9%, or 1.9%

in constant currencies, to 105.4 million euros.

Regionally, Sartorius reported the highest dynamics in North

America, with sales revenue up 18.9%. The key growth driver in this

region was the excellent performance of both its laboratory and

bioprocess businesses. The company’s business saw double-digit

growth, at 13.0%, in Asia as well. In Europe, where the economic

environment was weaker on the whole, Sartorius expanded its

business at 8.6% (all regional figures in constant currencies).

Substantial increase in earnings

Despite the heavy investments made in new production capacity

and the expansion of its sales structures as planned, Sartorius

further increased its profitability in the reporting year. Based on

dynamic sales growth, the Group’s operating earnings surged 20.3%

from 112.2 million euros in the previous year to 135.0 million

euros. The respective margin for the Group rose from 15.3% a year

earlier to 16.0% and, therefore, marks a new high. Besides the

expansion of sales volume, the favorable currency environment

contributed to positive development of consolidated earnings.

In view of the divisions, the Bioprocess Solutions Division, in

particular, significantly expanded its operating earnings at a

growth rate of 22.9%, from 71.6 million euros a year ago to 88.0

million euros. The operating profit margin for this division

climbed from 17.5% to 18.6%. The Lab Products & Services

Division reported operating earnings of 36.9 million euros, up from

30.7 million euros in the year before. This equates to an increase

of 20.1% and an approximately constant margin of 13.7% (previous

year: 13.8%). The Industrial Weighing Division posted earnings of

10.1 million euros and a margin of 9.9%, up from 9.9 million euros

and 9.8%, respectively, a year earlier.

Including extraordinary items of -13.9 million euros (previous

year: -11.3 million euros), Group EBITA rose year on year from

100.9 million euros to 121.1 million euros and its respective

margin increased from 13.8% to 14.3%. These extraordinary expenses

primarily were related to the transfer of single-use bag

manufacture from California, USA, to Puerto Rico, the integration

of the Biohit Liquid Handling business, and to further Group

projects.

The Group’s relevant net profit totaled 62.9 million euros, up

from 52.8 million euros a year ago. Its respective earnings per

ordinary share are at 3.68 euros, up from 3.09 euros a year

earlier, and per preference share, at 3.70 euros, up from 3.11

euros a year ago.

In 2012, net operating cash flow was at 53.2 million euros

(previous year: 79.0 million euros) and was used, inter alia, for

financing investments to substantially expand capacity levels. The

key financial indicator, the ratio of net debt to underlying

EBITDA, remained constant at 1.9 (previous year: 1.9) in spite of

the high investments made, and thus continues to remain at a

comfortable level.

Positive outlook for fiscal 2013

Sartorius is set to further grow its business in the current

year: For 2013, the company projects that sales revenue on the

basis of constant currencies will increase by approximately 6% to

9%. Along with growth in sales, profitability is forecasted to rise

again. Without any currency effects considered, the operating EBITA

margin at Group level is expected to increase to about 16.5%.

In view of the three divisions, company management anticipates

that sales for Bioprocess Solutions will grow approximately 9% to

12%. Cooperation in cell culture media, based on the agreement

signed in December 2012 with the Swiss life science group Lonza, is

projected to contribute around three to four percentage points to

this growth. Management forecasts that the division’s operating

EBITA margin will increase to approximately 19%.

For the Lab Products & Services Division, the company

expects sales to grow by approximately 3% to 6% and its operating

EBITA margin to increase to around 14%.

The Industrial Weighing Division projects sales revenue to rise

by approximately 0% to 3% and its operating EBITA margin to reach

approximately 10%. (All figures currency-adjusted)

“The majority of our business areas are driven by stable and

long-term trends; this is why we have set ambitious targets for the

new fiscal year“, commented Dr. Kreuzburg about the forecast. For

part of our business, however, further economic development will

play a role, especially in Europe.”

* Sartorius uses earnings before interest, taxes and

amortization (EBITA) as the key profitability measure. To enable a

more meaningful comparison with the year-earlier figures, the

company reports earnings adjusted for extraordinary items (=

operating EBITA or operating earnings) in addition to EBITA.

Key performance indicators for 2012 at a glance

In millions of euros(unless otherwise specified)

Sartorius Group Bioprocess

SolutionsDivision Lab Products &

ServicesDivision Industrial

WeighingDivision 2012 2011

in %

2012 2011 in %

2012 2011 in %

2012 2011

In % Order intake

866.8 749.5

15.7

479.5 432.0 11.0

282.0 216.0 30.5

105.4

101.4 3.9 Sales revenue

845.7 733.1

15.4

474.2 410.2 15.6

268.9 222.0 21.1

102.7

100.9 1.8 Operating earnings

(underlying EBITA)1)

135.0 112.2 20.3

88.0

71.6 22.9

36.9 30.7 20.1

10.1 9.9 2.6 EBITA margin1)

16.0% 15.3%

18.6%

17.5%

13.7% 13.8%

9.9% 9.8% Extraordinary expenses

13.9 11.3 22.8

Group net profit1)2)

62.9 52.8 19.1

Earnings per ordinary

share1)2) in €

3.68 3.09 19.2

Earnings

per preference share1)2) in €

3.70 3.11

19.1

1) Adjusted for extraordinary items (underlying)

2) Relevant consolidated net profit = underlying net profit

after non-controlling interest, excluding non-cash amortization and

additional effects from valuation adjustments of derivative

financial instruments

The numbers mentioned above are still subject to final review by

the auditors. The final figures will be announced at the annual

press conference on March 11, 2013.

Current Image Files:

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius

AG:www.sartorius.com/fileadmin/media/global/company/joachim_kreuzburg_1.jpg

Sartorius products used in the manufacture of

medications:www.sartorius.com/fileadmin/media/global/company/pr_20120419_bioprocess_solutions.jpg

Sartorius products used in laboratory

research:www.sartorius.com/fileadmin/media/global/company/pr_20120419_lab_products_services.jpg

Conference Call and Webcast:

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius, will discuss the preliminary figures for 2012 with

analysts and investors on Tuesday, January 29, 2013, at 3:30 p.m.

Central European Time (CET), in a teleconference. You may dial into

the teleconference starting at 3:20 p.m. CET at the following

numbers:

Germany: +49 (0)69 2222 34066France: +33 (0)1 70 48 01 63UK: +44

(0)20 3450 9571USA: +1646 254 3387

The dial-in code is 3225124; to view the webcast, log onto:

www.sartorius.com

Upcoming Financial Dates:

March 11, 2013 Annual press conference in Goettingen,

GermanyApril 18, 2013 Annual Shareholders’ Meeting in Goettingen,

GermanyApril 23, 2013 Publication of first-quarter figures (Jan. –

March 2013)

This press release contains statements about the future

development of the Sartorius Group. The content of these statements

cannot be guaranteed as they are based on assumptions and estimates

that harbor certain risks and uncertainties.

This is a translation of the original German-language press

release. Sartorius shall not assume any liability for the

correctness of this translation. The original German press release

is the legally binding version. Furthermore, Sartorius reserves the

right not to be responsible for the topicality, correctness,

completeness or quality of the information provided. Liability

claims regarding damage caused by the use of any information

provided, including any kind of information which is incomplete or

incorrect, will therefore be rejected

A Profile of Sartorius

The Sartorius Group is a leading international laboratory and

process technology provider covering the segments of Bioprocess

Solutions, Lab Products & Services and Industrial Weighing. In

2012, the technology group earned sales revenue of 845.7 million

euros according to preliminary figures. Founded in 1870, the

Goettingen-based company currently employs around 5,500 persons.

The major areas of activity of its Bioprocess Solutions segment

cover filtration, fluid management, fermentation, cell cultivation

and purification, and focus on production processes in the

biopharmaceutical industry. The Lab Products & Services segment

primarily manufactures laboratory instruments and lab consumables.

Industrial Weighing concentrates on weighing, monitoring and

control applications in the manufacturing processes of the food,

chemical and pharma sectors. Sartorius has its own production

facilities in Europe, Asia and America as well as sales

subsidiaries and local commercial agencies in more than 110

countries.

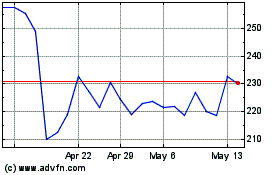

Sartorius (TG:SRT)

Historical Stock Chart

From Nov 2024 to Dec 2024

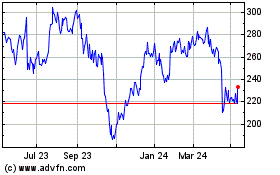

Sartorius (TG:SRT)

Historical Stock Chart

From Dec 2023 to Dec 2024